Administration Manual - B.E.S.T. Undertaking.

Administration Manual - B.E.S.T. Undertaking.

Administration Manual - B.E.S.T. Undertaking.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

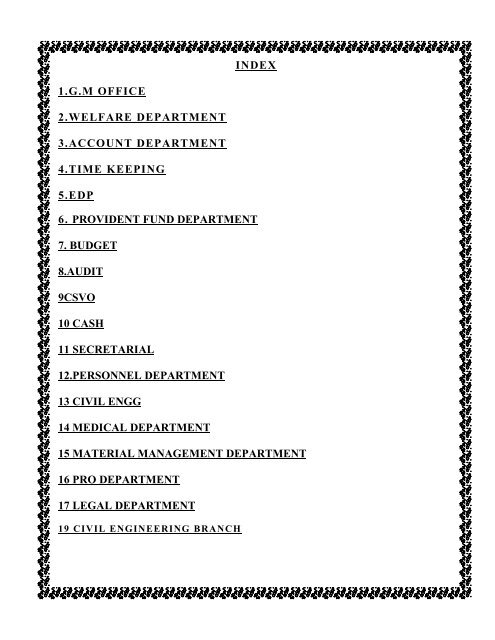

1.G.M OFFICE<br />

2.WELFARE DEPARTMENT<br />

3.ACCOUNT DEPARTMENT<br />

4.TIME KEEPING<br />

5.EDP<br />

INDEX<br />

6. PROVIDENT FUND DEPARTMENT<br />

7. BUDGET<br />

8.AUDIT<br />

9CSVO<br />

10 CASH<br />

11 SECRETARIAL<br />

12.PERSONNEL DEPARTMENT<br />

13 CIVIL ENGG<br />

14 MEDICAL DEPARTMENT<br />

15 MATERIAL MANAGEMENT DEPARTMENT<br />

16 PRO DEPARTMENT<br />

17 LEGAL DEPARTMENT<br />

19 CIVIL ENGINEERING BRANCH

GM’s OFFICE MANUAL

namely:<br />

INTRODUCTION<br />

The B.E.S.&T. <strong>Undertaking</strong> has two major branches of activities,<br />

Distribution of electrical energy to the electricity consumers within<br />

the City of Mumbai and carriage of passengers by omni buses in<br />

the Brihan-Mumbai area as also in the extended Suburban areas<br />

upto Thane Fly-over on the Eastern side and Bhayander on the<br />

Western side.<br />

The General Manager of the <strong>Undertaking</strong> is appointed by the<br />

Brihan-Mumbai Mahanagarpalika subject to the approval of the State<br />

Government for a period of 5 years in the first instance, renewable from<br />

time to time with the approval of the State Government for a period not<br />

exceeding 5 years at a time, under Section 60 A of the MMC Act. He is<br />

the Chief Executive of the BEST <strong>Undertaking</strong>. He manages the<br />

<strong>Undertaking</strong> and performs all acts necessary for the economical and<br />

efficient maintenance, operation, administration and development of the<br />

<strong>Undertaking</strong> subject to the superintendence of the BES&T Committee<br />

and the Brihan-Mumbai Mahanagarpalika, under Section 460 (A) of the<br />

MMC Act. For this purpose, he has been delegated powers under<br />

various Sections of the said Act from time to time.<br />

General Manager’s Office, therefore, plays an important role in the<br />

day-to-day functioning of the <strong>Undertaking</strong>.

SUPDT. T&T<br />

Gr. A-4<br />

SUPERVISOR<br />

Gr. A/G VII<br />

CLERK<br />

Gr. A/G V<br />

GENERAL MANAGER<br />

PS to GM<br />

Gr. A-5<br />

PA to GM<br />

Gr. A/G X<br />

O.A.<br />

Gr. A/G VIII<br />

STENOGRAPHER<br />

Gr. A/G V<br />

SUPDT. (ES)<br />

Gr. A-4<br />

Sr. STENOGRAPHER<br />

Gr. A/G VII

Tasks and Functions<br />

The tasks and functions of the GM’s Office mainly centers around<br />

the day-to-day appointments of the General Manager, who is the Chief<br />

Executive of the <strong>Undertaking</strong>, apart from all other administrative<br />

functions of the Department.<br />

The main functions of this Section are as under:-<br />

To co-ordinate / arrange internal meetings of the General Manager<br />

with the officers of the <strong>Undertaking</strong> as well as briefing meetings<br />

for the General Manager as and when desired by the General<br />

Manager, when meetings are fixed by higher authorities in State<br />

Government / MCGM, etc.<br />

To coordinate/arrange meetings of the General Manager with<br />

outside agencies like State Government, Municipal Corporation,<br />

other dignitaries etc. as and when intimations are received by the<br />

Office, as also prepare and keep ready folders / papers for the<br />

General Manager for such meetings.<br />

To make travel / accommodation arrangements for deputations of<br />

General Manager to attend Training Programmes, Seminars /<br />

Conferences / Meetings with high level officials of Central<br />

Government, Association of State Road Transport <strong>Undertaking</strong>s,<br />

Central Institute of Road Transport etc.

To scrutinize files received from various sections/ departments of<br />

the <strong>Undertaking</strong> and put up to General Manager with comments /<br />

suggestions, if any and send to concerned officials after General<br />

Manager’s scrutiny/ approval.<br />

To put up daily mail to the General Manager after scrutiny and<br />

forward them to concerned officers, as directed by the General<br />

Manager.<br />

To attend to visitors who come to meet the General Manager with<br />

their grievances and requests.<br />

To attend to telephone calls received for the General Manager as<br />

well as for the department and to connect telephones as and when<br />

instructed by the General Manager.<br />

To maintain General Manager’s diary and fix appointments /<br />

programmes of the General Manager, after consultations with the<br />

General Manager.<br />

To keep papers / folders ready for General Manager’s deputations<br />

and meetings such as B.E.S. & T. Committee Meetings, meetings<br />

with internal officers, Govt. / Municipal Officers, etc.<br />

To record movement of files / mail received by the GM’s Office in<br />

Computer / Registers maintained for the purpose.<br />

To maintain Imprest Cash.

To book Journey Tickets for the General Manager as well as other<br />

Senior Officers of the <strong>Undertaking</strong> and also make accommodation<br />

arrangements for the officers of the <strong>Undertaking</strong> as and when<br />

necessary.<br />

To prepare bills concerning D.A. / T.A. payable to General Manager<br />

as well as other officials, whenever they proceed on deputations,<br />

cost of Air Tickets, recoupment of amounts spent from Imprest<br />

Cash for purchase of sundry items / Railway Tickets etc.<br />

To dispatch correspondence by the General Manager / Personal<br />

Secretary to the General Manager with officers of Central / State<br />

Governments, Municipal Officers, State Road Transport<br />

<strong>Undertaking</strong>s etc.<br />

To arrange refreshments during meetings held by the General<br />

Manager with officers of the <strong>Undertaking</strong> as well as with<br />

dignitaries of other agencies, whenever directed by the General<br />

Manager.<br />

To receive fax / e-mail messages received for the General Manager<br />

and other various officers of the <strong>Undertaking</strong>, record the same in<br />

register and dispatch to respective officers.<br />

To draft Minutes of the meetings held by the General Manager and<br />

circulate the same on approval, as and when directed by the<br />

General Manager.

