South African Business 2016 edition

- Text

- Investment

- Government

- Business

- Development

- Network

- Sectors

- Investing

- Business

- Africa

- African

- Economic

- Manufacturing

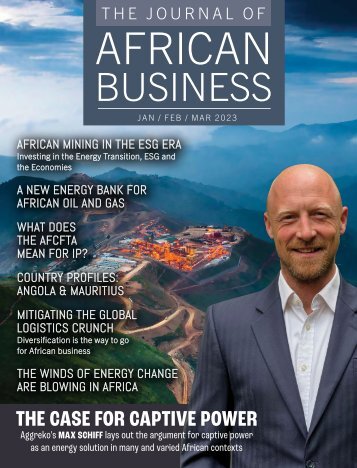

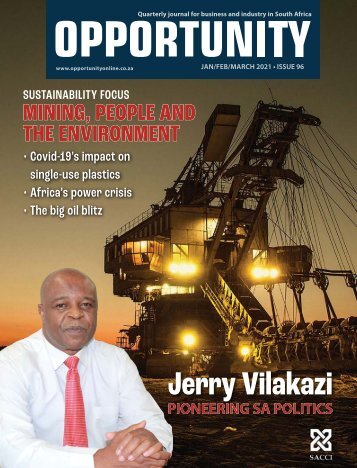

- Mining

- Opportunities

- Economy

- Overview

SPECIAL FEATURE late in

SPECIAL FEATURE late in 2014. The health sector laboratory will be undertaken in collaboration with provinces, districts and clinic managers with the aim of producing a detailed plan for improving service delivery in public sector clinics in all provinces, including indicators, targets and timeframes, in addition to a guideline for clinic managers to develop and sustain these improvements. Success of Operation Phakisa “The key step in Operation Phakisa’s approach,” said the President, “will be the intensive work sessions necessary to deliver complete and signedoff action plans for presentation to Cabinet. These work sessions will help create transparency and help to remove bottlenecks and resolve the most critical challenges facing a sector.” Once the detailed delivery plans have been completed, President Zuma said government will then move into the implementation phase of Operation Phakisa—with him taking a personal interest in monitoring the progress and implementing the project. “The people of South Africa deserve much better from all of us. Through Operation Phakisa and all our other key strategic interventions to achieve the goals of the National Development Plan, we must work tirelessly to move our country forward and build a better life for all, especially the poor and the working class,” he said, urging key role players to commit fully to the success of this programme. SOUTH AFRICAN BUSINESS 2016 20

Meeting targets Highlights of the Operation include the cabinet approved issuing to Transnet Port Terminals (TPT) of a permanent operating licence to operate the manganese container terminal at the Port of Ngqura. Significant economic opportunities arising out of this development include the upgrading of the rail network (R2.3-billion) from Northern Cape to Port of Ngqura in order to support axle loads of 26t. Knock-on effects occur along the rail infrastructure value chain, with significant opportunities for localisation, such as signalling systems. The relocation of manganese operations from the Port of Saldanha would open opportunities for offshore oil and gas activities such as rig repair and maintenance. There is an opportunity to capture the lucrative repair market by extending and expanding our port capabilities to service current and future vessels in East and West Africa. Opportunities for local shipbuilding industry have arisen as a result of tenders issued by Armscor for a new hydrographic vessel under Project Hotel and six new offshore and inshore patrol vessels under Project Biro. The acquisition of the six IPVs/OPVs by the Navy is a major boost to the local shipbuilding industry as 60% local content is required. Projected spend over the next three to four years is approximately R6.6-billion, providing the opportunity to deepen component manufacturing and rebuild domestic capabilities. Transnet National Ports Authority (TNPA) and Transnet SOC Limited have adopted a Public- Private-Partnership (PPP) model to finance new Operation Phakisa infrastructure. TNPA has committed R7-billion for public sector investment in domestic ports to support industrial opportunities in the ports. Saldanha Bay port has been established as an oil and gas hub, the total scope of the initiative amounting to a R9.2-billion investment (public and private). TNPA has appointed transactional advisors for the refurbishment and maintenance of port SPECIAL FEATURE facilities. The scope and maintenance refurbishment requirements have been completed and The dti has designated working vessels for local procurement (60% local content). A R1.4-billion tender by TNPA for the procurement of tug boats was awarded to a South African company in support of local procurement. The dti is in the process of developing a strategic marketing campaign and value proposition for investors into the MTM sector. In addition to the Marine sector, progress has occurred within the oil and gas and aquaculture sectors, a Delivery Unit and Steering Committee was established at DMR and is fully functional. The financial analysis of South African offshore oil and gas sector procurement has been completed ahead of schedule. This work included the determination of product and service categories and spend (values); compilation of suppliers’ database and classification of procurement (with measurement and standards criteria) in terms of domestic vs foreign value addition in final goods and services. Setting of minimum targets for local production and supply awaits the finalisation of Mineral Petroleum and Resources Development Amendment Bill (MPRDA) legislative process. A total of 10 catalyst projects are in progress with funding secured from the Aquaculture Development Enhancement Programme (ADEP), the private sector investment at R305- million, and Government investment at R105- million. The National Regulator for Compulsory Specifications (NRCS) has been co-opted for sampling and food safety standards. Public Works has signed off leases on four projects. South Africa is ideally positioned to serve the East-West cargo traffic lane and the booming African offshore oil and gas industry through marine manufacturing, which includes ship and rig repair, refurbishment and boatbuilding. Despite this competitive advantage, we currently capture only 1% of the global market of ship repair and refurbishment. Efforts are underway to ensure that all of Operation Phakisa’s Oceans Economy initiatives are prioritised and resourced accordingly. 21 SOUTH AFRICAN BUSINESS 2016

