Blue Chip Issue 90

- Text

- Advisers

- Advisors

- Investment

- Fpi

- Financialplanning

- Financial

- Global

- Investments

- Momentum

- Investors

- Wealth

- Retirement

- Income

- Funds

- Portfolio

- Solutions

BLUE CHIP INVESTMENT |

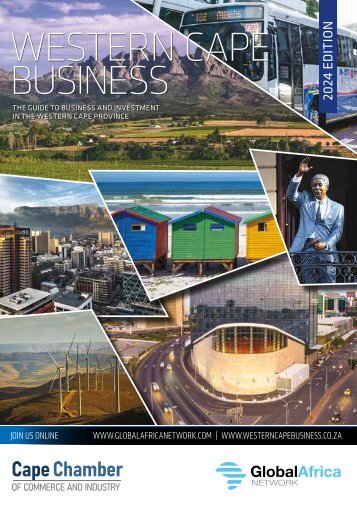

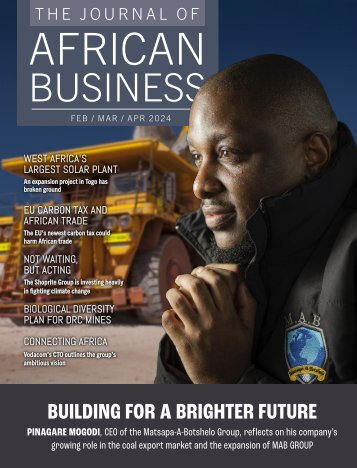

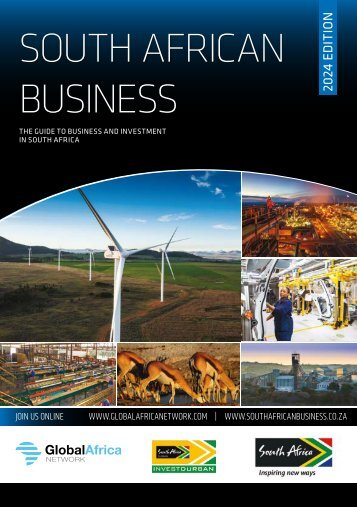

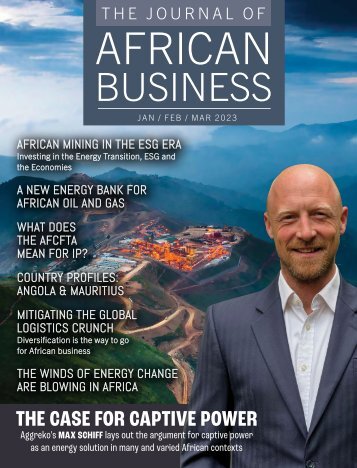

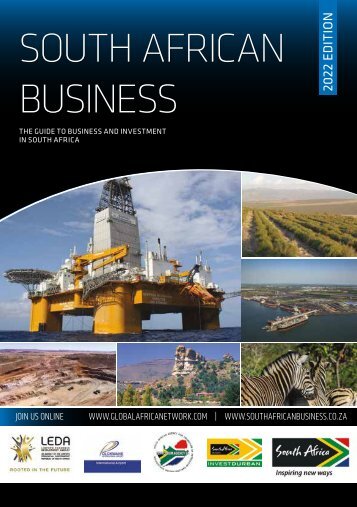

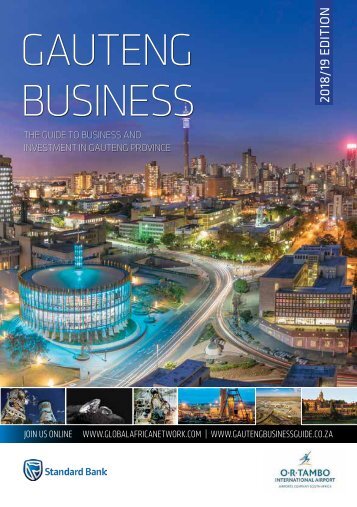

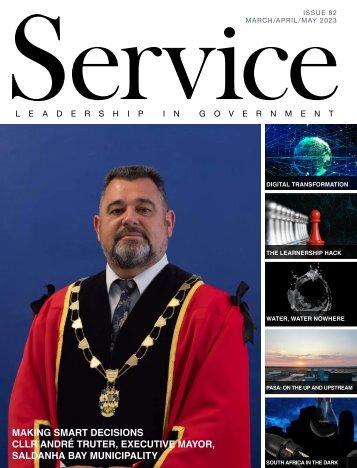

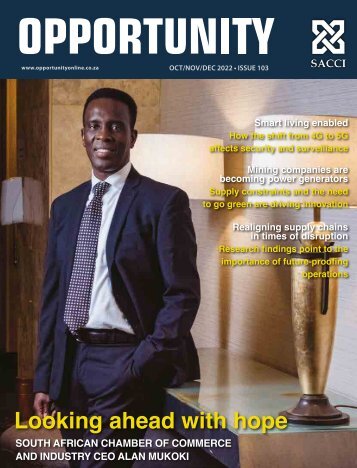

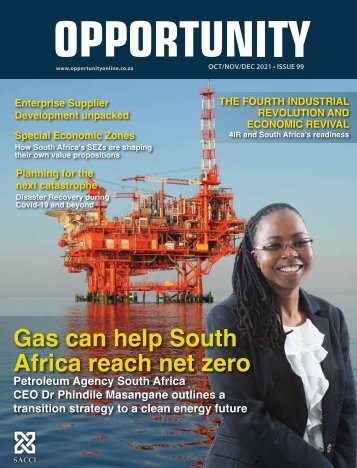

BLUE CHIP INVESTMENT | ETPs Worth its weight in gold A pioneer in the South African exchange-traded funds industry, Absa Corporate and Investment Bank’s exchange-traded products business was established in early 2000 to provide investors with passive investment solutions by using exchange-traded products as tools or building blocks. Blue Chip speaks to Michael Mgwaba, who heads up the ETP business at Absa. Please share your career trajectory to your current position. I have more than 17 years of experience in the exchange-traded product (ETP) industry, starting in the middle office and working my way up to head the ETP business and as CEO of one of the largest exchange-traded fund (ETF) issuers in Africa, the NewGold Issuer (RF) Limited. In your role, you are responsible for the development and origination of innovative funds and solutions for retail and institutional investors. Are there any new products for 2024 in the pipeline? Our team is working on a few products/solutions that in our view can be considered viable investment tools for various investors in their portfolio construction. We can provide more detailed information when cleared with the listing authority. Please tell us about Absa’s ETP business. The Absa ETP business established itself as the market leader in precious metals and fixed-income ETFs and has been the largest issuer of ETPs in the market for the better part of the last two decades. Some of its flagship products are NewGold which has multiple listings across Africa and NewPlat which at some point became the world’s largest platinum ETF. The business has won many accolades over the years, it has expanded its offering to include Actively Managed Certificates (AMCs) and today its focus is on products linked to precious metals, global currencies and more. NewGold ETF is one of the simplest and most cost-efficient methods for investors to invest directly in actual gold. How so? NewGold was one of the first few gold ETFs launched globally in 2004 and the first of its kind in Africa. It started off charging the same investment fee as some of the