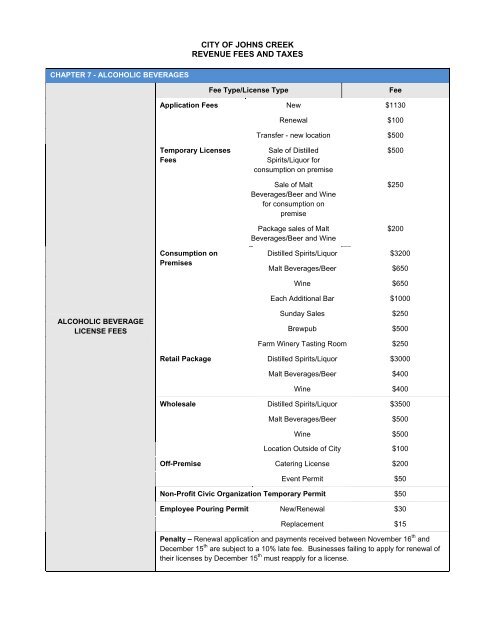

City of Johns Creek Revenue Fees and Taxes

City of Johns Creek Revenue Fees and Taxes

City of Johns Creek Revenue Fees and Taxes

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Retail Liquor by the Drink 3%Wholesale Wine & Liquor $0.22 per literALCOHOLIC BEVERAGEEXCISE TAXES(7-8)Beer - DraftBeer – Bottles or Cans$6.00 per 15 ½ galloncontainer$0.05 per 12 oz. containerPenalty – late filing 15%Interest – late filing1% per monthCHAPTER 10 - TAXESFee Type/License TypeFeeAD VALOREM TAXES(10-1)HOTEL AND MOTEL TAX(10-2)RENTAL MOTOR VEHICLEEXCISE TAX(10-3)Collected by the Fulton County Tax Commissioner. Phone: (404) 730-6100Excise Tax 7%Penalty – late filing 10%Interest – late filing1% per monthExcise Tax 3%Penalty – late filing 5%Interest – late filing 1%CHAPTER 11 - BUSINESS OCCUPATION TAX, LICENSES AND REGULATIONOCCUPATION TAXES &FEES(Gross Receipts Tax)(11-1)Fee/Tax TypeAdministrative Fee – nonrefundable fee for h<strong>and</strong>ling<strong>and</strong> processing business occupation tax registrationsFee/Tax$75Flat Rate – for the first $20,000 <strong>of</strong> gross revenue $50Employee – per employee tax $13Gross <strong>Revenue</strong>s Above $20,000 are taxed using a fee class table based onpr<strong>of</strong>itability. The fee class table ranges from $0.50 to $2.20 per $1,000 <strong>of</strong> gross revenuebased on the North American Industry Classification System (NAICS) Code <strong>of</strong> thebusiness.Fee Class TableFee Class Tax Rate Fee Class Tax Rate Fee Class Tax Rate1 $0.50 9 $1.40 17 $1.802 $0.80 10 $1.45 18 $1.853 $0.85 11 $1.50 19 $1.904 $0.90 12 $1.55 20 $1.955 $0.95 13 $1.60 21 $2.006 $1.15 14 $1.65 22 $2.107 $1.20 15 $1.70 23 $2.158 $1.35 16 $1.75 24 $2.20Penalty – occupation tax is due within 30 days <strong>of</strong> thecommencement <strong>of</strong> business in the <strong>City</strong> or by March31 st when the business was in operation the preceding10% <strong>of</strong> the amount owed foreach calendar year or portionthere<strong>of</strong>

calendar yearInterest – delinquent taxes <strong>and</strong> fees.1.5% per monthINSURERS LICENSE FEES(11-2)License Fee $150FINANCIAL INSTITUTIONS(11-4)Business License Tax0.25% <strong>of</strong> the gross receipts(minimum $1,000)DOOR TO DOOR SALESMEN(11-5)TAXICABSPermit Fee – valid for 6 months for each solicitor $75Taxicab Fee – per taxicab $150(11-7) Driver’s Permit $50MASSAGEESTABLISHMENTS & SPAS(11-8)ESCORT SERVICESLicense Fee $250Background Investigation Fee $50License Fee $250(11-9) Background Investigation Fee $50