RECAUDACION DEL SERVICIO DE RENTAS INTERNAS FRENTE ...

RECAUDACION DEL SERVICIO DE RENTAS INTERNAS FRENTE ...

RECAUDACION DEL SERVICIO DE RENTAS INTERNAS FRENTE ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

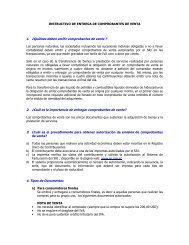

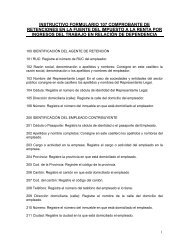

CUADRO No. "A1"<br />

<strong>RECAUDACION</strong> <strong><strong>DE</strong>L</strong> <strong>SERVICIO</strong> <strong>DE</strong> <strong>RENTAS</strong> <strong>INTERNAS</strong> (1)<br />

<strong>FRENTE</strong> A INGRESOS CODIFICADOS <strong><strong>DE</strong>L</strong> PRESUPUESTO <strong><strong>DE</strong>L</strong> ESTADO (2)<br />

AÑO 2002<br />

(Valores en USD$ dólares)<br />

Presupuesto<br />

aprobado 2002 (4)<br />

Recaudación<br />

Ene - Dic 2002<br />

TOTAL NETO 2,477,782,633 2,704,447,280 109.15%<br />

Impuesto a la Renta Global 589,455,538 670,974,577 113.83%<br />

Retenciones en la Fuente 381,291,583 425,781,126 111.67%<br />

Anticipos a la Renta 33,246,256 77,664,904 233.60%<br />

Declaraciones 174,917,700 167,528,546 95.78%<br />

Impuesto al Valor Agregado 1,612,596,579 1,692,197,518 104.94%<br />

IVA Interno 966,720,909 977,373,946 101.10%<br />

IVA Importaciones 645,875,670 714,823,572 110.68%<br />

Impuesto a los Consumos Especiales 225,882,329 257,068,871 113.81%<br />

ICE de Operaciones Internas 193,369,374 212,913,900 110.11%<br />

ICE de Importaciones 32,512,955 44,154,970 135.81%<br />

Impuesto a los Vehículos Motorizados 25,079,203 47,966,100 191.26%<br />

Intereses por Mora Tributaria 7,562,391 8,859,005 117.15%<br />

Multas Tributarias Fiscales 15,912,000 21,785,461 136.91%<br />

Otros Ingresos 1,294,592 5,595,749 432.24%<br />

Nota (1): Cifras provisionales.<br />

Nota (2): Conforme al Presupuesto aprobado por el Congreso Nacional<br />

Nota (3): Proporción establecida de acuerdo a la estacionalidad de cada impuesto<br />

Nota (4): A partir del mes de abril, la recaudación del impuesto a la salida del país pasó a control de los municipios.<br />

El valor presupuestado por este concepto de $21,487,115 ha sido restado, al igual que la recaudación<br />

Elaboración: Planificación.- Servicio de Rentas Internas<br />

Fecha: 1/10/2003

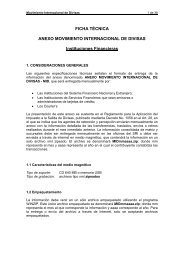

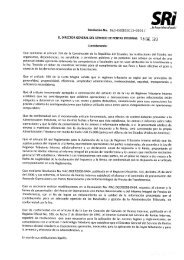

CUADRO No. "A2"<br />

<strong>RECAUDACION</strong> <strong><strong>DE</strong>L</strong> <strong>SERVICIO</strong> <strong>DE</strong> <strong>RENTAS</strong> <strong>INTERNAS</strong> (1)<br />

PERIODO ENERO - DICIEMBRE 2002<br />

CONSOLIDADO NACIONAL<br />

(miles de dólares)<br />

CONCEPTOS TOTAL ENE FEB MAR ABR MAY JUN JUL AGO SEP OCT NOV DIC<br />

TOTAL BRUTO 2,758,659.9 239,438.7 188,350.4 207,047.9 348,322.8 215,243.1 211,727.4 254,996.0 214,636.9 242,192.6 220,539.2 204,570.7 211,594.2<br />

