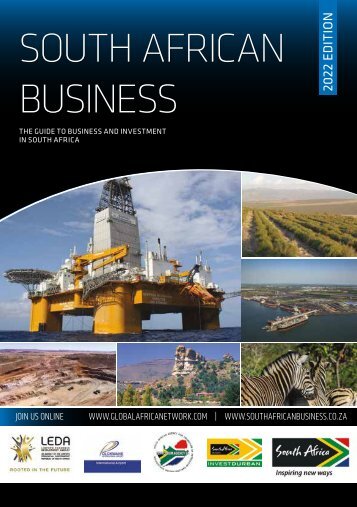

South African Business 2020 edition

- Text

- Infrastructure

- Energy

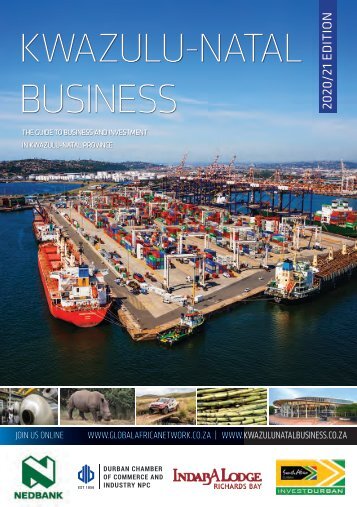

- Maritime

- Trade

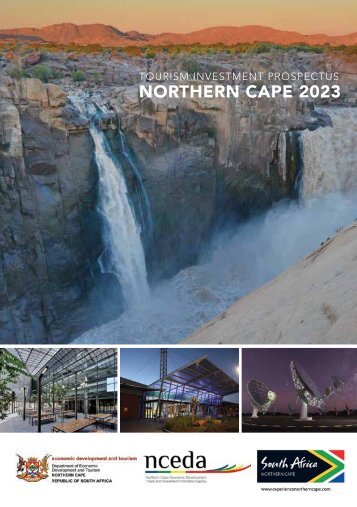

- Tourism

- Regional

- Province

- Industry

- Economy

- Investor

- Invest

- Africa

- Africa

- Sector

- Investment

- Business

- Industrial

- Projects

- Economic

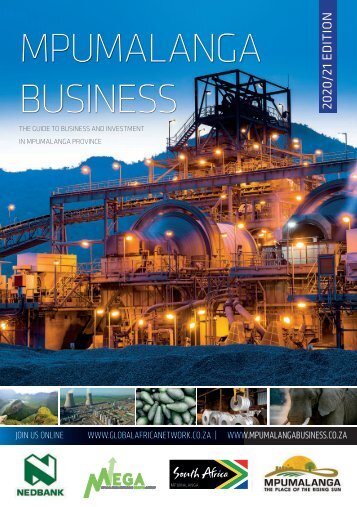

- Mining

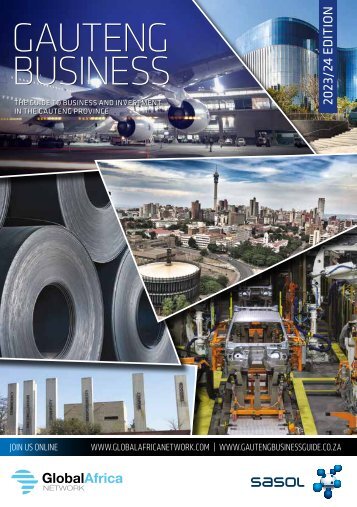

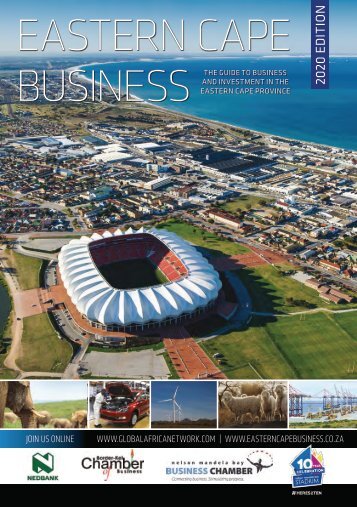

OVERVIEW Automotive

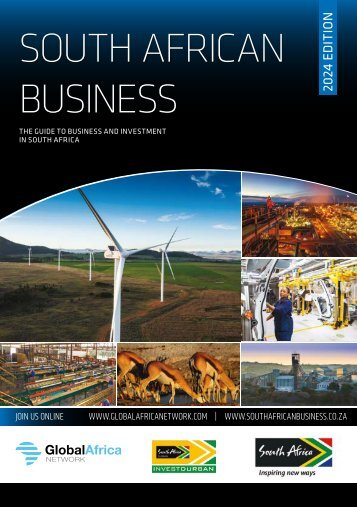

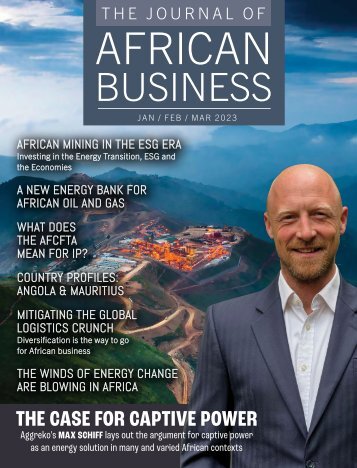

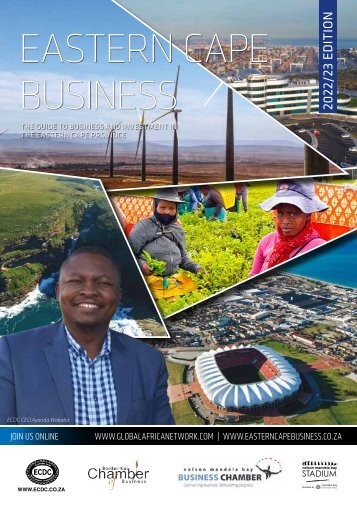

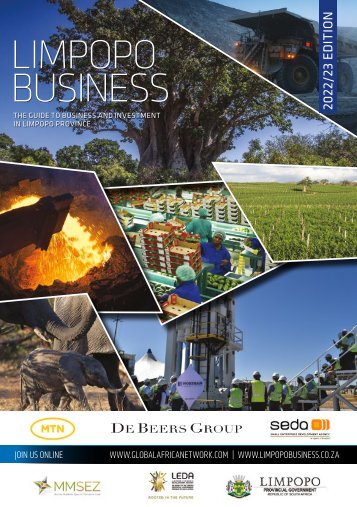

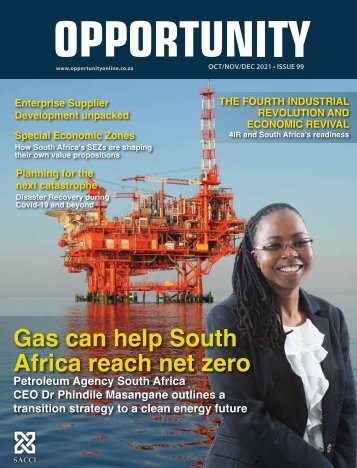

OVERVIEW Automotive Vehicle exports are boosting the South African economy. SECTOR INSIGHT Giant vehicles for defence, construction and mining are a growth sector. South Africa’s automotive sector continues to excel in production volumes and exports. Another first was achieved in 2018 when the country’s vehicles were sent to a total of 155 countries. Vehicle and automotive component exports in 2018 brought in R178.8-billion, fully 14% of South Africa’s total export basket. Automotive and automotive components make up 30.2% of total manufacturing output and about 7% of the nation’s Gross Domestic Product (GDP). Two of the newest production lines are up and running at BMW’s Rossyln plant (BMW X3 SUV) and in Uitenhage where Volkswagen has added an additional production line to produce more Polos. All of the country’s major manufacturers such as Mercedes-Benz (East London), Toyota (Durban) and Ford (Port Elizabeth and Tshwane) have invested large