Berlin Office Market Profile - Q2 2012 - Jones Lang LaSalle

Berlin Office Market Profile - Q2 2012 - Jones Lang LaSalle

Berlin Office Market Profile - Q2 2012 - Jones Lang LaSalle

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

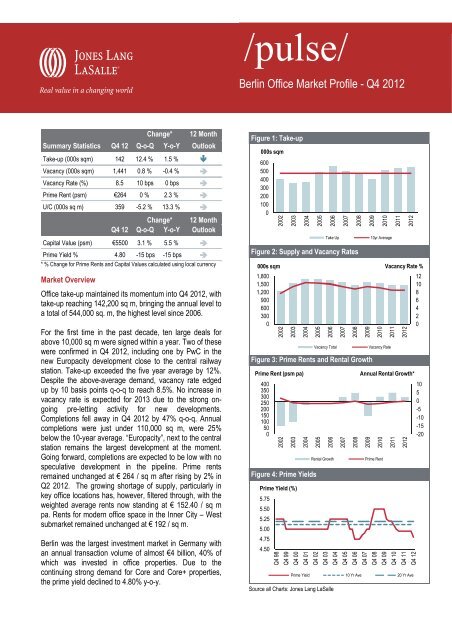

Change* 12 Month<br />

Summary Statistics Q4 12 Q-o-Q Y-o-Y Outlook<br />

Take-up (000s sqm) 142 12.4 % 1.5 % <br />

Vacancy (000s sqm) 1,441 0.8 % -0.4 % <br />

Vacancy Rate (%) 8.5 10 bps 0 bps <br />

Prime Rent (psm) €264 0 % 2.3 % <br />

U/C (000s sq m) 359 -5.2 % 13.3 % <br />

Change*<br />

12 Month<br />

Q4 12 Q-o-Q Y-o-Y Outlook<br />

Capital Value (psm) €5500 3.1 % 5.5 % <br />

Prime Yield % 4.80 -15 bps -15 bps <br />

* % Change for Prime Rents and Capital Values calculated using local currency<br />

<strong>Market</strong> Overview<br />

<strong>Office</strong> take-up maintained its momentum into Q4 <strong>2012</strong>, with<br />

take-up reaching 142,200 sq m, bringing the annual level to<br />

a total of 544,000 sq. m, the highest level since 2006.<br />

For the first time in the past decade, ten large deals for<br />

above 10,000 sq m were signed within a year. Two of these<br />

were confirmed in Q4 <strong>2012</strong>, including one by PwC in the<br />

new Europacity development close to the central railway<br />

station. Take-up exceeded the five year average by 12%.<br />

Despite the above-average demand, vacancy rate edged<br />

up by 10 basis points q-o-q to reach 8.5%. No increase in<br />

vacancy rate is expected for 2013 due to the strong ongoing<br />

pre-letting activity for new developments.<br />

Completions fell away in Q4 <strong>2012</strong> by 47% q-o-q. Annual<br />

completions were just under 110,000 sq m, were 25%<br />

below the 10-year average. “Europacity”, next to the central<br />

station remains the largest development at the moment.<br />

Going forward, completions are expected to be low with no<br />

speculative development in the pipeline. Prime rents<br />

remained unchanged at € 264 / sq m after rising by 2% in<br />

<strong>Q2</strong> <strong>2012</strong>. The growing shortage of supply, particularly in<br />

key office locations has, however, filtered through, with the<br />

weighted average rents now standing at € 152.40 / sq m<br />

pa. Rents for modern office space in the Inner City – West<br />

submarket remained unchanged at € 192 / sq m.<br />

<strong>Berlin</strong> was the largest investment market in Germany with<br />

an annual transaction volume of almost €4 billion, 40% of<br />

which was invested in office properties. Due to the<br />

continuing strong demand for Core and Core+ properties,<br />

the prime yield declined to 4.80% y-o-y.<br />

<strong>Berlin</strong> <strong>Office</strong> <strong>Market</strong> <strong>Profile</strong> - Q4 <strong>2012</strong><br />

Figure 1: Take-up<br />

000s sqm<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

Figure 2: Supply and Vacancy Rates<br />

000s sqm<br />

1,800<br />

1,500<br />

1,200<br />

900<br />

600<br />

300<br />

0<br />

2002<br />

2003<br />

2004<br />

2005<br />

2008<br />

2009<br />

2010<br />

Take Up 10yr Average<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

Vacancy Total Vacancy Rate<br />

Figure 3: Prime Rents and Rental Growth<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

Rental Growth Prime Rent<br />

2011<br />

<strong>2012</strong><br />

Vacancy Rate %<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

2011<br />

2011<br />

<strong>2012</strong><br />

Prime Rent (psm pa) Annual Rental Growth*<br />

Figure 4: Prime Yields<br />

Prime Yield (%)<br />

5.75<br />

5.50<br />

5.25<br />

5.00<br />

4.75<br />

4.50<br />

<strong>2012</strong><br />

Q4 98<br />

Q4 99<br />

Q4 00<br />

Q4 01<br />

Q4 02<br />

Q4 03<br />

Q4 04<br />

Q4 05<br />

Q4 06<br />

Q4 07<br />

Q4 08<br />

Q4 09<br />

Q4 10<br />

Q4 11<br />

Q4 12<br />

Prime Yield 10 Yr Ave 20 Yr Ave<br />

Source all Charts: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20

<strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong> Contacts<br />

Ruediger Thraene<br />

Team Leader <strong>Office</strong> Leasing<br />

<strong>Berlin</strong><br />

+49 30 20 39 80 311<br />

ruediger.thraene@eu.jll.com<br />

<strong>Berlin</strong> <strong>Office</strong> <strong>Market</strong> <strong>Profile</strong> – Q4 <strong>2012</strong><br />

Pulse reports from <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong> are frequent updates on real estate market dynamics.<br />

www.joneslanglasalle.eu<br />

Ferdinand Rock<br />

Head of <strong>Office</strong> Leasing, Germany<br />

Munich<br />

+49 (0) 89 290088 40<br />

ferdinand.rock@eu.jll.com<br />

Helge Scheunemann<br />

Head of Research, Germany<br />

Hamburg<br />

+49 (0) 40 350011 225<br />

helge.scheunemann@eu.jll.com<br />

COPYRIGHT © JONES LANG LASALLE IP, INC. 2013. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without prior written consent of<br />

<strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong>. It is based on material that we believe to be reliable. Whilst every effort has been made to ensure its accuracy, we cannot offer any warranty that it contains no factual errors. We<br />

would like to be told of any such errors in order to correct them.