TAKAFULIFE SERIES LATEST - MAA

TAKAFULIFE SERIES LATEST - MAA

TAKAFULIFE SERIES LATEST - MAA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

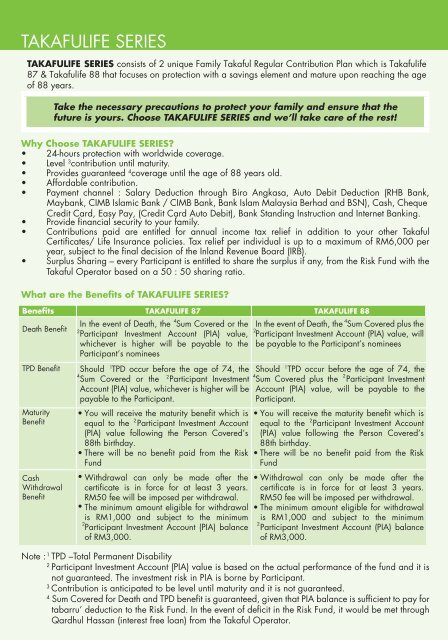

<strong>TAKAFULIFE</strong> <strong>SERIES</strong><br />

<strong>TAKAFULIFE</strong> <strong>SERIES</strong> consists of 2 unique Family Takaful Regular Contribution Plan which is Takafulife<br />

87 & Takafulife 88 that focuses on protection with a savings element and mature upon reaching the age<br />

of 88 years.<br />

Take the necessary precautions to protect your family and ensure that the<br />

future is yours. Choose <strong>TAKAFULIFE</strong> <strong>SERIES</strong> and we’ll take care of the rest!<br />

Why Choose <strong>TAKAFULIFE</strong> <strong>SERIES</strong>?<br />

• 24-hours protection with worldwide coverage.<br />

• Level 3 contribution until maturity.<br />

• Provides guaranteed 4 coverage until the age of 88 years old.<br />

• Affordable contribution.<br />

• Payment channel : Salary Deduction through Biro Angkasa, Auto Debit Deduction (RHB Bank,<br />

Maybank, CIMB Islamic Bank / CIMB Bank, Bank Islam Malaysia Berhad and BSN), Cash, Cheque<br />

Credit Card, Easy Pay, (Credit Card Auto Debit), Bank Standing Instruction and Internet Banking.<br />

• Provide security to your family.<br />

• Contributions paid are entitled for annual income tax relief in addition to your other Takaful<br />

Life Insurance policies. Tax relief per individual is up to a maximum of RM6,000 per<br />

year, subject to the decision of the Inland Revenue Board (IRB).<br />

• Surplus Sharing – every Participant is entitled to share the surplus if any, from the Risk Fund with the<br />

Takaful Operator based on a 50 : 50 sharing ratio.<br />

What are the Benefits of <strong>TAKAFULIFE</strong> <strong>SERIES</strong>?<br />

Benefits <strong>TAKAFULIFE</strong> 87<br />

<strong>TAKAFULIFE</strong> 88<br />

Death Benefit<br />

TPD Benefit<br />

Maturity<br />

Benefit<br />

Cash<br />

Withdrawal<br />

Benefit<br />

4 4<br />

In the event of Death, the Sum Covered or the In the event of Death, the Sum Covered plus the<br />

2<br />

2<br />

Participant Investment Account (PIA) value, Participant Investment Account (PIA) value, will<br />

whichever is higher will be payable to the be payable to the Participant’s nominees<br />

Participant’s nominees<br />

1<br />

1<br />

Should TPD occur before the age of 74, the Should TPD occur before the age of 74, the<br />

4 2<br />

4 2<br />

Sum Covered or the Participant Investment Sum Covered plus the Participant Investment<br />

Account (PIA) value, whichever is higher will be Account (PIA) value, will be payable to the<br />

payable to the Participant.<br />

Participant.<br />

• You will receive the maturity benefit which is<br />

2<br />

equal to the Participant Investment Account<br />

(PIA) value following the Person Covered’s<br />

88th birthday.<br />

• There will be no benefit paid from the Risk<br />

Fund<br />

• Withdrawal can only be made after the<br />

certificate is in force for at least 3 years.<br />

RM50 fee will be imposed per withdrawal.<br />

• The minimum amount eligible for withdrawal<br />

is RM1,000 and subject to the minimum<br />

2<br />

Participant Investment Account (PIA) balance<br />

of RM3,000.<br />

• You will receive the maturity benefit which is<br />

2<br />

equal to the Participant Investment Account<br />

(PIA) value following the Person Covered’s<br />

88th birthday.<br />

• There will be no benefit paid from the Risk<br />

Fund<br />

• Withdrawal can only be made after the<br />

certificate is in force for at least 3 years.<br />

RM50 fee will be imposed per withdrawal.<br />

• The minimum amount eligible for withdrawal<br />

is RM1,000 and subject to the minimum<br />

2<br />

Participant Investment Account (PIA) balance<br />

of RM3,000.<br />

Note : 1 TPD –Total Permanent Disability<br />

2<br />

Participant Investment Account (PIA) value is based on the actual performance of the fund and it is<br />

not guaranteed. The investment risk in PIA is borne by Participant.<br />

3<br />

Contribution is anticipated to be level until maturity and it is not guaranteed.<br />

4<br />

Sum Covered for Death and TPD is guaranteed, given that PIA balance is to pay for<br />

tabarru’ deduction to the Risk Fund. In the event of in the Risk Fund, it would be met through<br />

Qardhul Hassan (interest free loan) from the Takaful Operator.