Resolution Portfolio Management & Oversight - RPM Oversight

Resolution Portfolio Management & Oversight - RPM Oversight

Resolution Portfolio Management & Oversight - RPM Oversight

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

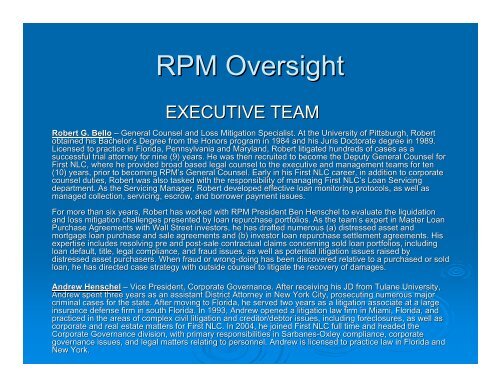

<strong>RPM</strong> <strong>Oversight</strong><br />

EXECUTIVE TEAM<br />

Robert G. Bello – General Counsel and Loss Mitigation Specialist. At the University University<br />

of Pittsburgh, Robert<br />

obtained his Bachelor’s Bachelor s Degree from the Honors program in 1984 and his Juris Doctorate degree in 1989.<br />

Licensed to practice in Florida, Pennsylvania and Maryland, Robert Robert<br />

litigated hundreds of cases as a<br />

successful trial attorney for nine (9) years. He was then recruited recruited<br />

to become the Deputy General Counsel for<br />

First NLC, where he provided broad based legal counsel to the executive executive<br />

and management teams for ten<br />

(10) years, prior to becoming <strong>RPM</strong>’s <strong>RPM</strong> s General Counsel. Early in his First NLC career, in addition to corporate<br />

counsel duties, Robert was also tasked with the responsibility of of<br />

managing First NLC’s NLC Loan Servicing<br />

department. As the Servicing Manager, Robert developed effective loan monitoring protocols, as well as<br />

managed collection, servicing, escrow, and borrower payment issues. issues.<br />

For more than six years, Robert has worked with <strong>RPM</strong> President Ben Ben<br />

Henschel to evaluate the liquidation<br />

and loss mitigation challenges presented by loan repurchase portfolios. portfolios.<br />

As the team’s team s expert in Master Loan<br />

Purchase Agreements with Wall Street investors, he has drafted numerous numerous<br />

(a) distressed asset and<br />

mortgage loan purchase and sale agreements and (b) investor loan repurchase settlement agreements. His<br />

expertise includes resolving pre and post-sale post sale contractual claims concerning sold loan portfolios, including including<br />

loan default, title, legal compliance, and fraud issues, as well as potential litigation issues raised by<br />

distressed asset purchasers. When fraud or wrong-doing wrong doing has been discovered relative to a purchased or sold<br />

loan, he has directed case strategy with outside counsel to litigate litigate<br />

the recovery of damages.<br />

Andrew Henschel – Vice President, Corporate Governance. After receiving his JD from from<br />

Tulane University,<br />

Andrew spent three years as an assistant District Attorney in New New<br />

York City, prosecuting numerous major<br />

criminal cases for the state. After moving to Florida, he served two years as a litigation associate at a large<br />

insurance defense firm in south Florida. In 1993, Andrew opened a litigation law firm in Miami, Florida, and<br />

practiced in the areas of complex civil litigation and creditor/debtor creditor/ debtor issues, including foreclosures, as well as<br />

corporate and real estate matters for First NLC. In 2004, he joined joined<br />

First NLC full time and headed the<br />

Corporate Governance division, with primary responsibilities in Sarbanes-Oxley Sarbanes Oxley compliance, corporate<br />

governance issues, and legal matters relating to personnel. Andrew Andrew<br />

is licensed to practice law in Florida and<br />

New York.