Resources Recruitment - Department of State Development - The ...

Resources Recruitment - Department of State Development - The ...

Resources Recruitment - Department of State Development - The ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Print post approved PP 665002/00062<br />

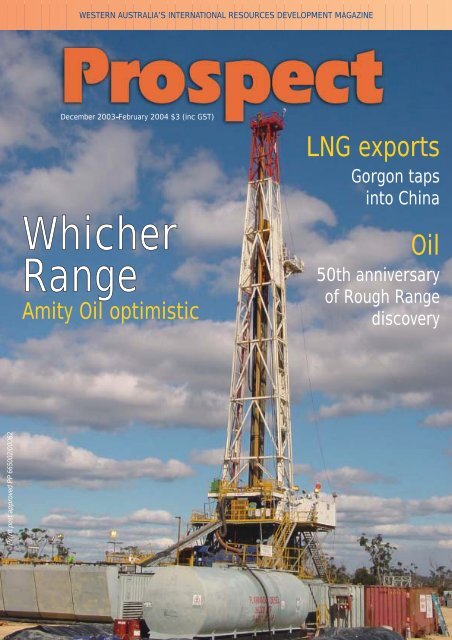

WESTERN AUSTRALIA’S INTERNATIONAL RESOURCES DEVELOPMENT MAGAZINE<br />

December 2003–February 2004 $3 (inc GST)<br />

Whicher<br />

Range<br />

Amity Oil optimistic<br />

LNG exports<br />

Gorgon taps<br />

into China<br />

Oil<br />

50th anniversary<br />

<strong>of</strong> Rough Range<br />

discovery

WESTERN AUSTRALIAN OFFICES<br />

<strong>Department</strong> <strong>of</strong> Industry and <strong>Resources</strong><br />

Mineral House • 100 Plain Street • EAST PERTH WA 6004<br />

Tel: +61 8 9222 3333 • Fax: +61 8 9222 3430<br />

www.doir.wa.gov.au<br />

Investment<br />

168–170 St Georges Terrace • PERTH Western Australia 6000<br />

Postal address: Box 7606 • Cloisters Square<br />

PERTH Western Australia 6850<br />

Tel: +61 8 9327 5555 • Fax: +61 8 9222 3862<br />

Email: investment@doir.wa.gov.au<br />

INTERNATIONAL OFFICES<br />

Europe<br />

Government <strong>of</strong> Western Australia<br />

European Office • 5th floor, Australia Centre<br />

Corner <strong>of</strong> Strand and Melbourne Place<br />

LONDON WC2B 4LG • UNITED KINGDOM<br />

Tel: +44 20 7240 2881 • Fax: +44 20 7240 6637<br />

Email: agent_general@wago.co.uk<br />

India — Mumbai<br />

Western Australian Trade Office<br />

93 Jolly Maker Chambers No 2<br />

9th floor, Nariman Point • MUMBAI 400 021 INDIA<br />

Tel: +91 22 230 3973/74/78 • Fax: +91 22 230 3977<br />

Email: sonia.grinceri@doir.wa.gov.au<br />

India — Chennai<br />

Western Australian Trade Office - Advisory Office<br />

1 Doshi Regency • 876 Poonamallee High Road<br />

Kilpauk • Chennai 600 084 • INDIA<br />

Tel: +91 44 640 0407 • Fax: +91 44 643 0064<br />

E-mail: kvrdctwa@md2.vsnl.net.in<br />

Indonesia — Jakarta<br />

Western Australia Trade Office<br />

c/- Australian Trade Commission • Australian Embassy<br />

JI H R Rasuna Said Kav C15 - 16, Kuningan<br />

Jakarta 12940 • INDONESIA<br />

Tel: +62 21 2550 5331 • Fax: +62 21 522 7103<br />

E-mail: trevor.boughton@austrade.gov.au<br />

Indonesia — Surabaya<br />

Western Australian Trade Office<br />

Graha Pena 17th floor • Jalan Ahmed Yani 88<br />

Surabaya 60234 INDONESIA<br />

Tel: +62 31 829 9979 • Fax: +62 31 829 9975<br />

Email: lydia.agam@doir.wa.gov.au<br />

Japan — Tokyo<br />

Western Australian Government Office<br />

Australian Business Centre<br />

28th floor, New Otani Garden Court<br />

4-1 Kioicho, Chiyoda-Ku • TOKYO 102-0094 JAPAN<br />

Tel: +81 3 5214 0791 • Fax: +81 3 5214 0796<br />

Email: tokyo@wajapan.net<br />

Japan — Kobe<br />

Western Australian Government Office<br />

6th floor, Golden Sun Building • 3-6 Nakayamate-dori<br />

4-Chome Chuo-Ku • KOBE 650-0004 JAPAN<br />

Tel: +81 78 242 7705 • Fax: +81 78 242 7707<br />

Email: kobe@wajapan.net<br />

Malaysia<br />

Western Australian Trade Office<br />

4th floor, UBN Tower • 10 Jalan P Ramlee<br />

KUALA LUMPUR 50250 MALAYSIA<br />

Tel: +60 3 2031 8175/6 • Fax: +60 3 2031 8177<br />

Email: elaine.yong@doir.wa.gov.au<br />

Middle East<br />

Western Australian Trade Office • Emarat Atrium<br />

PO Box 58007 • Dubai • UNITED ARAB EMIRATES<br />

Tel: +971 4 343 3226 • Fax: +971 4 343 3238<br />

E-mail: chris.heysen@wato.ae<br />

People’s Republic <strong>of</strong> China — Shanghai<br />

Western Australian Trade & Investment Promotion<br />

Shanghai Representative Office • Room 2208, CITIC Square<br />

1168 Nanjing Road West • Shanghai 200041<br />

THE PEOPLE'S REPUBLIC OF CHINA<br />

Tel: +86 21 5292 5899 • Fax: +86 21 5292 5889<br />

Email: bj.zhuang@doir.wa.gov.au<br />

People’s Republic <strong>of</strong> China — Hangzhou<br />

Western Australian Trade & Investment Promotion<br />

Hangzhou Representative Office<br />

Room 910 • World Trade Office Plaza<br />

Zhejiang World Trade Centre<br />

15 Shuguang Road • Hangzhou 310007<br />

PEOPLES REPUBLIC OF CHINA<br />

Tel: +86 571 8795 0296 • Fax: +86 571 8795 0295<br />

E-mail: stella.bu@doir.wa.gov.au<br />

Taiwan<br />

WA Business <strong>Development</strong> Manager<br />

Australian Commerce & Industry Office<br />

Australian Business Centre<br />

Suite 2606, International Trade Building<br />

#333 Keelung Road Section 1 • TAIPEI 110 TAIWAN<br />

Tel: +886 2 8780 9118 ext 216 • Fax: +886 2 2757 6707<br />

Email: nicholas.mckay@austrade,gov.au<br />

Thailand<br />

WA Business <strong>Development</strong> Manager<br />

Australian Trade Commission • Australian Embassy<br />

37 South Sathorn Road • BANGKOK 10120 • THAILAND<br />

Tel: +662 287 2680 Ext 3307 • Fax: +662 287 2589<br />

E-mail: siraphop@austrade.gov.au<br />

FROM THE MINISTER<br />

<strong>The</strong> Western Australia Government reconfirmed its<br />

commitment to social, economic and environmentally<br />

conscious development in the recently released <strong>State</strong><br />

Sustainability Strategy. This strategy will see the Government<br />

work more closely with industry in the future to ensure<br />

sustainable development and a strong contribution to<br />

environmental improvement globally.<br />

This commitment links closely with another Government aim —<br />

to <strong>of</strong>fer an environment for responsible and rewarding<br />

investment in Western Australia.<br />

<strong>The</strong> National Australia Bank index indicates there has never<br />

been a better time to invest in Western Australia, with business conditions at their<br />

highest level in a decade. In fact, business investment in our <strong>State</strong> was the stand-out<br />

performer <strong>of</strong> the domestic economy over 2002-03, increasing by nearly 22%, while the<br />

<strong>State</strong>’s economy grew by 7.7% — the fastest rate in five years and well above the national<br />

average <strong>of</strong> 5.8%.<br />

<strong>The</strong> main contributors to this strong performance were private expenditure on<br />

buildings and structures and private expenditure on machinery and equipment — data<br />

confirming that the Government is solidifying Western Australia's position as the engine<br />

room <strong>of</strong> the national economy.<br />

Our resources sector is driving a strong period <strong>of</strong> economic growth in WA, creating jobs<br />

and opportunities and making us the envy <strong>of</strong> the eastern seaboard. With a number <strong>of</strong><br />

our major resources projects yet to begin construction, the potential for even stronger<br />

growth in the years ahead is high.<br />

We are at the dawn <strong>of</strong> a prosperous era — one that will be built on our strong foundation<br />