NOTAS <strong>DE</strong> CREDITO 48,594.9 4,827.3 1,895.4 2,153.1 2,791.0 2,606.4 4,265.1 3,286.2 4,460.6 3,711.9 4,792.8 5,401.6 8,403.5<br />

COMPENSACIONES 516.4 7.1 2.3 29.4 229.2 3.0 11.3 98.7 1.3 111.1 21.9 0.9 0.1<br />

TOTAL NETO 2,709,548.6 234,604.2 186,452.7 204,865.5 345,302.6 212,633.8 207,451.0 251,611.1 210,174.9 238,369.5 215,724.4 199,168.1 203,190.6<br />

Impuesto a la Renta Global (2) 670,974.6 44,721.5 29,892.6 48,274.4 163,141.4 44,015.9 35,102.2 78,568.4 35,636.6 71,687.6 39,337.1 37,478.1 43,118.8<br />

Impuesto al Valor Agregado 1,692,197.5 161,979.3 130,647.9 127,007.0 150,600.2 139,479.6 145,144.1 140,733.7 144,128.1 137,868.2 147,078.4 133,821.5 133,709.6<br />

IVA de Operaciones Internas 1,052,022.2 103,664.9 81,730.2 78,450.9 84,747.7 83,429.0 91,415.0 86,784.2 86,238.4 86,525.8 94,390.6 86,784.2 87,861.3<br />

Devoluciones de IVA (3) (74,648.2) (1,999.8) (938.4) (2,202.7) (1,563.8) (10,251.5) (2,258.4) (3,988.2) (11,427.6) (9,784.6) (12,861.0) (8,135.2) (9,236.9)<br />

IVA de Importaciones 714,823.5 60,314.1 49,856.1 50,758.8 67,416.2 66,302.2 55,987.6 57,937.7 69,317.4 61,127.0 65,548.9 55,172.4 55,085.2<br />

Impuesto a los Consumos Especiales 257,068.9 21,468.0 18,924.5 19,905.5 22,275.2 20,253.3 19,099.6 20,302.5 24,084.2 23,685.2 23,925.7 23,005.4 20,139.6<br />

ICE de Operaciones Internas 212,913.9 17,486.0 15,640.2 16,395.3 18,537.0 16,442.0 16,140.9 17,129.2 19,158.9 20,196.4 19,307.2 19,736.0 16,744.7<br />

ICE de Importaciones 44,155.0 3,982.0 3,284.3 3,510.2 3,738.2 3,811.3 2,958.7 3,173.3 4,925.3 3,488.8 4,618.5 3,269.4 3,394.9<br />

Impuesto a los Vehículos Motorizados 47,966.1 1,805.1 3,418.0 5,020.0 6,424.2 5,796.5 5,157.5 8,549.6 3,143.4 2,301.6 1,903.8 1,508.8 2,937.7<br />

Impuesto 48,231.2 1,815.2 3,421.8 5,028.7 6,464.5 5,835.5 5,190.8 8,570.2 3,158.4 2,314.5 1,939.1 1,522.2 2,970.2<br />

Devolución (265.1) (10.1) (3.8) (8.7) (40.3) (39.0) (33.4) (20.6) (15.0) (13.0) (35.4) (13.4) (32.4)<br />

Impuesto a la Salida del País (4) 5,101.3 1,833.3 1,511.2 1,756.8 - - - - - - - - -<br />

Intereses por Mora Tributaria 8,859.0 630.0 659.2 890.8 705.9 720.8 659.2 652.2 809.8 628.0 850.0 719.8 933.4<br />

Multas Tributarias Fiscales 21,785.5 1,802.9 1,280.6 1,858.8 2,004.4 1,902.0 1,693.5 1,929.8 1,723.8 1,600.9 2,073.2 2,164.3 1,751.3<br />

Otros Ingresos 5,595.7 364.2 118.6 152.3 151.4 465.8 594.8 875.0 649.1 598.1 556.2 470.2 600.2<br />

Otros 2,045.8 364.2 118.6 149.1 125.0 219.5 146.6 147.5 118.4 203.7 200.2 124.2 128.8<br />

I. Transf. dominio vehíc. usados 3,550.0 - - 3.2 26.4 246.2 448.2 727.4 530.7 394.4 355.9 346.0 471.4<br />

Nota (1): Información Provisional.<br />

Nota (2): Incluye donaciones efectuadas en el mes de abril/2002 por un valor de USD$ 31,283.7 miles y en julio (anticipos IR) por USD$ 5,415.7 miles. (Art.50 LRTI)<br />