To take dictations from General Manager / Personal Secretary to<br />

General Manager, Superintendent (Electric Supply) and<br />

Superintendent (Transportation Engineering & Traffic) whenever<br />

required.<br />

To type D.O. letters from General Manager to officials of State /<br />

Central / Municipal and other Government / Semi-Government<br />

organizations, whenever drafts are put up by Departments.<br />

General Manager(GM)<br />

As briefed in the introductory note, he is the Chief Executive of the <strong>Undertaking</strong>.<br />

While managing the BEST <strong>Undertaking</strong> and performing all acts necessary for the<br />

economical and efficient maintenance, operation, administration and development of<br />

the <strong>Undertaking</strong>, the General Manager has to supervise, control and look after the<br />

entire administration / functioning of the <strong>Undertaking</strong>. He has to take various policy<br />

decisions for the smooth running and operation of its activities, attend meetings of<br />

various Statutory Bodies viz. B.E.S. & T. Committee meetings, meetings concerning<br />

BEST held by Municipal Corporation of Greater Mumbai and the State Government /<br />

Central Government. He has to proceed on domestic / international deputations to<br />

represent the <strong>Undertaking</strong> at the high level meetings / conferences / seminars, hold<br />

internal meetings / discussions with Heads of Departments of the <strong>Undertaking</strong> on<br />

various issues, present BEST Budget as well as Bus fare / Electricity tariff revision<br />

proposals before the B.E.S. & T. Committee / the Municipal Corporation of Greater<br />

Mumbai (MCGM) as well as the Maharashtra Electricity Regulatory Authority (MERC)<br />

for their approval. He meets people / employees who approach with

grievances, discuss with Representative and Approved Unions to settle labour related<br />

matters, such as wage agreements, strike / stoppage of work, etc. apart from attending<br />

day-to-day administrative work. He has to perform all these assignments aiming<br />

mainly at economical and efficient maintenance, operation, administration and<br />

development of the <strong>Undertaking</strong>.<br />

Superintendent(Electric Supply) (SSGM)<br />

Superintendent (Electric Supply) reports to the General Manager<br />

and assists the General Manager in day-to-day working with regard<br />

to Supply Branch activities.<br />

Various proposals, Committee Notes including purchase of<br />

materials, received in GM’s Office, pertaining to Electric Supply<br />

Branch are scrutinized by Superintendent (Electric Supply) before<br />

submission to the General Manager. He places his comments /<br />

suggestions, if any, on the proposals and puts up the files for GM’s<br />

sanction / approval. He also attends to consumers’ complaints<br />

referred by the GM.<br />

In addition to this, he takes part in various discussions /<br />

briefing of important meetings held by the General Manager,<br />

prepares draft Minutes of such meetings as and when directed by the<br />

General Manager and also carries out the any other work assigned to<br />

him by the General Manager from time to time.

Superintendent (Traffic & Transp.Engg)(STT)<br />

Superintendent (Traffic & Transportation Engineering) assists<br />

the General Manager in matters pertaining to Traffic & Transportation<br />

Engineering Departments and directly reports to the General<br />

Manager.<br />

He scrutinizes the various proposals / Committee Notes put up<br />

by Traffic and Transportation Engineering Departments. He also<br />

scrutinizes the proposals put up by the Materials Management<br />

Department for purchase of spare parts, etc. and proposals put up by<br />

Civil, Legal and other departments in respect of Traffic and<br />

Transportation Engineering Departments. After proper scrutiny /<br />

study, he places the files before the General Manager for his sanction<br />

/ approval with his comments / suggestions, if any. He maintains<br />

up-to-date statistical records pertaining to operation of buses,<br />

earnings, expenditure, etc. He also maintains technical data<br />

pertaining to various types of buses.<br />

In addition to this, he takes part in various discussions /<br />

briefings of important meetings held by the General Manager and<br />

prepares draft Minutes of such meetings.<br />

He also works as a Liaison Officer with Motor Vehicle Section<br />

and Transportation Engineering Department pertaining to the<br />

maintenance of the <strong>Undertaking</strong>’s cars used by the General Manager.<br />

He also carries out work assigned to him by the General<br />

Manager from time to time.

Personal Secretary to the General Manager<br />

(PS to GM)<br />

Personal Secretary to the General Manager plays an important<br />

role in the day-to-day working of the GM’s Office. For administrative<br />

purpose, he is the Head of Department for the GM’s Office and is<br />

directly reporting to the General Manager.<br />

Being Personal Secretary of the General Manager, he has to<br />

maintain GM’s appointment diary and arrange meetings/discussions,<br />

issue notices, draft letters, receive Telephone Calls, connect various<br />

dignitaries to GM on phone, make arrangements for GM’s<br />

deputations, visits and attends visitors. He has to scrutinise the<br />

mail / e-mail messages received for the GM and mark them to<br />

concerned Divisional Heads for necessary action. He has also to<br />

collect information required by the GM and submit to him.<br />

All the files meant for the GM are routed through PS to GM and<br />

action, if any, are taken by PS to GM as per GM’s directives on these<br />

files. He also makes arrangement for guest house accommodations<br />

to guests as and when requests are received and arranges vehicles<br />

for the guests, if necessary, with the approval of the General<br />

Manager.<br />

He also carries out the work assigned to him by the General<br />

Manager from time to time.

Personal Assistant to the General Manager<br />

(PS to GM)<br />

Personal Assistant to General Manager directly reports to the<br />

General Manager and assists the General Manager as well as the<br />

Personal Secretary to General Manager in their work, which includes<br />

attending of phone calls, maintaining of diary for the General<br />

Manager, co-ordination of various discussions / meetings held by the<br />

General Manager, preparation of folder for the General Manager’s<br />

deputations by collecting data from other departments etc. Personal<br />

work of General Manager such as maintaining personal files / Bank<br />

Accounts assigned by the General Manager from time to time.<br />

In addition to this, he has to maintain Confidential Records of<br />

‘A’ Grade Officers under the supervision and guidance of Personal<br />

Secretary to the General Manager and also maintain Imprest Cash,<br />

Service Records of the staff and ‘A’ grade officers of the <strong>Undertaking</strong><br />

who are directly reporting to the General Manager. He also has to<br />

look after administrative work of the GM’s Office.<br />

Office Assistant (OA)<br />

Office Assistant in GM’s Office assists the PA to GM, PS to GM,<br />

STT and SSGM in their day-to-day administrative work. He directly<br />

reports to the Personal Secretary to the General Manager. He<br />

prepares itinerary & folder for GM’s

deputations, prepares deputation bills of the General Manager as well<br />

as of the other officers working in the GM’s Office, occasionally<br />

attends phone calls, updates lists of telephone nos. of the officers of<br />

Mantralaya, MCGM, ASRTU, BEST etc. He also guides the<br />

subordinates in their work, helps to coordinate meetings held by GM<br />

and keeps files ready in advance for discussions of the GM. He looks<br />

after the maintenance of computers, xerox, fax and typerwriter<br />

installed in the office. Also carries out the work of following-up of<br />

purchase proposals etc. and other incidental work given from time to<br />

time.<br />

Supervisor<br />

Supervisor in GM’s Office mainly carries out the work of<br />

maintaining record of inter-departmental files as well as mail<br />

received in GM’s Office by manually entering details on the Personal<br />

Computer. He also keeps a record of representations received by the<br />

General Manager in English by appropriately entering the details on<br />

the Personal Computer. He assists the officers as and when required<br />

in all administrative work and guides his subordinates in their day to<br />

day work and carries out the work of Clerk in his absence. He is<br />

directly reporting to the Personal Secretary to the General Manager.<br />

Sr. Stenographer & Stenographer

Stenographers in GM’s Office take dictations from the GM as<br />

also from PS to GM / PA to GM, SSGM and STT and do other<br />

incidental work including that of checking of the e-mail messages<br />

received on the computer. They directly report to the Personal<br />

Secretary to the General Manager.<br />

Clerk<br />

Clerk in GM’s Office mainly carries out the work of maintaining<br />

various registers such as Marathi letter register, Employment<br />

Register, Bill Register, Leave Register, Purchase Register, Magazine<br />

Register etc. He also keeps record of the representations received<br />

by the General Manager in Marathi from general public as well as<br />

from employees by making entries in appropriate registers. He looks<br />

after the stationery items and puts up requisitions whenever<br />

necessary. He also arranges to dispatch files, notes, letters from<br />

GM’s Office to concerned officials / offices. He carries out the<br />

working filing. He also looks after the work of Supervisor in his<br />

absence. He directly reports to the Personal Secretary to the<br />

General Manager.<br />

manual1.doc<br />

_____

THE BRIHANMUMBAI ELECTRIC SUPPLY & TRANSPORT UNDERTAKING<br />

(Brihanmumbai Mahanagarpalika)

MANUAL OF WELFARE DEPARTMENT<br />

INTRODUCTORY :<br />

Advancement of science, inventions in various fields of<br />

science, every change leads to ultimate goal of upliftment of<br />

human life, their way of life, their standard of living, its<br />

betterment is the prime factor. It is an accepted fact that<br />

the developed or the developing countries have been<br />

achieving their growth through higher efficiency by<br />

providing better working conditions, better welfare facilities<br />

to their employees. Advancement in industrialization leads<br />

to growth, coverage of more and more people in working<br />

class, the time and changing situations gave birth to the<br />

concept of Labour Welfare.<br />

A well known Economist of the ancient times, Kautilya,<br />

has also described the importance of labour welfare which<br />

plays key roll in the economy as, “ In the happiness of the<br />

subjects lies the benefit of the king and in what is<br />

beneficial to the subjects in his own benefit”. For Kautilya<br />

the subjects and their welfare was more important than<br />

kingship. Every idea in the Arthashastra is directed<br />

towards this end. Thus, every CEO has to take into<br />

consideration the welfare of his employees first, which is<br />

ultimately, be his own benefit. The Arthashastra clearly<br />

shows that Kautilya had a vision for the welfare of the<br />

society.

