Blue Chip Issue 78 - Jan 2021

- Text

- Lifeinsurance

- Retirementplanning

- Retirement

- Insurance

- Equity

- Wealthmanagement

- Advisor

- Financial

- Planner

- Invest

- Emerging

- Wealth

- Investments

- Global

- Asset

- Investing

- Investors

- Markets

- Offshore

3FINANCIAL PLANNING

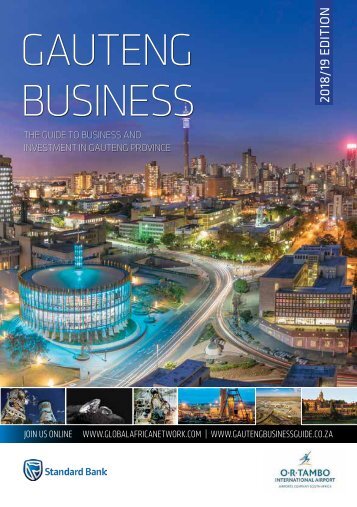

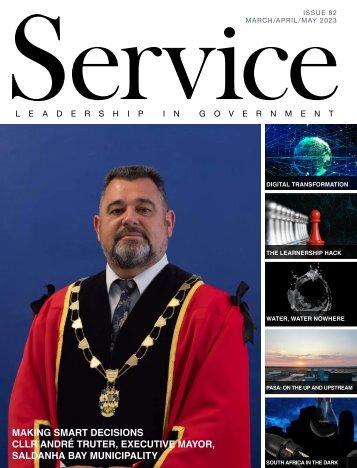

3FINANCIAL PLANNING ROLES of the financial planner Facilitating thoughts, choices and actions A World War II Wellington bomber My father was a pilot in the Second World War. He flew Wellington bombers for the RAF. Their job was to fly at night and bomb strategic enemy positions. On one mission my father’s plane had mechanical difficulties over the Red Sea. They managed to crash-land into the sea. Although the plane broke apart on impact, three of the crew survived the crash and managed to hold onto pieces of the fuselage. It became apparent that there were sharks in the water, circling them. I’m not sure how the conversation went at that stage, but their dilemma was whether to hang onto the pieces of wreckage and hope for the best or swim, hoping to get away from the sharks. My father was the only one who decided to stay put. The other two crewmen felt they had more chance of survival by swimming away from the danger lurking in the water. They were never seen again. The next morning my father washed up onto the Arabian coast. He was not in a great state. But fortuitously some Arabian soldiers, who had been alerted to the crash, were searching the coastline for any survivors. Miraculously they found my father lying on the beach. Despite being a bit of wreck himself he had to endure a two-day journey on the back of a camel to get to the nearest hospital. For many people, such a journey is a bucket-list activity. I don’t think he enjoyed it much. But he survived. And after his recovery was able to return to action. Many factors led to my father surviving what should have been a fatal crash. Floating wreckage; the direction of the current; soldiers remarkably finding him. But before any of those factors could come into play, he had to make a decision, amidst uncertainty, and in the face of immediate danger. His crew decided that to act and swim for safety was the right decision. My father, despite the obvious dangers, decided that to hang onto some wreckage and let the ocean take control was the best option for him. They were faced with a tough choice, in murky water, in the dark, with immediate danger present. What relevance does this story have to financial planning? When a financial planner sits with a client, the context may be different but similar challenges are present. The future is uncertain. The waters are murky. There are often visible and invisible dangers or threats to consider. And invariably a financial planning meeting involves difficult decision-making. Whether it be a decision to do something or not, it is still a decision. Often with life-changing implications. To save or not. To spend less or more. To take out life insurance. To prepare a will. As a financial planner, you help clients make and implement key decisions about their life and money. If one considers what goes into making a decision, there are usually three ingredients: thought, choice and action. Thinking partner In the immediate aftermath of their crash, my father and his crew had to think about what to do. When clients come to you, they may not know it, but the first thing they need is help to think about their situation, their dilemmas. As human beings, we have the unique ability to think together. To share thoughts. To share how we see ourselves, others and the world. We do this through communicating, written and verbal. Conversation. Books. Media. A Robo-advisor can prompt a client to answer questions which will follow a decision tree pattern that will lead to a solution for the client. But those questions are not necessarily the right questions 56 www.bluechipdigital.co.za

