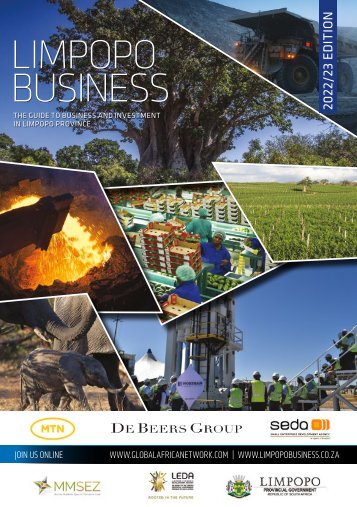

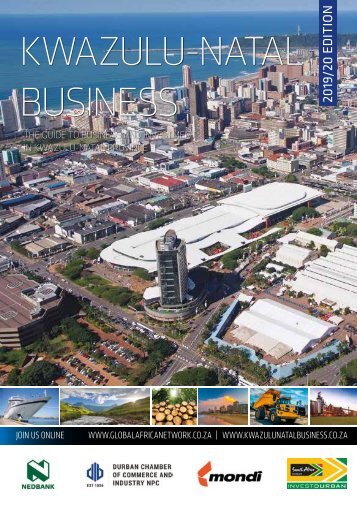

KwaZulu-Natal Business 2021-22

- Text

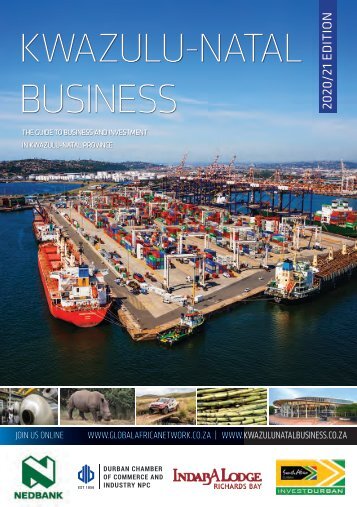

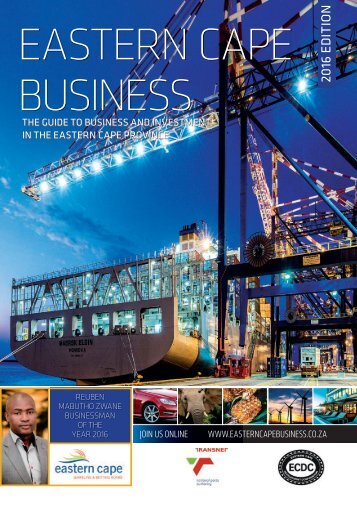

- Harbours

- Ports

- Africa

- Southafrica

- Kwazulunatal

- Business

- Investment

- Infrastructure

- Export

- Ilembe

- Industrial

- Province

- Provincial

- Economic

- Sector

- African

- Municipality

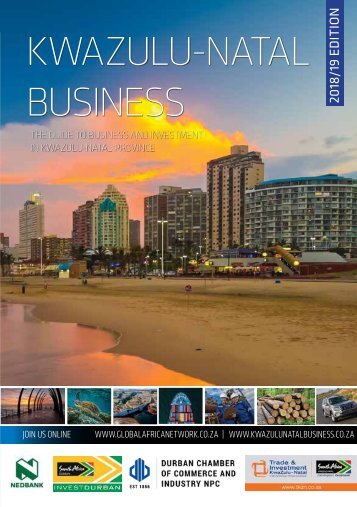

- Durban

OVERVIEW Banking and

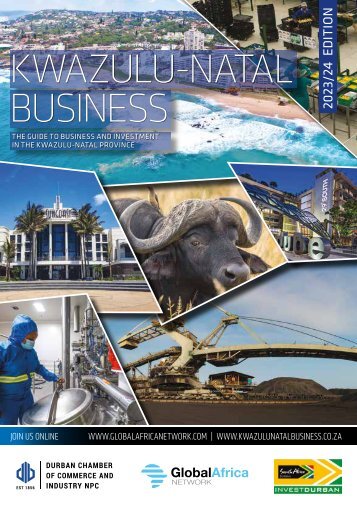

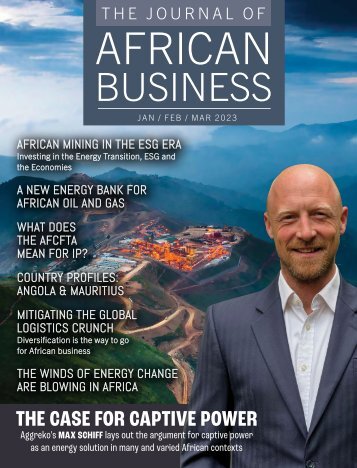

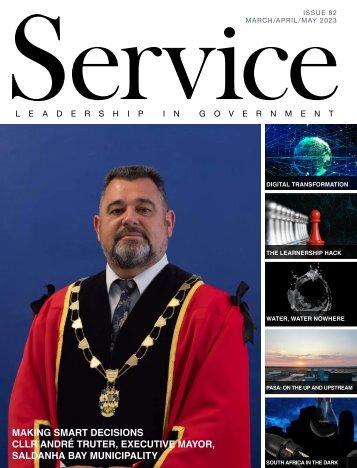

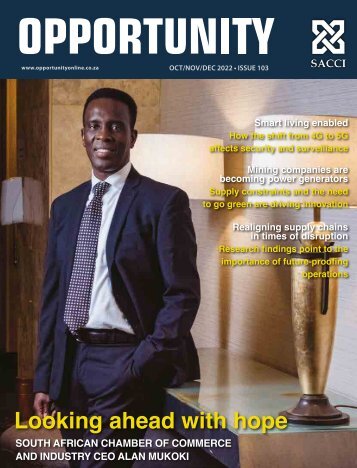

OVERVIEW Banking and financial services Choices for South African financial consumers are expanding. Aspen has taken a secondary listing on the A2X. Credit: Hodari Properties Aspen Pharmacare is a speciality pharmaceuticals company with a presence in more than 50 countries and nearly 9 000 employees. The company’s headquarters are in La Lucia Ridge north of Durban. Aspen’s production facilities are elsewhere, but the global headquarters offer a grand view of the Indian Ocean (and the roof of the headquarters of another giant South African company, Unilever South Africa) in an area popular with tax consultants and stock brokers. Aspen’s revenue in 2020 increased to R38.6-billion. Aspen’s decision to register a second listing on one of South Africa’s newest stock exchanges (the primary listing remains on the JSE) was a boost for A2X, which set out to attract secondary listings. Patrice Motsepe’s African Rainbow Capital is an investor in A2X. The announcement in December 2020 that Prosus was going to take a secondary listing on A2X raised the bourse’s total market capitalisation to nearly R5-trillion across 40 companies. Prosus, a consumer Internet group and technology investor, has a market cap of R2.7-trillion. Of the four new exchanges, Equity Express Securities Exchange (EESE) trades in Black Economic Empowerment (BEE) while ZARX and 4AX are targeting companies that are not listed elsewhere. ZARX has agricultural holding companies like TWK and Senwes among its first clients. SECTOR INSIGHT MyMo is Standard Bank’s newest low-cost bank account. Together with real estate and general business, the financial sector in KwaZulu- Natal accounts for 18% of gross domestic product (GDP). Big strides have been made in providing banking services to the previously unbanked but there is still a long way to go. The widespread use of smartphones is creating new opportunities for banks and other financial service providers to further close the gap. Standard Bank introduced the low-cost MyMo account in KwaZulu-Natal in 2020. With free electronic transactions, unlimited card swipes and a low KWAZULU-NATAL BUSINESS 2021/22 46