: 2 :<br />

....2/-<br />

Labour Welfare in its widest connotation is understood<br />

as “a condition of well being, happiness and satisfaction of<br />

the workers and their families in the context of their ‘<br />

Industrial Life’. The Welfare of the industry is closely<br />

connected with the Welfare of those<br />

who work for its progress and prosperity. It is accepted<br />

that Welfare of Labour is Welfare of the Industry”. Thus,<br />

Labour Welfare deals with the physical, mental, emotional<br />

and social well being of the employees at the working place<br />

as well as outside the working place, i.e. in their social life.<br />

The B.E.S. & T. <strong>Undertaking</strong> has provided various<br />

statutory and non-statutory welfare facilities to its<br />

employees. Various provisions of the laws require the<br />

employer to maintain welfare facilities for their employees.<br />

It is well known fact that the higher efficiency of<br />

employees is obtained by providing better welfare facilities.

Considering the above factors, the Welfare Department<br />

of the <strong>Undertaking</strong> is executing various functions/welfare<br />

activities for the benefit of the employees of the<br />

<strong>Undertaking</strong> and their family members.<br />

: 3 :<br />

These Welfare activities are as follows:<br />

Sr.No. Activities<br />

1. Provision of canteens<br />

2. Hospitalisation Scheme & Medical Aid<br />

…3/-<br />

3. Hospitalisation at Talegaon General Hospital<br />

4. Blood Donation camps at various<br />

Depots/Workshops<br />

5. Medical Check up Camps at various<br />

Depots,Workshops, Staff Quarters & Receiving<br />

Stations<br />

6. Training Camp on Yoga, Stress Management<br />

7. Scholarship Scheme

8. Insecticide Treatment<br />

9. Good Housekeeping Scheme<br />

10. Family Welfare Fund Scheme<br />

11. Barber Shops at Depots<br />

12. Library facility at Depots/Workshops<br />

13. Provision of facility at Ladies Cloak Rooms<br />

14. Premises at Walkeshwar & Meher Mansion,<br />

Colaba (Guest Houses)<br />

15. Nursery at Anik & Colaba Depot<br />

16. Cleanliness at the Electric House, Transport<br />

House, premises at Head Office & GM’s<br />

Residence<br />

17. Social Activities<br />

18. Arts & Sports Club<br />

19. Arrangement of various functions<br />

20. HIV/AIDS Workplace Intervention Policy<br />

…4/-

1. PROVISION OF CANTEENS :<br />

: 4 :<br />

The <strong>Undertaking</strong> has provided canteens at its all 25<br />

Bus Depots and 2 Workshops. It has also provided 40 Tea<br />

Stalls/Canteens at Bus Stations/ Bus Termini. 2 mobile<br />

canteens for use of Traffic & Supply Outdoor staff are also<br />

provided to meet the catering needs of the staff members at<br />

concessional rates. The contracts for running these<br />

canteens/tea stalls are awarded to various contractors as<br />

per the procedure. The canteen contractors are paid certain<br />

amount as subsidy to cover the losses for providing the<br />

victuals at concessional rates as specified by the<br />

<strong>Undertaking</strong>. The number of employees for the purpose of<br />

payment of subsidy is computed on the basis of the number<br />

of staff reporting at a particular i.e. Depot/Workshop/Bus<br />

Station/Receiving Station, as on 1 st April of every year. All<br />

Administrative work pertaining to awarding of canteen<br />

contracts, inviting tenders, arrangement for payment of PF/<br />

ESI/Profession Tax/Maharashtra Labour Welfare Fund<br />

(MLWF) contribution of canteen staff and its recovery from<br />

Canteen Contractors, Municipal Licenses follow up,<br />

payment of subsidy, etc. is carried out by us.<br />

To keep vigil and check on the day-to-day activities of<br />

the canteen, as well as the job of supervision and control<br />

over the depot/workshop canteens is entrusted to the

Transportation Engineering Department, Bus Station Tea<br />

Stalls/canteens to Traffic Department and Receiving station<br />

canteens to Supply Department, as they are the major User<br />

Departments of the canteens.<br />

…5/-

: 5 :<br />

ACTIVITIES OF CANTEEN SECTIONS :<br />

1. Initiating proposals for awarding of contracts in respect of Depot/<br />

Workshop/Receiving Stations Canteens, Bus Station Canteens, Mobile Canteens<br />

and other proposals.<br />

2. Correspondence with various Departments for calculation of subsidy,<br />

imposing of fines, Security Deposits.<br />

3. Guidance/Correspondence with Transportation Engineering, Supply & Traffic<br />

Department for smooth functioning of Canteens at Depots/Workshops/Bus<br />

Stations.<br />

4. Correspondence with all canteen contractors.<br />

PROCEDURE OF AWARDING OF CONTRACTS TO RUN THE<br />

CANTEENS AT BUS DEPOTS, WORKSHOPS, BUS<br />

STATIONS, MOBILE CANTEENS AND ITS ALLIED WORK<br />

The work of awarding of contracts to run the canteens<br />

at Bus Depots, Workshops, Bus Stations, Mobile Canteens<br />

and its allied administrative work is entrusted with the<br />

Department. The procedure of awarding of canteen<br />

contracts and its procedure is described as follows.<br />

…6/-

: 6 :<br />

AWARDING OF CONTRACT BY PUBLIC ADVERTISEMENT<br />

i.e. BY INVITING TENDERS :<br />

The Department makes necessary arrangement for the<br />

appointment of a new contractor for running the canteen<br />

whenever the canteen is vacant. On some occasions, when<br />

the existing canteen contractor terminates the ‘contract’ in<br />

between the expiry of the contractual period or after the<br />

expiry of the contract period, due to any reasons<br />

whatsoever, then the contractor is appointed by usual<br />

procedure. In above cases, the sanction of the Management<br />

is obtained for inviting tenders through public<br />

advertisement in local newspapers for appointment of<br />

canteen contractor.<br />

ii) After publishing of the advertisement in the local<br />

newspaper, the necessary arrangements are made for<br />

issuing of tender forms to the prospective tenderers. The<br />

prospective tenderers collects the tender forms and copy of<br />

the terms and conditions from the Welfare Department by<br />

paying the cost of the same in the Cash Department.<br />

iii) Before submitting the tenders, the tenderers have to<br />

pay ‘Earnest Money Deposit’, as stipulated, either by cash<br />

or by demand draft in the Cash Department at Colaba.<br />

At present, the Earnest

: 7 :<br />

…7/-<br />

Money Deposit (EMD) for Depot/Workshop/Receiving Station<br />

canteens is Rs. 5,000/-, for Bus Station/Termini canteens<br />

is Rs. 3,000/- and for Mobile canteens is Rs. 1,000/-. The<br />

tenderer should duly fill in the Application/Tender form and<br />

also affix a Xerox copy of the paid EMD receipt. The<br />

Tenderer shall then submit the duly filled in and signed<br />

tender form/application form, in a sealed envelope, on or<br />

before the stipulated date in the tender box.<br />

iv) The submission of the Tender is subject to the ‘General<br />

conditions of Tender’ and ‘General Terms and conditions of<br />

canteen contracts’, a copy of which are given to the<br />

tenderer alongwith the Application form. The tenderers are<br />

required to fulfill all the terms and conditions and also<br />

comply with all the instructions given therein.<br />

v) No interest is paid on the “Earnest Money Deposit” and<br />

the same is refunded after a period of 9 months from<br />

the date of opening of the tender. However, the Earnest<br />

Money Deposit is forfeited, if the tender is withdrawn after<br />

its closing date and before the expiry of the last date of the<br />

period of validity or if the successful tenderer refuses to

accept the contract for any reasons whatsoever, as<br />

mentioned in the ‘General conditions of tender’. The offers<br />

submitted by the tenderers remain irrevocable for<br />

acceptance for 9 months from the date of opening of the<br />

tender.<br />

: 8 :<br />

…8/-<br />

vi) At present, the minimum Security Deposit to be offered<br />

for accepting the contract to run a canteen is as follows:-<br />

For Depot/Workshop/ Equivalent to 12 months subsidy<br />

Rec. Stn. Canteens of respective canteen<br />

For Bus Station/Termini/ Rs. 2,00,000/- for ‘A’<br />

Category<br />

Mobile Canteens (Maximum business)<br />

Canteens<br />

Category<br />

canteens<br />

Rs. 1,50,000/- for ‘B’ Category<br />

(Medium business) canteens<br />

Rs. 1,00,000/- for ‘C’<br />

(Minimum business)

