Markedsrapport – Desember 2007 - NRP AS

Markedsrapport – Desember 2007 - NRP AS

Markedsrapport – Desember 2007 - NRP AS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Markedsrapport</strong> <strong>–</strong> <strong>Desember</strong> <strong>2007</strong> Side 20<br />

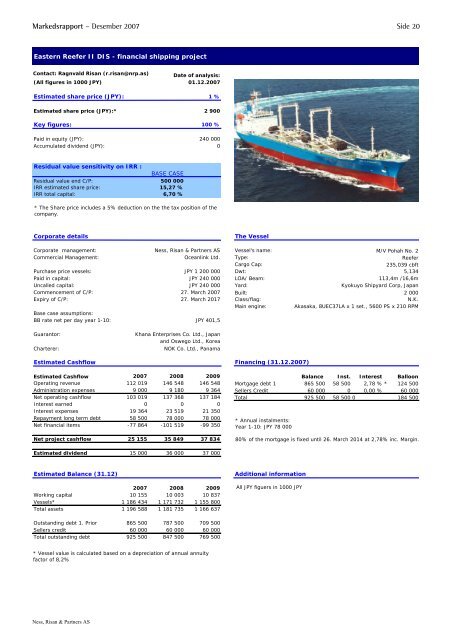

Eastern Reefer II DIS - financial shipping project<br />

Contact: Ragnvald Risan (r.risan@nrp.as) Date of analysis:<br />

(All figures in 1000 JPY) 01.12.<strong>2007</strong><br />

Estimated share price (JPY): 1 %<br />

Estimated share price (JPY):* 2 900<br />

Key figures: 100 %<br />

Paid in equity (JPY): 240 000<br />

Accumulated dividend (JPY): 0<br />

Residual value sensitivity on IRR :<br />

B<strong>AS</strong>E C<strong>AS</strong>E<br />

Residual value end C/P: 500 000<br />

IRR estimated share price: 15,27 %<br />

IRR total capital: 6,70 %<br />

* The Share price includes a 5% deduction on the the tax position of the<br />

company.<br />

Corporate details The Vessel<br />

Corporate management: Ness, Risan & Partners <strong>AS</strong> Vessel's name: M/V Pohah No. 2<br />

Commercial Management: Oceanlink Ltd. Type: Reefer<br />

Cargo Cap: 235,039 cbft<br />

Purchase price vessels: JPY 1 200 000 Dwt: 5,134<br />

Paid in capital: JPY 240 000 LOA/ Beam: 113,4m /16,6m<br />

Uncalled capital: JPY 240 000 Yard: Kyokuyo Shipyard Corp, Japan<br />

Commencement of C/P: 27. March <strong>2007</strong> Built: 2 000<br />

Expiry of C/P: 27. March 2017 Class/flag: N.K.<br />

Main engine: Akasaka, 8UEC37LA x 1 set., 5600 PS x 210 RPM<br />

Base case assumptions:<br />

BB rate net per day year 1-10: JPY 401,5<br />

Guarantor: Khana Enterprises Co. Ltd., Japan<br />

and Oswego Ltd., Korea<br />

Charterer: NOK Co. Ltd., Panama<br />

Estimated Cashflow Financing (31.12.<strong>2007</strong>)<br />

Estimated Cashflow <strong>2007</strong> 2008 2009 Balance Inst. Interest Balloon<br />

Operating revenue 112 019 146 548 146 548 Mortgage debt 1 865 500 58 500 2,78 % * 124 500<br />

Administration expenses 9 000 9 180 9 364 Sellers Credit 60 000 0 0,00 % 60 000<br />

Net operating cashflow 103 019 137 368 137 184 Total 925 500 58 500 0 184 500<br />

Interest earned 0 0 0<br />

Interest expenses 19 364 23 519 21 350<br />

Repayment long term debt 58 500 78 000 78 000<br />

Net financial items -77 864 -101 519 -99 350<br />

Net project cashflow 25 155 35 849 37 834<br />

Estimated dividend 15 000 36 000 37 000<br />

Estimated Balance (31.12) Additional information<br />

<strong>2007</strong> 2008 2009<br />

Working capital 10 155 10 003 10 837<br />

Vessels* 1 186 434 1 171 732 1 155 800<br />

Total assets 1 196 588 1 181 735 1 166 637<br />

Outstanding debt 1. Prior 865 500 787 500 709 500<br />

Sellers credit 60 000 60 000 60 000<br />

Total outstanding debt 925 500 847 500 769 500<br />

* Vessel value is calculated based on a depreciation of annual annuity<br />

factor of 8,2%<br />

Ness, Risan & Partners <strong>AS</strong><br />

* Annual instalments:<br />

Year 1-10: JPY 78 000<br />

80% of the mortgage is fixed until 26. March 2014 at 2,78% inc. Margin.<br />

All JPY figuers in 1000 JPY