<strong>of</strong> innovation and strategic sustainable development.<br />

FROM THE DIRECTOR GENERAL<br />

This edition <strong>of</strong> Prospect focuses on the South West region <strong>of</strong><br />

Western Australia, an area with considerable resources<br />

development potential.<br />

<strong>The</strong> region already produces more than A$5 billion worth <strong>of</strong><br />

minerals and petroleum annually, equating to 18% <strong>of</strong> Western<br />

Australia’s total yearly production <strong>of</strong> these commodities. And<br />

there is so much potential to build on that success, especially<br />

with employment-boosting downstream processing industries.<br />

Overall, Western Australia’s mineral and petroleum sales reached<br />

$28 billion in 2002-03. That’s a good outcome, considering the<br />

increased value <strong>of</strong> the Australian dollar against the US currency<br />

and the industry’s extraordinarily high growth rates in recent<br />

years.<br />

Clive Brown, MLA<br />

Minister for <strong>State</strong><br />

<strong>Development</strong><br />

Jim Limerick<br />

Director General<br />

<strong>Department</strong> <strong>of</strong> Industry<br />

and <strong>Resources</strong><br />

This edition <strong>of</strong> Prospect also reports on an agreement between<br />

partners in the Gorgon gas project to supply A$30 billion worth<br />

<strong>of</strong> LNG to China, the potential development <strong>of</strong> a stainless steel industry in the <strong>State</strong> and<br />

the Supreme Court <strong>of</strong> Western Australia’s decision to grant proponents in the Hope Downs<br />

iron ore project third-party access to BHP Billiton’s rail network in the Pilbara.<br />

We at the <strong>Department</strong> <strong>of</strong> Industry and <strong>Resources</strong> wish all <strong>of</strong> our Prospect readers a happy<br />

and safe Christmas, and a prosperous year in 2004.

2 GORGON GAS<br />

In what’s shaping up as the LNG industry’s biggest<br />

single export deal, partners in the Gorgon gas project<br />

have signed an agreement to supply China with 100<br />

million tonnes <strong>of</strong> LNG worth up to A$30 billion.<br />

3 STAINLESS STEEL<br />

<strong>The</strong> head <strong>of</strong> the Australian Stainless Steel <strong>Development</strong><br />

Association says Western Australia has the potential to<br />

become a major production centre for the commodity.<br />

4 INVESTMENT OPPORTUNITIES<br />

<strong>The</strong> <strong>Department</strong> <strong>of</strong> Industry and <strong>Resources</strong>lists a<br />

number <strong>of</strong> resource-related investment prospects for the<br />

South West <strong>of</strong> Western Australia.<br />

8 PETROLEUM EXPLORATION<br />

Big rewards await those who can find commercial<br />

quantities <strong>of</strong> gas and petroleum in the Perth Basin.<br />

14 ALCOA ANNIVERSARY<br />

After 40 years <strong>of</strong> mining bauxite in Western Australia,<br />

Alcoa now employs 4300 people and produces A$2.3<br />

billion worth <strong>of</strong> alumina annually.<br />

Front cover:<br />

Amity Oil’s exploration drill<br />

rig at Whicher Range near<br />

Busselton.<br />

Prospect ISSN 1037-4590<br />

Western Australian Prospect magazine is published quarterly by the Western Australian Government’s <strong>Department</strong> <strong>of</strong> Industry and<br />

<strong>Resources</strong> (DoIR) and Ray Burns Media.<br />

Editorial management: John Terrell, DoIR Communications & Marketing Division. Tel: (08) 9327 5555 • Fax: (08) 9327 5500.<br />

Advertising management: Ray Burns Media, PO Box 1230, South Perth Westerm Australia 6951<br />

Tel: (08) 9474 3288 • Mobile: 0408 474 328 • Email: rayburns@rayburnsmedia.com.au<br />

Prospect has been compiled in good faith by the <strong>Department</strong> <strong>of</strong> Industry and <strong>Resources</strong> from information and data gathered in the<br />

course <strong>of</strong> the magazine’s production. Opinions expressed in Prospect are those <strong>of</strong> the authors and not necessarily those <strong>of</strong> the<br />

<strong>Department</strong> <strong>of</strong> Industry and <strong>Resources</strong>. No person or organisation should act on the basis <strong>of</strong><br />

any matter contained in this publication without considering, and if necessary taking,<br />

appropriate pr<strong>of</strong>essional advice from other sources. <strong>The</strong> <strong>Department</strong> <strong>of</strong> Industry and<br />

<strong>Resources</strong>, its employees and contracted personnel undertake no responsibility to any<br />

person or organisation in respect <strong>of</strong> this publication.<br />

ABN: 69 410 335 356<br />

in this issue �<br />

special feature<br />

SOUTH WEST<br />

In this edition, Prospect<br />

takes a look at the South<br />

West <strong>of</strong> Western Australia,<br />

an area with a reputation<br />

not only for fine wines,<br />

timber and tourism, but also<br />

for its mineral, petroleum<br />

and renewable timber<br />

potential. Turn to pages<br />

4-21 for more details.<br />

15 MINERAL SANDS<br />

Doral Mineral Sands Pty Ltd creates a good impression in<br />

and around Dardanup where it has established a new heavy<br />

mineral sands mine and plant.<br />

16 COGENERATION<br />

Alinta and Alcoa combine with a plan to lower CO 2 emissions<br />

and save millions <strong>of</strong> dollars with a cogeneration plant at the<br />

Pinjarra alumina refinery.<br />

17 CLEAN COAL<br />

Often seen as a dirty fuel, coal is fighting back with<br />

researchers heralding a brighter future for the <strong>State</strong>’s coal<br />

industry.<br />

21 WATER SUPPLIES<br />

Progress with the development <strong>of</strong> A$80 million worth <strong>of</strong><br />

water infrastructure for gas processing projects on the<br />

Burrup Peninsula.<br />

22 OIL MILESTONE<br />

December 2003 marks the 50th anniversary <strong>of</strong> the first oil<br />

discovery <strong>of</strong> oil at Rough Range in northwest Western<br />

Australia. Petroleum is now the <strong>State</strong>’s No. 1 resource<br />

commodity, with output worth in excess <strong>of</strong> A$10 billion<br />

annually.<br />

36 RESOURCES MAP<br />

<strong>Department</strong> <strong>of</strong><br />

Industry and <strong>Resources</strong><br />

www.doir.wa.gov.au<br />

Prospect December 2003–February 2004 1

It’s the biggest, as Gorgon taps into China<br />

Gorgon partnership: Among those attending the Canberra ceremony to mark the<br />

agreement for the supply <strong>of</strong> A$30 billion worth <strong>of</strong> LNG from the Gorgon project to China<br />

were the President <strong>of</strong> CNOOC, Fu Chengyu, Western Australian Premier, Ge<strong>of</strong>f Gallop, and<br />

the Managing Director <strong>of</strong> ChevronTexaco Australia Pty Ltd, Jay Johnson.<br />

Welcome to DoIR’S new website<br />

2 Prospect December 2003–February 2004<br />

<strong>The</strong> <strong>Department</strong> <strong>of</strong> Industry<br />

