Blue Chip| Issue 87 - May/June/July 2023

- Text

- Financial

- Financialplanning

- Investments

- Managers

- Advisors

- Asset

- Investors

- Profession

- Hedge

- Crypto

- Funds

- Assets

BLUE CHIP INVESTMENT |

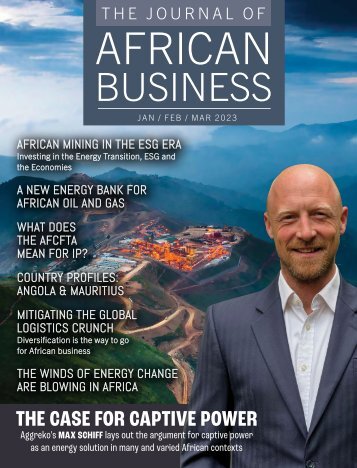

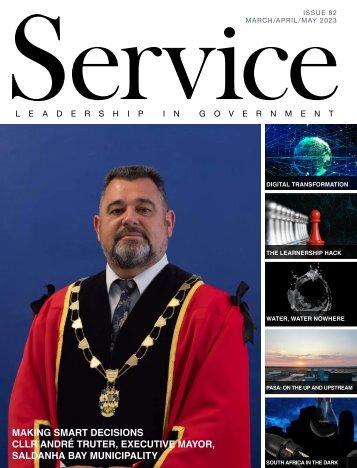

BLUE CHIP INVESTMENT | Economy Will China’s reopening benefit the global economy? We look at whether China’s recovery will boost the rest of the world by raising growth or whether it will cause inflation to come roaring back. The outlook is decisively better for China after the government’s pivot on zero-Covid policy (ZCP) late last year. Early indications from high frequency data and the January PMI surveys are that service sector activity has rebounded strongly. By contrast, the positive impact on manufacturing was capped by weak external demand while housing transactions have only muddled along after some initial improvement. Recovery in China to be driven by services This is likely to set the tone for the shape of the recovery. After all, it is China’s service sector that has really been hampered by ZCP over the past couple of years as restrictions curbed travel. “Revenge spending” on services has been observed in most economies around the world that have transitioned away from measures aimed to contain the spread of Covid, and China is likely to experience the same release of pent-up consumer demand. However, a key difference to other economies – certainly major developed markets – is that households in China do not appear to be sitting on a huge stock of savings that can be drawn down to fund a prolonged period of rampant consumption. While China’s savings rate has risen a bit, fiscal support has focused on helping the supply side of the economy rather than direct transfers to households, as was the case in the US, for example. “Sugar high” recovery likely to fade into 2024 Our baseline forecast for China now assumes three consecutive quarters of above-trend growth starting in Q1 2023 skewed towards services. We think that will lift GDP growth from our previous forecast of 5% to around 6.2% in 2023. However, the “sugar high” 40 www.bluechipdigital.co.za

INVESTMENT | Economy BLUE CHIP will probably fade as the release of pent-up demand is exhausted, savings are spent and cyclical forces turn less favourable. We think GDP growth will ease back to 4.5% in 2024. “Revenge spending” on services has been observed in most economies around the world. Source: Refinitiv, Oxford Analytica, Schroders Economics Group, as at February 2023. Based on data for 2018, except Russia and Vietnam which is based on 2017 data. Limited spill-over to other economies The positive spill-overs to other economies may be quite limited. - Small Asian economies to benefit The return of Chinese tourists will boost other parts of Asia, but these are likely to be the small Asian economies that account for only a fraction of world GDP. - European exporters may not benefit as much as in the past: Europe would usually benefit from an upturn in China’s economic cycle as stronger growth stimulates investment by manufacturers in response to an increase in demand for goods. However, we expect the recovery to be skewed towards services, not manufacturing. Furthermore, prior strong investment and soft external demand means that the recovery is unlikely to spur a renewed investment cycle in manufacturing that sucks in imports from Europe and the rest of the world. Finally, while ZCP may have delayed foreign direct investment, it is not clear if multinationals will increase investment in China at a time when geopolitical pressures are pushing for supply chain diversification. - Energy exporters could benefit Commodity exporters may receive some support if prices rise, but the playbook may be different this time. Whereas past recoveries driven by construction have buoyed the prices of industrial metals, benefiting exporters in the likes of Latin America and Africa, a recovery in services may be more supportive of energy. This could fire up global inflation again, putting real incomes back under pressure and leaving less room for central banks to lower interest rates in 2024. Some emerging markets would thrive in an environment of higher oil prices, but most face a period of sluggish growth as higher interest rates and subdued external demand bite. China’s reopening won’t benefit the global economy much The upshot is that while abandoning ZCP has clearly improved the outlook for China this year, the rest of the world may not benefit much, if at all. Indeed, while we have also revised up our expectations for growth in the US and eurozone this year, the upgrades are due to domestic factors rather than a boost from China. David Rees, Senior Emerging Markets Economist, Schroders Important information: For professional investors and advisors only. The material is not suitable for retail clients. We define “professional investors” as those who have the appropriate expertise and knowledge eg asset managers, distributors and financial intermediaries. Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. The views and opinions contained herein are those of the individuals to whom they are attributed and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. Information herein is believed to be reliable, but Schroders does not warrant its completeness or accuracy. Issued in March 2023 by Schroders Investment Management Ltd registration number: 01893220 (Incorporated in England and Wales) which is authorised and regulated in the UK by the Financial Conduct Authority and an authorised financial services provider in South Africa FSP No: 48998. www.bluechipdigital.co.za 41

