FIN 515 Week 5 Problem Set

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

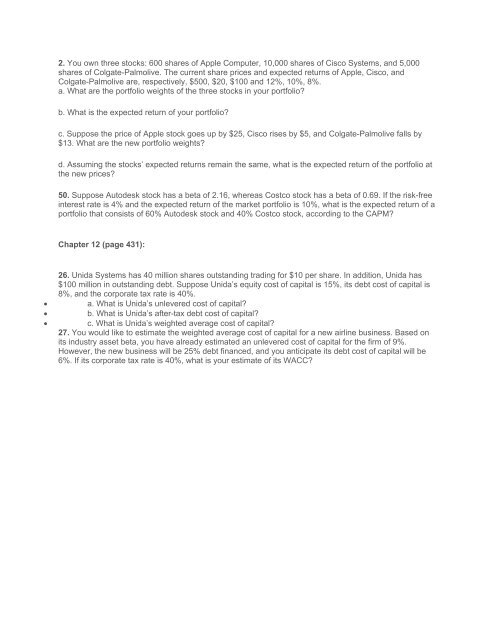

2. You own three stocks: 600 shares of Apple Computer, 10,000 shares of Cisco Systems, and 5,000<br />

shares of Colgate-Palmolive. The current share prices and expected returns of Apple, Cisco, and<br />

Colgate-Palmolive are, respectively, $500, $20, $100 and 12%, 10%, 8%.<br />

a. What are the portfolio weights of the three stocks in your portfolio?<br />

b. What is the expected return of your portfolio?<br />

c. Suppose the price of Apple stock goes up by $25, Cisco rises by $5, and Colgate-Palmolive falls by<br />

$13. What are the new portfolio weights?<br />

d. Assuming the stocks’ expected returns remain the same, what is the expected return of the portfolio at<br />

the new prices?<br />

50. Suppose Autodesk stock has a beta of 2.16, whereas Costco stock has a beta of 0.69. If the risk-free<br />

interest rate is 4% and the expected return of the market portfolio is 10%, what is the expected return of a<br />

portfolio that consists of 60% Autodesk stock and 40% Costco stock, according to the CAPM?<br />

Chapter 12 (page 431):<br />

<br />

<br />

<br />

26. Unida Systems has 40 million shares outstanding trading for $10 per share. In addition, Unida has<br />

$100 million in outstanding debt. Suppose Unida’s equity cost of capital is 15%, its debt cost of capital is<br />

8%, and the corporate tax rate is 40%.<br />

a. What is Unida’s unlevered cost of capital?<br />

b. What is Unida’s after-tax debt cost of capital?<br />

c. What is Unida’s weighted average cost of capital?<br />

27. You would like to estimate the weighted average cost of capital for a new airline business. Based on<br />

its industry asset beta, you have already estimated an unlevered cost of capital for the firm of 9%.<br />

However, the new business will be 25% debt financed, and you anticipate its debt cost of capital will be<br />

6%. If its corporate tax rate is 40%, what is your estimate of its WACC?