Regnskaps rapporter - Danske Invest

Regnskaps rapporter - Danske Invest

Regnskaps rapporter - Danske Invest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

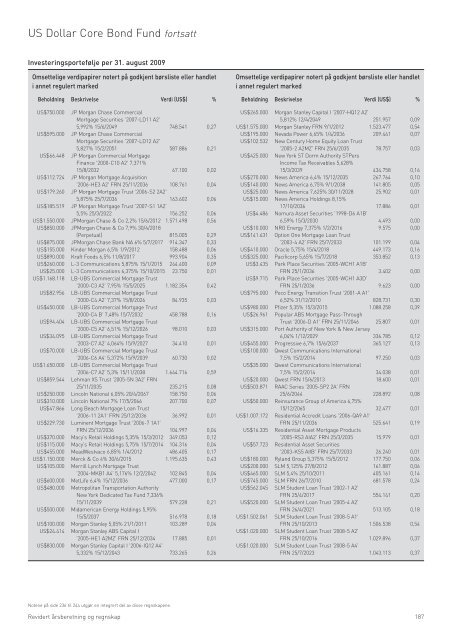

US Dollar Core Bond Fund fortsatt<br />

<strong>Invest</strong>eringsportefølje per 31. august 2009<br />

Omsettelige verdipapirer notert på godkjent børsliste eller handlet<br />

i annet regulert marked<br />

Beholdning Beskrivelse Verdi (US$) %<br />

US$750.000 JP Morgan Chase Commercial<br />

Mortgage Securities '2007-LD11 A2'<br />

5,992% 15/6/2049 748.541 0,27<br />

US$595.000 JP Morgan Chase Commercial<br />

Mortgage Securities '2007-LD12 A2'<br />

5,827% 15/2/2051 587.886 0,21<br />

US$66.448 JP Morgan Commercial Mortgage<br />

Finance '2000-C10 A2' 7,371%<br />

15/8/2032 67.100 0,02<br />

US$112.724 JP Morgan Mortgage Acquisition<br />

'2006-HE3 A2' FRN 25/11/2036 108.761 0,04<br />

US$179.260 JP Morgan Mortgage Trust '2006-S2 2A2'<br />

5,875% 25/7/2036 163.602 0,06<br />

US$185.519 JP Morgan Mortgage Trust '2007-S1 1A2'<br />

5,5% 25/3/2022 156.252 0,06<br />

US$1.550.000 JPMorgan Chase & Co 2,2% 15/6/2012 1.571.498 0,56<br />

US$850.000 JPMorgan Chase & Co 7,9% 30/4/2018<br />

(Perpetual) 815.005 0,29<br />

US$875.000 JPMorgan Chase Bank NA 6% 5/7/2017 914.347 0,33<br />

US$155.000 Kinder Morgan 6,5% 1/9/2012 158.488 0,06<br />

US$890.000 Kraft Foods 6,5% 11/8/2017 993.904 0,35<br />

US$260.000 L-3 Communications 5,875% 15/1/2015 244.400 0,09<br />

US$25.000 L-3 Communications 6,375% 15/10/2015 23.750 0,01<br />

US$1.168.118 LB-UBS Commercial Mortgage Trust<br />

'2000-C3 A2' 7,95% 15/5/2025 1.182.354 0,42<br />

US$82.956 LB-UBS Commercial Mortgage Trust<br />

'2000-C4 A2' 7,37% 15/8/2026 84.935 0,03<br />

US$450.000 LB-UBS Commercial Mortgage Trust<br />

'2000-C4 B' 7,48% 15/7/2032 458.788 0,16<br />

US$94.404 LB-UBS Commercial Mortgage Trust<br />

'2000-C5 A2' 6,51% 15/12/2026 98.010 0,03<br />

US$34.095 LB-UBS Commercial Mortgage Trust<br />

'2003-C7 A2' 4,064% 15/9/2027 34.410 0,01<br />

US$70.000 LB-UBS Commercial Mortgage Trust<br />

'2006-C6 A4' 5,372% 15/9/2039 60.730 0,02<br />

US$1.650.000 LB-UBS Commercial Mortgage Trust<br />

'2006-C7 A2' 5,3% 15/11/2038 1.644.716 0,59<br />

US$859.544 Lehman XS Trust '2005-5N 3A2' FRN<br />

25/11/2035 235.215 0,08<br />

US$250.000 Lincoln National 6,05% 20/4/2067 158.750 0,06<br />

US$310.000 Lincoln National 7% 17/5/2066 207.700 0,07<br />

US$47.866 Long Beach Mortgage Loan Trust<br />

'2006-11 2A1' FRN 25/12/2036 36.992 0,01<br />

US$229.730 Luminent Mortgage Trust '2006-7 1A1'<br />

FRN 25/12/2036 104.997 0,04<br />

US$370.000 Macy's Retail Holdings 5,35% 15/3/2012 349.053 0,12<br />

US$115.000 Macy's Retail Holdings 5,75% 15/7/2014 104.316 0,04<br />

US$455.000 MeadWestvaco 6,85% 1/4/2012 486.405 0,17<br />

US$1.150.000 Merck & Co 4% 30/6/2015 1.195.635 0,43<br />

US$105.000 Merrill Lynch Mortgage Trust<br />

'2004-MKB1 A4' 5,176% 12/2/2042 102.845 0,04<br />

US$600.000 MetLife 6,4% 15/12/2036 477.000 0,17<br />

US$480.000 Metropolitan Transportation Authority<br />

New York Dedicated Tax Fund 7,336%<br />

15/11/2039 579.228 0,21<br />

US$500.000 Midamerican Energy Holdings 5,95%<br />

15/5/2037 516.978 0,18<br />

US$100.000 Morgan Stanley 5,05% 21/1/2011 103.289 0,04<br />

US$24.414 Morgan Stanley ABS Capital I<br />