large global gold ETFs at 0.40% annually. To align itself with its mission to provide an effective way to own gold and democratise its investment, Absa decided to reduce its cost to investors significantly, ensuring that the man on the street can also enjoy the investment benefit associated with investing in gold Today, NewGold is one of the lowest-cost gold ETFs in the world at 0.30% annually and currently, there are no similar products in South Africa whose effective charge is lower than that of NewGold. The use of NewGold by investors has also evolved over the years, whereas in the past it was mainly acquired by long-term investors who wanted to benefit from sustainable returns. Today, we also see tactical investors who want to benefit from short-term trends like changes in interest rates, currency fluctuations, etc. Other investors use it to park excess cash while in search of good opportunities in the market and sell it later. Why gold? Gold has historically demonstrated the following attributes: a superior store of value, especially during times of high inflation and currency volatility. It has proven to have a low to negative correlation to most asset classes, making it one of the most effective diversifiers in a traditional 60/40 portfolio. Recent analysis done by the World Gold Council suggests that adding gold into a diversified Michael Mgwaba, Head of ETP Business, Absa portfolio investing in global assets can improve risk-adjusted returns. It is rare to find all these attributes in one asset. These attributes stem from the fact that gold has both industrial and investment use and its supply and demand is diverse. Please tell us about the current ETP landscape. South Africa’s ETP industry has grown tremendously over the years, especially around the number of products it offers to the market, diverse asset classes that are offered via ETPs and various investment strategies that investors today can access by investing in ETPs. It has moved from an industry associated with passive investment strategies to one that provides both active and passive strategies/solutions. Today its offering is used by institutional investors in portfolio construction and core-satellite strategies as well as by retail investors as building blocks. The industry has evolved over the past 22 years and its offerings now include AMCs and Actively Managed ETFs. What advice would you give investors in terms of ETPs? With markets very volatile and geopolitical tension perpetuating an uncertain future, diversification becomes more important than ever. ETPs are an efficient and cost-effective way to achieve it. Gold can act or be considered as insurance in your portfolio. 46 www.bluechipdigital.co.za