sums in increasing production or in taking on new vehicle models. The purchase by the United Arab Emirates of an armoured personnel carrier made by defence and aerospace company Paramount Group at a trade show in early 2019 was a reminder that the South African automotive industry extends beyond sedans and pickup trucks (or bakkies as they are known in South Africa). The Mbombe 4 (pictured) is the third in a series of combat vehicles produced by Paramount. Paramount South Africa has been created so that it can participate in the local market. Gauteng also has DCD Protected Mobility which manufactures armoured cars in Boksburg, branded as Vehicle Mounted Mine Detectors. In nearby Benoni, BAE Systems OMC designs and manufactures protected vehicles. Bell Equipment, which originated in Richards Bay and still has a large manufacturing facility there, now claims 50 000 machines operating in over 80 countries around the world. Its articulated dump trucks supply hundreds of mining operations and it has over 100 other products. Bell is in the process of transferring production of its truck range to its factory in Germany, which will double in size to accommodate the growing demand for trucks in Europe and America. The shift will not affect employment levels at the Richards Bay site because Bell started assembling Kamaz heavyduty trucks in 2019 for the African market. Kamaz, a Russian brand that has won 14 Dakar rallies, is known for its reliability in tough conditions. Bell’s intention is to increase the percentage of local components over time. Dezzi Equipment also makes loaders, dump trucks and haulers in KwaZulu-Natal, 300km south of Richards Bay at Port Shepstone. SOUTH AFRICAN BUSINESS 2020 84