'2005-HE1 A2MZ' FRN 25/12/2034 17.885 0,01<br />

US$830.000 Morgan Stanley Capital I '2006-IQ12 A4'<br />

5,332% 15/12/2043 733.265 0,26<br />

Notene på side 236 til 244 utgjør en integrert del av disse regnskapene.<br />

Omsettelige verdipapirer notert på godkjent børsliste eller handlet<br />

i annet regulert marked<br />

Beholdning Beskrivelse Verdi (US$) %<br />

US$265.000 Morgan Stanley Capital I '2007-HQ12 A2'<br />

5,812% 12/4/2049 251.957 0,09<br />

US$1.575.000 Morgan Stanley FRN 9/1/2012 1.523.477 0,54<br />

US$195.000 Nevada Power 6,65% 1/4/2036 209.441 0,07<br />

US$102.532 New Century Home Equity Loan Trust<br />

'2005-2 A2MZ' FRN 25/6/2035 78.757 0,03<br />

US$425.000 New York ST Dorm Authority STPers<br />

Income Tax Receivables 5,628%<br />

15/3/2039 434.758 0,16<br />

US$270.000 News America 6,4% 15/12/2035 267.764 0,10<br />

US$140.000 News America 6,75% 9/1/2038 141.805 0,05<br />

US$25.000 News America 7,625% 30/11/2028 25.902 0,01<br />

US$15.000 News America Holdings 8,15%<br />

17/10/2036 17.886 0,01<br />

US$4.486 Nomura Asset Securities '1998-D6 A1B'<br />

6,59% 15/3/2030 4.493 0,00<br />

US$10.000 NRG Energy 7,375% 1/2/2016 9.575 0,00<br />

US$141.631 Option One Mortgage Loan Trust<br />

'2003-4 A2' FRN 25/7/2033 101.199 0,04<br />

US$410.000 Oracle 5,75% 15/4/2018 449.173 0,16<br />

US$325.000 Pacificorp 5,65% 15/7/2018 353.852 0,13<br />

US$3.435 Park Place Securities '2005-WCH1 A1B'<br />

FRN 25/1/2036 3.402 0,00<br />

US$9.715 Park Place Securities '2005-WCH1 A3D'<br />

FRN 25/1/2036 9.623 0,00<br />

US$795.000 Peco Energy Transition Trust '2001-A A1'<br />

6,52% 31/12/2010 828.731 0,30<br />

US$980.000 Pfizer 5,35% 15/3/2015 1.088.258 0,39<br />

US$26.961 Popular ABS Mortgage Pass-Through<br />

Trust '2006-D A1' FRN 25/11/2046 25.807 0,01<br />

US$315.000 Port Authority of New York & New Jersey<br />

6,04% 1/12/2029 336.785 0,12<br />

US$455.000 Progressive 6,7% 15/6/2037 365.127 0,13<br />

US$100.000 Qwest Communications International<br />

7,5% 15/2/2014 97.250 0,03<br />

US$35.000 Qwest Communications International<br />

7,5% 15/2/2014 34.038 0,01<br />

US$20.000 Qwest FRN 15/6/2013 18.600 0,01<br />

US$503.871 RAAC Series '2005-SP2 2A' FRN<br />

25/6/2044 228.892 0,08<br />

US$50.000 Reinsurance Group of America 6,75%<br />

15/12/2065 32.477 0,01<br />

US$1.007.172 Residential Accredit Loans '2006-QA9 A1'<br />

FRN 25/11/2036 525.641 0,19<br />

US$16.335 Residential Asset Mortgage Products<br />

'2005-RS3 AIA2' FRN 25/3/2035 15.979 0,01<br />

US$57.723 Residential Asset Securities<br />

'2003-KS5 AIIB' FRN 25/7/2033 26.240 0,01<br />

US$180.000 Ryland Group 5,375% 15/5/2012 177.750 0,06<br />

US$200.000 SLM 5,125% 27/8/2012 161.887 0,06<br />

US$465.000 SLM 5,4% 25/10/2011 405.161 0,14<br />

US$745.000 SLM FRN 26/7/2010 681.578 0,24<br />

US$562.045 SLM Student Loan Trust '2002-1 A2'<br />

FRN 25/4/2017 554.141 0,20<br />

US$520.000 SLM Student Loan Trust '2005-4 A2'<br />

FRN 26/4/2021 513.105 0,18<br />

US$1.502.061 SLM Student Loan Trust '2008-5 A1'<br />

FRN 25/10/2013 1.506.538 0,54<br />

US$1.020.000 SLM Student Loan Trust '2008-5 A2'<br />

FRN 25/10/2016 1.029.896 0,37<br />

US$1.020.000 SLM Student Loan Trust '2008-5 A4'<br />

FRN 25/7/2023 1.043.113 0,37<br />

Revidert årsberetning og regnskap 187