Nota (3): El valor de devoluciones de IVA corresponde solo al sector público. (Art. 69 de la ley de Régimen Tributario Interno).<br />

Nota (4): A partir del mes de abril/2002, este impuesto se recauda en los Municipios de Quito y Guayaquil.<br />

Elaboración: Departamento de Planificación SRI.<br />

Fecha: 1/10/2003

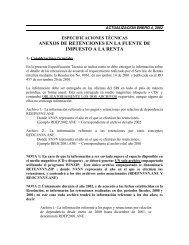

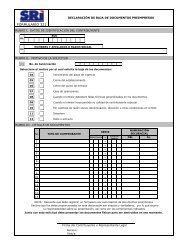

CUADRO No. "A3"<br />

<strong>RECAUDACION</strong> <strong><strong>DE</strong>L</strong> <strong>SERVICIO</strong> <strong>DE</strong> <strong>RENTAS</strong> <strong>INTERNAS</strong><br />

PERIODOS ENERO-DICIEMBRE 2002 / 2001<br />

CONSOLIDADO NACIONAL<br />

(miles de dólares)<br />

(1)<br />

CONCEPTOS TOTAL \ 2002 Crec. ENE. Crec. FEB. Crec. MAR. Crec. ABR. Crec. MAY. Crec. JUN. Crec. JUL. Crec. AGO. Crec. SEP. Crec. OCT. Crec. NOV. Crec. DIC. Crec.<br />

TOTAL BRUTO 2,758,659.9 15.9% 239,438.7 40.0% 188,350.4 35.5% 207,047.9 32.2% 348,322.8 10.8% 215,243.1 15.6% 211,727.4 10.6% 254,996.0 6.8% 214,636.9 8.5% 242,192.6 13.5% 220,539.2 19.3% 204,570.7 6.3% 211,594.2 9.3%<br />

NOTAS <strong>DE</strong> CREDITO 48,594.9 44.8% 4,827.3 58.8% 1,895.4 -32.4% 2,153.1 -21.0% 2,791.0 -51.4% 2,606.4 -39.3% 4,265.1 68.4% 3,286.2 18.4% 4,460.6 373.0% 3,711.9 170.0% 4,792.8 279.1% 5,401.6 59.7% 8,403.5 214.5%<br />

COMPENSACIONES 516.4 47.0% 7.1 274.9% 2.3 -11.1% 29.4 -75.0% 229.2 144.8% 3.0 -82.9% 11.3 162.2% 98.7 16.4% 1.3 -67.7% 111.1 792.4% 21.9 73.4% 0.9 350.4% 0.1<br />

TOTAL NETO 2,709,548.6 15.5% 234,604.2 39.7% 186,452.7 36.9% 204,865.5 33.3% 345,302.6 11.9% 212,633.8 16.9% 207,451.0 9.8% 251,611.1 6.7% 210,174.9 6.7% 238,369.5 12.5% 215,724.4 17.5% 199,168.1 5.3% 203,190.6 6.5%<br />

Impuesto a la Renta Global (2) 670,974.58 13.4% 44,721.51 15.6% 29,892.60 31.4% 48,274.36 41.6% 163,141.43 -11.5% 44,015.9 4.9% 35,102 20.1% 78,568.4 12.8% 35,636.6 38.6% 71,687.6 23.9% 39,337.1 41.4% 37,478.1 31.3% 43,118.8 38.8%<br />

Impuesto al Valor Agregado 1,692,197.5 14.9% 161,979.3 54.4% 130,647.9 29.7% 127,007.0 22.0% 150,600.2 41.4% 139,479.6 18.8% 145,144.1 9.5% 140,733.7 3.9% 144,128.1 -1.8% 137,868.2 7.5% 147,078.4 14.1% 133,821.5 0.1% 133,709.6 0.2%<br />

IVA de Operaciones Internas 1,052,022.2 16.7% 103,664.9 51.6% 81,730.2 18.5% 78,450.9 27.3% 84,747.7 32.4% 83,429.0 20.2% 91,415.0 9.6% 86,784.2 7.7% 86,238.4 4.1% 86,525.8 7.9% 94,390.6 25.1% 86,784.2 8.9% 87,861.3 0.8%<br />