OVERVIEW Long-term state support of the industry through the Automotive Production and Development Programme (APDP) is a major reason for the continuing health of this vital sector. The industry itself is looking to Africa for new markets. By increasing total production numbers to one-million vehicles, the sector will be more viable. The National Department of Trade and Industry and Competition (the dtic), working together with the National Association of Automobile Manufacturers of South Africa (NAAMSA) has set targets for 2035 to increase production to 1% of world volumes (which would mean 1.4-million more vehicles made in SA), increasing local content and doubling employment and blackowned businesses in the sector. The Eastern Cape manufactures half of the country’s passenger vehicles and provides 51% of South Africa’s vehicle exports. The sector accounts for over 40 000 formal sector jobs in the province. Phase 1 in the construction process of the vehicle assembly plant of Beijing Automotive Group South Africa (BAIC SA) was completed in 2018. The total project involves an investment of R11-billion. BAIC expects to be building 50 000 vehicles per year at its site at Coega SEZ by 2022. The decision in 2017 of General Motors to disinvest from South Africa has not had any knock-on effect. The company’s sale of its plant in Port Elizabeth was just one sale of many around the world. Isuzu has bought the factory. In January 2018, Mercedes-Benz South Africa (MBSA) started producing the Mercedes-AMG C 63 S at its East London factory, after an investment of R200-million. MBSA started exporting record volumes in 2016 and has kept up the pace since then. BMW South Africa has invested R6-billion in its Rosslyn plant to manufacture the new BMW X3 model. Nissan is another big automotive manufacturer with a plant at Rosslyn, north-west of Pretoria. Gauteng is also home to a strong automotive components industry, together with several bus and truck assembly plants. These include Scania, TFM Industries and MAN Truck and Bus South Africa, as well as the Chinese truck manufacturer FAW, which owns an assembly plant in Isando. Bejing Automotive Works (BAW) assembles taxis at Springs. In 2016, Toyota invested R6.1-billion into its massive plant at Prospecton, Durban. The company regularly sells about a quarter of the vehicles sold in South Africa, and accounts for the same proportion of exports. The Corolla car, the Hilux bakkie and the Fortuner SUV are manufactured at the plant. Automotive components South Africa has a sophisticated automotive components sector. The catalytic converter sector experienced incredible growth for a number of years but volatility in the platinum mining sector, together with increased interest in electric vehicles and hybrids, means that exporters (largely based in Port Elizabeth) have had to work harder. Tyre and glass manufacturers are clustered around the areas where the automotive industry is active. Tyre manufacturer and distributor Sumitomo Rubber South Africa was established in 2014 and makes and sells brands such as Dunlop, Falken and Sumitomo Tyre into Africa. Bridgestone Tyres has plants in Port Elizabeth and Brits and Continental makes tyres in Port Elizabeth. The large number of vehicle models produced in South Africa is a complicating factor for the components sector: low volumes often mean high prices. Two Port Elizabeth companies export significant portions of their production to overcome this: Schaeffler SA exports to its international parent so that it can achieve higher volumes. Shatterprufe supplies the majority of windscreens to the South African market but there are 12 model ranges to serve. ONLINE RESOURCES Automotive Industry Development Centre: www.aidc.co.za National Association of Automotive Component and Allied Manufacturers: www.naacam.co.za National Association of Automobile Manufacturers of South Africa: www.naamsa.co.za 85 SOUTH AFRICAN BUSINESS 2020