OVERVIEW monthly fee, the MyMo account is ideal for low-income earners, microentrepreneurs and the poor. Customers do not have to visit branches to sign up for the account. They can take a selfie on the mobile app. Says Imraan Noorbhai, Provincial Head of Standard Bank KZN, “Given South Africa’s history and current economy, financial inclusion is extremely important for us, and with the MyMo account, we want our customers to thrive financially.” Shariah-compliant banking is provided by alBaraka Bank which has its headquarters at Kingsmead in Durban, which is also the site of its corporate-banking division. In 2020 the bank announced plans for a comprehensive Shariah-compliant banking app, enabling clients to do transactions via mobile devices. Other technological updates are being explored to allow customers to open bank accounts from the comfort of their own homes. HBZ Bank, a wholly-owned subsidiary of Habib Bank and AG Zurich, has branches in Westville, Durban and Pietermaritzburg. In 2017 Tyme Digital received a licence to run a bank. By early 2019, TymeBank was available in 500 Pick n Pay and Boxer stores and more than 50 000 customers had an account. Tyme stands for Take Your Money Everywhere; the bank does not have a branch network. African Rainbow Capital began as the venture’s BEE partner but in 2018 bought out the Commonwealth Bank of Australia. Tyme reported in October 2020 that it had 2.4-million customers, up from 1.4-million at the end of March. A 400% increase in the use of services such as airtime and electricity purchases was also noted. Second to market among the country’s new banks was Discovery Bank, which officially launched in 2019 and is experiencing rapid growth with retail deposits at the end of 2020 of R5.7-billion. Discovery Bank is applying the behavioural model it uses in its health business to reward good financial behaviour. The Discovery group is already a giant on the JSE with a market value of R83-billion and access to millions of customers. Development loans The Brics New Development Bank has made a 0-million loan for the expansion of the container terminal in Durban. The busy port is currently stretched beyond capacity and waiting time for trucks can be extremely long. Activist groups in Durban’s southern suburbs are opposing the loan and the expansion, saying that further development will increase pollution in the area and lead to even more dangerous traffic congestion. Up the coast at Richards Bay, the World Bank’s International Finance Corporation (IFC) has committed -million to a feasibility study on the construction of a liquefied natural gas (LNG) storage and regasification terminal. The study’s costs are shared with Transnet and a private investor will be sought if the feasibility study is positive. The Chartered Institute of Government Finance, Audit and Risk Officers (Cigfaro) advises institutions, trains its members in public finance and promotes the interests of professionals in the public sector. It also develops and assesses qualifications and advises tertiary institutions on the requirements for courses. The South African Institute for Chartered Accountants International provides training in financial reporting standards for SMMEs while the Insurance Institute of KwaZulu-Natal (IISA) holds regular education workshops. The institute’s mentorship programme is run in association with the Musifunde Training Centre. ■ ONLINE RESOURCES Association for Savings and Investment South Africa: www.asisa.org.za Financial Sector Conduct Authority: www.fsca.co.za Insurance Institute of South Africa (KwaZulu-Natal): www.iikzn.co.za South African Institute for Chartered Accountants: www.saica.co.za 47 KWAZULU-NATAL BUSINESS 2021/22

- Page 1 and 2: ole in the automotive sector while

- Page 3 and 4: 0 0 11 1 0 1 0 11 0 0 11 1 0 1 0 11

- Page 5 and 6: WHO WE ARE Policy and advocacy are

- Page 7 and 8: Inspiring hope and enabling dreams

- Page 9 and 10: EBH South Africa Trusted ship repai

- Page 11 and 12: SMME VIRTUAL ROADSHOW PRACTICAL AND

- Page 13 and 14: SPECIAL FEATURE A wetland conservat

- Page 15 and 16: SPECIAL FEATURE Geography The mixed

- Page 17 and 18: tourist enterprises. The Lubombo Mo

- Page 19 and 20: Key sectors Our Business Clients se

- Page 21 and 22: SPECIAL FEATURE Donald Trump’s in

- Page 23 and 24: SPECIAL FEATURE year and made up a

- Page 25: FOCUS Sugarcane fields sector depar

- Page 28 and 29: OVERVIEW Agriculture A Value Chain

- Page 30 and 31: Producing crops that feed our count

- Page 32 and 33: OVERVIEW Forestry and paper A beeke

- Page 34 and 35: OVERVIEW Engineering A respected un

- Page 36 and 37: FOCUS Gas discoveries are a boost t

- Page 38 and 39: OVERVIEW Construction and property

- Page 40 and 41: OVERVIEW Manufacturing Cellphones a

- Page 42 and 43: OVERVIEW Education and training An

- Page 44 and 45: REALISING DREAMS THROUGH QUALITY ED

- Page 46 and 47: OVERVIEW Water Waste-water works ar

- Page 50 and 51: OVERVIEW Development finance and SM

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...