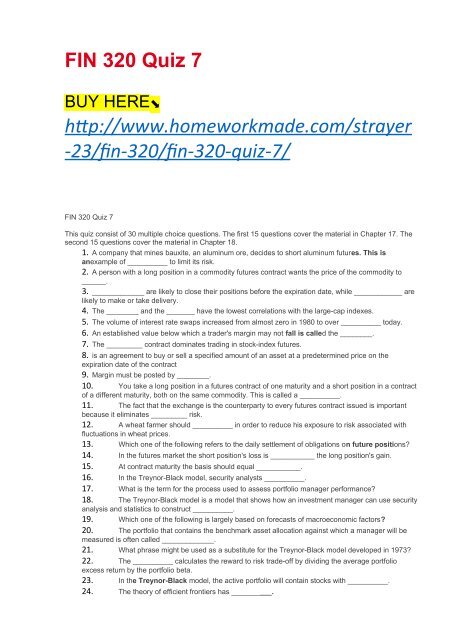

FIN 320 Quiz 7

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>FIN</strong> <strong>320</strong> <strong>Quiz</strong> 7<br />

BUY HERE⬊<br />

htp://www.homeworkmade.com/strayer<br />

-23/fn-<strong>320</strong>/fn-<strong>320</strong>-quiz-7/<br />

<strong>FIN</strong> <strong>320</strong> <strong>Quiz</strong> 7<br />

This quiz consist of 30 multiple choice questions. The first 15 questions cover the material in Chapter 17. The<br />

second 15 questions cover the material in Chapter 18.<br />

1. A company that mines bauxite, an aluminum ore, decides to short aluminum futures. This is<br />

anexample of __________ to limit its risk.<br />

2. A person with a long position in a commodity futures contract wants the price of the commodity to<br />

______.<br />

3. _____________ are likely to close their positions before the expiration date, while ____________ are<br />

likely to make or take delivery.<br />

4. The ________ and the _______ have the lowest correlations with the large-cap indexes.<br />

5. The volume of interest rate swaps increased from almost zero in 1980 to over __________ today.<br />

6. An established value below which a trader's margin may not fall is called the ________.<br />

7. The _________ contract dominates trading in stock-index futures.<br />

8. is an agreement to buy or sell a specified amount of an asset at a predetermined price on the<br />

expiration date of the contract<br />

9. Margin must be posted by ________.<br />

10. You take a long position in a futures contract of one maturity and a short position in a contract<br />

of a different maturity, both on the same commodity. This is called a __________.<br />

11. The fact that the exchange is the counterparty to every futures contract issued is important<br />

because it eliminates _________ risk.<br />

12. A wheat farmer should __________ in order to reduce his exposure to risk associated with<br />

fluctuations in wheat prices.<br />

13. Which one of the following refers to the daily settlement of obligations on future positions?<br />

14. In the futures market the short position's loss is ___________ the long position's gain.<br />

15. At contract maturity the basis should equal ___________.<br />

16. In the Treynor-Black model, security analysts __________.<br />

17. What is the term for the process used to assess portfolio manager performance?<br />

18. The Treynor-Black model is a model that shows how an investment manager can use security<br />

analysis and statistics to construct __________.<br />

19. Which one of the following is largely based on forecasts of macroeconomic factors?<br />

20. The portfolio that contains the benchmark asset allocation against which a manager will be<br />

measured is often called _____________.<br />

21. What phrase might be used as a substitute for the Treynor-Black model developed in 1973?<br />

22. The __________ calculates the reward to risk trade-off by dividing the average portfolio<br />

excess return by the portfolio beta.<br />

23. In the Treynor-Black model, the active portfolio will contain stocks with __________.<br />

24. The theory of efficient frontiers has __________.

25. Perfect-timing ability is equivalent to having __________ on the market portfolio.<br />

26. Which one of the following averaging methods is the preferred method of constructing returns<br />

series for use in evaluating portfolio performance?<br />

27. The comparison universe is __________.<br />

28. Which one of the following performance measures is the Sharpe ratio?<br />

29. The M2 measure of portfolio performance was developed by ______________.<br />

30. Empirical tests to date show ______________.