Koperasi Peduli Rakyat Sejahtera - Smecda

Koperasi Peduli Rakyat Sejahtera - Smecda

Koperasi Peduli Rakyat Sejahtera - Smecda

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KSP WAHANA ARTA MUKTI<br />

If there is no Lie Betrween us is the<br />

Key to Success<br />

Save Loan Cooperation (KSP) of<br />

Wahana Arta Mukti (WAM) Dawuan<br />

Subang District grows and develops<br />

in Subang Regency, the regency that used<br />

to be known as honey pineapple producer is<br />

worth paying attention to. In 2004, the Government<br />

through Ministry of Cooperation and<br />

UMKM scrolled agribusiness aid fund in the<br />

amount of Rp 1 billion. This save loan was<br />

formerly in the form of Save Loan Unit from<br />

KUD Wahana Arta Mukti. In October 2004,<br />

Save Loan Cooperation (KSP) was born with<br />

legal entity No. 553/BH 10.11/X/2004 dated<br />

5 October 2004.<br />

The applied business pattern was<br />

monthly pattern loan (conventional) and<br />

weekly pattern loan, with loan service in the<br />

amount of 2.5% per month. The term for return<br />

varied between 10 – 18 months. In addition,<br />

nearly 90% of denizens in Dawuan<br />

Subang District depended on agricultural<br />

sector in their daily lives, such as rice,<br />

(kadang), corn, etc. It was this potential that<br />

was considered as quite promising.<br />

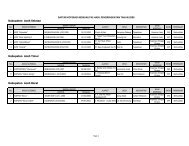

The highest loan was stipulated at Rp<br />

20 million, with loan service in the amount of<br />

2.5%. However in practice not all profit went<br />

to KSP petty cash, some was returned to the<br />

customers i.e., in the amount of 0.5%. The<br />

requirements are that such return must be<br />

made in timely manner. This program was<br />

intended to drive the awareness of borrowers<br />

to always return credits in timely maner.<br />

This way was considered as quite successful.<br />

Based on the record, the level of return<br />

at KSP reached up to more than 99%.<br />

Not only in terms of loan, KSP management<br />

is also selective in accepting new members.<br />

To be able to become a member of<br />

KSP the manager applies several requirements,<br />

among others is that the customer<br />

has borrowed at least 3 times. If the return<br />

has been favorable 3 times consecutively,<br />

the customer may apply to become a member.<br />

The amount of loan at this early stage<br />

is not more than Rp 2 million.<br />

Up to now the number of members of<br />

KSP WAM has been 130, and the number<br />

of customers has been 700. They are not<br />

only small traders such as peddlers, but are<br />

also middle scale businessmen.<br />

Business funded by KSP Sahana Arta<br />

Mukti includes agribusiness sector (agriculture,<br />

animal farming, fishery), commerce sector<br />

business (shops, pavement sellers), trading<br />

sector business (hardware store, crops<br />

processors) , and micro small business<br />

(handicraft, furniture).<br />

The high level of money circulation has<br />

made KSP Wahana Arta Mukti’s asset to increase.<br />

Now its total asset reaches Rp 2.198<br />

billion. In providing service to customers,<br />

KSP Wahan Arta Mukti is supported by 14<br />

staff who are high school graduates and 1<br />

university graduate.<br />

Another important thing is the effort of<br />

the administrators and managemewnt in developing<br />

the working mental of their staff<br />

through the internalization of KSP Wahan<br />

Arta Mukti motto: “There is no lie between<br />

us” and “There is no grudge between us.”<br />

K o p e r a s i P e d u l i , R a k y a t S e j a h t e r a 53