Blue Chip Issue 88

- Text

- Fpi

- Offshore

- Investment

- Invest

- Financialservices

- Financial

- Financialplanning

- Annuity

- Investor

- Funds

- Portfolio

- Investments

- Momentum

- Wealth

- Asset

- Advisors

- Retirement

BLUE CHIP INVESTMENT |

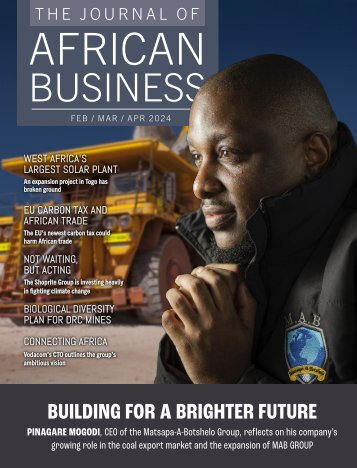

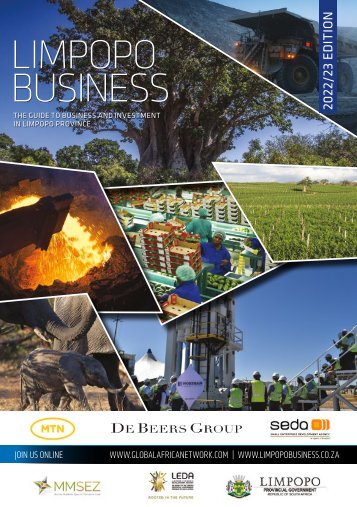

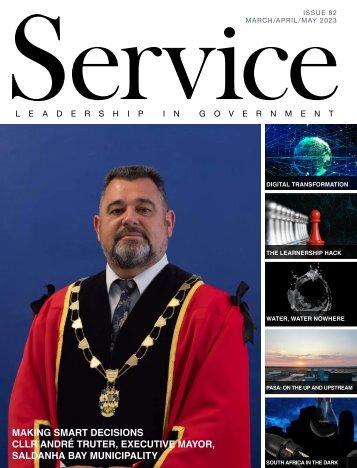

BLUE CHIP INVESTMENT | Technology Big tech turnaround: what’s behind the recovery? After dominating stock market returns amid the Covid pandemic, the household names of the US tech sector endured a miserable 2022. In recent months the tables have turned once again – we look at why. Big tech has enjoyed a resurgence this year. Seven large US companies (Apple, Microsoft, Alphabet, Amazon, Tesla, Netflix and Nvidia) have collectively returned 34% in the four months to 30 April 2023. Excluding these stocks, the remainder of the MSCI USA index has returned just 3%. The big tech stocks were “pandemic winners” in 2020 and 2021 amid strong demand for their products. They then experienced a difficult 2022 amid concerns over rising inflation and higher interest rates. That’s because higher rates mean their future profits and cash flows are worth less today. Inflation is still elevated though, and rates have been rising so far this year, so what’s behind the renewed rally for US big tech? The better performance can to some extent be explained by improving fundamentals, although it is a complex picture. Companies like Microsoft and Nvidia are enjoying very strong business trends. Those two companies are also thought likely to be clear winners of the generative AI revolution. Apple has also 30 www.bluechipdigital.co.za

