Obrazac P-OD - Chronos Zenica

Obrazac P-OD - Chronos Zenica

Obrazac P-OD - Chronos Zenica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

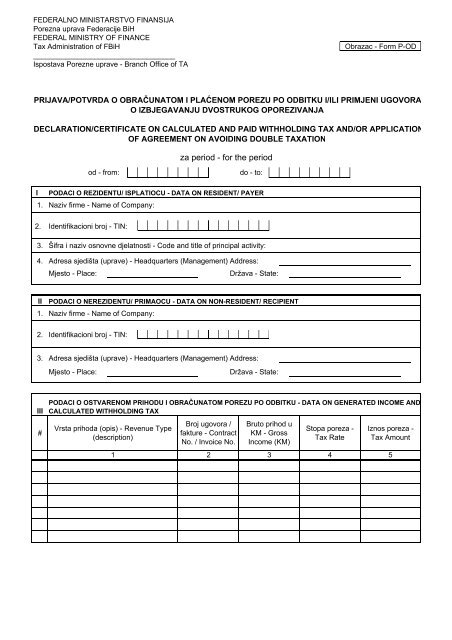

FEDERALNO MINISTARSTVO FINANSIJA<br />

Porezna uprava Federacije BiH<br />

FEDERAL MINISTRY OF FINANCE<br />

Tax Administration of FBiH<br />

___________________________________<br />

Ispostava Porezne uprave - Branch Office of TA<br />

<strong>Obrazac</strong> - Form P-<strong>OD</strong><br />

PRIJAVA/POTVRDA O OBRAČUNATOM I PLAĆENOM POREZU PO <strong>OD</strong>BITKU I/ILI PRIMJENI UGOVORA<br />

O IZBJEGAVANJU DVOSTRUKOG OPOREZIVANJA<br />

DECLARATION/CERTIFICATE ON CALCULATED AND PAID WITHHOLDING TAX AND/OR APPLICATION<br />

OF AGREEMENT ON AVOIDING DOUBLE TAXATION<br />

za period - for the period<br />

od - from:<br />

do - to:<br />

I P<strong>OD</strong>ACI O REZIDENTU/ ISPLATIOCU - DATA ON RESIDENT/ PAYER<br />

1. Naziv firme - Name of Company:<br />

2. Identifikacioni broj - TIN:<br />

3. Šifra i naziv osnovne djelatnosti - Code and title of principal activity:<br />

4. Adresa sjedišta (uprave) - Headquarters (Management) Address:<br />

Mjesto - Place:<br />

Država - State:<br />

II<br />

P<strong>OD</strong>ACI O NEREZIDENTU/ PRIMAOCU - DATA ON NON-RESIDENT/ RECIPIENT<br />

1. Naziv firme - Name of Company:<br />

2. Identifikacioni broj - TIN:<br />

3. Adresa sjedišta (uprave) - Headquarters (Management) Address:<br />

Mjesto - Place:<br />

Država - State:<br />

III<br />

#<br />

P<strong>OD</strong>ACI O OSTVARENOM PRIH<strong>OD</strong>U I OBRAČUNATOM POREZU PO <strong>OD</strong>BITKU - DATA ON GENERATED INCOME AND<br />

CALCULATED WITHHOLDING TAX<br />

Vrsta prihoda (opis) - Revenue Type<br />

(description)<br />

Broj ugovora /<br />

fakture - Contract<br />

No. / Invoice No.<br />

1 2<br />

Bruto prihod u<br />

KM - Gross<br />

Income (KM)<br />

3<br />

Stopa poreza -<br />

Tax Rate<br />

4<br />

Iznos poreza -<br />

Tax Amount<br />

5

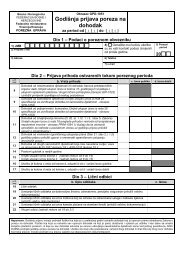

IV<br />

#<br />

P<strong>OD</strong>ACI O OBRAČUNATOM POREZU PREMA UGOVORU O IZBJEGAVANJU DVOSTRUKOG OPOREZIVANJA - DATA<br />

ON CALCULATED TAX PER AGREEMENT ON AVOIDING DOUBLE TAXATION<br />

Vrsta prihoda (opis) - Revenue Type<br />

(description)<br />

Broj ugovora /<br />

fakture - Contract<br />

No. / Invoice No.<br />

Bruto prihod u<br />

KM - Gross<br />

Income (KM)<br />

Stopa poreza iz<br />

Ugovora -<br />

Agreement Tax<br />

Rate<br />

6 7 8 9<br />

Tax Amount<br />

10<br />

V<br />

PRILOŽENI DOKUMENTI (naziv i broj) - SUPPORTING DOCUMENTATION (title and number) - enclosed<br />

1.<br />

2.<br />

3.<br />

4.<br />

5.<br />

6.<br />

7.<br />

VI NAPOMENA POREZNE UPRAVE (ako je ima) - TAX ADMINISTRATION REMARKS (if any)<br />

Datum - Date:<br />

Obračun sačinio - Calculated by M.P. - STAMP Odgovorno lice - Liable Person<br />

UPUTSTVO ZA POPUNJAVANJE<br />

1.<strong>Obrazac</strong> P-<strong>OD</strong> podnosi se u svrhu prijave/potvrde o plaćenom porezu po odbitku i/ili primjene ugovora o izbjegavanju dvostrukog oporezivanja<br />

pravnih lica čije je sjedište van teritorije Bosne i Hercegovine.<br />

2.<strong>Obrazac</strong> se popunjava u četiri primjerka od kojih jedan ostaje kod isplatioca, jedan primaocu prihoda, jedan Poreznoj upravi i jedan inostranom<br />

poreznom organu.<br />

3. Tačku I, II, III i IV popunjava isplatilac, a V i VI popunjava Porezna uprava.<br />

INSTRUCTION<br />

1. Form P-<strong>OD</strong> is filed as declaration/certificate on paid withholding tax and/or application of the agreement on avoiding double taxation of legal<br />

entities whose headquarters offices are outside BiH.<br />

2. Form is to be filled out in 4 copies where one remains with payer, one is provided to the recipient of the income, one to the Tax Administration and<br />

one to the foreign tax body.<br />

3. Item I, II, III and IV shall be filled out by the payer, and V and VI by the Tax Administration.