for the client to answer. As Albert Einstein said (or is famously attributed to have said), “If I had one hour to solve a problem and my life depended on the solution, I would spend the first 55 minutes trying to find the right question to ask, and the last five minutes determining the answer.” For the Robo-advisor the real risk is Garbage In, Garbage Out. In working with a person directly, the human advisor should try to find the right questions to ask. Questions that help the client to think through their circumstances, situation, dilemmas, plans, goals and dreams. A conversation is a fluid process where people think together. The Robo-advisor may think up to a point with a client. But it will need to be pre-programmed with multitudes of options to help each client think through their own life before no surprise, then, that Ricardo Semler, a coming up with appropriate answers for whatever aspect of highly successful, innovative industrialist their life is being examined. and entrepreneur from Brazil, wrote a People in general don’t always have the privilege of book insight entitled into The their Seven own Day lives. Weekend. We don’t know He what we don’t encourages know. We employers have blind spots. to think We differently have hidden undiscovered about how talents. they We manage may even their have people, hidden and or repressed goals, more importantly, desires, dreams. how to The get Robo-advisor the best out assumes your of people. client He argues knows that what technology they want. that You as a human advisor was cannot supposed assume to make that. As life a thinking easier such partner, as you help your clients laptops, think cellphones about their lives. and email, To understand has actually their context, their relationships encroached with on themselves, people’s free their time. relationships with others and the world. Having developed that understanding, you can help But as he says, this can be a good thing clients explore their potential choices to deal with the murky water if you have the autonomy to get your work in which they find themselves. done on your own terms and to blend your Choice work architect life and personal life. He suggests that My father innovative could’ve employers instructed will his eventually crew to stay realise with the wreckage. It was that what people he believed may be was more the productive best course if of they action. But in that case have of life the or flexibility death, he had to decide to allow for each themselves man to make their own decision when and to live work or and die with play, it. rather If your than clients the don’t own their decisions, employer you deciding. rather than Rather they become than time accountable in, for those decisions. employers The waters ideally of should the future focus are on always value out. murky. In helping The clients importance make choices, of value financial was planners play the role of the choice architect. But anyone who has worked with an highlighted for me recently when I met architect will know, it is not simply a matter of the architect telling with a financial planner who related how you what to do. The client always has opinions, wishes, desires they helped a potential client resolve a and wants. Often there is much emotion that underpins a choice – whether dilemma it be about fear, desire their or even future excitement. retirement. And unfortunately, it seems They that helped when the it comes client to assess working retirement with clients’ money, very often options choices in are a more made rigorous in fearful and response creative to the obvious or perceived way than dangers if the or threats. client had simply tried Most to do often it on the story their we own. focus No on doubt is the story the of the threat. It is the experience way we are and wired. thinking Our brains that this are planner continually looking for threats. had That’s done how over we have many survived years as made a species. this Identify threats and meeting avoid them. very It impactful. is no surprise that the most commonly used tool to help with client investment decision-making is called a risk When it came to discussing the financial profile. It’s not called an opportunity profile or a return profile, planning fee, the planner mentioned that it’s called a risk profile. And we use such a profile when making the upfront financial planning fee was investment decisions because we as human beings struggle to make rational decisions. We are not always rational. improved by 40%. Operational costs with 23% less electricity and 90% FINANCIAL paper PLANNING used. Perpetual Guardian, a New Zeala based financial services firm, moved t four-day week in late 2018. Producti Would my father’s crew have swum off into the dark, supposedly improved 20% over an eight-week per to get away from the sharks if they were rational? No. They made an independent survey showed staff str a decision based on fear. Probably more like terror. Rationally, the levels reduced and work-life bala chances of swimming off into the open ocean with sharks around and surviving are very low. In this improved case, it was from zero. dramatically. The rational decision would have been to stay with As you the floating think about wreckage. innovating to k Despite trying to think through their up situation with constant and consider change, the don’t get st options that faced them, my father’s on crew technology did not act and rationally. forget about y They made a decision based on their people. emotions. They You may face just the end same up working f challenge with your clients, all the business time. that has found a real way to m a dent in traffic congestion! Your client’s actions start with how well they think and the R20k, and that the process usually involved References four meetings. The potential client had David Rock, The Neuroscience of Leadershi experienced so quality much value of in just choices one – Improving they Organisations make. by Understand aspect of the Behavioural first meeting coach that they were the Brain, Talk at FPI Convention, 2012 moved to ask After if this his was two R20k crew per members meeting had Morgan swum off, Housel, I’m sure The advantage my father of being a – not because considered they didn’t whether want to or pay not the had little made underemployed, the right choice. www.collaborativefu He was fee but because alone. they His thought mind must given have wandered the com, and 17 wondered. May 2017 Perhaps he value they had was already tempted experienced, at some point this to swim Ricardo off. But Semler, he stuck The to his Seven original Day Weekend, was a possibility. decision, and it saved his life. Your Penguin clients face Publishing, similar challenges 2004 when making choices. They may second Robert guess Booth, themselves. Four-day week: Or be trial finds low The value in people swayed by friends and family. Or stress by news and headlines increased productivity, or market www. sentiment. Enter the role of the behavioural coach. A decision is a In a knowledge-based economy, when you theguardian.com, 9 February 2019 form of behaviour. An action. Not only does your client need your are providing a professional service based McKinley Corbley, Microsoft Japan Recently help to make a decision, but to stick to it, and only change it for on knowledge, experience, thinking and Gave their Employees a 4-day Week – and the right reasons. Clients who own their decisions are more likely interpersonal to skills, do this. to But quantify they will anything still need your Productivity help as a behavioural Skyrocketed coach. by 40%, www. in terms of time Vanguard – be it your defines employees’ behavioural coaching goodnewsnetwork.org, as a process that, 8 November “… 2019 working hours facilitates or the thinking time spent such with that a the client LinkedIn succeeds Talent Solutions, in changing 2019 a Global Tale client – is a disservice behaviour to which the would value that otherwise Trends prevent Report, him 2019 or her from financial planners achieving and their staff goals”. potentially You facilitate Samantha your client’s McLaren, thinking How these as a 4 Compan can add to their thinking clients’ partner. lives. But as we have seen are Embracing this is not Flexible enough. work They – and Why Yo So the opportunity need your is ripe guidance for the as picking a choice Should architect Too, to www.businesslinkedin.com, make the most 22 to innovate with appropriate respect choices to how for you themselves. get May And 2019 they need your gentle but firm challenging as a behavioural and keep people and make them more coach when they begin to wonder productive. LinkedIn’s 2019 Global Talent or wander. Trends Report indicates that over 30% of Your client’s actions start job-seekers will with turn how down well a job they if there think are and not flexible work the arrangements. quality of choices Computer they giant Dell implemented make. Attending flexible to your work client’s practices in 2009. thoughts, US healthcare choices and company actions Humana did consistently the same in and 2016, systematically using technology to will enable give them call-centre the best workers chance of to work from home. dealing with the challenges of an More recently uncertain Microsoft future. in Japan experimented with a four-day week for References: The Vanguard Advisor their employees. Without an adjustment Rob Macdonald, Head of Strategic Advis Alpha guide to proactive behaviour- Rob Macdonald, Head of in remuneration. The result? Productivity Services at Fundhouse al coaching; Donald G. Bennyhoff, Strategic Advisory Services CFA; November 2018 at Fundhouse 44 www.bluechipjournal.co.za www.bluechipdigital.co.za 57