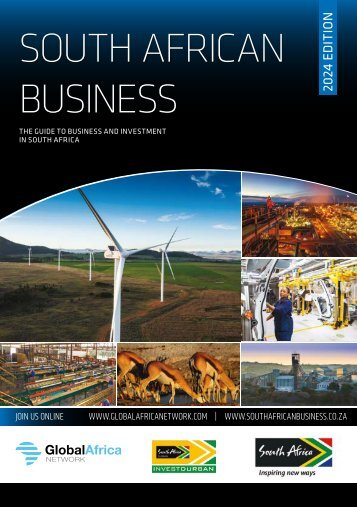

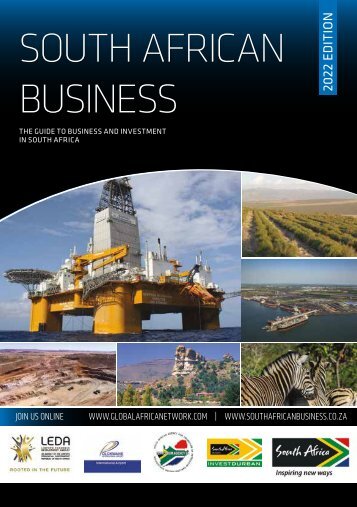

- Page 1: SOUTH AFRICAN BUSINESS 2016 EDITION

- Page 6: CONTENTS Introduction CONTENTS Sout

- Page 10 and 11: CREDITS Publisher Chris Whales Publ

- Page 12 and 13: SPECIAL FEATURE South Africa A peri

- Page 14 and 15: SPECIAL FEATURE In a year that saw

- Page 16 and 17: SPECIAL FEATURE owes its existence

- Page 18 and 19: SPECIAL FEATURE against water losse

- Page 20 and 21: SPECIAL FEATURE Operation Phakisa h

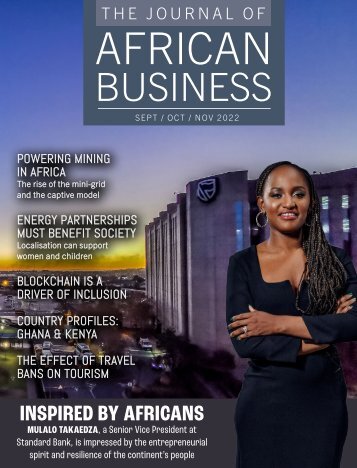

- Page 24 and 25: SPECIAL FEATURE Understanding Afric

- Page 26 and 27: INTERVIEW Job creation on track Ala

- Page 28 and 29: SPECIAL FEATURE Business funding Th

- Page 30 and 31: SPECIAL FEATURE in turn makes it ve

- Page 32 and 33: SPECIAL FEATURE Contact: 012 394 18

- Page 34 and 35: SPECIAL FEATURE Black Business Supp

- Page 36 and 37: SPECIAL FEATURE The evolution of sk

- Page 38: SPECIAL FEATURE providing TVET lear

- Page 42: PROFILE FP&M Seta Facilitating and

- Page 45 and 46: • The development of a national s

- Page 48 and 49: FOCUS Champions of change Five dyna

- Page 50 and 51: SPECIAL FEATURE The top law firms S

- Page 52 and 53: SPECIAL FEATURE Keeping the BRICS t

- Page 54 and 55: SPECIAL FEATURE Keeping BEPS in che

- Page 56 and 57: SPECIAL FEATURE IPAP in action In 2

- Page 58 and 59: FOCUS THERE’S NO END TO THE BENEF

- Page 60 and 61: INTERVIEW The riches of Africa awai

- Page 62 and 63: INTERVIEW and it could actually be

- Page 64 and 65: PROFILE ECIC exco profiles Profiles

- Page 66 and 67: INTERVIEW The hub of Africa Tim Har

- Page 69 and 70: Key sectors Overview of the main ec

- Page 71 and 72: OVERVIEW from the subsistence farme

- Page 73 and 74:

OVERVIEW South Africa produces abou

- Page 75 and 76:

South Africa’s looming energy gap

- Page 77 and 78:

How will these resources be develop

- Page 79 and 80:

Vall exclusive economic zone limits

- Page 82 and 83:

OVERVIEW NEED PIC Mining The South

- Page 84 and 85:

OVERVIEW Mineral beneficiation The