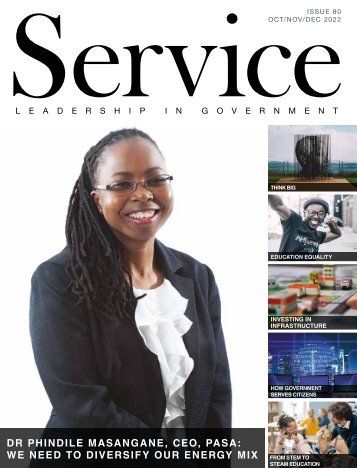

Financial Planning Institute of Southern Africa Become a CERTIFIED FINANCIAL PLANNER ® professional The CERTIFIED FINANCIAL PLANNER ® professional designation is internationally recognised as the standard for financial planning professionals which sets them apart. The status gives consumers confidence that the financial planner they are dealing with is suitably qualified to give trusted advise to assist them with their varied financial planning needs. Consumers are assured that a CFP ® professional remains up to date with developments in their profession to better serve the needs of their clients. Below are just some of the main secondary member benefits of being a CFP ® professional with the FPI • Commissioner of Oath status • Designation recognized by South African Qualifications Authority (SAQA) & registered on the National Learning Database • Apply with FPI to become a SARS Tax Practitioner In addition to this, the CFP ® designation has been recognized by the FSCA in their proposal as the only mark to currently meet the standard and will be limited to a Financial Planner title of an adviser holding a professional designation. CFP®, CERTIFIED FINANCIAL PLANNER® and are trademarks owned outside the U.S. by Financial Planning Standards Board Ltd. The Financial Planning Institute of Southern Africa is the marks licensing authority for the CFP® marks in South Africa through agreement with FPSB. Please visit www.fpsb.org to learn more about FPSB and the affiliate countries.

