ECO 301 TEST BANK FOR CHAPTER 4 Uncertainty

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

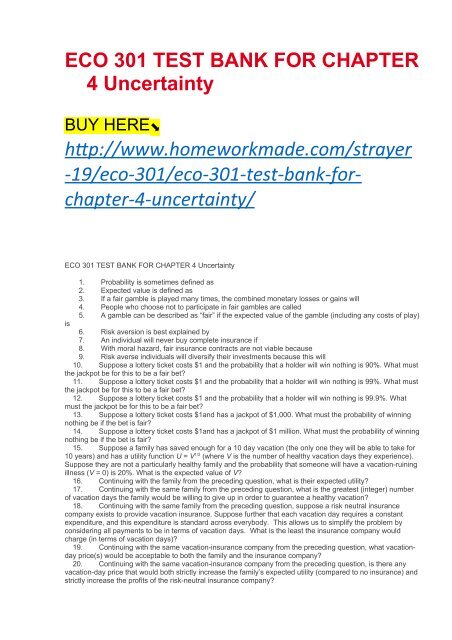

<strong>ECO</strong> <strong>301</strong> <strong>TEST</strong> <strong>BANK</strong> <strong>FOR</strong> <strong>CHAPTER</strong><br />

4 <strong>Uncertainty</strong><br />

BUY HERE⬊<br />

htp://www.homeworkmade.com/strayer<br />

-19/eco-<strong>301</strong>/eco-<strong>301</strong>-test-bank-forchapter-4-uncertainty/<br />

<strong>ECO</strong> <strong>301</strong> <strong>TEST</strong> <strong>BANK</strong> <strong>FOR</strong> <strong>CHAPTER</strong> 4 <strong>Uncertainty</strong><br />

1. Probability is sometimes defined as<br />

2. Expected value is defined as<br />

3. If a fair gamble is played many times, the combined monetary losses or gains will<br />

4. People who choose not to participate in fair gambles are called<br />

5. A gamble can be described as “fair” if the expected value of the gamble (including any costs of play)<br />

is<br />

6. Risk aversion is best explained by<br />

7. An individual will never buy complete insurance if<br />

8. With moral hazard, fair insurance contracts are not viable because<br />

9. Risk averse individuals will diversify their investments because this will<br />

10. Suppose a lottery ticket costs $1 and the probability that a holder will win nothing is 90%. What must<br />

the jackpot be for this to be a fair bet?<br />

11. Suppose a lottery ticket costs $1 and the probability that a holder will win nothing is 99%. What must<br />

the jackpot be for this to be a fair bet?<br />

12. Suppose a lottery ticket costs $1 and the probability that a holder will win nothing is 99.9%. What<br />

must the jackpot be for this to be a fair bet?<br />

13. Suppose a lottery ticket costs $1and has a jackpot of $1,000. What must the probability of winning<br />

nothing be if the bet is fair?<br />

14. Suppose a lottery ticket costs $1and has a jackpot of $1 million. What must the probability of winning<br />

nothing be if the bet is fair?<br />

15. Suppose a family has saved enough for a 10 day vacation (the only one they will be able to take for<br />

10 years) and has a utility function U = V 1/2 (where V is the number of healthy vacation days they experience).<br />

Suppose they are not a particularly healthy family and the probability that someone will have a vacation-ruining<br />

illness (V = 0) is 20%. What is the expected value of V?<br />

16. Continuing with the family from the preceding question, what is their expected utility?<br />

17. Continuing with the same family from the preceding question, what is the greatest (integer) number<br />

of vacation days the family would be willing to give up in order to guarantee a healthy vacation?<br />

18. Continuing with the same family from the preceding question, suppose a risk neutral insurance<br />

company exists to provide vacation insurance. Suppose further that each vacation day requires a constant<br />

expenditure, and this expenditure is standard across everybody. This allows us to simplify the problem by<br />

considering all payments to be in terms of vacation days. What is the least the insurance company would<br />

charge (in terms of vacation days)?<br />

19. Continuing with the same vacation-insurance company from the preceding question, what vacationday<br />

price(s) would be acceptable to both the family and the insurance company?<br />

20. Continuing with the same vacation-insurance company from the preceding question, is there any<br />

vacation-day price that would both strictly increase the family’s expected utility (compared to no insurance) and<br />

strictly increase the profits of the risk-neutral insurance company?

21. Suppose a family has saved enough for a 10 day vacation (the only one they will be able to take for<br />

10 years) and has a utility function U = V 1/2 (where V is the number of healthy vacation days they experience).<br />

Suppose they are not a particularly healthy family and the probability that someone will have a vacation ruining<br />

illness (V = 0) is 30%. What is the expected value of V?<br />

22. Continuing with the family from the preceding question, what is their expected utility?<br />

23. Continuing with the same family from the preceding question, what is the greatest (integer) number<br />

of vacation days the family would be willing to give up in order to guarantee a healthy vacation?<br />

24. Continuing with the same family from the preceding question, suppose a risk neutral insurance<br />

company exists to provide vacation insurance. Suppose further that each vacation day requires a constant<br />

expenditure, and this expenditure is standard across everybody. This allows us to simplify the problem by<br />

considering all payments to be in terms of vacation days. What is the least the insurance company would<br />

charge (in terms of vacation days)?<br />

25. Continuing with the same vacation-insurance company from the preceding question, what vacationday<br />

price(s) would be acceptable to both the family and the insurance company?<br />

26. Continuing with the same vacation-insurance company from the preceding question, is there any<br />

vacation-day price that would both strictly increase the family’s expected utility (compared to no insurance) and<br />

strictly increase the profits of the risk-neutral insurance company?<br />

27. Suppose a risk-neutral power plant needs 10,000 tons of coal for its operations next month. It is<br />

uncertain about the future price of coal. Today it sells for $60 a ton but next month it could be $50 or $70 (with<br />

equal probability). How much would the power plant be willing to pay today for an option to buy a ton of coal<br />

next month at today’s price? (Ignore discounting over the short period of a month.)<br />

28. Continuing with the power plant from the previous question, suppose instead the price of coal next<br />

month could be $54 or $66 (with equal probability). Now how much would it be willing to pay for an option to<br />

buy a ton of coal oil next month at today’s price?<br />

29. Continue with the power plant from the previous question, where again coal currently sells for $60 a<br />

ton but will sell for either $54 or $66 next month with equal probability. Now suppose coal can be stored for a<br />

month at the cost of $2 per ton. How would the new alternative of being able to buy coal at today’s prices and<br />

store it affect the amount the power plant would be willing to pay for an option to buy coal next month at today’s<br />

prices?