- Page 1: BLUE Issue 87 • May/June/July 202

- Page 8 and 9: CONTENTS ISSUE 87 MAY/JUNE/JULY 202

- Page 10 and 11: CONTENTS ISSUE 87 MAY/JUNE/JULY 202

- Page 12 and 13: BLUE CHIP FPI UPDATES | CEO message

- Page 14 and 15: BLUE CHIP BLUE CHIP On the money Ma

- Page 16: BLUE CHIP On the money Making waves

- Page 20 and 21: BLUE CHIP COLUMN ChatGPT: the lean

- Page 22 and 23: BLUE CHIP COLUMN USE YOUR DISCRETIO

- Page 24 and 25: BLUE CHIP FPI | Financial Planner o

- Page 26 and 27: BLUE CHIP FPI | Financial Planner o

- Page 28 and 29: BLUE CHIP PROFESSIONAL ACCOUNTANCY

- Page 30 and 31: BLUE CHIP PROFESSIONAL ACCOUNTANCY

- Page 32 and 33: BLUE CHIP INVESTMENT | Cryptocurren

- Page 34 and 35: get valued at -billion and then

- Page 36 and 37: BLUE CHIP INVESTMENT | Trends Is th

- Page 38 and 39: BLUE CHIP INVESTMENT | Hedge funds

- Page 40 and 41: BLUE CHIP INVESTMENT | Responsible

- Page 44 and 45: INVESTMENT | Responsible investment

- Page 46 and 47: BLUE CHIP INVESTMENT | Economy Tran

- Page 48 and 49: BLUE CHIP FINANCIAL PLANNING | Inve

- Page 50 and 51: BLUE CHIP INVESTMENT | Hedge funds

- Page 52 and 53: BLUE CHIP INVESTMENT | Fund managem

- Page 54 and 55: BLUE CHIP ROUND TABLE SERIES | DFM

- Page 56 and 57: BLUE CHIP ROUND TABLE SERIES | DFM

- Page 58 and 59: BLUE CHIP ROUND TABLE SERIES | DFM

- Page 60 and 61: BLUE CHIP INVESTMENT | Economy Ther

- Page 62 and 63: Time, relationships and control - t

- Page 64 and 65: BLUE CHIP FINANCIAL PLANNING | Reti

- Page 66 and 67: BLUE CHIP FINANCIAL PLANNING | Esta

- Page 68 and 69: BLUE CHIP INVESTMENT | Research The

- Page 70 and 71: BLUE CHIP FINANCIAL PLANNING | Savi

- Page 72 and 73: The future of financial planning: a

- Page 74 and 75: BLUE CHIP FINANCIAL PLANNING | FP p

- Page 76 and 77: BLUE CHIP FINANCIAL PLANNING | Cryp

- Page 78 and 79: BLUE CHIP FINANCIAL PLANNING | Cryp

- Page 80 and 81: BLUE CHIP FINANCIAL PLANNING | Legi

- Page 82 and 83: BLUE CHIP FINANCIAL PLANNING | Legi

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...