- Page 1:

xxaro’s Belfast coal mine is the

- Page 5 and 6:

PROFILE 3 SOUTH AFRICAN BUSINESS 20

- Page 7 and 8:

MESSAGE PROFILE Beyond the business

- Page 9 and 10:

WHAT YOU NEED TO KNOW PROCESS FOR A

- Page 11 and 12:

® Build your investment while we b

- Page 13 and 14:

FOREWORD UNPACK YOUR POTENTIAL WITH

- Page 15 and 16:

STAND OUT WITH sustained savings Be

- Page 17 and 18:

SPECIAL FEATURE showing at micro le

- Page 19 and 20:

SPECIAL FEATURE Investing in South

- Page 21 and 22:

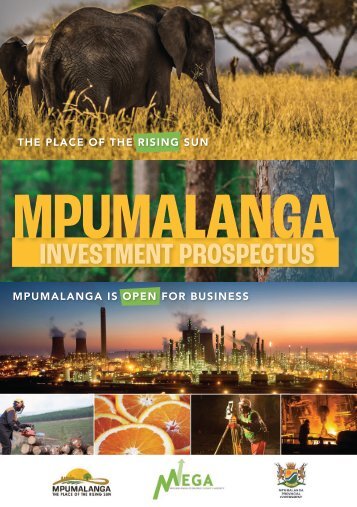

10 REASONS WHY YOU SHOULD INVEST IN

- Page 23 and 24:

SPECIAL FEATURE KwaZulu-Natal Capit

- Page 25 and 26:

Sectoral strengths of South African

- Page 27 and 28:

INTERVIEW 0 0 11 01 1 0 11 01 0 1 0

- Page 29 and 30:

FOCUS mangoes, 65% of its papayas,

- Page 31 and 32:

SPECIAL FEATURE transported around

- Page 33 and 34:

SPECIAL FEATURE This means that the

- Page 35 and 36: SPECIAL FEATURE FOCUS MELROSE ARCH

- Page 38 and 39: INTERVIEW PROFILE Maritz Electrical

- Page 40 and 41: SPECIAL FEATURE Mining for the futu

- Page 42: SPECIAL FEATURE New Vaal Colliery a

- Page 45 and 46: Comprehensive turnkey tesng soluons

- Page 47 and 48: portive of the need to address the

- Page 49: 28 October 2019. closer to the time

- Page 52 and 53: PROFILE Bonds with China boost jobs

- Page 54 and 55: FOCUS Women of PMC Experience, skil

- Page 56 and 57: The Export Credit Insurance Corpora

- Page 59 and 60: KEY SECTORS Overviews of the main e

- Page 61 and 62: Land Bank is also looking to create

- Page 63 and 64: Sharing Africa’s beauty with the

- Page 65 and 66: FOCUS HASSLE FREE PREPAID MANAGEMEN

- Page 67 and 68: OVERVIEW The economic power of rene

- Page 69 and 70: Renewables leader • >10% market s

- Page 71: OVERVIEW FOCUS expanded with the oi

- Page 75 and 76: OVERVIEW 10 megalitres of drinking

- Page 77 and 78: OVERVIEW of TMH Africa, a part of t

- Page 79 and 80: OVERVIEW will rise 150m above the c

- Page 81 and 82: FOCUS grade to HD quality using a l

- Page 83 and 84: OVERVIEW on generics. Annual produc

- Page 85: Kemtek pursues continual growth Kem

- Page 89 and 90: OVERVIEW Several airports are possi

- Page 91 and 92: Banking and financial services New

- Page 93 and 94: Audit and Risk Management Solutions

- Page 95 and 96: financial services (FSP 44673) and

- Page 97 and 98: OVERVIEW FOCUS in Gauteng, the prov

- Page 99 and 100: SUPPLYING INDUSTRIAL GASES TO SOUTH

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...