and <strong>Resources</strong> (DoIR) has<br />

totally revamped its website to<br />

reflect its wider responsibilities<br />

and improved customer focus<br />

since the amalgamation <strong>of</strong> the<br />

former <strong>Department</strong> <strong>of</strong> Mineral<br />

and Petroleum <strong>Resources</strong><br />

(MPR) with the industry and<br />

trades responsibilities <strong>of</strong> the<br />

former <strong>Department</strong> <strong>of</strong> industry<br />

and Technology (DoIT).<br />

Prospect readers are invited to<br />

explore the website, and gain a<br />

better understanding <strong>of</strong> the<br />

new organisation, and<br />

the many services<br />

that it <strong>of</strong>fers to<br />

clients and the public<br />

at large.<br />

In Australia’s and the liquefied natural gas (LNG)<br />

industry’s biggest single export deal, partners in<br />

the Gorgon gas project have entered into an<br />

agreement to supply China with 100 million tonnes <strong>of</strong><br />

LNG worth up to A$30 billion.<br />

<strong>The</strong> deal, with the China National Offshore Oil<br />

Company (CNOOC), was signed in Canberra on 24<br />

October during a visit to Australia by China’s President<br />

Hu Jintao. It coincided with the signing <strong>of</strong> a broader<br />

trade and economic accord between Australia and<br />

China.<br />

“Past, present and future, we see Australia as our<br />

important economic partner,” President Hu declared<br />

during his visit.<br />

This spells good news not only for Western<br />

Australian-based LNG traders, but also several<br />

mineral producers that have either established or are<br />

currently forging new alliances and markets in China.<br />

Western Australia’s Premier, Ge<strong>of</strong>f Gallop, said the<br />

agreement would further strengthen the <strong>State</strong>’s<br />

reputation as a world-class supplier <strong>of</strong> high-quality,<br />

competitively priced and environmentally friendly<br />

energy, and would further enhance its growing<br />

relationship with China.<br />

<strong>The</strong> agreement anticipated that CNOOC would<br />

buy an equity in the Gorgon gas project.<br />

ChevronTexaco Australia Pty Ltd’s Managing<br />

Director, Jay Johnson, said the agreement was<br />

significant as it provided a basis to underpin the<br />

commercialisation <strong>of</strong> the Gorgon field.<br />

<strong>The</strong> Gorgon development received in-principle<br />

approval in September, and a <strong>State</strong> Agreement was<br />

signed to facilitate the establishment <strong>of</strong> gas<br />

processing facilities on Barrow Island, <strong>of</strong>f Western<br />

Australia’s northwest coast.<br />

CNOOC is currently involved in the development<br />

<strong>of</strong> two LNG receival terminals in China, one in<br />

Guangdong province, the other in Fujian.<br />

CNOOC's President Fu Chengyu, who<br />

accompanied the Chinese President on his visit to<br />

Australia, said the Gorgon deal strongly reinforced the<br />

ties <strong>of</strong> friendship between China and Australia, and<br />

was a result <strong>of</strong> the good relations that had developed<br />

over the last few years.<br />

“We look forward to becoming an active and<br />

constructive player in the Australian hydrocarbon<br />

business as a Gorgon participant,” he said.<br />

Key economic benefits for Western Australia from<br />

the Gorgon project include:<br />

• jobs for 3000 people during the construction phase<br />

and 400 permanent jobs,<br />

• 6000 indirect jobs across the nation,<br />

• annual exports valued at A$2.5 billion,<br />

• A$18 billion in royalties to the Federal and Western<br />

Australian governments, and<br />

• a A$2 billion per year boost to the <strong>State</strong><br />

economy.

Great stainless steel opportunity<br />

for Western Australia<br />

Western Australia is leading the race<br />

over other Australian <strong>State</strong>s to<br />

become a significant producer —<br />

and exporter — <strong>of</strong> stainless steel.<br />

One <strong>of</strong> the world’s biggest iron ore traders<br />

(with Brazil), and the world’s third largest<br />

producer <strong>of</strong> nickel (behind Canada and<br />

Russia), Western Australia is well positioned<br />

to host the nation’s only stainless steel<br />

production facility, according to Richard<br />

Matheson, Executive Director <strong>of</strong> the<br />

Australian Stainless Steel <strong>Development</strong><br />

Association.<br />

Mr Matheson said Western Australia had<br />

relatively cheap energy, it had a skilled<br />

workforce, and was advantaged by its<br />

proximity to growing markets in Asia.<br />

<strong>The</strong> only other ingredient required to<br />

make stainless steel is chromium. While<br />

Western Australia has small, but promising<br />

chromium resources in the Pilbara, it may be<br />

necessary to import supplies <strong>of</strong> this<br />

commodity across the Indian Ocean from<br />

South Africa if a stainless steel plant was<br />

established here, Mr Matheson said.<br />

A good investment opportunity awaits any<br />

company or consortia with the vision to<br />

become the foundation operator <strong>of</strong> a<br />

stainless steel production facility in Western<br />

Australia.<br />

Such a plant would add to the diverse<br />

range <strong>of</strong> minerals and value-added products<br />

that the <strong>State</strong> already exports to various<br />

markets around the world.<br />

Rio Tinto’s HIsmelt pig iron plant at<br />

Kwinana, currently under construction, could<br />

become a catalyst for the company’s<br />

extension into stainless steel production.<br />

Since 1950, the demand for stainless steel<br />

has grown globally at a rate <strong>of</strong> 5.8% per year.<br />

Currently, world usage is about 20 Mt/a, and<br />

based on current forecasts, the demand is<br />

expected to be 30 Mt/a 10 years from now.<br />

About 128 000 tonnes <strong>of</strong> stainless steel <strong>of</strong><br />

various grades was imported into Australia<br />

last year, while Australian foundries produced<br />

a mere 4000–5000 tonnes <strong>of</strong> stainless steel.<br />

<strong>The</strong> Western Australian resources sector is<br />

a big user <strong>of</strong> stainless steel products, and with<br />

billions worth <strong>of</strong> petrochemical and other<br />

resource projects slated for development, the<br />

demand will continue to rise.<br />

Mr Matheson said an Australian-based<br />

stainless steel plant would need to have a<br />

capacity <strong>of</strong> around 500 000 tonnes per year,<br />

preferably with a 50% charge <strong>of</strong> scrap<br />

material.<br />

Polished performance: Since 1950, the demand for stainless steel has grown globally at a rate<br />

<strong>of</strong> 5.8% per year. Current world usage is about 20 Mt/a, and based on current forecasts,<br />

demand is expected to be 30 Mt/a 10 years from now. Many new buildings are now featuring<br />

long-lasting stainless steel cladding.<br />

However, he added, new technology could<br />

also make it attractive to produce stainless<br />

steel from virgin material.<br />

Production <strong>of</strong> stainless steel in Australia<br />

ended when BHP closed its electric arc<br />

furnace at Port Kembla in 1987, and the<br />

company’s cold-rolling mill in Wollongong in<br />

1997. Australian imports are now mainly<br />

sourced from Europe (Sweden, Finland,<br />

Germany, Italy, France, the United Kingdom<br />

and Spain), Korea, Taiwan, Japan and South<br />

Africa.<br />

Key industries in which stainless steel plays<br />

a part are food and beverage manufacturing<br />

(including wine production), food preparation<br />

and storage, household product<br />

manufacturing, automotive, resource<br />

processing, petrochemical, transport, marine,<br />

medical, water treatment and architectural<br />

construction industries.<br />

Prospect December 2003–February 2004 3

INVESTMENT OPPORTUNITIES — SOUTH WEST REGION<br />

Direct reduced iron (DRI) and hot briquetted<br />

iron (HBI) at Geraldton. This would be based<br />

on the development <strong>of</strong> the Koolanooka, Mt<br />

Gibson and Tallering Peak iron ore deposits,<br />

using Western Australian natural gas to fuel<br />

such a development.<br />

Further iron-related downstream processing<br />

opportunities based on the abovementioned<br />

and other resources in the Mid West.<br />

Copper and zinc<br />

Based on resources from the Golden Grove<br />

mine in the Mid West, a copper–zinc smelter<br />

could be competitive if located in the region. A<br />

port upgrade is now in progress in Geraldton,<br />

providing an opportunity to feed into expanding<br />

Asian and Indian markets.<br />

Tantalum alloy production<br />

Greenbushes tantalum is currently exported as<br />

a concentrate, but there is scope to upgrade<br />

this material for the aerospace market, and<br />

specialty chemicals used for silicon chips for<br />

mobile phones.<br />

Titanium metal (sponge) production<br />

Any expansion <strong>of</strong> the Dampier-to-Bunbury<br />

natural gas pipeline should lower the price <strong>of</strong><br />

gas and electricity, opening the way for a<br />

titanium metal (sponge) plant to be<br />

established, using product from the two<br />

existing low-cost titanium plants at Kwinana<br />

and Kemerton.<br />

Titanium dioxide pigment<br />

Despite already significant production,<br />

additional scope exists for further pigment<br />

manufacture to supply future growth <strong>of</strong> this<br />

basic commodity, which is used to make<br />

paints and plastics.<br />

Nickel–cobalt refining/smelting and stainless<br />

steel production<br />

Western Australia has world-class iron ore and<br />

nickel resources, plus competitively priced<br />

natural gas to support such an industry.<br />

Synergies associated with the nickel refinery<br />

and HIsmelt iron plant at Kwinana, plus the<br />

proximity <strong>of</strong> increasing markets in Asia,<br />

present many possibilities.<br />

High-purity silicon smelting<br />

<strong>The</strong> availability <strong>of</strong> high-purity silica sand, hard<br />

