options

options

options

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

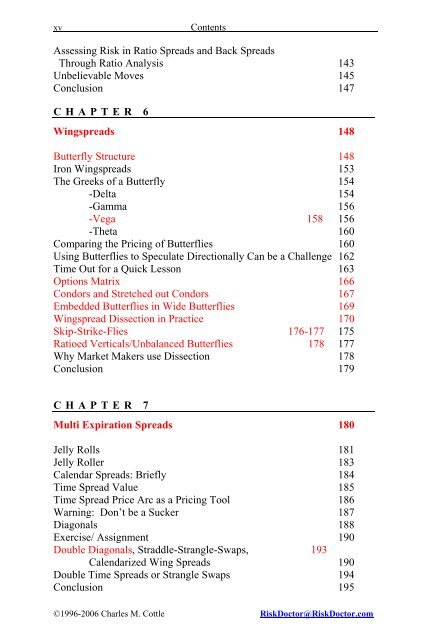

xv Contents<br />

Assessing Risk in Ratio Spreads and Back Spreads<br />

Through Ratio Analysis 143<br />

Unbelievable Moves 145<br />

Conclusion 147<br />

CHAPTER 6<br />

Wingspreads 148<br />

Butterfly Structure 148<br />

Iron Wingspreads 153<br />

The Greeks of a Butterfly 154<br />

-Delta 154<br />

-Gamma 156<br />

-Vega 158 156<br />

-Theta 160<br />

Comparing the Pricing of Butterflies 160<br />

Using Butterflies to Speculate Directionally Can be a Challenge 162<br />

Time Out for a Quick Lesson 163<br />

Options Matrix 166<br />

Condors and Stretched out Condors 167<br />

Embedded Butterflies in Wide Butterflies 169<br />

Wingspread Dissection in Practice 170<br />

Skip-Strike-Flies 176-177 175<br />

Ratioed Verticals/Unbalanced Butterflies 178 177<br />

Why Market Makers use Dissection 178<br />

Conclusion 179<br />

CHAPTER 7<br />

Multi Expiration Spreads 180<br />

Jelly Rolls 181<br />

Jelly Roller 183<br />

Calendar Spreads: Briefly 184<br />

Time Spread Value 185<br />

Time Spread Price Arc as a Pricing Tool 186<br />

Warning: Don’t be a Sucker 187<br />

Diagonals 188<br />

Exercise/ Assignment 190<br />

Double Diagonals, Straddle-Strangle-Swaps, 193<br />

Calendarized Wing Spreads 190<br />

Double Time Spreads or Strangle Swaps 194<br />

Conclusion 195<br />

©1996-2006 Charles M. Cottle RiskDoctor@RiskDoctor.com