- Page 1 and 2:

Issue 78 • January 2021 www.bluec

- Page 3 and 4:

CONTENTS 02 WHAT’S HAPPENING AT T

- Page 5 and 6:

Being a member of the FPI doesn’t

- Page 7 and 8: On the money Making waves this quar

- Page 9 and 10: VIR I UAL EVENTS Conceptulisation,

- Page 11: FINANCIAL PLANNER OF THE YEAR as we

- Page 15 and 16: INTERVIEW for yourself so that you

- Page 17 and 18: INTERVIEW A diverse group of friend

- Page 19 and 20: KAPIL JOSHI, HEAD OF MOMENTUM COLLE

- Page 21 and 22: With us, it’s personal Client nee

- Page 23 and 24: OFFSHORE INVESTMENTS by a select fe

- Page 25 and 26: OFFSHORE 2021 THE REAL REASON YOU S

- Page 27 and 28: strategy and product suite. It is c

- Page 29 and 30: It is estimated that between 65% an

- Page 31 and 32: When you decide to invest offshore

- Page 33 and 34: In many cases, indirect investment

- Page 35 and 36: otherwise have to do for more well-

- Page 37 and 38: FINANCIAL EMIGRATION DO THE COSTS A

- Page 39 and 40: IT PAYS TO PLAN IF YOU’RE LOOKING

- Page 41 and 42: a fine balancing act that aims to e

- Page 43 and 44: PROUDLY SOUTH AFRICAN OR A GLOBAL C

- Page 45 and 46: SLOWLY UNPACKING FINANCIAL EMIGRATI

- Page 47 and 48: SHOW YOUR MONEY THE WORLD WITH INVE

- Page 49 and 50: OFFSHORE INVESTMENTS Economic theor

- Page 52 and 53: OFFSHORE INVESTING Emerging markets

- Page 54 and 55: ASSET MANAGEMENT New horizons The d

- Page 56 and 57: INVESTOR BEHAVIOUR Being Spock (AND

- Page 60 and 61: FINANCIAL PLANNING Have you thought

- Page 62 and 63: FINANCIAL COACHING Are you, the fin

- Page 64: ETHICS How conflicted are professio

- Page 67: VIR I UAL EVENTS Visit our website:

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...