major risk factors and their management within the ... - Euler Hermes

major risk factors and their management within the ... - Euler Hermes

major risk factors and their management within the ... - Euler Hermes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4 Quantitative<br />

MAJOR RISK FACTORS AND THEIR MANAGEMENT WITHIN THE GROUP<br />

<strong>and</strong> qualitative appendices relating to <strong>risk</strong> <strong>factors</strong><br />

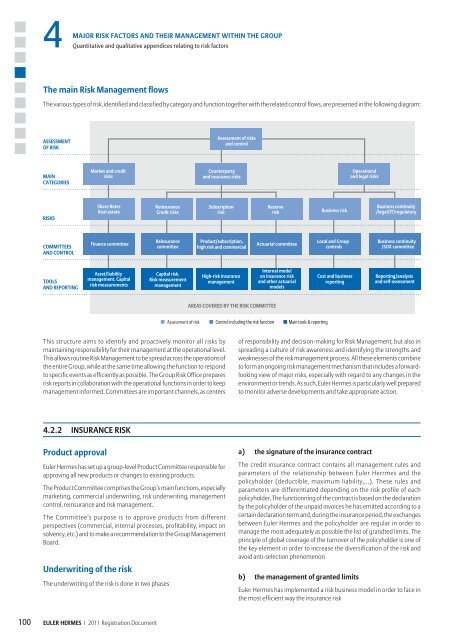

The main Risk Management flows<br />

The various types of <strong>risk</strong>, identified <strong>and</strong> classified by category <strong>and</strong> function toge<strong>the</strong>r with <strong>the</strong> related control flows, are presented in <strong>the</strong> following diagram:<br />

ASSESSMENT<br />

OF RISK<br />

MAIN<br />

CATEGORIES<br />

RISKS<br />

COMMITTEES<br />

AND CONTROL<br />

TOOLS<br />

AND REPORTING<br />

Market <strong>and</strong> credit<br />

<strong>risk</strong>s<br />

Share Rates<br />

Real estate<br />

Finance committee<br />

Asset/liability<br />

<strong>management</strong>. Capital<br />

<strong>risk</strong> measurements<br />

This structure aims to identify <strong>and</strong> proactively monitor all <strong>risk</strong>s by<br />

maintaining responsibility for <strong><strong>the</strong>ir</strong> <strong>management</strong> at <strong>the</strong> operational level.<br />

This allows routine Risk Management to be spread across <strong>the</strong> operations of<br />

<strong>the</strong> entire Group, while at <strong>the</strong> same time allowing <strong>the</strong> function to respond<br />

to specific events as efficiently as possible. The Group Risk Office prepares<br />

<strong>risk</strong> reports in collaboration with <strong>the</strong> operational functions in order to keep<br />

<strong>management</strong> informed. Committees are important channels, as centers<br />

4.2.2 INSURANCE RISK<br />

Product approval<br />

100 EULER HERMES I 2011 Registration Document<br />

Reinsurance<br />

Credit <strong>risk</strong>s<br />

Reinsurance<br />

committee<br />

Capital <strong>risk</strong>.<br />

Risk measurement<br />

<strong>management</strong><br />

Assessment of <strong>risk</strong>s<br />

<strong>and</strong> control<br />

Counterparty<br />

<strong>and</strong> insurance <strong>risk</strong>s<br />

Subscription<br />

<strong>risk</strong><br />

Product/subscription,<br />

high <strong>risk</strong> <strong>and</strong> commercial<br />

High-<strong>risk</strong> insurance<br />

<strong>management</strong><br />

<strong>Euler</strong> <strong>Hermes</strong> has set up a group-level Product Committee responsible for<br />

approving all new products or changes to existing products.<br />

The Product Committee comprises <strong>the</strong> Group’s main functions, especially<br />

marketing, commercial underwriting, <strong>risk</strong> underwriting, <strong>management</strong><br />

control, reinsurance <strong>and</strong> <strong>risk</strong> <strong>management</strong>.<br />

The Committee’s purpose is to approve products from different<br />

perspectives (commercial, internal processes, profitability, impact on<br />

solvency, etc.) <strong>and</strong> to make a recommendation to <strong>the</strong> Group Management<br />

Board.<br />

Underwriting of <strong>the</strong> <strong>risk</strong><br />

The underwriting of <strong>the</strong> <strong>risk</strong> is done in two phases<br />

Reserve<br />

<strong>risk</strong><br />

AREAS COVERED BY THE RISK COMMITTEE<br />

Actuarial committee<br />

Internal model<br />

on insurance <strong>risk</strong><br />

<strong>and</strong> o<strong>the</strong>r actuarial<br />

models<br />

■ Assessment of <strong>risk</strong> ■ Control including <strong>the</strong> <strong>risk</strong> function ■ Main tools & reporting<br />

Business <strong>risk</strong><br />

Local <strong>and</strong> Group<br />

controls<br />

Cost <strong>and</strong> business<br />

reporting<br />

Operational<br />

<strong>and</strong> legal <strong>risk</strong>s<br />

Business continuity<br />

/legal/IT/regulatory<br />

Business continuity<br />

/SOX committee<br />

Reporting/analysis<br />

<strong>and</strong> self-assessment<br />

of responsibility <strong>and</strong> decision-making for Risk Management, but also in<br />

spreading a culture of <strong>risk</strong> awareness <strong>and</strong> identifying <strong>the</strong> strengths <strong>and</strong><br />

weaknesses of <strong>the</strong> <strong>risk</strong> <strong>management</strong> process. All <strong>the</strong>se elements combine<br />

to form an ongoing <strong>risk</strong> <strong>management</strong> mechanism that includes a forwardlooking<br />

view of <strong>major</strong> <strong>risk</strong>s, especially with regard to any changes in <strong>the</strong><br />

environment or trends. As such, <strong>Euler</strong> <strong>Hermes</strong> is particularly well prepared<br />

to monitor adverse developments <strong>and</strong> take appropriate action.<br />

a) <strong>the</strong> signature of <strong>the</strong> insurance contract<br />

The credit insurance contract contains all <strong>management</strong> rules <strong>and</strong><br />

parameters of <strong>the</strong> relationship between <strong>Euler</strong> Herrmes <strong>and</strong> <strong>the</strong><br />

policyholder (deductible, maximum liability,…). These rules <strong>and</strong><br />

parameters are differentiated depending on <strong>the</strong> <strong>risk</strong> profile of each<br />

policyholder. The functionning of <strong>the</strong> contract is based on <strong>the</strong> declaration<br />

by <strong>the</strong> policyholder of <strong>the</strong> unpaid invoices he has emitted according to a<br />

certain declaration term <strong>and</strong>, during <strong>the</strong> insurance period, <strong>the</strong> exchanges<br />

between <strong>Euler</strong> <strong>Hermes</strong> <strong>and</strong> <strong>the</strong> policyholder are regular in order to<br />

manage <strong>the</strong> most adequately as possible <strong>the</strong> list of gr<strong>and</strong>ted limits. The<br />

principle of global coverage of <strong>the</strong> turnover of <strong>the</strong> policyholder is one of<br />

<strong>the</strong> key element in order to increase <strong>the</strong> diversification of <strong>the</strong> <strong>risk</strong> <strong>and</strong><br />

avoid anti-selection phenomenon<br />

b) <strong>the</strong> <strong>management</strong> of granted limits<br />

<strong>Euler</strong> <strong>Hermes</strong> has implemented a <strong>risk</strong> business model in order to face in<br />

<strong>the</strong> most efficient way <strong>the</strong> insurance <strong>risk</strong>