Annual Report - Li Ning

Annual Report - Li Ning

Annual Report - Li Ning

- TAGS

- annual

- ning

- www.lining.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

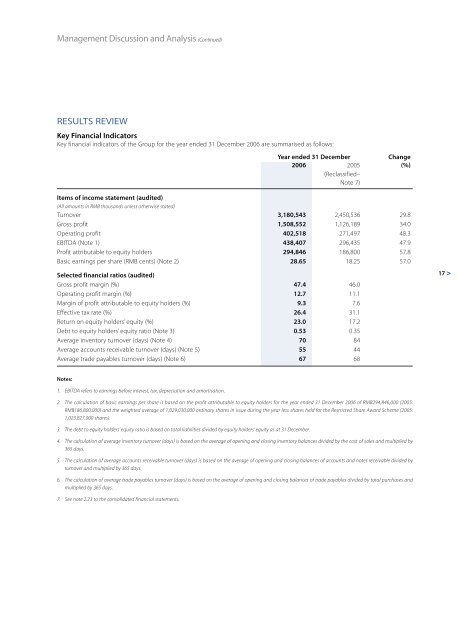

Management Discussion and Analysis (Continued)<br />

RESULTS REVIEW<br />

Key Financial Indicators<br />

Key financial indicators of the Group for the year ended 31 December 2006 are summarised as follows:<br />

Year ended 31 December Change<br />

2006 2005 (%)<br />

(Reclassified–<br />

Note 7)<br />

Items of income statement (audited)<br />

(All amounts in RMB thousands unless otherwise stated)<br />

Turnover 3,180,543 2,450,536 29.8<br />

Gross profit 1,508,552 1,126,189 34.0<br />

Operating profit 402,518 271,497 48.3<br />

EBITDA (Note 1) 438,407 296,435 47.9<br />

Profit attributable to equity holders 294,846 186,800 57.8<br />

Basic earnings per share (RMB cents) (Note 2) 28.65 18.25 57.0<br />

Selected financial ratios (audited)<br />

Gross profit margin (%) 47.4 46.0<br />

Operating profit margin (%) 12.7 11.1<br />

Margin of profit attributable to equity holders (%) 9.3 7.6<br />

Effective tax rate (%) 26.4 31.1<br />

Return on equity holders’ equity (%) 23.0 17.2<br />

Debt to equity holders’ equity ratio (Note 3) 0.53 0.35<br />

Average inventory turnover (days) (Note 4) 70 84<br />

Average accounts receivable turnover (days) (Note 5) 55 44<br />

Average trade payables turnover (days) (Note 6) 67 68<br />

Notes:<br />

1. EBITDA refers to earnings before interest, tax, depreciation and amortisation.<br />

2. The calculation of basic earnings per share is based on the profit attributable to equity holders for the year ended 31 December 2006 of RMB294,846,000 (2005:<br />

RMB186,800,000) and the weighted average of 1,029,030,000 ordinary shares in issue during the year less shares held for the Restricted Share Award Scheme (2005:<br />

1,023,827,000 shares).<br />

3. The debt to equity holders’ equity ratio is based on total liabilities divided by equity holders’ equity as at 31 December.<br />

4. The calculation of average inventory turnover (days) is based on the average of opening and closing inventory balances divided by the cost of sales and multiplied by<br />

365 days.<br />

5. The calculation of average accounts receivable turnover (days) is based on the average of opening and closing balances of accounts and notes receivable divided by<br />

turnover and multiplied by 365 days.<br />

6. The calculation of average trade payables turnover (days) is based on the average of opening and closing balances of trade payables divided by total purchases and<br />

multiplied by 365 days.<br />

7. See note 2.23 to the consolidated financial statements.<br />

17 >