rock quartz deposits and reductants make it<br />

attractive to expand an existing smelter, or for<br />

a new smelter to be established. Markets<br />

could be linked to aluminium metal production<br />

and the manufacture <strong>of</strong> semiconductors.<br />

Prospects are enhanced by Western<br />

Australia’s proximity to markets in Asia,<br />

especially Japan and India.<br />

Aluminium smelting<br />

Such a project could be linked to some <strong>of</strong> the<br />

world’s most efficient alumina refineries in the<br />

4 Prospect December 2003–February 2004<br />

South West <strong>of</strong> Western Australia. <strong>The</strong><br />

looming sale and likely expansion <strong>of</strong> the<br />

Dampier-to-Bunbury natural gas pipeline, plus<br />

deregulation <strong>of</strong> the <strong>State</strong>’s electricity<br />

industry, should pave the way for cheaper<br />

energy to become available. <strong>The</strong> availability<br />

<strong>of</strong> efficient road, rail and port infrastructure<br />

makes an aluminium smelter a real<br />

possibility.<br />

Oil and gas developments in the Perth Basin<br />

Under-explored onshore and <strong>of</strong>fshore sites<br />

provide huge potential for explorers to tap<br />

into nearby ready-made markets in the most<br />

populated region <strong>of</strong> Western Australia.<br />

Coal<br />

Technology advances make clean coal an<br />

exciting option for power generation.<br />

Extensive sub-bituminous coal deposits and<br />

the increasing use <strong>of</strong> coal derivatives for<br />

chemical and pharmaceutical applications<br />

provide a raft <strong>of</strong> potential investment<br />

opportunities.<br />

Kaolin<br />

Massive untapped kaolin resources exist in<br />

the <strong>State</strong>’s South West which could be<br />

exploited for local and export markets.<br />

Renewable timber plantations<br />

Wood pulp mill<br />

Woodchip export business<br />

<strong>The</strong> South West <strong>of</strong> Western Australia has<br />

been identified as a highly favourable area for<br />

further investment in plantation enterprises.<br />

Investment opportunities include the<br />

establishment <strong>of</strong> renewable bluegums and<br />

other eucalyptus plantations (for greenhouse<br />

gas abatement, to combat land degradation<br />

and other sustainability-related matters), as<br />

well as the processing <strong>of</strong> timber for<br />

woodchips, saw logs and pulp.<br />

Other sustainable, renewable, carbon-neutral<br />

agri and silviculture businesses<br />

A myriad <strong>of</strong> other opportunities exist in this<br />

field across the South West. <strong>The</strong>y include<br />

canola for bio-diesel, wheat straw for pulp<br />

mills, low-grade grain for ethanol production<br />

(petrol additive or solvent), canola straw and<br />

other biomass for fibreboard, oil mallees for<br />

eucalyptus oil production, plantation<br />

bluegums for timber substitutes.<br />

Industrial land and infrastructure<br />

<strong>The</strong> South West <strong>of</strong> Western Australia has a<br />

number <strong>of</strong> industrial estates that can<br />

accommodate major resource-related<br />

downstream processing and support<br />

industries. <strong>The</strong> <strong>Department</strong> <strong>of</strong> Industry and<br />

<strong>Resources</strong> is also keen to hear from any<br />

potential private-enterprise infrastructure<br />

providers that are interested in investing in<br />

Western Australia.<br />

For further information, please contact Steve Arnott or David Ryan at the <strong>Department</strong> <strong>of</strong><br />

Industry and <strong>Resources</strong> on +61 8 9327 5555.<br />

SOUTH WEST<br />

Mineral and petroleum production 2002<br />

A$ million<br />

Alumina 3400<br />

Clay, gravel, sand 7<br />

Coal 266<br />

Gold 307<br />

Gypsum 2<br />

Heavy mineral sands 873<br />

Iron ore 110<br />

Nickel/cobalt 100<br />

Limestone/limesand 11<br />

Petroleum 25<br />

Salt 6<br />

Silica sand 6<br />

Spongolite 1<br />

Talc 9<br />

Tin, tantalum, lithium 5<br />

Total 5128

South West<br />

Geraldton q<br />

PERTH<br />

Bunbury q<br />

q<br />

Esperance<br />

q Albany

Amity Oil remains optimistic<br />

Since its discovery more than 30 years<br />

ago, the Whicher Range gas project in<br />

the South West <strong>of</strong> Western Australia has<br />

promised to enhance the economic<br />

prosperity <strong>of</strong> the region by providing a<br />

competitive source <strong>of</strong> fuel for power<br />

generation. Unfortunately, extracting the gas<br />

out from the 4 trillion cubic feet field has<br />

proved difficult. However, project operator,<br />

Amity Oil NL, is hoping for some good news<br />

by year’s end.<br />

Amity and its partners are currently<br />

spending A$10–12 million to drill down to<br />

the start <strong>of</strong> the reservoir at 3700 metres.<br />

Since the discovery <strong>of</strong> the field by Union Oil<br />

<strong>Development</strong> Corporation in 1968, four<br />

holes have intersected the gas field, but the<br />

use <strong>of</strong> mud and water in the drilling process<br />

caused damage to the reservoir and resulted<br />

in sub-commercial quantities <strong>of</strong> gas being<br />

recovered.<br />

Under the latest drilling program, mud<br />

and water will again be used to reach the<br />

reservoir, but the drilling medium will then<br />

be replaced by air to pump the gas out in a<br />

bid to avoid damage to the reservoir.<br />

Amity Oil managing director, Howard<br />

McLaughlin, said there was considerable<br />

potential for the gas if it could be proven to<br />

the market that the resource was<br />

commercial.<br />

"Potential markets for the gas exist south<br />

<strong>of</strong> Perth and include power generation and<br />

individual users," said Mr McLaughlin.<br />

"Once that’s achieved, we will secure<br />

contracts, drill more wells, complete<br />

permitting and land rights negotiations and<br />

work through any remaining road blocks."<br />

Large projects on the drawing board that<br />

could benefit from a local source <strong>of</strong> energy<br />

for cheap power generation include a<br />

proposed pulp mill, an aluminium smelter,<br />

expansion <strong>of</strong> existing mineral processing<br />

operations and power generation.<br />

<strong>The</strong> success <strong>of</strong> the Whicher 5 well was still<br />

uncertain at the time Prospect magazine<br />

went to press on Friday 5 December 2003.<br />

If the well fails to live up to expectations,<br />

there are still some courses <strong>of</strong> action open to<br />

Amity and its partners — such as horizontal<br />

drilling or hydraulic fracturing using carbon<br />

dioxide.<br />

Remedial work on the damaged Whicher<br />

4 well in 1999 resulted in a flow rate <strong>of</strong> 2.5<br />

6 Prospect December 2003–February 2004<br />

BY DAMON FRITH<br />

Well spudded: <strong>The</strong> start <strong>of</strong> more than 3700 metres <strong>of</strong> drilling to test the practicality <strong>of</strong><br />

extracting tight gas from the Whicher Range field near Busselton.<br />

million cubic feet a day, twice that <strong>of</strong> previous<br />

flows, but still well below the flow rates Amity<br />

is expecting from its new approach to tapping<br />

the Permian-age Sue Group reservoir.<br />

Located 21 km south <strong>of</strong> Busselton, the<br />

Whicher project is cashed up following a<br />

farm-in agreement earlier this year by Amity<br />

and United <strong>State</strong>s based GeoPetro <strong>Resources</strong><br />

with Korea National Oil Corporation and<br />

Seoul City Gas Company. Under the<br />

agreement, the two Asian companies will<br />

commit A$6.7 million for exploration at<br />

Whicher Range for a 20% and 15% interest in<br />

the project respectively.<br />

If the Whicher partners can turn the<br />

project into an operating field, it will be at a<br />

time when deregulation <strong>of</strong> the Western<br />

Australian Government owned Western<br />

Power could stimulate interest in the South<br />

West for new private-enterprise generated<br />

power.