Devoluciones de IVA (3) (74,648.2) 81.7% (1,999.8) -42.8% (938.4) 9.2% (2,202.7) -56.6% (1,563.8) -5.0% (10,251.5) 91.2% (2,258.4) -25.3% (3,988.2) 1270.8% (11,427.6) 1148.3% (9,784.6) 179.6% (12,861.0) 157.1% (8,135.2) 37.8% (9,236.9) 54.0%<br />

IVA de Importaciones 714,823.5 16.8% 60,314.1 50.6% 49,856.1 52.7% 50,758.8 6.6% 67,416.2 52.8% 66,302.2 24.3% 55,987.6 7.3% 57,937.7 5.0% 69,317.4 6.9% 61,127.0 18.5% 65,548.9 12.2% 55,172.4 -7.9% 55,085.2 5.2%<br />

Impuesto a los Consumos Especiales 257,068.9 41.7% 21,468.0 62.0% 18,924.5 97.8% 19,905.5 59.4% 22,275.2 114.0% 20,253.3 76.0% 19,099.6 21.8% 20,302.5 36.2% 24,084.2 48.3% 23,685.2 23.4% 23,925.7 20.8% 23,005.4 13.1% 20,139.6 11.5%<br />

ICE de Operaciones Internas 212,913.9 43.3% 17,486.0 50.3% 15,640.2 95.9% 16,395.3 58.1% 18,537.0 125.1% 16,442.0 85.1% 16,140.9 25.6% 17,129.2 37.9% 19,158.9 47.7% 20,196.4 27.4% 19,307.2 18.1% 19,736.0 19.6% 16,744.7 15.3%<br />

ICE de Importaciones 44,155.0 34.2% 3,982.0 146.2% 3,284.3 107.3% 3,510.2 65.9% 3,738.2 71.9% 3,811.3 45.0% 2,958.7 4.5% 3,173.3 27.5% 4,925.3 50.6% 3,488.8 4.0% 4,618.5 33.6% 3,269.4 -14.8% 3,394.9 -4.1%<br />

Impuesto a los Vehículos Motorizados 47,966.1 -2.1% 1,805.1 229.4% 3,418.0 860.0% 5,020.0 6,424.2 72.2% 5,796.5 -21.9% 5,157.5 -33.4% 8,549.6 -27.7% 3,143.4 -25.9% 2,301.6 -21.4% 1,903.8 -42.6% 1,508.8 -46.0% 2,937.7 -28.3%<br />

Impuesto a la Salida del País (4) 5,101.3 -72.3% 1,833.3 16.9% 1,511.2 13.3% 1,756.8 12.5% - - - - - - - -100.0% - -100.0% - -100.0%<br />

Intereses por Mora Tributaria 8,859.0 24.7% 630.0 65.9% 659.2 30.4% 890.8 95.1% 705.9 22.7% 720.8 38.2% 659.2 16.0% 652.2 -16.4% 809.8 61.8% 628.0 16.8% 850.0 43.1% 719.8 8.1% 933.4 -8.4%<br />

Multas Tributarias Fiscales 21,785.5 36.5% 1,802.9 102.5% 1,280.6 61.5% 1,858.8 105.4% 2,004.4 47.2% 1,902.0 25.9% 1,693.5 14.7% 1,929.8 40.5% 1,723.8 29.4% 1,600.9 6.1% 2,073.2 21.8% 2,164.3 44.4% 1,751.3 9.3%<br />

Otros Ingresos 5,595.7 -39.9% 364.2 -95.3% 118.6 -31.0% 152.3 33.8% 151.4 -23.3% 465.8 256.2% 594.8 262.5% 875.0 532.8% 649.1 172.4% 598.1 556.5% 556.2 451.5% 470.2 301.2% 600.2 408.5%<br />

CONCEPTOS TOTAL \ 2001 Ene-01 Feb-01 Mar-01 Abr-01 May-01 Jun-01 Jul-01 Ago-01 Sep-01 Oct-01 Nov-01 Dic-01<br />

TOTAL BRUTO 2,379,558.9 171,029.7 139,036.5 156,584.6 314,380.1 186,172.2 191,461.0 238,733.9 197,897.1 213,321.6 184,918.8 192,504.7 193,518.8<br />