vii) On expiry of the date for issuance of tender forms,<br />

the list of tenderers is obtained from the Cash Department<br />

who has paid the EMD. The tenders are opened on the<br />

notified date in the presence of the Representatives of the<br />

Accounts Department, Welfare Department and the<br />

tenderers who are present. The particulars of the tenders,<br />

so opened, are being recorded in the Tender Register by the<br />

Welfare personnel, including the tenders which are found to<br />

be non-eligible for any reasons. Signatures of the<br />

Representatives, Officers of the Welfare Department,<br />

Accounts Department and the tenderers present are<br />

obtained on the tender register after opening the tenders.<br />

: 9 :<br />

…9/-<br />

viii) The applications/tender forms are scrutinized to<br />

ascertain whether the tenders submitted are in accordance<br />

with the terms and conditions. After scrutiny of all the<br />

tenders, a proposal is prepared and forwarded to the<br />

Management, through the Tender Committee Members and<br />

Audit Department, for approval and sanction for awarding<br />

of contract to run the concerned canteen. Three separate<br />

Tender Committees have been formed for recommendation of<br />

tenders received in respect of Depot/Workshop Canteens,<br />

Receiving Station Canteens and Bus Station Canteens as<br />

follows :-

Sr.No. Tender Committee Members Canteens<br />

1.<br />

2.<br />

3.<br />

AGM(P), AGM(A), CAO & FA,<br />

CET(Op.) & Jt.CWO<br />

AGM(P), AGM(A), CAO & FA,<br />

CE(ES) & Jt.CWO<br />

AGM(P), AGM(A), CAO & FA,<br />

CTM(Admn.) & Jt.CWO<br />

AWARD OF CANTEEN CONTRACTS :<br />

Depots/Dadar<br />

Workshops<br />

Receiving<br />

Stations/ Supply<br />

Workshop<br />

Bus Stations and<br />

Mobiles<br />

The contract for running the canteen is awarded to the<br />

successful tenderer who offers the highest security deposit<br />

(interest free) having requisite experience in the field and<br />

who ranks first in<br />

: 10 :<br />

…10/-<br />

the list of tenderers. After obtaining the Management’s<br />

sanction, the successful tenderer is intimated to accept the<br />

contract to run the concerned canteen through an ‘offer<br />

letter’ and the tenderer is asked to comply with all the

equirements, such as payment of the security deposit<br />

offered, execution of ‘undertaking’ on stamp paper<br />

of<br />

Rs.200/- and payment of Rs.500/- as Agreement<br />

preparation charges, within a stipulated time from the<br />

receipt of the said letter.<br />

ACTION AGAINST DEFAULTING TENDERERS :<br />

If in any case, the tenderer who has been<br />

awarded/offered the contract to run the canteen, fails to<br />

comply with the terms and conditions mentioned in the<br />

‘offer letter’, the EMD paid by him/her is forfeited and<br />

his/her claim is cancelled/deleted from the list of<br />

tenderers. The canteen contract, in such cases, is then<br />

offered to the next highest valid bidder on the tenderers<br />

list. If he also fails to accept the contract, his EMD Deposit<br />

is also forfeited, and the contract is offered to the third<br />

highest valid bidder and so on.<br />

ENTERING INTO CONTRACTS.<br />

i) The contracts to run the canteens/tea stalls are on<br />

monthly tenancy basis and the canteen contractors has to<br />

pay monthly tenancy fee of Re. 1/- p.m. The terms and<br />

conditions of the tenancy to run the canteens/ tea stalls<br />

are operative initially for a period of<br />

…11/-

: 11 :<br />

three years from the date of awarding the contract and<br />

thereafter renewed from time to time on the basis of<br />

satisfactory canteen services and as per the terms and<br />

conditions of the contract.<br />

ii) After completion of the requirements mentioned in the<br />

‘offer letter’, the tenderer enters into a ‘monthly tenancy<br />

undertaking/Agreement’ with the <strong>Undertaking</strong>.<br />

iii) After completion of all the above formalities, the<br />

Welfare Department intimates the appointment of canteen<br />

contractor to the User Department. The User Department<br />

then arranges to handover the canteen premises to the<br />

canteen contractor, along with fittings and fixtures,<br />

furniture, equipments, etc. under acknowledgement.<br />

iv) After the expiry of the contract period, necessary<br />

arrangements are made for renewal/termination of the<br />

canteen contracts on the basis of reports from the user<br />

department and as per the terms and conditions of the<br />

monthly tenancy agreement.<br />

MUNICIPAL & OTHER RELATED LICENSES.<br />

All the relevant documents, such as copy of the<br />

approved plans, copy of the undertaking/agreement, NOC<br />

from the <strong>Undertaking</strong> etc, are provided to the canteen

contractor to submit the same to the MCGM Authority and<br />

various other government authorities to obtain the various<br />

licenses for running the canteen. It is the responsibility<br />

: 12 :<br />

…12/-<br />

of the canteen contractor to approach the concerned<br />

Municipal & other Government Authorities and obtain the<br />

Licenses from the Authorities concerned. Similarly, the<br />

canteen contractor is also required to get the Municipal &<br />

other Licenses renewed every year. The User Department<br />

ensures that the canteen contractor acquires the Licenses<br />

and renews it every year.<br />

COMPUTING THE RATE OF SUBSIDY :<br />

i) Subsidy is paid to the canteen contractors on the basis<br />

of the strength of staff on the 1 st day of the financial year,<br />

i.e. 1 st April, in the Depot/Workshop/Receiving Station/Bus<br />

Station where the canteen is located. Hence, it is<br />

imperative that the strength of the installation is reviewed<br />

every year so as to arrive at the fair and correct amount<br />

payable to a canteen contractor.<br />

ii) Vide a Departmental Circular, all the Heads of<br />

Departments/Branches are being requested to submit the<br />

number of employees reporting for work at various<br />

Depots/Workshop/Bus station/Receiving station &<br />

Installation, as on 1 st April of the corresponding year.

iii) On receipt of information from the various Heads of the<br />

Departments, the total number of staff is being worked out<br />

jointly by Audit & Welfare Department. Every bus route<br />

and the number of bus conductors/drivers working on it<br />

are taken into consideration.<br />

…13/-<br />

: 13 :<br />

iv) After arriving at the final figures with the help of the<br />

Representative of the Audit Department, a proposal is<br />

prepared and forwarded for the AGM(P)’s approval.<br />

v) After approval, the canteen contractors are being paid<br />

subsidy as per the number of staff computed and approved<br />

for that particular year. As the work of computing the<br />

number of staff takes two or three months time, the subsidy<br />

of the canteen contractors is adjusted accordingly in the<br />

proceeding months of that year. Further, as the work of<br />

computing subsidy is complex involving nearly 43,500<br />

employees of the <strong>Undertaking</strong>, it is carried out only once in<br />

a year and the staff position at the beginning of the<br />

financial year is only taken into consideration. Routine<br />

transfers during the year are not considered. However,<br />

when there is mass transfer of staff/employees, at the time<br />

of commissioning/closure of a Depot , the amount of<br />

subsidy payable is revised.