Peak potential looms for Kemerton<br />

Industrial Park<br />

Kemerton on the way up: Millennium<br />

Inorganic Chemical’s titanium dioxide plant at<br />

Kemerton will soon have a neighbour, in the<br />

form <strong>of</strong> a 260 megawatt power station to be<br />

operated by Transfield Services Limited.<br />

Kemerton Industrial Park, long<br />

overlooked as a preferred site for<br />

major industry in Western Australia’s<br />

South West region, has scored a major coup<br />

by being chosen as the location for a new<br />

A$250 million gas-fired power station.<br />

<strong>The</strong> 260 megawatt power station, to be<br />

owned and operated by Transfield Services<br />

Limited, is designed to meet the peak-load<br />

requirements <strong>of</strong> Western Australia’s largest<br />

electricity provider, Western Power.<br />

Kemerton was chosen ahead <strong>of</strong> four other<br />

sites for the new power station. Other<br />

options included Pinjar, north <strong>of</strong> Perth, where<br />

Western Power operates a number <strong>of</strong> gasfired<br />

power generating units, two sites in the<br />

Kwinana – East Rockingham area and another<br />

at Bunbury.<br />

Western Power has negotiated a 25-year<br />

power purchase agreement with Transfield<br />

that will come into effect when the Kemerton<br />

power station is operational in late 2005.<br />

<strong>The</strong> station will be built by Siemens under<br />

a fixed-priced turnkey contract with<br />

Transfield.<br />

About 400 people will be employed during<br />

the 14-month construction phase, with<br />

Australian content and local contractors to be<br />

used wherever possible.<br />

<strong>The</strong> A$250 million cost includes two gas<br />

turbines, new substation works and a hookup<br />

to the nearby Dampier-to-Bunbury<br />

natural gas pipeline.<br />

8 Prospect December 2003–February 2004<br />

Construction is expected to start in early<br />

2004, with the power station due to be<br />

operating by October 2005.<br />

Kemerton’s success in securing the power<br />

station is a coup for those running the South<br />

West industrial park, because, apart from a<br />

A$15.5 million waste water treatment plant<br />

completed last year, it is the first major new<br />

industry to be established there since<br />

Simcoa’s silicon smelter and SCM Chemicals’<br />

(now Millennium Inorganic Chemicals)<br />

titanium dioxide plant began operations<br />

more than a decade ago.<br />

<strong>The</strong> latest power station decision renews<br />

impetus for Kemerton Industrial Park to<br />

realise its true potential, and become the<br />

premier hub for major industry south <strong>of</strong> the<br />

Kwinana industrial strip.<br />

LandCorp General Manager Operations,<br />

Mike Moloney, is optimistic that the power<br />

station deal will kick-start a bright new future<br />

for the industrial park.<br />

“While we recognise there have been no<br />

new major industries established there for<br />

more than a decade, the ground work has<br />

been laid at Kemerton for many exciting<br />

development opportunities to unfold in the<br />

years ahead,” he said.<br />

With plenty <strong>of</strong> land available, natural gas<br />

and electricity running right through the park<br />

and a major new power station, Kemerton<br />

presents an attractive proposition for<br />

industrial developers.<br />

Kemerton has everything waiting to catch<br />

the overflow from Kwinana. In fact, its<br />

industrial core is being expanded from 1151<br />

to 2106 ha. Significant environmental work<br />

has been undertaken to assist developers<br />

establish their projects inside the industrial<br />

core, with a substantial 5437 ha buffer zone<br />

separating it from non industrial land.<br />

<strong>The</strong> park has excellent road access both to<br />

the Port <strong>of</strong> Bunbury and the Perth<br />

metropolitan area, via the Old Coast Road.<br />

Environmental approval is currently being<br />

sought for a rail link between Kemerton and<br />

the port at Bunbury.<br />

<strong>The</strong> new private power station earmarked<br />

for Kemerton also provides an opportunity to<br />

meet the additional energy requirements <strong>of</strong><br />

new industries within the industrial park in a<br />

competitive environment. Possible new<br />

industries include a pulp mill and aluminium<br />

smelter.<br />

Enquiries should be directed to LandCorp:<br />

Telephone: +61 (8) 9482 7499<br />

Facsimile: +61 (8) 9481 0861<br />

Email: landcorp@landcorp.com.au<br />

Big incentives<br />

It is becoming increasingly clear that<br />

hydrogen will not replace traditional fuels<br />

overnight.<br />

<strong>The</strong> timeframe for any major shift to<br />

hydrogen is likely to be long term, perhaps 30<br />

to 50 years, experts are saying.<br />

On this basis, the clean-burning qualities<br />

<strong>of</strong> natural gas will always be attractive, at<br />

least until the hydrogen economy kicks in.<br />

That’s good news for petroleum explorers<br />

operating within Australia, especially those<br />

eyeing investment opportunities in the<br />

country’s most prospective resources <strong>State</strong>,<br />

Western Australia.<br />

Investment analysts within the<br />

<strong>Department</strong> <strong>of</strong> Industry and <strong>Resources</strong> say<br />

that an excellent window <strong>of</strong> opportunity<br />

exists for petroleum companies to find — and<br />

commercialise — gas and oil resources within<br />

the Perth Basin, an area that roughly stretches<br />

from Geraldton south to Augusta.<br />

<strong>The</strong> current demand for gas in the <strong>State</strong>’s<br />

South West (an arc from Geraldton extending<br />

to the south coast) is approximately 600<br />

terajoules per day equivalent. Over the next<br />

20 years, the energy requirement for this area<br />

is expected to expand to something like 1200<br />

TJ/d.<br />

That means more energy, particularly gas,<br />

needs to come from somewhere.<br />

Most <strong>of</strong> the extra demand will be directly<br />

or indirectly driven by the resources sector.<br />

<strong>The</strong> source <strong>of</strong> this additional gas is<br />

anyone’s guess. But, it would be a distinct<br />

advantage, both for Western Australia and the<br />

supplier, if it were sourced from the lightly<br />

explored Perth Basin.<br />

A study is currently in progress to<br />

determine likely energy needs <strong>of</strong> South West<br />

coastal regions <strong>of</strong> Western Australia over the<br />

next 20 years.<br />

<strong>The</strong> study will consider broad<br />

requirements to deliver competitively priced<br />

energy to supply mineral developments and<br />

processing in the region. In particular, the<br />

study aims to identify energy prices that will<br />

meet present interest in world-scale<br />

downstream resource projects such as light<br />

metals.<br />

So, potentially good rewards await<br />

petroleum explorers who can discover viable<br />

new gas resources within the Perth Basin.<br />

<strong>The</strong> Perth Basin has been a reliable gas<br />

producer for a number <strong>of</strong> decades and first<br />

supplied gas to Perth in 1971, long before the<br />

giant North Rankin gas-condensate field<br />

came on-stream in 1984.

While resources within the fabulously rich<br />

<strong>of</strong>fshore Carnarvon Basin to the north are<br />

sufficient to sustain a world-class LNG export<br />

industry and major gas processing on the<br />

Burrup Peninsula, requirements for gas in the<br />

Perth Basin are orientated towards domestic<br />

fuel and industry needs. Currently, Western<br />

Australia has both the largest industrial gas<br />

market in Australia, and the highest<br />

penetration <strong>of</strong> gas as a fuel for industry.<br />

BY DAMON FRITH<br />

United <strong>State</strong>s-based Red<br />

Mountain Energy could<br />

soon be an Australian listed<br />

company if its project to<br />

extract gas from coal beds<br />

south <strong>of</strong> Dunsborough can be<br />

made commercial.<br />

Red Mountain has sufficient cash to carry out a<br />

three-well drill program on the Sue Coal<br />

Measures, which could contain as much as 500<br />

billion cubic feet <strong>of</strong> recoverable gas. Drilling is<br />

expected to start in March 2004, following<br />

government and native title approvals.<br />

If the wells are successful, Red Mountain<br />

managing director, Steve Thomas, said<br />

additional funding would be required to move to<br />

a commercial operation and a public listing<br />

would be the preferred route.<br />

Under the development proposal, according to<br />

Mr Thomas, each well would be capable <strong>of</strong><br />

producing about 150 000 cubic feet <strong>of</strong> gas a<br />

day, with all producing wells tied into a lowpressure<br />

central gathering system.<br />

<strong>The</strong> gas would then be passed though micro<br />

turbines about the size <strong>of</strong> a refrigerator, but<br />

capable <strong>of</strong> producing 30–60 Kw <strong>of</strong> electricity<br />