NOTAS <strong>DE</strong> CREDITO 33,554.1 3,040.8 2,805.5 2,726.8 5,743.3 4,292.7 2,533.3 2,775.0 943.1 1,374.6 1,264.3 3,382.9 2,671.9<br />

COMPENSACIONES 351.4 1.9 2.6 117.4 93.6 17.3 4.3 84.8 4.1 12.5 12.6 0.2 -<br />

TOTAL NETO 2,345,653.4 167,987.0 136,228.4 153,740.3 308,543.2 181,862.2 188,923.4 235,874.2 196,949.8 211,934.6 183,641.8 189,121.6 190,846.8<br />

Impuesto a la Renta Global 591,660.4 38,703.1 22,743.3 34,082.3 184,342.1 41,944.8 29,218.6 69,628.5 25,711.6 57,864.7 27,829.3 28,537.7 31,054.4<br />

Impuesto al Valor Agregado 1,472,766.2 104,924.8 100,758.3 104,126.8 106,496.6 117,389.5 132,514.8 135,482.9 146,752.3 128,246.5 128,867.8 133,709.9 133,495.9<br />

IVA de Operaciones Internas 901,599.4 68,373.1 68,964.5 61,609.9 64,012.5 69,389.7 83,383.8 80,599.4 82,829.6 80,161.1 75,435.9 79,712.3 87,127.3<br />

Devoluciones de IVA (4) (41,077.7) (3,498.2) (859.3) (5,079.8) (1,646.7) (5,360.6) (3,024.8) (290.9) (915.5) (3,499.4) (5,002.4) (5,903.1) (5,997.0)<br />

IVA de Importaciones 612,244.5 40,049.9 32,653.1 47,596.6 44,130.8 53,360.4 52,155.8 55,174.4 64,838.1 51,584.8 58,434.4 59,900.6 52,365.6<br />

Impuesto a los Consumos Especiales 181,472.3 13,250.6 9,566.5 12,487.2 10,409.2 11,510.2 15,686.6 14,907.8 16,242.8 19,201.6 19,805.7 20,346.3 18,057.7<br />

ICE de Operaciones Internas 148,571.2 11,633.4 7,982.1 10,371.6 8,234.3 8,880.9 12,854.0 12,419.4 12,973.2 15,847.5 16,349.3 16,507.6 14,518.0<br />

ICE de Importaciones 32,901.0 1,617.2 1,584.5 2,115.6 2,174.9 2,629.3 2,832.6 2,488.3 3,269.6 3,354.1 3,456.3 3,838.8 3,539.8<br />

Impuesto a los Vehículos Motorizados 49,007.7 548.0 356.0 7.0 3,730.0 7,421.2 7,744.1 11,828.3 4,240.0 2,926.4 3,314.8 2,792.0 4,099.7<br />

Impuesto a la Salida del País 18,383.7 1,568.1 1,333.6 1,561.8 1,431.4 1,432.8 1,549.9 1,735.1 1,932.3 1,557.1 1,427.5 1,454.0 1,400.2<br />

Intereses por Mora Tributaria 7,104.5 379.7 505.4 456.6 575.2 521.6 568.5 780.2 500.5 537.8 594.1 665.6 1,019.3<br />

Multas Tributarias Fiscales 15,954.3 890.1 793.2 904.8 1,361.3 1,511.2 1,476.8 1,373.1 1,332.0 1,509.5 1,701.8 1,498.9 1,601.6<br />

Otros Ingresos 9,304.4 7,722.6 172.0 113.9 197.4 130.8 164.1 138.3 238.3 91.1 100.9 117.2 118.0<br />

Nota (1): Información Provisional.<br />

Nota (2): Incluye donaciones efectuadas en el mes de abril/2002 por un valor de USD$ 31,283.7 miles y en julio (anticipos IR) por USD$ 5,415.7 miles. (Art.50 LRTI)<br />

Nota (3): El valor de devoluciones de IVA corresponde solo al sector público. (Art. 69 de la ley de Régimen Tributario Interno).<br />

Nota (4): A partir del mes de abril/2002, este impuesto se recauda en los Municipios de Quito y Guayaquil.<br />

