RISULTATI AL 31 DICEMBRE 2007 - BNP Paribas

RISULTATI AL 31 DICEMBRE 2007 - BNP Paribas

RISULTATI AL 31 DICEMBRE 2007 - BNP Paribas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

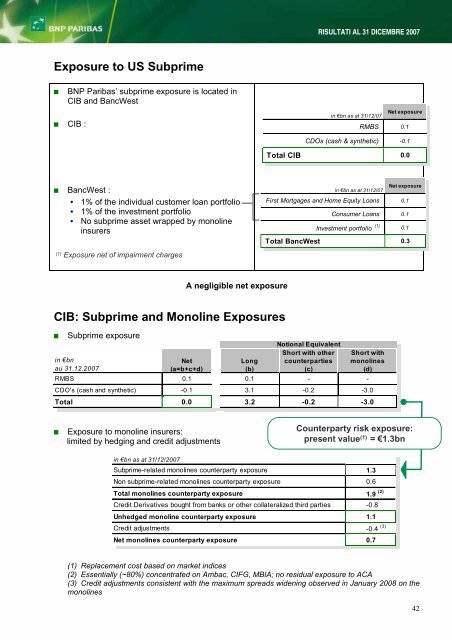

Exposure to US Subprime<br />

<strong>BNP</strong> <strong>Paribas</strong>’ subprime exposure is located in<br />

CIB and BancWest<br />

CIB :<br />

BancWest :<br />

1% of the individual customer loan portfolio<br />

1% of the investment portfolio<br />

No subprime asset wrapped by monoline<br />

insurers<br />

(1) Exposure net of impairment charges<br />

A negligible net exposure<br />

CIB: Subprime and Monoline Exposures<br />

Subprime exposure<br />

Exposure to monoline insurers:<br />

limited by hedging and credit adjustments<br />

<strong>RISULTATI</strong> <strong>AL</strong> <strong>31</strong> <strong>DICEMBRE</strong> <strong>2007</strong><br />

in €bn as at <strong>31</strong>/12/07<br />

in €bn as at <strong>31</strong>/12/07<br />

Net exposure<br />

Net exposure<br />

RMBS<br />

RMBS<br />

0.1<br />

0.1<br />

CDOs<br />

CDOs<br />

(cash<br />

(cash<br />

&<br />

&<br />

synthetic) -0.1<br />

synthetic) -0.1<br />

Total Total CIB 0.0<br />

CIB 0.0<br />

Net exposure<br />

in €bn as at <strong>31</strong>/12/07 Net exposure<br />

in €bn as at <strong>31</strong>/12/07<br />

First<br />

First<br />

Mortgages<br />

Mortgages<br />

and<br />

and<br />

Home<br />

Home<br />

Equity<br />

Equity<br />

Loans 0.1<br />

Loans 0.1<br />

Consumer<br />

Consumer<br />

Loans 0.1<br />

Loans 0.1<br />

Investment portfolio (1)<br />

Investment portfolio (1)<br />

(1) Replacement cost based on market indices<br />

(2) Essentially (~80%) concentrated on Ambac, CIFG, MBIA; no residual exposure to ACA<br />

(3) Credit adjustments consistent with the maximum spreads widening observed in January 2008 on the<br />

monolines<br />

0.1<br />

0.1<br />

Total<br />

Total<br />

BancWest 0.3<br />

BancWest 0.3<br />

in €bn<br />

in €bn<br />

au <strong>31</strong>.12.<strong>2007</strong><br />

au <strong>31</strong>.12.<strong>2007</strong><br />

RMBS<br />

RMBS<br />

Net<br />

Net<br />

(a=b+c+d)<br />

(a=b+c+d)<br />

0.1<br />

0.1<br />

Long<br />

Long<br />

(b)<br />

(b)<br />

0.1<br />

0.1<br />

Notional Equivalent<br />

Notional Equivalent<br />

Short with other<br />

Short with other<br />

counterparties<br />

counterparties<br />

(c)<br />

(c)<br />

-<br />

-<br />

Short with<br />

Short with<br />

monolines<br />

monolines<br />

(d)<br />

(d)<br />

-<br />

-<br />

CDO's (cash and synthetic)<br />

CDO's (cash and synthetic)<br />

-0.1<br />

-0.1<br />

3.1<br />

3.1<br />

-0.2<br />

-0.2<br />

-3.0<br />

-3.0<br />

Total<br />

Total<br />

0.0<br />

0.0<br />

3.2<br />

3.2<br />

-0.2<br />

-0.2<br />

-3.0<br />

-3.0<br />

Counterparty risk exposure:<br />

present value (1) = €1.3bn<br />

in €bn as at <strong>31</strong>/12/<strong>2007</strong><br />

Subprime-related monolines counterparty exposure 1.3<br />

Non subprime-related monolines counterparty exposure 0.6<br />

Total monolines counterparty exposure 1.9 (2)<br />

Credit Derivatives bought from banks or other collateralized third parties -0.8<br />

Unhedged monoline counterparty exposure 1.1<br />

Credit adjustments -0.4 (3)<br />

in €bn as at <strong>31</strong>/12/<strong>2007</strong><br />

Subprime-related monolines counterparty exposure 1.3<br />

Non subprime-related monolines counterparty exposure 0.6<br />

Total monolines counterparty exposure 1.9<br />

Net monolines counterparty exposure 0.7<br />

(2)<br />

Credit Derivatives bought from banks or other collateralized third parties -0.8<br />

Unhedged monoline counterparty exposure 1.1<br />

Credit adjustments -0.4 (3)<br />

Net monolines counterparty exposure 0.7<br />

42