GST Suvidha Kendra Business Proposal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

G S T S U V I D H A K E N D R A & W E A L T H<br />

<strong>GST</strong> <strong>Suvidha</strong> <strong>Kendra</strong> is a source of ongoing recurring income. You need to divide<br />

your services in 3 parts :<br />

<strong>GST</strong> & Other Tax Related Services<br />

Utility - Recharges, Insurance, PAN, Bill Payments, Bus, Train, Flight, Hotel etc.<br />

Money Transfer - ATM and Direct Money Transfer.<br />

Since, <strong>GST</strong> Services have monthly income facility because <strong>GST</strong> Returns needs to<br />

be filed on monthly basis , you can earn monthly income from <strong>GST</strong>.<br />

Rest of the services like Utility and Money Transfer are needed to have Crowd in<br />

your shop to do indirect marketing of your <strong>GST</strong> Services. You can also think of Utility<br />

is helpful to overcome the initial investment & ongoing cost.<br />

Let's say if you make 300 <strong>GST</strong> Registrtions in one year , it means if the clients are<br />

going to file returns with you , you can earn 200 Rs from each client and it makes<br />

60,000 Rs monthly recurring income.<br />

Let's take another example of AEPS ( Aadhaar Enabled Payment System ) & Money<br />

transfer. If you are able to rotate 2,00,000 Rs with AEPS and DMT, you can earn 1%<br />

of it on daily basis which is 2000 Rs per day. It makes 60,000 Rs per month as well.<br />

In short, if you put your efforts in right direction, you can earn from 25000 to 100,000<br />

Rs per month if your location and efforts are enough.<br />

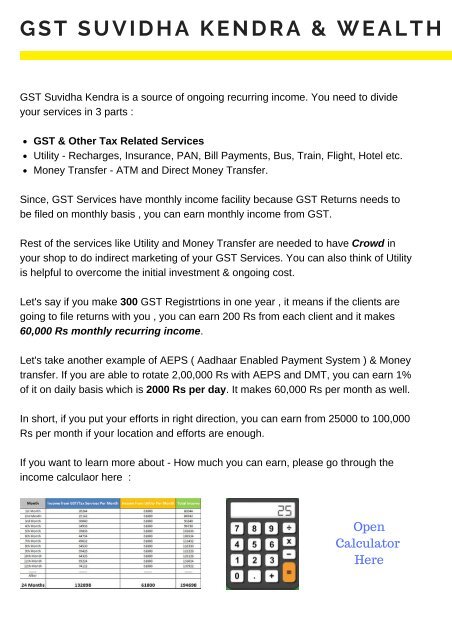

If you want to learn more about - How much you can earn, please go through the<br />

income calculaor here :<br />

Open<br />

Calculator<br />

Here