Elaboración: Departamento de Planificación SRI.<br />

Fecha: 1/10/2003

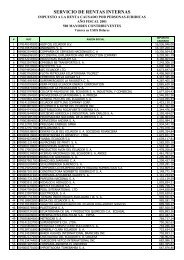

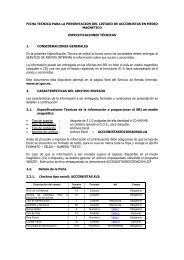

CUADRO No. "A4"<br />

<strong>RECAUDACION</strong> <strong><strong>DE</strong>L</strong> <strong>SERVICIO</strong> <strong>DE</strong> <strong>RENTAS</strong> <strong>INTERNAS</strong> (1)<br />

PERIODO ENERO - DICIEMBRE / 2002<br />

POR DOMICILIO FISCAL<br />

(miles de dólares)<br />

IMPTO. IMP. VALOR IMP. VALOR IMP. VALOR IMP. CONSUMOS I.C.E I.C.E. IMPTO. (2) IMP. A LA MULTAS INTERESES OTROS<br />

REGIONALES TOTAL NOTAS <strong>DE</strong> COMPEN A LA AGREGADO AGREGADO <strong>DE</strong>VOLUCIONES AGREGADO ESPECIALES INTERNO IMPORTAC. VEHICULOS SALIDA TRIBUTARIAS MORA INGRESOS<br />

CREDITO SACIONES RENTA TOTAL (3) INTERNO <strong>DE</strong> IVA IMPORTAC. TOTAL MOTORIZADOS <strong><strong>DE</strong>L</strong> PAIS TRIBUTARIA<br />

TOTAL 2,758,659.9 48,594.9 516.4 670,974.6 1,692,197.4 1,052,022.3 (74,648.2) 714,823.5 257,068.9 212,913.9 44,155.0 47,966.1 5,101.3 21,785.5 8,859.0 5,595.7<br />

No asignados 54,820.8 3.2 0.0 2,682.4 199.2 199.2 - - 2.7 2.7 0.0 47,928.30 0.0 337.7 88.1 3,579.4<br />

Regional Norte 1,496,158.3 29,426.5 140.5 403,328.2 900,958.9 675,844.8 (15,709.42) 240,823.6 147,125.0 128,206.1 18,918.9 22.0 2,820.8 8,284.2 3,400.6 651.6<br />

CARCHI 54,028.7 8.6 0.0 916.8 48,563.4 1,021.1 (224.2) 47,766.6 4,343.1 0.0 4,343.1 0.00 0.0 159.4 35.5 1.9<br />

ESMERALDAS 131,017.7 276.5 21.9 2,898.4 117,611.1 3,686.4 (111.0) 114,035.6 9,823.2 0.0 9,823.2 0.00 0.0 309.8 74.4 2.5<br />

IMBABURA 11,404.6 94.1 0.0 4,946.0 5,373.8 5,845.0 (471.2) 0.0 360.6 360.6 0.0 0.01 0.0 497.2 128.5 4.2<br />

NAPO 1,503.2 10.2 0.0 368.3 1,014.8 1,092.3 (77.5) 0.0 0.0 0.0 0.0 0.00 0.0 92.6 17.1 0.2<br />

PICHINCHA 1,295,361.7 29,032.6 118.6 393,145.3 726,827.0 662,348.2 (14,542.6) 79,021.4 132,598.1 127,845.4 4,752.6 21.95 2,820.8 7,055.8 3,120.4 621.2<br />

SUCUMBIOS 2,041.0 4.5 0.0 824.8 1,058.3 1,318.8 (260.6) 0.0 0.0 0.0 0.0 0.00 0.0 116.1 15.7 21.6<br />

ORELLANA 801.6 0.0 0.0 228.6 510.6 532.8 (22.3) 0.0 0.0 0.0 0.0 0.00 0.0 53.4 9.0 0.0<br />

Regional Litoral 1,017,075.7 16,693.2 340.3 207,806.8 681,456.3 289,690.8 (38,729.67) 430,495.2 94,212.4 78,305.7 15,906.7 5.8 2,280.5 9,121.0 4,102.5 1,056.9<br />

EL ORO 45,332.7 77.2 0.0 9,807.3 33,190.6 7,758.8 (507.8) 25,939.6 713.5 8.1 705.4 0.00 0.0 1,076.5 382.0 85.5<br />