PAYMENT OF SUBSIDY TO THE CANTEEN CONTRACTOR<br />

:<br />

As the canteen contractor is required to sell the food<br />

stuffs/victuals prepared by him at concessional rates fixed<br />

by the <strong>Undertaking</strong>, monthly subsidy is paid to him/her to<br />

compensate for the losses incurred by him/her in this<br />

respect. At present, Rs. 28/- per employee per month is<br />

paid as subsidy to the canteen contractors. The total<br />

amount of subsidy payable per month to a<br />

: 14 :<br />

…14/-<br />

particular canteen contractor depends upon the staff<br />

strength of the installation where the canteen is located.<br />

Besides the subsidy, the canteen contractor is allowed free<br />

use of water and electricity.<br />

ii) The canteen contractors are entitled for subsidy only if<br />

they manage the canteen to the entire satisfaction of the<br />

<strong>Undertaking</strong> and in accordance with the terms and<br />

conditions of the undertaking/Agreement. For this purpose,<br />

they are required to maintain a ‘Wage Register’ and cover<br />

the canteen staff engaged by them under the provisions of<br />

the various Labour Enactment/Legislation viz. Minimum<br />

Wages Act, Provident Fund Act, ESI Act and Maharashtra<br />

Labour Welfare Fund Act. The canteen contractors are

equired to follow the following procedures for claiming the<br />

subsidy:-<br />

a) The canteen contractor submits their monthly subsidy<br />

claim in the prescribed format, duly filled in, along<br />

with the Wage Register and a copy of the page showing<br />

the Wages paid for that particular month to the<br />

Authorized Visiting Officer of the User Department, by<br />

the end of every month. The Authorized Visiting Officer<br />

will ensure that the Wage Register is duly filled in all<br />

respects and certify the Subsidy Claim form and<br />

forward it to the Department by the 5 th of every month.<br />

b) On receipt of the duly certified copy, the deductions of<br />

the amount towards PF/ESI/Profession Tax/MLWF<br />

Contributions<br />

: 15 :<br />

…15/-<br />

and other statutory payments are made from the<br />

Subsidy amount payable to the canteen contractors.<br />

c) The subsidy bill is prepared in the name of the canteen<br />

contractor after deduction of T.D.S and Education cess<br />

on Income Tax if the amount payable is Rs. 20,000/-<br />

per year or more and the same is recorded in the<br />

“Subsidy Bill Register’ kept in the Department. In case<br />

of any deductions on account of fines/penalties

imposed on the canteen contractors due to any<br />

lapses/irregularities on their part, the same are<br />

deducted from the subsidy amount payable to them.<br />

d) The subsidy bill is later on forwarded to the<br />

Audit/Accounts Department and finally to the Cash<br />

Department for issuing of the cheques. On receipt of<br />

intimation from the Cash Department, the canteen<br />

contractors are required to collect the cheque from the<br />

Cash Department at Colaba.<br />

REVISION OF SUBSIDY AND RATES OF TARIFF ITEMS :<br />

The <strong>Undertaking</strong> considers ‘revision in the subsidy’ or<br />

increase in the rates of the Tariff Items when it is felt that<br />

the subsidy being<br />

paid to them is not sufficient to meet the liabilities of the<br />

canteen contractor due to various reasons/factors, such as<br />

increase in the market prices of raw materials/commodities,<br />

increase in the wages as per the Minimum Wages Act,<br />

increase in PF/ESI/ Professional<br />

: 16 :<br />

…16/-<br />

Tax/MLWF Contributions or any other factors related with<br />

the functioning of the canteens.