- Page 86 and 87:

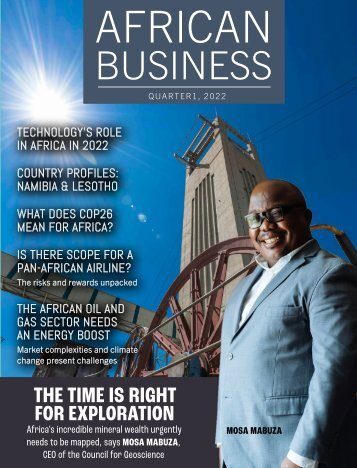

PROFILE The Council for Geoscience

- Page 88 and 89:

OVERVIEW Energy The South African e

- Page 90 and 91:

INTERVIEW Cummins South Africa Cumm

- Page 92 and 93:

OVERVIEW Manufacturing Increasing m

- Page 94 and 95:

OVERVIEW Automotive International i

- Page 96 and 97:

OVERVIEW Automotive components Incu

- Page 98 and 99:

OVERVIEW Chemicals and pharmaceutic

- Page 100 and 101:

OVERVIEW Healthcare South Africa’

- Page 102 and 103:

OVERVIEW Water Severe water restric

- Page 104:

OVERVIEW Improving quality The intr

- Page 107 and 108:

Our Vision is is “Quality water f

- Page 109 and 110:

OVERVIEW 107 SOUTH AFRICAN BUSINESS

- Page 111 and 112:

OVERVIEW airports in India and Braz

- Page 113 and 114:

affords, while maintaining its envi

- Page 115 and 116:

kets, except Australia. In Africa,

- Page 117 and 118:

Rosebank, Johannesburg, renamed ‘

- Page 119 and 120:

Trade with Africa Improved infrastr

- Page 121 and 122:

FOCUS MTN plugs R1.2-billion into K

- Page 123 and 124:

MTN rolls out fibre infrastructure

- Page 125 and 126:

OVERVIEW community engagement. The

- Page 127 and 128:

PROFILE For BEE Verification and is

- Page 129 and 130:

OVERVIEW attracting and retaining c

- Page 131 and 132:

OVERVIEW Small business is taken ve

- Page 133 and 134:

Franchise Fund—an innovative plat

- Page 135 and 136:

educating young people in fields th

- Page 137 and 138:

OVERVIEW Management Plan has divert

- Page 139 and 140:

hazardous waste is also not being c

- Page 141 and 142:

INTERVIEW yourself up as a Tier 1 o

- Page 144 and 145:

OVERVIEW Renewable energy South Afr

- Page 146 and 147:

INTERVIEW Plenty of scope for solar

- Page 148 and 149:

LISTINGS South African business org

- Page 150 and 151:

LISTINGS South African National Gov

- Page 152 and 153:

LISTINGS Department of Communicatio

- Page 154 and 155:

LISTINGS Department of Human Settle

- Page 156 and 157:

LISTINGS Department of Science and

- Page 158 and 159:

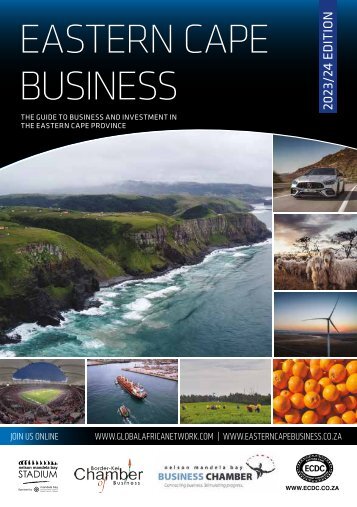

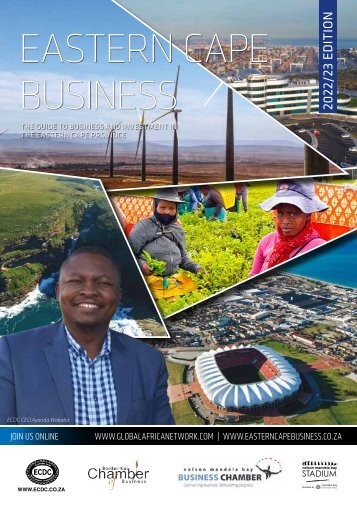

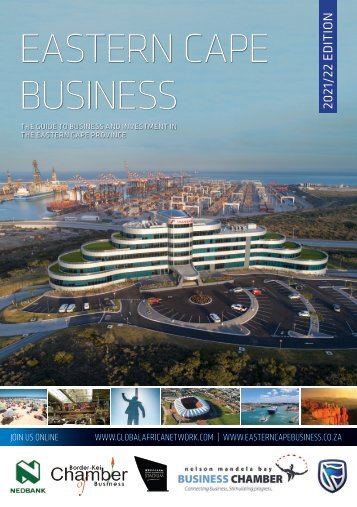

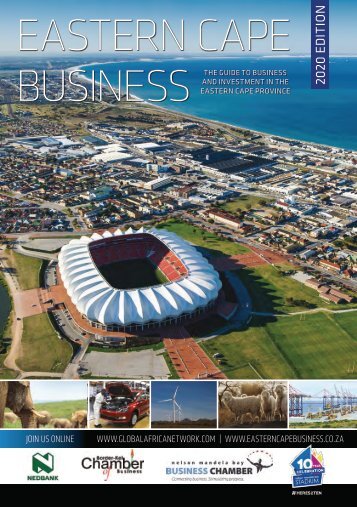

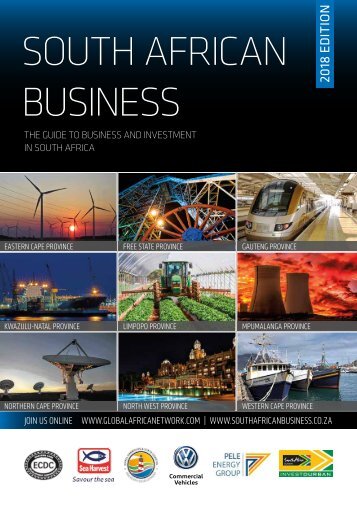

OVERVIEW Regional overview: Eastern

- Page 162 and 163:

INTERVIEW Buffalo City on the rise

- Page 164 and 165:

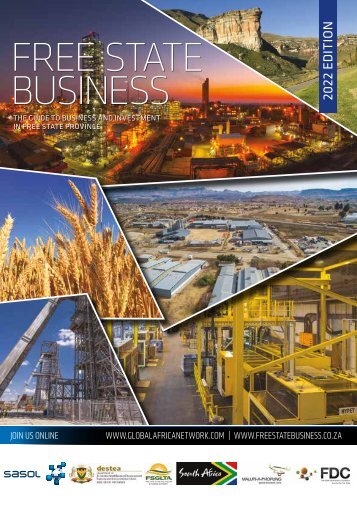

OVERVIEW Regional overview: Free St

- Page 166 and 167:

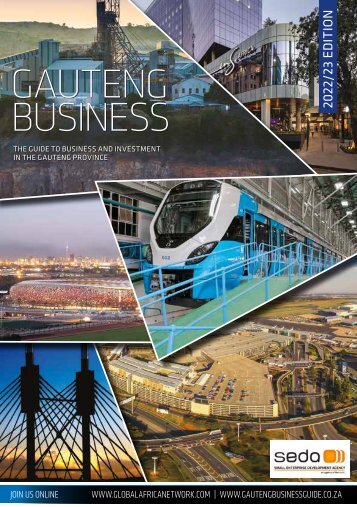

OVERVIEW Regional overview: Gauteng

- Page 168 and 169:

FOCUS A Catalyst for Economic Devel

- Page 170 and 171:

FOCUS business people and tourists

- Page 172 and 173:

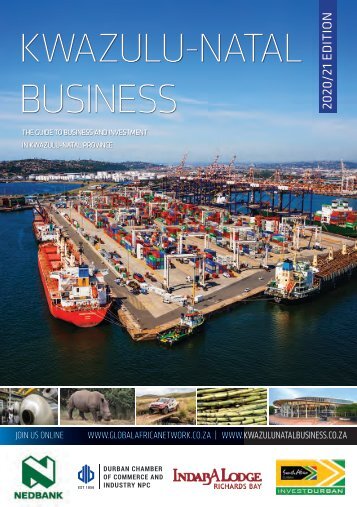

OVERVIEW Regional overview: KwaZulu

- Page 174 and 175:

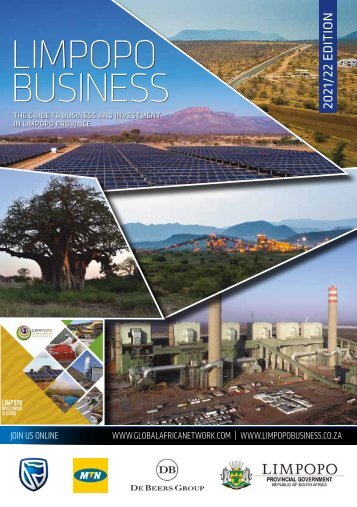

OVERVIEW Regional overview: Limpopo

- Page 176 and 177:

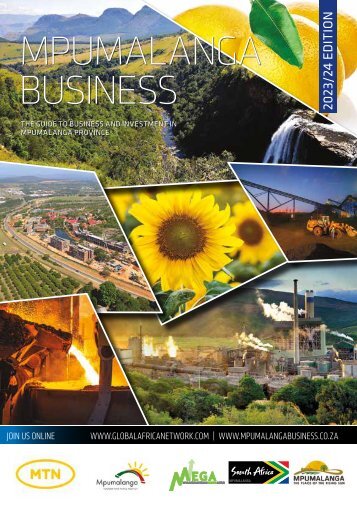

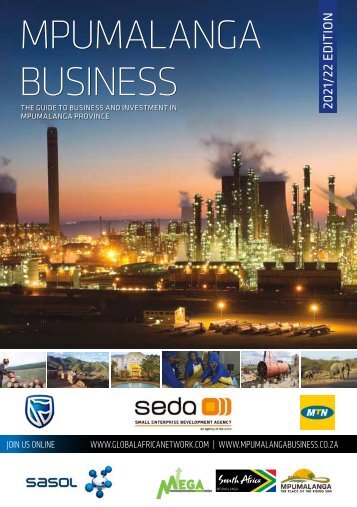

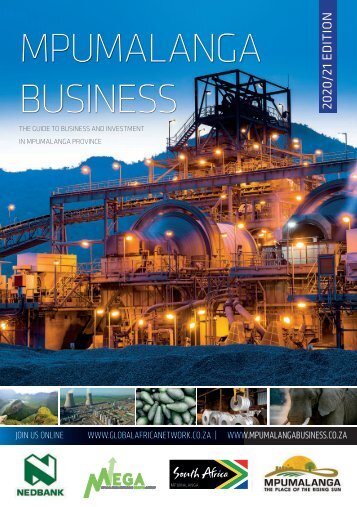

OVERVIEW Regional overview: Mpumala

- Page 178 and 179:

The powerhouse of Africa Mpumalanga

- Page 180 and 181:

Mpumalanga: Key Sectors Mpumalanga

- Page 182 and 183:

Nkomazi Special Economic Zone The N

- Page 184 and 185:

INVEST IN THE PROVINCE OF THE RISIN

- Page 186 and 187:

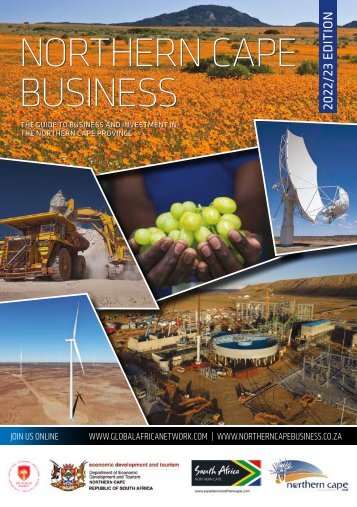

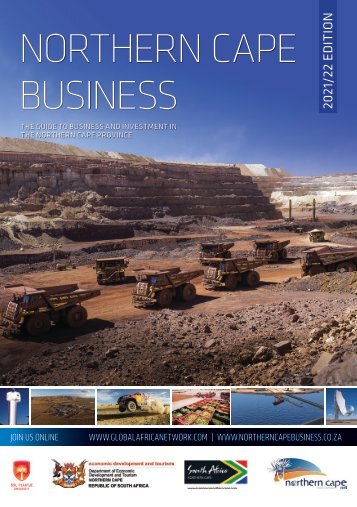

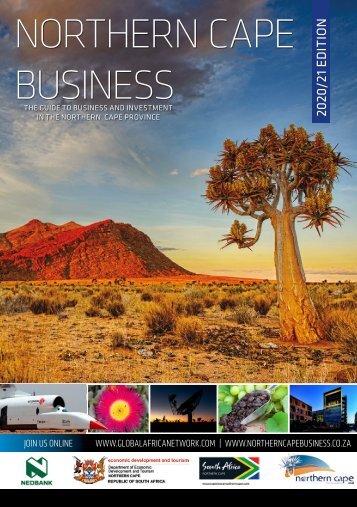

OVERVIEW Regional overview: Norther

- Page 188 and 189:

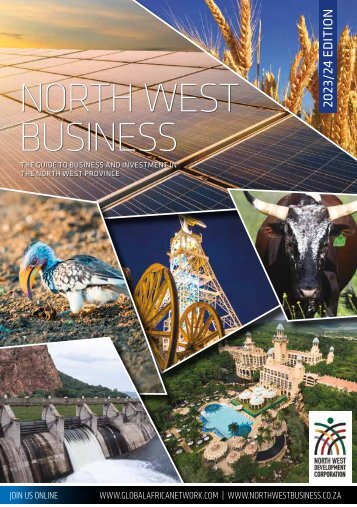

OVERVIEW Regional overview: North W

- Page 190 and 191:

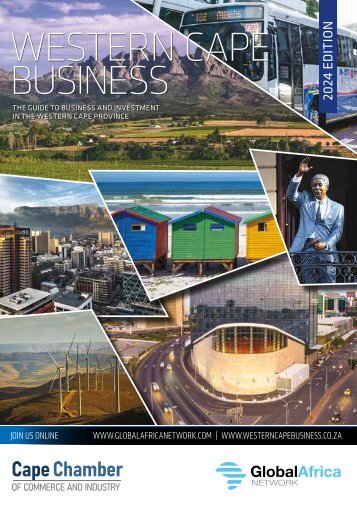

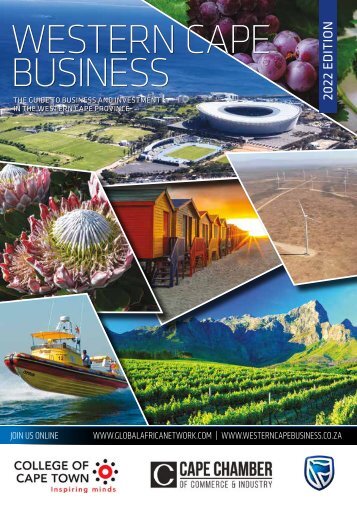

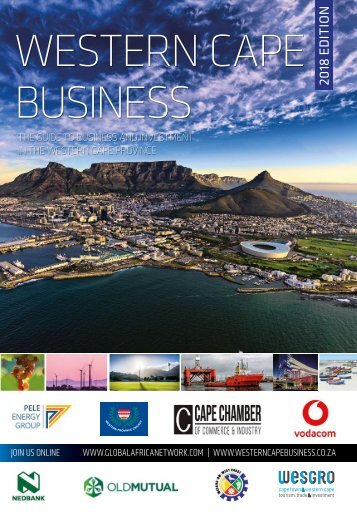

OVERVIEW Regional overview: Western

- Page 192 and 193:

FOCUS Khayelitsha - the power of to

- Page 194 and 195:

INDEX INDEX Abeco Tanks ...........

- Page 196:

ENSafrica.com ENSafrica | Africa’

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...