with low greenhouse emissions and no water<br />

used in the process. Unlike diesel generators,<br />

the micro turbines can also work 24 hours a day<br />

without restrictions and little maintenance. <strong>The</strong><br />

power generated would flow through to the local<br />

grid for distribution to customers.<br />

Mr Thomas said the project would be a boutique<br />

energy producer with product sold to businesses<br />

such as holiday resorts and small factories.<br />

“We can get by on low production. Each well<br />

costs about $80 000 and production is simple<br />

— each well is essentially a water well with a<br />

pump in it. Well life is seven to eight years,” he<br />

said.<br />

“Environmentally, we have advantages as well.<br />

<strong>The</strong>re are no chemicals used in the wells, the<br />

rigs are compact and the water we extract while<br />

Based on current drawdown figures, the<br />

Perth Basin has reserves for only another 10<br />

years.<br />

A drilling program is currently in progress<br />

in the southern part <strong>of</strong> the Perth Basin at<br />

Whicher Range, near Busselton, in a bid to<br />

commercialise a known “tight gas” resource,<br />

estimated at 4 Tcf in place.<br />

Any sizeable new gas discoveries could be<br />

readily fed into existing pipeline<br />

dewatering a well prior to production is fresh<br />

and can be used by local farmers.”<br />

Coal bed methane (CBM) gas production is<br />

new to Western Australia, but common in<br />

the United <strong>State</strong>s and <strong>of</strong> increasing<br />

importance on the east coast <strong>of</strong> Australia.<br />

Red Mountain had CBM operations in the<br />

US, but sold its assets about nine months<br />

ago. Aside from its Australian project, the<br />

company is negotiating for acreage in<br />

Canada and will seek other opportunities in<br />

Australia, North America and New Zealand.<br />

Mr Thomas said a stable environment was<br />

required to make the operation viable as a<br />

change in pricing policies or the business<br />

regulatory environment could make the<br />

project unviable.<br />

He said the working area for the CBM<br />

project stretched from south <strong>of</strong><br />

Dunsborough to Augusta and would keep<br />

the company occupied for the next couple <strong>of</strong><br />

years.<br />

<strong>The</strong> move to establish a public company to<br />

develop the project recently took a step<br />

forward with negotiations currently<br />

underway to purchase a shelf company as<br />

the first step to listing the company in<br />

Australia. A prospectus could be released<br />

soon.<br />

Mr Thomas said progressing the CBM<br />

project to a commercial operation would<br />

require debt or capital funding.<br />

Mr Thomas is the former managing director<br />

<strong>of</strong> another locally listed company, Growth<br />

<strong>Resources</strong>, which had exploration<br />

acreage in Alaska.<br />

south west �<br />

for Perth Basin petroleum explorers<br />

BY JIM KENDAL AND JOHN TERRELL • DEPARTMENT OF INDUSTRY AND RESOURCES<br />

Coal bed methane<br />

Gas <strong>of</strong> a different kind<br />

Turning gas into electricity:<br />

Numerous micro turbines about<br />

the size <strong>of</strong> a refrigerator, each<br />

capable <strong>of</strong> producing 30–60 Kw <strong>of</strong><br />

electricity using coal-bed methane<br />

as a fuel, could one day be used<br />

to feed electricity into the South<br />

West power grid.<br />

infrastructure in Western<br />

Australia under the <strong>State</strong>’s<br />

open access legislation, or<br />

be channelled directly to<br />

new or existing gas<br />

markets if developers<br />

decide to build a new<br />

pipeline.<br />

Plenty <strong>of</strong> minerals<br />

Areas in and adjacent<br />

to the Perth Basin are well<br />

endowed with mineral<br />

resources, and any one <strong>of</strong><br />

a number <strong>of</strong> new resource<br />

projects would benefit<br />

from additional gas<br />

supplies from the Perth<br />

Basin.<br />

Developing resources<br />

such as the Tallering Peak,<br />

Mt Gibson and<br />

Koolyanobbing iron ore<br />

deposits, expanding heavy<br />

mineral sands operations,<br />

increasing bauxite and<br />

gold mining in the Darling<br />

Ranges, the possibility <strong>of</strong><br />

an aluminium smelter and<br />

50 km<br />

115° 116°<br />

JT 1 2 7.10.03<br />

development <strong>of</strong> the Ravensthorpe laterite<br />

nickel project could provide a strong demand<br />

for gas over the next 20 years.<br />

<strong>The</strong> three key features <strong>of</strong> the Perth Basin<br />

are its high prospectivity for oil and gas, easy<br />

access to exploration acreage, and a strong<br />

local demand for gas.<br />

Besides the potential mobilisation <strong>of</strong><br />

several large resource projects, there is also<br />

potential for a small petroleum refinery to be<br />

established, plus several other downstream<br />

processing industries that could benefit from<br />

any gas discovery in the Perth Basin.<br />

In short, the Perth Basin is a highly<br />

attractive investment opportunity for both<br />

international and junior petroleum explorers.<br />

Explorers will be comforted by the fact<br />

that unlike many other hydrocarbon basins<br />

in Australia, the Perth Basin is not isolated.<br />

Located on or near the lower west coast, it<br />

straddles the largest gas pipeline in Australia,<br />

and is on the doorstep <strong>of</strong> Perth.<br />

Of course, Perth’s Mediterranean-style<br />

climate and lifestyle (pristine beaches, lobster<br />

fishing, some <strong>of</strong> the tallest forests in the<br />

world, whale-watching opportunities, worldfamous<br />

wineries, plus affordable<br />

accommodation and outstanding<br />

educational facilities) are additional features<br />

for investors to consider.<br />

Prospect December 2003–February 2004 9<br />

Petroleum well<br />

Prospect<br />

Seismic line<br />

Sundalara<br />

Dandaragan Deep<br />

Gingin Br ook<br />

Ec Eclipse lipse West<br />

INDIAN<br />

OCEAN<br />

Bunbury<br />

Carnamah<br />

Warr o<br />

Pe rth<br />

Ec lipse<br />

30°<br />

32°<br />

34°

<strong>The</strong> power <strong>of</strong> biomass<br />

Residue from an innovative timber<br />

project will fuel<br />

Western Australia’s first<br />

biomass power station, based<br />

on the sprawling pine forests<br />

north <strong>of</strong> Perth.<br />

Beacons International Ltd<br />

is leading a group which plans<br />

a 30 megawatt power station<br />

close to a timber veneer<br />

factory in the City <strong>of</strong><br />

Wanneroo, capable <strong>of</strong><br />

providing electricity for 24<br />

000 homes.<br />

<strong>The</strong> plantations cover 21<br />

000 hectares, mainly in the<br />

Gnangara area, as well as<br />

revegetated farming<br />

properties to the northeast,<br />

east and south <strong>of</strong> Perth. As<br />

the pine trees are cut down<br />

over the next quarter <strong>of</strong> a<br />

century, the residue will<br />

provide an astonishing 160<br />

000 tonnes a year <strong>of</strong> waste<br />

material which, without the<br />

power station, would have<br />

been largely wasted.<br />

<strong>The</strong> laminated veneer<br />

lumber factory to be operated<br />

by Wesbeam Ltd will produce<br />

90 000 tonnes <strong>of</strong> product a<br />

year.<br />

This massive resource <strong>of</strong><br />

fuel will be ideal for the<br />

biomass power station that<br />

will make a contribution to<br />

Perth’s electricity needs.<br />

Biomass, the description<br />

<strong>of</strong> any residue from<br />

agriculture, is regarded as one<br />

<strong>of</strong> the most promising <strong>of</strong><br />

alternative energy sources, and uses welltried<br />

technology, with generating equipment<br />

readily available.<br />

<strong>The</strong> Gnangara project is likely to be the<br />

first <strong>of</strong> several planned by Beacons<br />

International, including the south <strong>of</strong> the<br />

<strong>State</strong>, based on the waste material from<br />

woodchip operations.<br />

<strong>The</strong>re are several potential ventures that<br />

would benefit local communities, especially<br />

where there is a growing demand for<br />

electricity.<br />

Although it is less exotic than wind power<br />

and solar energy, biomass makes up the<br />

greatest proportion <strong>of</strong> sustainable energy<br />

10 Prospect December 2003–February 2004<br />

BYJOHN MCILWRAITH<br />

Biomass bonus: Millions <strong>of</strong> pine trees have been planted in Western<br />

Australia that will feed timber into a laminated veneer lumber plant (LVL)<br />

in the City <strong>of</strong> Wanneroo. Bark and other waste material from the LVL plant<br />

will provide fuel for Western Australia’s first biomass power station.<br />

projects around the world at present, and has<br />

the virtue <strong>of</strong> using material that would<br />

otherwise be discarded.<br />

Biomass power stations in Western<br />

Australia will go a long way towards meeting<br />

the <strong>State</strong>’s target for sustainable energy, a<br />

target that is likely to be increased in the<br />

future.<br />

At present, the <strong>State</strong> has an objective <strong>of</strong><br />