INVESTMENT | Technology BLUE CHIP recently reported very resilient quarterly earnings, showing it is proving more robust than other more commoditised companies in the consumer electronics sector. What’s more, following the pressures experienced last year, some of the other members of this group – Amazon, Alphabet, Meta and Netflix – have now discovered the merits of cost-cutting. There is lot of potential to take out costs in those companies following the huge hiring spree of the previous three years. This could be either through headcount reductions or in some cases by reducing the compensation paid to some of the expensive talent they have as the labour market softens. So, we can say that fundamentals have been improving with regards to either the top line (ie sales/revenue) or bottom line (ie improving operating efficiency/cost-cutting to enhance profitability) for members of this big tech cohort. However, that’s not necessarily the whole story. Part of what’s going on in markets is a growth rotation. The banking sector stress we have seen this year has been a catalyst for a rotation away from value parts of the market and back into growth stocks. That is because the bank stress is contributing to tighter lending conditions, alongside interest rate rises. If the Federal Reserve were to pause its rate hikes, that would reduce a headwind for growth stocks like technology. This rotation has been a lot more pronounced in the US, which reinforces the view that it may well be to do with concerns over the economy and more cyclical parts of the market. Kondi Nkosi, Country Head, Schroders Important Information For professional investors and advisors only. The material is not suitable for retail clients. We define “Professional Investors” as those who have the appropriate expertise and knowledge eg asset managers, distributors and financial intermediaries. Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. Past Performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. The views and opinions contained herein are those of the individuals to whom they are attributed and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Issued in May 2023 by Schroders Investment Management Ltd registration number: 01893220 (Incorporated in England and Wales) which is authorised and regulated in the UK by the Financial Conduct Authority and an authorised financial services. www.bluechipdigital.co.za 31

- Page 1: BLUE CHIP 0.5 CONTINUOUS PROFESSION

- Page 6 and 7: CONTENTS ISSUE 88 AUG/SEPT/OCT 2023

- Page 8 and 9: CONTENTS ISSUE 88 AUG/SEPT/OCT 2023

- Page 10 and 11: BLUE CHIP FPI UPDATES | CEO message

- Page 12 and 13: FPI Professional's Convention 2023

- Page 14 and 15: BLUE CHIP BLUE CHIP On the money Ma

- Page 16: BLUE CHIP On the money Making waves

- Page 19 and 20: The complexities facing investors (

- Page 22 and 23: BLUE CHIP FINANCIAL PLANNING | Legi

- Page 24 and 25: BLUE CHIP FINANCIAL PLANNING | Legi

- Page 26 and 27: BLUE CHIP FINANCIAL PLANNING | Savi

- Page 28 and 29: BLUE CHIP INVESTMENT | Economy Look

- Page 30 and 31: BLUE CHIP INVESTMENT | Economy Char

- Page 34 and 35: BLUE CHIP INVESTMENT | Offshore Top

- Page 36 and 37: BLUE CHIP ROUND TABLE SERIES | Offs

- Page 38 and 39: BLUE CHIP INVESTMENT | Economy Wher

- Page 40 and 41: BLUE CHIP PRACTICE MANAGEMENT | Wea

- Page 42 and 43: BLUE CHIP PRACTICE MANAGEMENT | Pro

- Page 44 and 45: BLUE CHIP INVESTMENT | DFM A DFM ca

- Page 46 and 47: BLUE CHIP FINANCIAL PLANNING | Savi

- Page 48 and 49: BLUE CHIP ROUND TABLE SERIES | Reti

- Page 50 and 51: BLUE CHIP ROUND TABLE SERIES | Reti

- Page 52: BLUE CHIP FINANCIAL PLANNING | Reti

- Page 55 and 56: www.cogence.co.za “In calculating

- Page 57 and 58: FINANCIAL PLANNING | Benefits BLUE

- Page 59 and 60: CLIENT ENGAGEMENT | Coaching BLUE C

- Page 61 and 62: INVESTMENT | Behavioural finance BL

- Page 63 and 64: INVESTMENT | Behavioural finance BL

- Page 65 and 66: CLIENT ENGAGEMENT | Behavioural fin

- Page 68 and 69: BLUE CHIP PRACTICE MANAGEMENT | Tec

- Page 70 and 71: BLUE CHIP INVESTMENT | Fund managem

- Page 72 and 73: BLUE CHIP INVESTMENT | Due diligenc

- Page 74 and 75: BLUE CHIP PRACTICE MANAGEMENT | Out

- Page 76 and 77: BLUE CHIP FINANCIAL PLANNING | Esta

- Page 78 and 79: BLUE CHIP FINANCIAL PLANNING | Even

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...