- Page 1: BLUE CHIP 0.5 CONTINUOUS PROFESSION

- Page 5 and 6: Professional Financial Planning and

- Page 7 and 8: Indexation: Anything but Passive. I

- Page 10 and 11: CONTENTS ISSUE 90 FEB/MAR/APR 2024

- Page 12 and 13: BLUE CHIP FPI UPDATES | CEO message

- Page 14 and 15: BLUE CHIP On the money Making waves

- Page 16 and 17: BLUE CHIP On the money Making waves

- Page 18 and 19: BLUE CHIP COLUMN How to get the yea

- Page 20: BLUE CHIP COLUMN Social media in fi

- Page 23 and 24: INVESTMENT | Leadership BLUE CHIP C

- Page 25 and 26: INVESTMENT | Leadership BLUE CHIP F

- Page 27 and 28: INVESTMENT | Economy BLUE CHIP Top

- Page 29 and 30: INVESTMENT | Innovation BLUE CHIP d

- Page 31 and 32: Annual Refresher 2024 Cape Town 27

- Page 33 and 34: FPI | Financial Planner of the Year

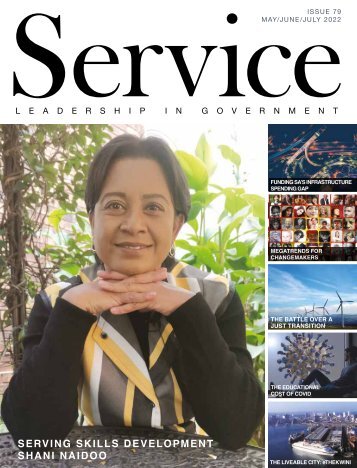

- Page 35 and 36: Young Financial Planners Organisati

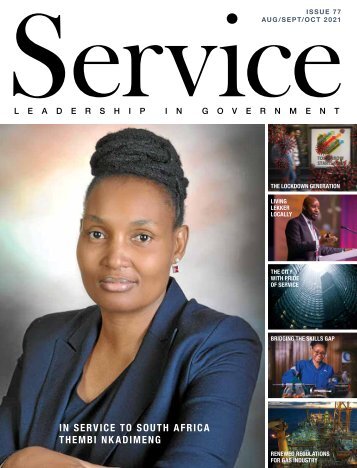

- Page 37 and 38: FPI UPDATES | Awards BLUE CHIP In a

- Page 39 and 40: FPI UPDATES | Awards BLUE CHIP The

- Page 41 and 42: FINANCIAL PLANNING | Retirement BLU

- Page 43 and 44: FINANCIAL PLANNING | Retirement BLU

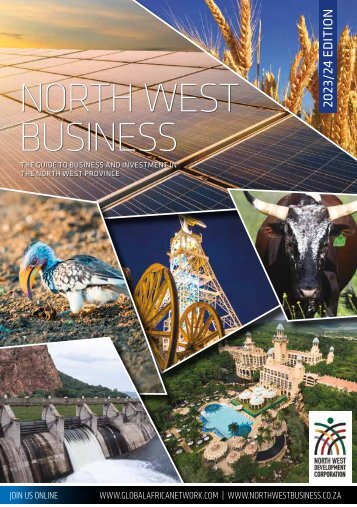

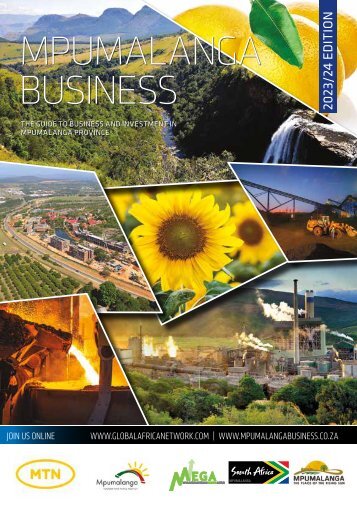

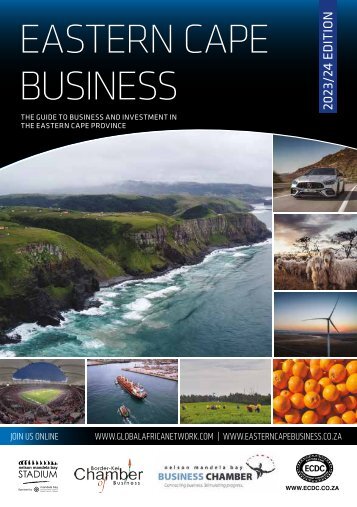

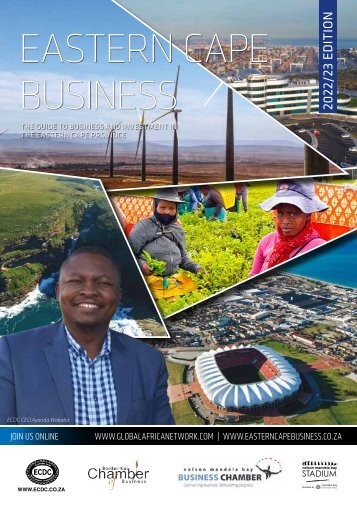

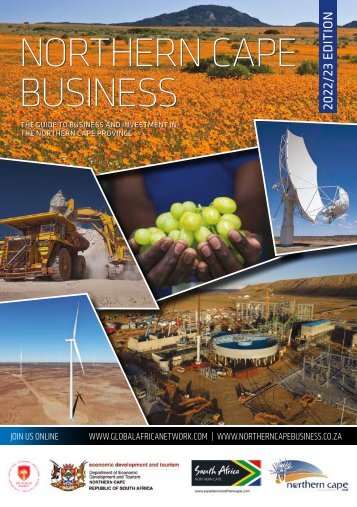

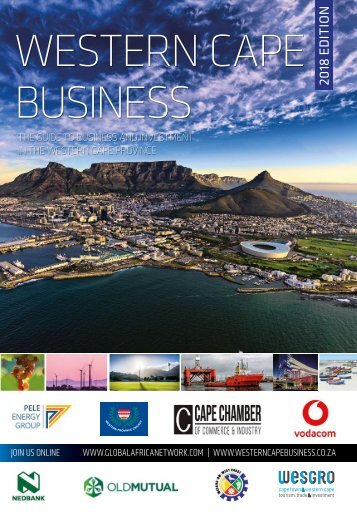

- Page 45 and 46: INVESTMENT | Exchange-traded produc

- Page 47: STRAPLINE BLUE CHIP www.bluechipdig

- Page 51 and 52: INVESTMENT | ETFs BLUE CHIP Kingsle

- Page 53 and 54: PRACTICE MANAGEMENT | Technology BL

- Page 55 and 56: PRACTICE MANAGEMENT | Technology Be

- Page 57 and 58: INVESTMENT | Economy BLUE CHIP The

- Page 59 and 60: INVESTMENT | Hedge funds BLUE CHIP

- Page 61 and 62: PRACTICE MANAGEMENT | Technology BL

- Page 63 and 64: USE AI FOR EFFORTLESS AGENDAS & MIN

- Page 65 and 66: PRACTICE MANAGEMENT | Technology BL

- Page 67 and 68: PRACTICE MANAGEMENT | Technology BL

- Page 69 and 70: CLIENT ENGAGEMENT | Coaching BLUE C

- Page 71 and 72: CLIENT ENGAGEMENT | Behavioural fin

- Page 73 and 74: PRIVATE CLIENT HOLDINGS IS AN AUTHO

- Page 75 and 76: FINANCIAL PLANNING | Legislation BL

- Page 77 and 78: DEVELOPMENT | Internships BLUE CHIP

- Page 79 and 80: FINANCIAL PLANNING | Legislation BL

- Page 81 and 82: FPI | Certification BLUE CHIP Next

- Page 83: Partner with us, become an FPI Appr

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...