ii) Under such circumstances, the Welfare Department<br />

along with the representatives of Personnel, Audit &<br />

Accounts Departments carries out survey of the various<br />

factors, which are responsible for increasing the liabilities<br />

of the canteen contractors.<br />

iii) From the collected information, the percentage<br />

fluctuation/increase in the liabilities of the canteen<br />

contractors and revision of the subsidy of rates are worked<br />

out. Further, the additional expenditure on the<br />

<strong>Undertaking</strong>, due to the proposed revision, is also worked<br />

out. The proposal, with all the facts and figures is<br />

submitted to the Management for its approval and sanction.<br />

PAYMENT OF PF/ESI/Professional Tax/MLWF<br />

CONTRIBUTIONS :<br />

The necessary arrangements are made to pay the PF,<br />

ESI, P. Tax and MLWF, to the government Authorities, in<br />

respect of the canteen staff engaged by the canteen<br />

contractors, by deducting the required amount from the<br />

“subsidy” payable to the canteen contractors, every month.<br />

: 17 :<br />

…17/-

RENEWAL OF CANTEEN CONTRACTS :<br />

The canteen contracts are awarded for the period of<br />

three years and before the expiry of the period the<br />

performance report and recommendation for renewal of<br />

canteen contract are obtained from the user department and<br />

accordingly Department forward a proposal to the<br />

Management for renewing canteen contract on revised terms<br />

and conditions. Mainly Security Deposit (interest free) is<br />

revised by obtaining additional Security Deposit (interest<br />

free) from the Canteen Contractors. After receiving<br />

additional Security Deposit amount from the concerned<br />

canteen contractors the necessary formalities in respect of<br />

renewal of contract by executing an ‘undertaking’ on a<br />

stamp paper of Rs.200/- and a payment of Rs.<br />

500/- as Agreement preparation charges and other<br />

administrative work for renewal of canteen contract are<br />

being completed. If any Canteen Contractor fails to pay the<br />

amount of additional Security Deposit (interest free)<br />

demanded from him/her, the ‘Monthly Tenancy’ of such<br />

canteen contractor is terminated by giving one calendar<br />

month’s notice and eviction action under Section 105-B of<br />

MMC Act, 1888 (Amended) upto date is initiated against<br />

such Canteen Contractors.<br />

…18/-

: 18 :<br />

ACTION AGAINST THE CANTEEN CONTRACTORS :<br />

The user departments’ viz. Transportation Engineering<br />

(Depot/Dadar Workshop canteen), Traffic (Bus station<br />

canteen), Mobile canteen and Supply (Receiving Station,<br />

Kussara Workshop & Pathakwadi canteen) recommend the<br />

action against the canteen contractors of their jurisdiction.<br />

Accordingly the welfare department implements the actions<br />

viz. fine, deduction of part of subsidy and termination of<br />

the canteen contract as recommended by the user<br />

departments. The actions depend upon the gravity of the<br />

lapses.<br />

The procedure for initiating action is as under :<br />

1) The user department issues warning letter to the<br />

canteen contractor for the minor lapses, noticed for the<br />

first time.<br />

2) The user department imposes fines depending upon the<br />

number of lapses, their repetition and gravity. While<br />

imposing fines inspection report in triplicate is<br />

prepared by the authorized visiting officer of the user<br />

department. Original report is handed over to the<br />

canteen contractor and duly acknowledged second copy<br />

of the report is submitted to the Welfare Department for

deduction of fine from the subsidy bill of the canteen<br />

contractor. Third copy is retained with user<br />

department.<br />

: 19 :<br />

…19/-<br />

The action of termination of contract is recommended<br />

after :<br />

a) The lapses are brought to the notice of the canteen<br />

contractor from time to time.<br />

b) The sufficient opportunity is given to the canteen<br />

contractor to show improvement by issuing him/her one<br />

calendar months notice.<br />

c) If there is no improvement during one month’s notice<br />

period, then such cases are forwarded for termination<br />

of contract along with the entire documentary<br />

evidences against the canteen contractor to the<br />

department with proper justification so as to forward<br />

the proposal to the Management for termination of<br />

canteen contract for its approval.<br />

d) After receiving approval of the Management, Welfare<br />

department initiates further action as per Section<br />

105(b) of MMC Act, 1888 Amended upto date, against<br />

the defaulter canteen contractor by issuing one<br />

calendar months termination notice. If the canteen<br />

contractor fails to vacate the canteen premises after<br />

expiry of termination notice period, a fourteen days

show cause notice is issued to him/her. After expiry of<br />

the show cause notice period, an enquiry is held for<br />

hearing before the Competent Authority.<br />

MATTERS IN RESPECT OF CANTEENS :<br />

dealt by<br />

Any policy matters in respect of the canteens is being<br />

: 20 :<br />

….20/-<br />

the department. Necessary proposal in this respect is<br />

prepared and submitted for the approval/sanction of the<br />

Management. Further, issuing of notices, instructions,<br />

letters, etc. to all the canteen contractor are dealt by the<br />

user departments & Welfare department.<br />

Fulfillment of statutory requirement.<br />

I) The canteen contractors are required to comply with<br />

various statutory provisions and run the canteens in<br />

accordance with the terms of the ‘undertaking’ entered<br />

into by them with the undertaking and follow all the<br />

rules/instructions issued from time to time. They are<br />

also liable to perform and observed all the laws, rules,<br />

bye laws and regulations frame/made by the<br />

Government or Municipal Authorities for the<br />

maintenance and operation of the canteen, as per the<br />

Factories Act 1948 & Rules 1963, Motor Transport

Workers Act 1961, Minimum Wages Act, various Labour<br />

Enactments/Legislation etc.<br />

2. HOSPITALISATION SCHEME & MEDICAL AID :<br />

The <strong>Undertaking</strong> has provided dispensaries at all<br />

Depots & Workshops. The certain medical facilities are<br />

provided to entire staff members of the <strong>Undertaking</strong> at<br />

these dispensaries. Similarly, certain medical investigation<br />

facilities are also made available at Mumbai Central<br />

Medical Investigation Center, where specialist viz.<br />

General<br />

: 21 :<br />

….21/-<br />

physician, General Surgeon, Cardiologist, chest specialist,<br />

Ophthalmic Surgeon, Radiologist and Pathologist etc. are<br />

available for specialized advices. The members of staff are<br />

therefore expected that they should avail the benefit of<br />

these dispensaries for their medical investigations. In<br />

certain cases, the employee patients are required to admit<br />

in Municipal / State Government Hospitals for availing<br />

medical treatments for a long duration.<br />

The Welfare Personnel regularly visits the employee<br />

patients admitted in various Government/Municipal<br />

hospitals located in the Traffic operational areas of

Mumbai, Navi Mumbai and extended suburbs of city limits.<br />

The required medicines, as prescribed by the Doctors are<br />

provided to the employee patients. The cost of medicines,<br />

surgical items, CT Scan, Angioplasty, Angiography, Stress<br />

Test, etc. is reimbursed to the employee patients. An<br />

imprest cash of Rs.3,00,000/- is maintained to cover this<br />

expenditure. The Welfare Personnel also visits the members<br />

of staff admitted in private hospitals and explain them the<br />

Hospital Scheme of the undertaking. The expenses incurred<br />

by the members of staff towards the medical treatment/<br />

investigations carried out in private hospitals are<br />

reimbursed as per Administrative Order No. 283 dtd.<br />

15.10.1999. The employee patients who are admitted in<br />

private hospital for treatment of specific diseases such<br />

as Cancer, Heart Surgery and Kidney transplantation are<br />

also rendered medical help and monetary assistance is<br />

provided as per the above mentioned Administrative<br />

: 22 :<br />

…22/-<br />

Order. All the above medical assistance/help is rendered to<br />

employee<br />

patients by Welfare Department under ‘Hospitalisation<br />

Scheme’. Some members of staff of the Welfare Department<br />

are working at the office situated at Wadala Depot for an<br />

urgent help to our employee patients admitted in the<br />

hospitals at peripheral area.

THE WORK - PROCESS OF THE HOSPITALISATION SECTION :<br />

1. Obtaining Management’s sanction for medical expenditures to be incurred on<br />

various employee patients.<br />

2. Preparing a monthly statement of expenditures incurred on employee patients,<br />

patient visit memos.<br />

3. Reporting of burn cases, bomb blasts, fatal/non fatal accidents, serious<br />

injuries, etc.<br />

4. Obtaining sanctions for visits to Talegaon Gen. Hospital & its reporting to the<br />

Management.<br />

5. Correspondence with various Hospitals, Replies to queries.<br />

6. On an average 1100 employee patients are given a medical assistance and an<br />

amount of Rs.1 crore is spent under this scheme annually.<br />

PROCEDURE OF MEDICAL/ FINANCIAL ASSISTANCE<br />

UNDER THE HOSPITALISATION SCHEME :<br />

The employee patients are availing the medical<br />

facilities at all depots/workshops from the Medical<br />

Department of the <strong>Undertaking</strong><br />

: 23 :<br />

…23/-<br />

and also from the medical investigation center at Mumbai<br />

Central Depot. However, when the staff member is required<br />

to be admitted in the Hospital for his/ her investigation/<br />

treatment or require to undergo the surgery, the department<br />

provide the necessary medical assistance to him/her. In<br />

terms of the Administrative Order No. 283 dated

15.10.1999 & Administrative Order No. 291 dated<br />

26.2.2001, the Welfare Department is entrusted with the<br />

work of making advance payment to the Municipal<br />

/Government Hospitals on behalf of the employee patient<br />

admitted in these hospitals.<br />

The detail procedure of availing the benefit under<br />

“Hospitalisation Scheme “ is as under.<br />

A) Treatment availed in Municipal/ Government<br />

Hospital<br />

1) Whenever any member of staff is admitted in any<br />

Municipal/ Government Hospital, the message to that<br />

effect, should be conveyed to the Traffic control on Tel.<br />

No. 24143611 / 24146162 /24136883/ 24134164<br />

either by the staff member or his/ her relatives or<br />

through their Heads of the Departments, giving the<br />

full details such as Full name, Check No., Pay sheet<br />

No., designation, Department, place of work, Name of<br />

the hospital, date & time of the admission, Ward No.,<br />

Bed No., Nature of sickness, etc. immediately.<br />

: 24 :<br />

….24/-

2) On receiving the message by the Traffic control section,<br />

the same is conveyed to the Hospitalization Section at<br />

Wadala on Tel. No. 24123504 or 24146262 Ext. 349,<br />

which functions from 8.30 am to 11.00 pm throughout<br />

the year including Saturdays, Sundays & Holidays.<br />

3) On receiving the message from Traffic Control, the<br />

welfare personnel visit the employee patient in the<br />

hospital in which he/she has been admitted. If the<br />

employee patient has been admitted in Municipal/<br />

Government Hospital, the Welfare personnel renders<br />

them the necessary medical assistance and payment of<br />

cost of medicines, arranges for various medical tests,<br />

Blood test, MRI SCANNING, CT SCANNING,<br />

ANGIOGRAPHY, STRESS TEST, DIALYSIS, etc. The<br />

Welfare<br />

personnel also assists the employee patients to get the<br />

estimates from the concerned Hospital authorities if<br />

they are required to undergo the surgeries like<br />

ANGIOPLASTY WITH STENTING, CORONARY BYPASS<br />

SURGERY, PACEMAKERS, KIDNEY TRANSPLANTATION,<br />

CANCER, TOTAL HIP REPLACEMENT SURGERIES etc.<br />

They also assists the employee patients to get the<br />

blood required for their surgeries. In cases where the<br />

expenditure involved in this medical procedure is<br />

beyond the permissible limit granted to the Welfare<br />

Department, the sanction of the Management is<br />

obtained for the same & the payment is made to the<br />

concerned Hospital.

: 25 :<br />

..25/-<br />

4) The role of the Department begins with the admission<br />

of the employee patient and completes on discharge<br />

from the Hospital.<br />

5) The officers/staff of the department is making payment<br />

of entire amount of medicines/hospitalizations for<br />

employee patients admitted in Municipal/Government<br />

Hospitals.<br />

B. REIMBURSEMENT OF MEDICAL EXPENDITURE<br />

INCURRED IN PRIVATE HOSPITAL :<br />

1) The Welfare Personnel visits the employee patients<br />

admitted in the private hospitals as a courtesy. They<br />

are also making necessary arrangement of blood units<br />

required for the employee patients for their<br />

treatment/surgery whenever needed.<br />

2) The employee patient is entitled to get a reimbursement<br />

of maximum of Rs. 20,000/- if it is an emergency for<br />

his Hospitalisation

3) The employee patient undergoes the surgery for Heart,<br />

Kidney transplantation, Cancer, Coronary Bypass<br />

surgery etc.. They are entitled to get reimbursement<br />

upto maximum of Rs.75,000/-.<br />

: 26 :<br />

….26/-<br />

3. HOSPITALISATION AT TALEGAON GENERAL HOSPITAL :<br />

The employee patients suffering from Tuberculosis are<br />

admitted at Talegaon General Hospital for their speedy<br />

recovery on recommendation of Medical Officer of the<br />

<strong>Undertaking</strong>.<br />

The employee patients admitted thereat, are provided<br />

with the best possible medical treatment, as well as other<br />

facilities Viz. meal, clothing, bed etc. by the hospital and<br />

the amount spent by the hospital for their treatment and<br />

other facilities are paid by the Medical Department of the<br />

<strong>Undertaking</strong> on monthly basis. In addition to above, these<br />

patients are also provided with 1 bottle of Bournvita of 500<br />

Gms every month as their special diet. The Recreation<br />

activities such as newspaper and T.V. sets etc. are also<br />

provided to these employee patients for entertainment<br />

purpose. On an average hundred employee patients are<br />

admitted to Talegaon General Hospital every year.

