Brochure: AAA2 / ARA2 / AEA2

Brochure: AAA2 / ARA2 / AEA2

Brochure: AAA2 / ARA2 / AEA2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AIA Assurance Account 2 / AIA Retirement Account 2 / AIA Education Account 2 3<br />

Complete protection in one plan<br />

Apart from the death and total and permanent disability (TPD) benefit 4 , you can further enhance<br />

your protection level by adding the following optional benefits 5 :<br />

• Critical Illness Coverage<br />

Pay lump sum benefit upon diagnosis of the covered critical illness.<br />

• Juvenile Illness Coverage (Child Health Guard)<br />

Provide coverage on juvenile related Illnesses such as Kawasaki, Severe Juvenile<br />

Rheumatoid Arthritis, Insulin Dependent Diabetes Mellitus and etc.<br />

• Female Coverage<br />

Pay lump sum benefit upon diagnosis of female related illness.<br />

• Hospitalization and Surgical Benefit<br />

Reimburse medical expenses in the event of hospitalization.<br />

• Accident Benefit<br />

Offer coverage for injury or death due to accidents.<br />

• Disability Income Benefit<br />

Pay income should the insured unfortunately become disabled.<br />

Guaranteed income for retirement (ARA 2 only)<br />

The Life Income option 6 allows you to enjoy your desired retirement life from as early as 40 years<br />

old. Under this benefit, the account value of your policy will be converted into guaranteed life<br />

income and is payable to you for as long as you live.<br />

Privilege for conversion (AEA 2 only)<br />

Upon maturity of the AEA 2, you have the privilege to continue your coverage by converting the<br />

plan to AAA 2 or ARA 2 without evidence of insurability while enjoy 100% of premium allocation for<br />

regular premium paid towards investment.<br />

Note: Please refer to the policy contract for full details of the benefit coverage.<br />

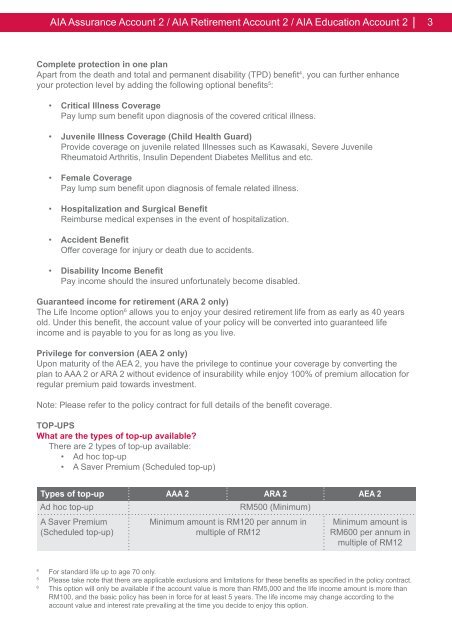

TOP-UPS<br />

What are the types of top-up available?<br />

There are 2 types of top-up available:<br />

• Ad hoc top-up<br />

• A Saver Premium (Scheduled top-up)<br />

Types of top-up<br />

Ad hoc top-up<br />

A Saver Premium<br />

(Scheduled top-up)<br />

AAA 2 ARA 2 AEA 2<br />

RM500 (Minimum)<br />

Minimum amount is RM120 per annum in<br />

multiple of RM12<br />

Minimum amount is<br />

RM600 per annum in<br />

multiple of RM12<br />

4<br />

For standard life up to age 70 only.<br />

5<br />

Please take note that there are applicable exclusions and limitations for these benefits as specified in the policy contract.<br />

6<br />

This option will only be available if the account value is more than RM5,000 and the life income amount is more than<br />

RM100, and the basic policy has been in force for at least 5 years. The life income may change according to the<br />

account value and interest rate prevailing at the time you decide to enjoy this option.