You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

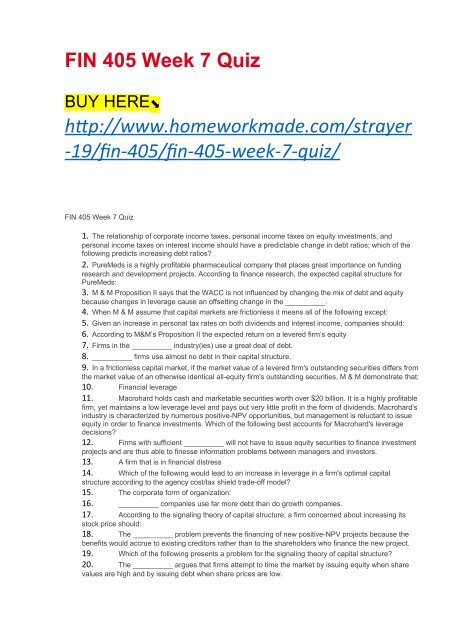

<strong>FIN</strong> <strong>405</strong> <strong>Week</strong> 7 <strong>Quiz</strong><br />

BUY HERE⬊<br />

htp://www.homeworkmade.com/strayer<br />

-19/fn-<strong>405</strong>/fn-<strong>405</strong>-week-7-quiz/<br />

<strong>FIN</strong> <strong>405</strong> <strong>Week</strong> 7 <strong>Quiz</strong><br />

1. The relationship of corporate income taxes, personal income taxes on equity investments, and<br />

personal income taxes on interest income should have a predictable change in debt ratios; which of the<br />

following predicts increasing debt ratios?<br />

2. PureMeds is a highly profitable pharmaceutical company that places great importance on funding<br />

research and development projects. According to finance research, the expected capital structure for<br />

PureMeds:<br />

3. M & M Proposition II says that the WACC is not influenced by changing the mix of debt and equity<br />

because changes in leverage cause an offsetting change in the __________.<br />

4. When M & M assume that capital markets are frictionless it means all of the following except:<br />

5. Given an increase in personal tax rates on both dividends and interest income, companies should:<br />

6. According to M&M’s Proposition II the expected return on a levered firm’s equity<br />

7. Firms in the __________ industry(ies) use a great deal of debt.<br />

8. __________ firms use almost no debt in their capital structure.<br />

9. In a frictionless capital market, if the market value of a levered firm's outstanding securities differs from<br />

the market value of an otherwise identical all-equity firm's outstanding securities, M & M demonstrate that:<br />

10. Financial leverage<br />

11. Macrohard holds cash and marketable securities worth over $20 billion. It is a highly profitable<br />

firm, yet maintains a low leverage level and pays out very little profit in the form of dividends. Macrohard's<br />

industry is characterized by numerous positive-NPV opportunities, but management is reluctant to issue<br />

equity in order to finance investments. Which of the following best accounts for Macrohard's leverage<br />

decisions?<br />

12. Firms with sufficient __________ will not have to issue equity securities to finance investment<br />

projects and are thus able to finesse information problems between managers and investors.<br />

13. A firm that is in financial distress<br />

14. Which of the following would lead to an increase in leverage in a firm's optimal capital<br />

structure according to the agency cost/tax shield trade-off model?<br />

15. The corporate form of organization:<br />

16. __________ companies use far more debt than do growth companies.<br />

17. According to the signaling theory of capital structure, a firm concerned about increasing its<br />

stock price should:<br />

18. The __________ problem prevents the financing of new positive-NPV projects because the<br />

benefits would accrue to existing creditors rather than to the shareholders who finance the new project.<br />

19. Which of the following presents a problem for the signaling theory of capital structure?<br />

20. The __________ argues that firms attempt to time the market by issuing equity when share<br />

values are high and by issuing debt when share prices are low.