AEN-2016-Market-Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In Japan, the automakers are partnering in a major effort to build out infrastructure for their hydrogen vehicles.<br />

Honda, Toyota, and Nissan are part of an agreement between 10 Japanese gas companies to jointly develop a<br />

100-station hydrogen highway in Japan. In South Korea, there are now 11 stations throughout the country. The<br />

Hyundai-Kia Motor Co. has been working with the government to increase the availability of these stations.<br />

From Europe to the Far East, the effort to bring hydrogen to the road continues.<br />

As Vehicle Sales Lag, Natural Gas Vehicle Infrastructure Sags<br />

In order for any alternative to gasoline or diesel to be viable as a transportation fuel, refueling infrastructure<br />

needs to be readily available. In the arena of alternative fuels for transportation, natural gas has proven to<br />

be one of the most popular alternatives to traditional liquid fuels in many global markets. Natural gas for<br />

use as a transportation fuel is available in two forms, CNG and LNG, with the former being by far the more<br />

common. CNG is primarily used for vehicles that operate within a limited geographic region, while LNG is more<br />

commonly used for long-haul trucking applications. CNG is stored in high-pressure tanks at 3,000–3,600 psi and<br />

U.S. Natural Gas Vehicle, All Classes<br />

can be stored for extended periods of time. LNG is stored in low pressure, cryogenic tanks at -259ºF.<br />

Natural gas has a number of distinct benefits compared with other options, particularly for larger vehicles. As<br />

a resource, natural gas is widely distributed around the globe, and with newer extraction techniques, such as<br />

horizontal drilling and hydraulic fracturing, usable supplies have risen significantly in the past decade. As a<br />

result, prices have fallen to less than half of the peaks reached in 2005 and 2008.<br />

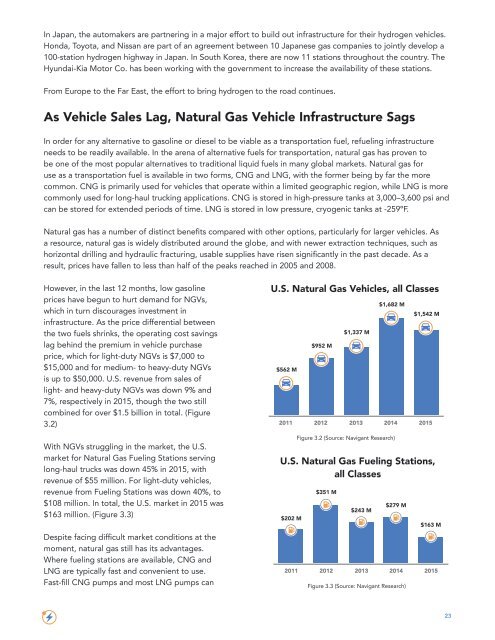

However, in the last 12 months, low gasoline<br />

prices have begun to hurt demand for NGVs,<br />

which in turn discourages investment in<br />

infrastructure. As the price differential between<br />

the two fuels shrinks, the operating cost savings<br />

lag behind the premium in vehicle purchase<br />

price, which for light-duty NGVs is $7,000 to<br />

$15,000 and for medium- to heavy-duty NGVs<br />

is up to $50,000. U.S. revenue from sales of<br />

light- and heavy-duty NGVs was down 9% and<br />

7%, respectively in 2015, though the two still<br />

combined for over $1.5 billion in total. (Figure<br />

3.2)<br />

With NGVs struggling in the market, the U.S.<br />

market for Natural Gas Fueling Stations serving<br />

long-haul trucks was down 45% in 2015, with<br />

revenue of $55 million. For light-duty vehicles,<br />

revenue from Fueling Stations was down 40%, to<br />

$108 million. In total, the U.S. market in 2015 was<br />

$163 million. (Figure 3.3)<br />

Despite facing difficult market conditions at the<br />

moment, natural gas still has its advantages.<br />

Where fueling stations are available, CNG and<br />

LNG are typically fast and convenient to use.<br />

Fast-fill CNG pumps and most LNG pumps can<br />

U.S. Natural Gas Vehicles, all Classes<br />

$1,682 M<br />

$1,542 M<br />

$1,337 M<br />

$952 M<br />

$562 M<br />

2011 2012 2013 2014 2015<br />

Figure 3.2 (Source: Navigant Research)<br />

U.S. Natural Gas Fueling Station, All Classes<br />

U.S. Natural Gas Fueling Stations,<br />

all Classes<br />

*Revenue shown only for product categories with revenue data for all years 2011 - 2015<br />

$351 M<br />

$279 M<br />

$243 M<br />

$202 M<br />

$163 M<br />

2011 2012 2013 2014 2015<br />

Figure 3.3 (Source: Navigant Research)<br />

23