The Welfare Officer renders the monthly visits to these<br />

employee patients for redressal of their grievances and<br />

checking of food quality, general cleanliness in the ward,<br />

timely changing of bed sheets etc. Besides this, One<br />

Medical Officer also visits Bimonthly to observe and assess<br />

the medical treatment, diet and to screen the recuperate<br />

condition of our employee patients. The medical officer also<br />

discusses the line of medical treatment rendered to our<br />

employee patients with the medical authorities of the<br />

hospital and<br />

: 27 :<br />

…..27/-<br />

submits his report to the Management. During the visits of<br />

the Medical Officers & Welfare Officers, they discuss the<br />

grievances of the patients with the hospital authorities and<br />

solve their problems by giving necessary instructions to the<br />

concerned staff.<br />

4. THE ARRANGEMENT OF BLOOD DONATION CAMPS<br />

AT VARIOUS DEPOTS/WORKSHOPS :<br />

On an average 20 Blood Donation camps are organized<br />

annually at various Depot/Workshop in co-ordination with K.E.M.,<br />

Rajawadi and Cooper Hospital Blood bank. These blood units<br />

deposited in the Blood banks. Whenever the employee patients and<br />

their family members requires the blood, they are supplied from

these Hospitals. During the time of blood donation the donor<br />

member are given 1 Kg. of sugar packet as a token gift by the<br />

undertaking and 2 hrs. concession for early going. The donor<br />

member is provided with the blood donation card from the concerned<br />

blood bank denoting the blood group of the donor employee and the<br />

date of blood donation.<br />

PROCEDURE TO GET BLOOD FOR STAFF MEMBERS<br />

AND THEIR RELATIVES :<br />

The <strong>Undertaking</strong> has an account with the K.E.M.,<br />

Rajawadi & Cooper Hospital Blood Bank. The blood<br />

units collected from the various blood donation drives are<br />

deposited in these blood banks. The Welfare Department<br />

makes the necessary arrangements to provide the blood to<br />

the needy staff members & their close relatives<br />

: 28 :<br />

…..28/-<br />

for their treatment or surgery as the case may be. The<br />

procedure to get the blood is as follows;<br />

“ Whenever any member of staff requires the blood for his<br />

/her treatment/ surgery or for their close relatives such as<br />

father, mother, brother, sister, wife & children, the<br />

employee patient or their relatives has to collect a blood<br />

requisition from the concerned hospital. The concerned<br />

staff member or his relative will then have to approach in<br />

person, to Head Office, Welfare Department (Colaba) or

office at Wadala (Hospitalisation cell) alongwith the<br />

application of the concerned staff member. The Department<br />

issues a note to the blood bank for getting the blood units.<br />

The requisition issued by the said hospital and blood<br />

sample is then produced at the concerned Blood Bank for<br />

cross matching.<br />

To render such valuable services to the staff members<br />

of the <strong>Undertaking</strong>, the office this Department at Wadala<br />

i.e. Hospitalisation cell remains open from 8.30 am to 11.00<br />

pm throughout the year including Sundays & Holidays.<br />

Contact Telephone Nos. For Blood Assistance.<br />

WELFARE DEPARTMENT, COLABA : 22840872,<br />

431<br />

22856262 EXT- 434,<br />

WELFARE DEPARTMENT, WADALA : 24123504,<br />

24146262 EXT 349<br />

TRAFFIC CONTROL, WADALA : 24143611 /<br />

24146162<br />

: 29 :<br />

…..29/-<br />

5. THE ARRANGEMENT OF MEDICAL CHECK UP CAMPS :<br />

The Welfare Department with the help of various social organizations like<br />

Lions Club, Cancer Patients Aids Association & other NGOs organises various<br />

medical check up camps at various Depots, Workshops, Receiving Stations & Staff<br />

Quarters for ENT Checking, Blood Test, Cancer checking, Skin checking, Pulse

Polio Immunisation Camps, Eye Checking, etc. for benefit of the <strong>Undertaking</strong>’s<br />

employees & their family members. These programmes are arranged/conducted in<br />

various depots/ workshops/ receiving stations. These facilities are also extended to<br />

the family members of the employees residing at Staff Quarters of the <strong>Undertaking</strong>.<br />

I. Correspondence of Medical Check up Camps<br />

Blood Donation Camps<br />

1. Obtaining Sanctions,<br />

2. Issue of circulars,<br />

3. Correspondence with various Institutions as Lions Club, Rotary<br />

4.<br />

Club, KEM, Tata Hospital etc.<br />

Issue of Thanks giving letters,<br />

5. Notes for concessions etc.,<br />

6. Maintaining record of Blood Donors.<br />

7. Provision of sugar during drives.<br />

: 30 :<br />

……30/-<br />

6. TRAINING CAMP ON YOGA, STRESS MANAGEMENT :<br />

The Department organizes the Training camp on Yoga at<br />

various Depots/ Workshops with the help of Ambika Yoga Kutir, to<br />

curtail the mental and physical tensions, various physical problems<br />

and blood pressure, Spondylitis, gastric problems, acidity, etc.. This<br />

Department also organizes the camps on Stress Management with<br />

the help of Prajapita Brahmakumari Ishwariya Vishwavidyalaya,<br />

K.E.M. Hospital, etc.

7. SCHOLARSHIP SCHEME :<br />

The Scholarship Scheme was introduced in the year<br />

1952 for promotion of education of the children of<br />

the members of undertaking’s staff. The scholarship as<br />

per the laid down procedure is awarded to maximum three<br />

children of the members of staff for pursuing further studies<br />

from VIIIth Standard onwards based on performance of the<br />

children in the preceding academic year subject to his/her<br />

acquiring the minimum stipulated percentage/marks. The<br />

scholarship amount is paid equivalent to the tuition fees<br />

prescribed by Maharasthra State Board of Technical<br />

Education & University of Mumbai.<br />

Activities of Scholarship Scheme<br />

: 31 :<br />

1. Inviting scholarship application form from member of staff.<br />

…31/-<br />

2. Letters to various Educational Institutions for obtaining Prospectus.<br />

3. Scrutiny of applications.<br />

4. Data feeding of 5500 (approx. Scholarship applications every year from<br />

September to March).

5. Initiating a proposal for award of Scholarship.<br />

6. Replies to queries etc.<br />

PROCEDURE :- SCHOLARSHIP SCHEME<br />

The working of scholarship scheme is as follows :<br />

1) Every year in the month of June/July applications are<br />

invited from the members of staff of the <strong>Undertaking</strong> by<br />

issuing circular.<br />

2) The prospectus/tuition fees details are collected from<br />

University Of Mumbai, Board Of Technical Education,<br />

Maharashtra State and various Govt. Educational<br />

Institutions.<br />

3) The applications received from the members of staff are<br />

scrutinised to assess their eligibility.<br />

4) The details/particulars of the members of staff and the<br />

study course for which his/her ward is studying are<br />

entered in the Scholarship Programme.<br />

: 32 :<br />

……32/-<br />

5) The print outs of the same are taken and checked with<br />

applications form.<br />

6) The scholarship is not awarded to correspondence<br />

courses, stipend receiving courses, ITI courses,<br />

professional courses etc.

7) Two separate lists of ‘eligible’ and ‘non-eligible’ wards are<br />

prepared and AGM(P)’s sanction is obtained to award<br />

scholarship to ‘eligible’ student children and not to award<br />

scholarship to Non-eligible student children for the reason<br />

mentioned at Sr.No.6 above.<br />

8) After AGM(P)’s approval the lists of eligible members of staff<br />

alongwith the details of tuition fees are forwarded to various<br />

heads of the departments.<br />

9) Attendance certificates/tuition fee receipts of the<br />

student/children for the current academic year are required to<br />

be submitted to the concerned departments. Thereafter<br />

payment advice is prepared and forwarded to AIA/EDPM in<br />

duplicate. The scholarship payment to the members of staff is<br />

made through paysheet under code 019.<br />

10) In case there is STPC (Subject to production of certificate) remark against the<br />

employees name, the eligibility letter (corrigendum) is given from Welfare<br />

Department after due verification of required documents.<br />

: 33 :<br />

....33/-<br />

11) The Audited scholarship payment advices sent by AIA are entered in the<br />

computerized list and forwarded to respective Heads of the Departments.<br />

12) Payment code 019 list received from EDP Department is entered in<br />

computerised list as confirmation of scholarship amount payment.

8. INSECTICIDE TREATMENT :<br />

In order to eradicate the nuisance of mosquitoes and<br />

other pests at various premises of the <strong>Undertaking</strong>, the<br />

insecticide treatment contracts are awarded for rendering<br />

insecticide/fogging treatment every year to the Brihan<br />

Mumbai Mahanagarpalika. Total 106 installations/premises<br />

are covered under the Insecticide treatment contract at<br />

present.<br />

PROCEDURE OF AWARDING OF INSECTICIDE<br />

TREATMENT CONTRACT TO BMC :<br />

In order to combat mosquito nuisance, flies nuisance<br />

and to maintain hygienic condition at various premises of<br />

the <strong>Undertaking</strong>, such as Bus Depots/Bus Station,<br />

Workshops, staff/officers quarters,<br />

cash receiving centers etc. the contract for rendering<br />

Insecticide treatment at these places is awarded every year<br />

to the Insecticide Branch of the MCGM.<br />

: 34 :<br />

….34/-<br />

The working of award of Insecticide Treatment contract<br />

is as follows :-

All Heads of the Departments are requested to forward<br />

upto date list of premises to be covered under insecticide<br />

treatment contract.<br />

Every year estimates are obtained from the Insecticide<br />

Officer of MCGM regarding insecticide treatment to be given<br />

to the various premises of the <strong>Undertaking</strong>. A detailed list<br />

