Takaful Wanita - MAA

Takaful Wanita - MAA

Takaful Wanita - MAA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

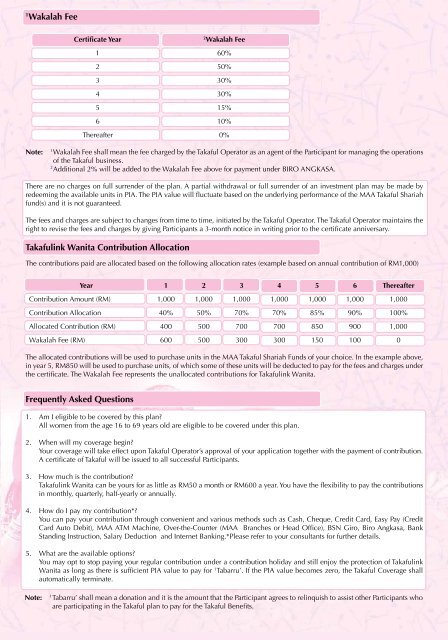

Wakalah Fee<br />

Certificate Year<br />

2<br />

Wakalah Fee<br />

1 60%<br />

2 50%<br />

3 30%<br />

4 30%<br />

5 15%<br />

6 10%<br />

Thereafter 0%<br />

Note:<br />

1<br />

Wakalah Fee shall mean the fee charged by the <strong>Takaful</strong> Operator as an agent of the Participant for managing the operations<br />

of the <strong>Takaful</strong> business.<br />

2<br />

Additional 2% will be added to the Wakalah Fee above for payment under BIRO ANGKASA.<br />

There are no charges on full surrender of the plan. A partial withdrawal or full surrender of an investment plan may be made by<br />

redeeming the available units in PIA. The PIA value will fluctuate based on the underlying performance of the <strong>MAA</strong> <strong>Takaful</strong> Shariah<br />

fund(s) and it is not guaranteed.<br />

The fees and charges are subject to changes from time to time, initiated by the <strong>Takaful</strong> Operator. The <strong>Takaful</strong> Operator maintains the<br />

right to revise the fees and charges by giving Participants a 3-month notice in writing prior to the certificate anniversary.<br />

<strong>Takaful</strong>ink <strong>Wanita</strong> Contribution Allocation<br />

The contributions paid are allocated based on the following allocation rates (example based on annual contribution of RM1,000)<br />

Year 1 2 3 4 5 6 Thereafter<br />

Contribution Amount (RM) 1,000 1,000 1,000 1,000 1,000 1,000 1,000<br />

Contribution Allocation 40% 50% 70% 70% 85% 90% 100%<br />

Allocated Contribution (RM) 400 500 700 700 850 900 1,000<br />

Wakalah Fee (RM) 600 500 300 300 150 100 0<br />

The allocated contributions will be used to purchase units in the <strong>MAA</strong> <strong>Takaful</strong> Shariah Funds of your choice. In the example above,<br />

in year 5, RM850 will be used to purchase units, of which some of these units will be deducted to pay for the fees and charges under<br />

the certificate. The Wakalah Fee represents the unallocated contributions for <strong>Takaful</strong>ink <strong>Wanita</strong>.<br />

Frequently Asked Questions<br />

1. Am I eligible to be covered by this plan?<br />

All women from the age 16 to 69 years old are eligible to be covered under this plan.<br />

2. When will my coverage begin?<br />

Your coverage will take effect upon <strong>Takaful</strong> Operator’s approval of your application together with the payment of contribution.<br />

A certificate of <strong>Takaful</strong> will be issued to all successful Participants.<br />

3. How much is the contribution?<br />

<strong>Takaful</strong>ink <strong>Wanita</strong> can be yours for as little as RM50 a month or RM600 a year. You have the flexibility to pay the contributions<br />

in monthly, quarterly, half-yearly or annually.<br />

4. How do I pay my contribution*?<br />

You can pay your contribution through convenient and various methods such as Cash, Cheque, Credit Card, Easy Pay (Credit<br />

Card Auto Debit), <strong>MAA</strong> ATM Machine, Over-the-Counter (<strong>MAA</strong> Branches or Head Office), BSN Giro, Biro Angkasa, Bank<br />

Standing Instruction, Salary Deduction and Internet Banking.*Please refer to your consultants for further details.<br />

5. What are the available options?<br />

You may opt to stop paying your regular contribution under a contribution holiday and still enjoy the protection of <strong>Takaful</strong>ink<br />

<strong>Wanita</strong> as long as there is sufficient PIA value to pay for 1 Tabarru’. If the PIA value becomes zero, the <strong>Takaful</strong> Coverage shall<br />

automatically terminate.<br />

Note:<br />

1<br />

Tabarru’ shall mean a donation and it is the amount that the Participant agrees to relinquish to assist other Participants who<br />

are participating in the <strong>Takaful</strong> plan to pay for the <strong>Takaful</strong> Benefits.