GUAYAS 963,330.1 16,612.5 340.3 194,352.4 644,489.6 277,853.5 (37,919.4) 404,555.6 93,418.4 78,217.1 15,201.3 3.30 2,280.5 7,355.0 3,521.9 956.1<br />

LOS RIOS 6,935.2 2.0 0.0 3,047.6 2,989.3 3,233.5 (244.3) 0.0 80.4 80.4 0.0 2.51 0.0 617.4 181.3 14.6<br />

GALAPAGOS 1,477.7 1.4 0.0 599.4 786.8 845.0 (58.2) 0.0 0.0 0.0 0.0 0.00 0.0 72.1 17.3 0.7<br />

Regional Austro 90,690.6 1,221.2 3.3 29,197.3 50,069.9 46,568.1 (8,425.32) 11,927.2 7,599.1 5,724.2 1,874.9 5.3 0.0 1,874.8 565.6 154.2<br />

AZUAY 74,041.0 1,127.9 3.3 20,931.3 42,703.3 36,326.5 (5,263.1) 11,639.9 7,576.6 5,703.7 1,872.8 4.79 0.0 1,191.0 410.8 92.0<br />

CAÑAR 6,256.4 57.0 0.0 3,068.3 2,848.4 3,211.7 (363.2) 0.0 0.1 0.1 0.0 0.00 0.0 202.6 53.1 26.9<br />

LOJA 8,525.5 30.8 0.0 4,258.7 3,801.4 5,168.8 (1,654.6) 287.2 22.3 20.2 2.0 0.00 0.0 310.6 70.0 31.9<br />

MORONA S. 1,019.8 5.5 0.0 597.1 295.2 1,129.0 (833.8) 0.0 0.0 0.0 0.0 0.00 0.0 99.6 19.2 3.3<br />

ZAMORA CH. 847.8 0.0 0.0 341.9 421.6 732.1 (310.6) 0.0 0.2 0.2 0.0 0.48 0.0 71.0 12.5 0.2<br />

Regional Centro 2 9,698.2 42.7 0.4 3,709.8 5,448.6 6,333.2 (884.6) 0.0 8.4 8.4 0.0 0.6 0.0 357.1 114.5 15.8<br />

BOLIVAR 1,492.9 0.0 0.4 511.7 929.7 929.8 (0.1) 0.0 5.0 5.0 0.0 0.00 0.0 32.4 6.5 7.1<br />

CHIMBORAZO 8,205.2 42.7 0.0 3,198.1 4,518.9 5,403.4 (884.5) 0.0 3.4 3.4 0.0 0.63 0.0 324.7 108.0 8.7<br />

Regional Centro 1 29,631.0 914.0 1.9 12,817.4 14,576.5 16,323.1 (1,746.5) 0.0 142.5 142.5 0.0 0.2 0.0 868.2 290.0 20.2<br />

COTOPAXI 6,348.6 90.9 0.6 2,480.9 3,443.4 3,468.0 (24.6) 0.0 0.0 0.0 0.0 0.00 0.0 265.1 64.8 2.9<br />

PASTAZA 1,654.8 67.9 0.0 528.7 928.5 967.2 (38.8) 0.0 0.0 0.0 0.0 0.00 0.0 107.8 21.9 0.1<br />

TUNGURAHUA 21,627.6 755.2 1.3 9,807.8 10,204.6 11,887.8 (1,683.2) 0.0 142.5 142.5 0.0 0.25 0.0 495.3 203.4 17.2<br />

Regional Manabí 60,585.3 294.2 30.0 11,432.6 39,488.0 17,063.1 (9,152.64) 31,577.6 7,978.9 524.4 7,454.4 3.9 0.0 942.4 297.6 117.6<br />

MANABI 60,585.3 294.2 30.0 11,432.6 39,488.0 17,063.1 (9,152.6) 31,577.6 7,978.9 524.4 7,454.4 3.91 0.0 942.4 297.6 117.6<br />

NOTA (1) : Información provisional<br />

NOTA (2) : No está considerado el reparto por provincias, del impuesto a los vehículos motorizados.<br />

NOTA (3) : Valor descontado el IVA devuelto a sector público. (Art. 69 de la ley de Régimen Tributario Interno).<br />

Elaboración: Planificación.- Servicio de Rentas Internas.- www.sri.gov.ec<br />

Fecha: 1/10/2003<br />

xm