is forwarded to the Insecticide Officer for inspecting the<br />

premises to enable them to forward the estimated cost of<br />

the treatment.<br />

The estimated cost forwarded by the Insecticide Officer<br />

are scrutinized and are put up for Managements approval.<br />

After Managements approval, it is reported to the B.E.S.&T.<br />

Committee as required under section 460 K(d) of the MMC<br />

(Amendment) Act, 1999. The committees sanction is also<br />

obtained as required u/s 460-M of the MMC(Amendment)<br />

Act 1999, for dispensing with the invitation of tenders by<br />

public advertising.<br />

9. GOOD HOUSEKEEPING SCHEME :<br />

The Good Housekeeping Scheme has been introduced<br />

with the aim of generating awareness of maintaining proper<br />

cleanliness at the work places and also to ensure the<br />

various aspects of safety, health,<br />

…..35/-

: 35 :<br />

and hygienic conditions. The Panel of Heads of Department<br />

appointed by GM, visits every installations during the year.<br />

The Panel Members get first hand information of the<br />

problems, issues and grievances during their visits. Some of<br />

them are solved on the spot. These visits help for upward<br />

and downward communications between the staff and the<br />

Management. On the basis of ranking/rating given by the<br />

Panel amongst the Depots/Workshops (which includes<br />

Engineering, Traffic and Receiving Stations and other<br />

Administrative Departments), two Good Housekeeping<br />

Rotating Trophies and nine Merit Certificates are awarded<br />

every year. These Rotating Trophies and Merit Certificates<br />

are awarded to the winners during the function on 26 th<br />

January on the eve of Republic Day at Backbay Depot at<br />

the hands of Hon’ble Chairman, BEST Committee/ Hon’ble<br />

G.M.<br />

Activities of Good Housekeeping Schemes<br />

1. Initiating a proposals,<br />

2. Intimation of dates to panel members,<br />

3. Correspondence with various Heads of Departments

4. Work pertaining to Prize Distribution Functions etc.<br />

: 36 :<br />

10. FAMILY WELFARE FUND :<br />

….36/-<br />

The Family Welfare Fund has been constituted by the<br />

Management and the Representative Unions of the<br />

<strong>Undertaking</strong>, with the aim of providing immediate monetary<br />

assistance to the widow/widower/legal heirs of the<br />

employees who expires while in the services of the<br />

<strong>Undertaking</strong>. The <strong>Undertaking</strong> has made a one time<br />

contribution of Rs. 5 lacs to the Family Welfare Fund<br />

created for the said purpose. The contribution from the<br />

employees is recovered from monthly salary/wages payable<br />

to the employees by crediting the amount of loose coins,<br />

which is less than Re.1/-.<br />

An immediate financial assistance of Rs.4,000/- is<br />

paid to the legal heir/family members of the employees,<br />

who expires while in the services of the <strong>Undertaking</strong>. The<br />

Welfare Department is entrusted with the work of extending<br />

monetary assistance to the staff members/employees who

fall under the General <strong>Administration</strong> category, for this<br />

purpose an imprest cash of Rs.40,000/- is maintained at<br />

the Welfare Department.<br />

The assistance under this Scheme to the members of<br />

staff of Traffic, Trans.Engg. and Supply Deptt. are also<br />

given by their own Departments respectively.<br />

: 37 :<br />

11. BARBAR SHOPS AT DEPOTS :<br />

….37/-<br />

The <strong>Undertaking</strong> has provided the Barber Shops in the<br />

premises of depots, for the benefit of Traffic outdoor staff,<br />

for their<br />

pleasant and decent appearance in the public which creates<br />

a good image of the <strong>Undertaking</strong>. The award/renewal of<br />

contracts for running these barber shops are done by the<br />

Welfare Department. The provision of furniture and other<br />

related administrative work of rent recovery etc. is attended<br />

by us. The Management fixes the concessional rates<br />

charged for these Barber Shops from time to time.

Activities of Barbershop<br />

1. Awarding of contracts of 25 Barbershops, its renewals.<br />

2. Rent Recovery advices,<br />

3. Correspondence with Traffic Departments etc.<br />

The provision of 2 nos of Barber chairs, steel counter<br />

with 2 drawers, steel bench, mirrors, etc. is made by this<br />

Department. The supervision and control over these<br />

Barbershops are maintained by the Traffic Department.<br />

: 38 :<br />

….38/-<br />

Procedure of awarding of contract to run the Barber<br />

shop at Depot :<br />

“Whenever a contract to run the Barbershop at Depots<br />

is to be awarded due to the termination of contract either<br />

by the <strong>Undertaking</strong> or Contractor or due to the installation<br />

of new depots, sealed offers are invited from the<br />

Barbershop contractors by giving ‘public advertisement’ in<br />

local newspapers. The offers received from the contractors<br />

for maximum interest free deposit and monthly

compensation on the maximum return is calculated &<br />

considered as formula given below. i.e.<br />

Monthly income = Monthly rent offered + 9% interest p.a.<br />

on<br />

Offered<br />

Security Deposit<br />

subject to minimum Security Deposit of Rs. 5,000/- and<br />

minimum monthly compensation of Rs.500/- per month.<br />

Besides this, the Earnest Money Deposit of Rs.300/- is<br />

taken from the bidders, which is refundable. The<br />

successful bidder has to deposit an amount equivalent to 6<br />

months rent as a Rent Deposit in addition to the Security<br />

Deposit offered by him and has to pay an amount of<br />

Rs.200/- for stamp paper for executing undertaking and<br />

Rs.500/- as administrative charges for this work to the<br />

<strong>Undertaking</strong>.<br />

: 39 :<br />

…39/-<br />

12) LIBRARY FACILITIES AT DEPOTS/WORKSHOPS :<br />

The <strong>Undertaking</strong> has provided libraries in various bus<br />

Depots/Workshops for the benefit of the employees of the<br />

<strong>Undertaking</strong>. The provision of furniture items such as one<br />

12

steel bookcase cupboard, one single pedestal table and two<br />

chairs for these libraries are made by this department.<br />

Functioning of these libraries is looked after by the Officer<br />

bearers/members of the representative union.<br />

13) PROVISION OF FACILITIES AT LADIES CLOAK<br />

ROOMS :<br />

The <strong>Undertaking</strong> has provided Ladies Common Rooms<br />

in various places where ladies staff are working. The<br />

provision of one dining table, two benches with backrest,<br />

one full size mirror and steel lockers to keep their<br />

belongings is made by this Department.<br />

The supervision and control of Barber shops, Libraries<br />

and Ladies Rooms are entrusted to Traffic Department to<br />

keep check and vigil on the day to day activities thereat.<br />

14) PREMISES AT WALKESHWAR & MEHER MANSION,<br />

COLABA (GUEST HOUSES) :<br />

For accommodation of various delegates, Directors,<br />

Officers of various STUs, other Govt./Semi Govt. institutions<br />

visiting Mumbai for official work, the 2 VIP Guest<br />

Houses have been provided at<br />

Walkeshwar & Meher Mansion, Colaba. These Guest Houses<br />

are well equipped with modern amenities and full-fledged<br />

kitchens.<br />

…40/-

: 40 :<br />

Functioning of the Department in respect of Guest House :<br />

1. Appointment of Caretaker-cum-cook :<br />

a) Caretaker cum cook at Walkeshwar and Meher Mansion<br />

Guest Houses are appointed by inviting tenders<br />

through public advertisements in local newspapers.<br />

b) Tenders/bidding invited on the monthly compensation<br />

payment to the Caretaker-cum-Cook.<br />

c) Contract for Caretaker-cum-Cook is awarded to the<br />

lowest quotation of monthly compensation payment<br />

submitted by the tenderer/bidder. The said contract is<br />

for one year period. Security Deposit (interest free) is<br />

obtained from the successful tenderer. Thereafter a<br />

contract is renewed by increasing 5% monthly<br />

compensation and Security Deposit (interest free) for<br />

further period after one year.<br />

2. Job Profile of Caretaker-cum-Cook<br />

a) Caretaker-cum-Cook is available round the clock i.e. 24<br />

hours in the Guest Houses.<br />

b) After receiving intimation about guest from G.M. Office<br />

he arranges beds, snacks, lunch, dinner for the guests.<br />

Washing of linens, bedsheets, covers, cleaning,<br />

sweeping of guest houses is his responsibility.

c) He collects occupancy charges as prescribed from<br />

the guests reported and remit the same<br />

immediately in the Cash<br />

…41/-<br />

: 41 :<br />

Department. He also collects Telephone charges if any<br />