deriving 5% <strong>of</strong> its electricity supplies from<br />

renewable energy, but this is an ambitious<br />

objective.<br />

<strong>The</strong> Gnangara project would use<br />

conventional boiler and turbine facilities, and<br />

would buy, for a modest sum, the residues<br />

discarded by the laminated veneer factory,<br />

and would also benefit from<br />

credits provided by<br />

governments for sustainable<br />

energy projects.<br />

Biomass obviously has a<br />

lower heating value than other<br />

fuels such as coal, and the<br />

modest economics <strong>of</strong> the<br />

venture requires that<br />

the residue be within<br />

100 km from a power<br />

station with a radius<br />

<strong>of</strong> 50 km more<br />

desirable.<br />

Because <strong>of</strong> the<br />

need to have the<br />

stations close to the<br />

source <strong>of</strong> the energy<br />

crops, they are likely<br />

to be located in rural<br />

areas, a socially<br />

desirable outcome.<br />

Beacons<br />

International has a<br />

long-term objective<br />

<strong>of</strong> linking biomass<br />

power generation with water<br />

projects, with the most<br />

ambitious concept, that <strong>of</strong><br />

desalination.<br />

<strong>The</strong> ventures it is examining<br />

in the south <strong>of</strong> the <strong>State</strong> take<br />

into account water shortages in<br />

some rural areas.<br />

Millions <strong>of</strong> trees have been<br />

planted in the Great Southern<br />

and adjacent areas over the past<br />

decade, and rapidly increasing<br />

wood chip production in the<br />

next few years will produce a<br />

valuable source <strong>of</strong> waste<br />

materials. Biomass processes<br />

have the added advantage <strong>of</strong> using almost all<br />

<strong>of</strong> the residues with, for example, the nutrient<br />

rich ash being incorporated into fertilisers.<br />

<strong>The</strong> Gnangara power station project is at<br />

an advanced stage <strong>of</strong> study, and Beacons and<br />

its fellow participants hope that construction<br />

could begin early in the second half <strong>of</strong> 2004,<br />

with the first power delivered in the first half<br />

<strong>of</strong> 2006.<br />

<strong>The</strong> estimated capital cost <strong>of</strong> A$69 million<br />

could be easily serviced from electricity tariffs<br />

expected to be secured under long-term<br />

contracts, making it an attractive<br />

investment.

Synthetic rutile research<br />

south west ��<br />

Waste not — as Iluka discovers products<br />

beyond the norm<br />

<strong>The</strong> resources sector’s current strong<br />

focus on sustainability has resulted in<br />

industries looking hard at the<br />

materials that their processes discard.<br />

Iluka <strong>Resources</strong> Limited has identified<br />

that reduced waste production in its<br />

synthetic rutile (SR) process would provide<br />

an economic advantage and a perceived<br />

product advantage when compared with<br />

competing products.<br />

So, when its newest SR plant was brought<br />

online in 1997 it was the first to generate<br />

electricity from the waste heat on the kiln.<br />

Much <strong>of</strong> the electricity for SR production on<br />

the two plants at Capel is now provided from<br />

waste heat generation.<br />

It had been known that the coal used in<br />

the kiln process is highly reactive (in fact,<br />

Collie coal has been regarded as an ideal<br />

medium for direct reduction because <strong>of</strong> its<br />

reactivity), but much <strong>of</strong> the charred coal in<br />

the waste streams has the properties to<br />

qualify it as activated carbon.<br />

In 2001, a strategic liaison with Norit<br />

Activated Carbon, a world leader in activated<br />

carbon manufacture and marketing, set Iluka<br />

on a program to recover carbon from waste<br />

streams for use as a highly valued product.<br />

In the past year, more than 1000 tonnes <strong>of</strong><br />

char was recovered, upgraded and shipped to<br />

the Netherlands for use in various Norit<br />

products. <strong>The</strong> development program will see<br />

that tonnage increase significantly over the<br />

coming years with the eventual aim <strong>of</strong> totally<br />

eliminating carbonaceous waste.<br />

<strong>The</strong> main discard from the SR process is<br />

the iron oxide extracted from the ilmenite.<br />

While the iron analysis <strong>of</strong> the material<br />

indicates suitability for production <strong>of</strong> pig<br />

iron, the very fine size, unusual impurities<br />

and residual salts detract from its value.<br />

Iluka developed a process especially for<br />

the processing <strong>of</strong> this and similar material,<br />

but the downturn in the global iron and steel<br />

market made the process unviable.<br />

Armed with better knowledge <strong>of</strong> the iron<br />

and steel industry and an appreciation <strong>of</strong> the<br />

properties <strong>of</strong> the iron oxide, Iluka is confident<br />

<strong>of</strong> finding a long-term use.<br />

<strong>The</strong> used acid stream in the SR process<br />

<strong>of</strong>fers a number <strong>of</strong> potential uses.<br />

In control: Already an efficient synthetic rutile producer, Iluka <strong>Resources</strong> is now capitalising on<br />

waste products to boost the overall efficiency <strong>of</strong> its South West operations.<br />

Sulphuric acid is used to leach iron and<br />

manganese from the SR as a final process<br />

step. Some <strong>of</strong> the used acid is recirculated to<br />

the process and some is discarded. <strong>The</strong><br />

discarded acid is first neutralised with<br />

quicklime to produce a solid, rich in gypsum<br />

and containing iron and manganese oxides.<br />

<strong>The</strong> solid separates from the water and has<br />

some useful properties. <strong>The</strong>se properties<br />

make the solids beneficial for upgrading poor<br />

sandy soil — the fine sizing helps moisture<br />

retention, the high pH helps buffer soil<br />

acidity and the complex iron compounds<br />

retain phosphorus.<br />

Effective use as a soil conditioner has been<br />

demonstrated and Iluka is reviewing the use<br />

<strong>of</strong> the solids in its own rehabilitation<br />

program.<br />

During early demonstration <strong>of</strong> the solids<br />

as a soil conditioner, a <strong>Department</strong> <strong>of</strong><br />

Agriculture scientist suggested that, with a<br />

small amount <strong>of</strong> processing, the material<br />

could be turned into a sulphur fertiliser.<br />

Granulating and curing led to the production<br />

<strong>of</strong> Iron Man Gypsum (named for the iron<br />

and manganese in the product). Iron Man<br />

Gypsum has been sold for five years as a<br />

persistent sulphur fertiliser providing<br />

valuable trace elements — manganese,<br />

iron, calcium and magnesium.<br />

Further review <strong>of</strong> the origin <strong>of</strong> the waste<br />

stream indicated a value in the unused<br />

acid, and the concept <strong>of</strong> using phosphate<br />

rock in place <strong>of</strong> the lime to undertake the<br />

first stage <strong>of</strong> the neutralisation <strong>of</strong> the used<br />

acid was born. Initial test work proved that<br />

a phosphate mineral, insoluble in water<br />

but soluble in the organic acids around<br />

plant roots could be produced. Currently,<br />

work is being undertaken at Perth’s<br />

Murdoch University to optimise the<br />

manufacture <strong>of</strong> a phosphate fertiliser that<br />

will not contaminate waterways and<br />

groundwater.<br />

<strong>The</strong> work done on used acid<br />

demonstrates three potential uses. <strong>The</strong><br />

solid waste is, in fact, useful as a soil<br />

conditioner and is potentially very<br />

beneficial agriculturally in the poor sandy<br />

soils around Western Australia’s SR plants.<br />

<strong>The</strong> sulphur in particular, is valuable as a<br />

nutrient, and by investigating further<br />

processing the value <strong>of</strong> the material can be<br />

enhanced considerably.<br />

Prospect December 2003–February 2004 11

12 Prospect December 2003–February 2004<br />

Portman fast tracks Koolyanobbing<br />

expansion to meet soaring demand<br />

Yilgarn iron ore<br />

producer Portman<br />

Limited has<br />

responded swiftly with the<br />

implementation <strong>of</strong> the<br />

A$20 million expansion <strong>of</strong><br />

its Koolyanobbing iron ore<br />

project to capitalise on<br />

soaring international iron<br />

ore demand.<br />

Buoyed by recent<br />

predictions that iron ore<br />

producers will reap<br />

another substantial price<br />

increase next year driven<br />

by China’s “ravenous<br />

appetite” for steel,<br />

Portman — like its<br />

counterparts at the upperend<br />

<strong>of</strong> the production<br />

Milestone: Portman’s port operations<br />

supervisor Roger Nancarrow (right) presents<br />

the Esperance Port Authority’s Bill Cutten with<br />

a hand-crafted grass tree bowl to<br />

commemorate the 20th million tonne <strong>of</strong> iron<br />

ore to be exported from Esperance.<br />

scale, Rio Tinto and BHP-Billiton — is racing to meet the new demand.<br />

A report released by AME Mineral Economics in October predicted that<br />

global iron ore consumption would increase by more than 6% in 2003,<br />

and continue rising over the next five years as demand in China doubles<br />

from the start <strong>of</strong> the decade to an estimated 500 Mt by 2008.<br />

On this basis, AME predicted that prices for benchmark Australian fines<br />

ore would match the 2002 increase <strong>of</strong> 9%, making 2003 prices the<br />

highest in a decade.<br />

“It is certainly a very exciting market,” says Richard Mehan, Portman’s<br />

General Manager, Iron Ore, the Portman executive responsible for<br />

overseeing the expansion project.<br />

“Our challenge is to position ourselves to meet the demand as quickly as<br />

possible, particularly considering the fact that the Koolyanobbing<br />

expansion project was held up for a couple <strong>of</strong> years due to environmental<br />

reasons,” he adds.<br />

<strong>The</strong> project now has the approval <strong>of</strong> both the <strong>State</strong> and Federal<br />

governments.<br />

Environmental approvals are conditional on no more than 30% <strong>of</strong> the<br />

native population <strong>of</strong> the plant Tetratheca paynterae being directly<br />

impacted by Portman’s initial mining operations.<br />

This will subsequently be increased to a 50% impact on completion <strong>of</strong> a<br />

comprehensive research and management plan by Portman which<br />

demonstrates that the remaining population <strong>of</strong> the plant can be<br />

maintained.<br />

<strong>The</strong> expansion project involves the development <strong>of</strong> new mining areas at<br />

Windarling and Mt Jackson, some 100 km north <strong>of</strong> Portman’s current<br />

mining operations at Koolyanobbing. Ore mined from the new areas will<br />

be trucked to the existing processing plant for blending to extend the life<br />

<strong>of</strong> the operation and, potentially, increase annual production.<br />

This tight development timetable should see Portman commence final<br />

construction and mine development activity at the Northern Tenements in<br />

early 2004, enabling it to produce first ore around March 2004.<br />

<strong>The</strong> base production rate for the expanded operation will be 4.8 Mt/a. An<br />

increase in the long-term production rate above 5.2 Mt/a will require a<br />

further capital investment, currently estimated at A$15 million.<br />

“That decision is driven by a number <strong>of</strong> factors including current market<br />

opportunities, new product opportunities and ore production from the<br />

Northern Tenements,” Mr Mehan said.<br />

Even at the base case production rate, the commencement <strong>of</strong> ore<br />

production at the Northern Tenements will ensure that iron ore mining<br />

continues at Koolyanobbing for many years to come.<br />

<strong>The</strong> operation recently celebrated a key milestone with the mining, railing<br />

and shipping <strong>of</strong> the 20 millionth tonne <strong>of</strong> ore.

A Bright Future<br />

Planned for Investors in Victoria Petroleum N.L.<br />

Victoria Petroleum N.L looks set to increase oil production after<br />

joining the ranks <strong>of</strong> Australia's oil producers. Participant in<br />

onshore North Perth Basin 5 MMBO Jingemia Oil Field<br />

production testing up to 1700 bopd in second half 2003.<br />

� <strong>Development</strong> drilling program in Jingemia Oil Field with<br />

aim to increase production to 4000bopd in 1st Qtr 2004<br />

� Four well November 2003-February 2004 drilling<br />

program in Surat Basin, QLD and Carnarvon Basin, WA<br />

targeting 54 Million bbl oil potential<br />

� Active explorer and major acreage holder in Cooper<br />

Basin, South Australia with 5 wells starting drilling in<br />

March 2004<br />

� Australia and US net oil production <strong>of</strong> 100 bopd in 3rd<br />

Qtr 2003 with 14 wells planned over next 9 months<br />

CONTACTS John Kopcheff Managing Director Chas Lane Exploration Manager<br />

PHONE 08 9220 9800 FACSIMILE 08 9220 9801 E-MAIL admin@vicpet.com.au<br />

ADDRESS Level 36 Exchange Plaza, 2 <strong>The</strong> Esplanade, Perth Western Australia 6000<br />

VICTORIA PETROLEUM ASX CODE: VPE FOR MORE INFORMATION PLEASE VISIT www.vicpet.com.au<br />

DHA - VP0098

Environmental excellence<br />

Beenup consultative group gets Gecko gong<br />

Despite the disappointment and<br />

difficulties associated with the<br />

closure <strong>of</strong> the Beenup mineral sands<br />

project near Augusta, the efforts <strong>of</strong> one <strong>of</strong> the<br />

parties involved, the Beenup Consultative<br />

Group, have shone through.<br />

Appropriately, the tireless efforts <strong>of</strong> the<br />

group have been recognised in the form <strong>of</strong> a<br />

Golden Gecko award for environmental<br />

excellence — the highest honour accorded to<br />

people, companies and groups associated<br />

with resources development in Western<br />

Australia.<br />

<strong>The</strong> A$200 million Beenup project<br />

commenced operations in 1997, but two<br />

years later BHP closed the mine after it failed<br />

to reach production targets due to technical<br />

and environmental problems.<br />

Located 17 km from Augusta, the<br />

premature closing <strong>of</strong> the mine was a blow to<br />

the local community, which had already<br />

planned for the long-term economic benefits<br />

and business opportunities <strong>of</strong> having a major<br />

minerals project on its doorstep. <strong>The</strong> Beenup<br />

site lies near the confluence <strong>of</strong> the Scott and<br />

Blackwood Rivers, and is adjacent to the Scott<br />

National Park.<br />

From its inception in 1989, the Beenup<br />

Consultative Group (BCG) has worked closely<br />

with BHP and local communities to achieve a<br />

result all could live with. From the outset it<br />

had to deal with two polarized camps in its<br />

dealings. <strong>The</strong> first camp saw employment and<br />

opportunities to boost the local economy,<br />

whereas the second camp viewed the project<br />

as an environmental disaster.<br />

Comprising representatives from the local<br />

community, BHP, conservation groups and<br />

the local council, the consultative group was<br />

an integral part in the successful opening <strong>of</strong><br />

Beenup, and its role has progressed through<br />

to the closure and rehabilitation <strong>of</strong> the site.<br />

BCG chairman, Nicholas Dornan, said<br />

initially the group had worked in an<br />

environment <strong>of</strong> strained relations between<br />

BHP and the community, but subsequently<br />

the situation had rapidly turned around.<br />

“BHP learned very quickly to provide all<br />

information on the project in an honest and<br />

open manner. It was quite a unique process<br />

— to be so involved with a major company<br />

and opening up new ways to engage with the<br />

local community,” Mr Dornan said.<br />

With the announcement <strong>of</strong> the closure <strong>of</strong><br />

the mine, the role <strong>of</strong> BCG changed from<br />

14 Prospect December 2003–February 2004<br />

managing the upside potential <strong>of</strong> the<br />

mine’s presence in the region to<br />

rehabilitation <strong>of</strong> the site and<br />

salvaging good from the disaster.<br />

Under the rehabilitation plan, a<br />

50 ha dredge pond has been retained<br />

as a permanent water body and<br />

forms part <strong>of</strong> a 270 ha seasonal<br />

wetland that has undergone extensive<br />

recontouring and revegetation. A further 65<br />

ha has been developed as pastoral land.<br />

<strong>The</strong> overall aim is to create an<br />

environment that supports a functioning,<br />

self-sustaining ecosystem.<br />

Alcoa anniversary<br />

So far, more than 2.5Mt <strong>of</strong> sand<br />

have been shifted from stockpiles<br />

and used to re-contour the land,<br />

with particular attention being<br />

given to the re-contouring <strong>of</strong> the<br />

pond.<br />

<strong>The</strong> seasonal wetland is being<br />

developed to create a diverse<br />

range <strong>of</strong> flora and fauna habitats with over<br />

110 million native seeds, representing over<br />

110 plant species, being planted under the<br />

revegetation program. At least four declared<br />

rare flora species have been established on<br />

the site and the project has developed<br />

40 years on and still contributing strongly<br />

Passing parade: This swish-looking black sedan was one <strong>of</strong> the first survey vehicles that headed<br />

into the Darling Range, southeast <strong>of</strong> Perth in the early 1960s, to help delineate world-class<br />

bauxite deposits that existed in the area. <strong>The</strong> coloured photograph shows one <strong>of</strong> the state-<strong>of</strong>-theart<br />

pieces <strong>of</strong> equipment that Alcoa currently uses. It is a remote-controlled Komatsu D575<br />

bulldozer that rips caprock to expose the bauxite orebody.<br />

It all began in July 1963 with 16 and 18<br />

tonne Leyland trucks hauling bauxite ore out<br />

<strong>of</strong> what is now Langford Park, a popular<br />

picnic spot at Jarrahdale, in the Darling Range<br />

about 40 km southeast <strong>of</strong> Perth.<br />

Western Australia’s bauxite mining industry<br />

has come a long way since that humble start,<br />

to a point where Alcoa now extracts 28 Mt <strong>of</strong><br />

bauxite annually from two mines at Huntly and<br />

Willowdale.<br />

<strong>The</strong> type <strong>of</strong> mining equipment employed today<br />

includes Komatsu P1600 excavators, Komatsu<br />