Gasette This issue - Government Finance Profession - HM Treasury

Gasette This issue - Government Finance Profession - HM Treasury

Gasette This issue - Government Finance Profession - HM Treasury

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

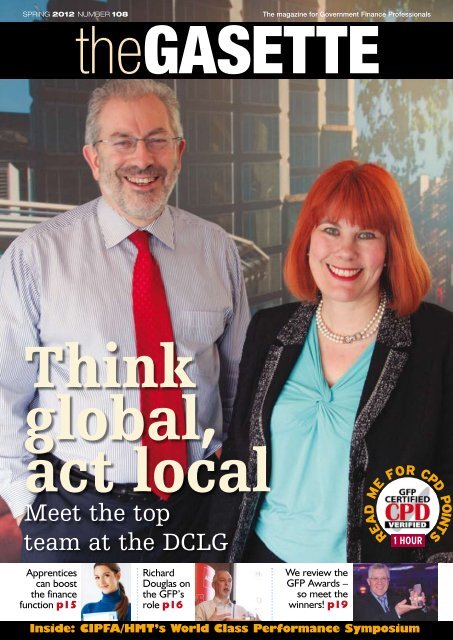

READ ME FOR CPD POINTSSPRING 2012 NUMBER 108The magazine for <strong>Government</strong> <strong>Finance</strong> <strong>Profession</strong>alstheGASETTEThinkglobal,act localMeet the topteam at the DCLG1 HOURApprenticescan boostthe financefunction p15RichardDouglas onthe GFP’srole p16We review theGFP Awards –so meet thewinners! p19Inside: CIPFA/<strong>HM</strong>T’s World Class Performance Symposium

CIMA, the Chartered Institute of ManagementAccountants, has 195,000 members and studentsworking in a variety of business sectors, includingover 8,000 in the UK public sector alone. CIMAnumbers continue to grow as organisationsrecognise the need for a more commercial approachblended with public sector accountabilities.CIMA works closely with employers, constantly updating itsqualification, professional experience requirements and continuingprofessional development. CIMA is the most relevant qualificationfor business, in both the public and private sectors, developingfinancially qualified leaders, who are pioneers in business. CharteredManagement Accountants have broad ranging business andmanagement skills to complement their financial training. Theyare able to offer strategic and practical advice; make and supportkey decisions; and manage risk. That’s why many of the world’slargest employers believe CIMA members are best qualified to drivebusiness performance, not just measure it.CGMA – the new global designationChartered Global Management Accountant (CGMA) is the globaldesignation for management accountants, powered by the resourcesand expertise of AICPA (the American Institute of Certified PublicAccountants) and CIMA, to elevate the profession of managementaccounting.The designation is a single global quality standard, so you can moveCGMAs with confidence around the organisation and around theworld. CGMAs are business strategists who apply non-financial,qualitative information alongside financial analysis to understandall aspects of a business.You can trust CGMAs to guide and support critical businessdecisions and drive strong business performance and all CIMAmembers are automatically entitled to use the CGMA designation.To find out more visit www.cgma.orgTo find out more visitwww.cimaglobal.com/gasette1

ContentsCELEBRATING GFP’S 30th YEARWelcome to your Spring <strong>issue</strong> of<strong>Gasette</strong>. In this edition, wefeature the first of a series ofjoint interviews with aPermanent Secretary and their Director-General <strong>Finance</strong> to profile the importance offinance in the departmental decision-makingprocess. We’ve started right at the very top ofthe Civil Service with our new Head, Sir BobKerslake, and DCLG’s DG <strong>Finance</strong> andCorporate Services, Sue Higgins.You will also find coverage of the 2012joint CIPFA/<strong>HM</strong> <strong>Treasury</strong> World ClassPerformance Symposium at which ChloeAwards winners, page 19Smith, the Economic Secretary to <strong>HM</strong> <strong>Treasury</strong>, recently spoke.Notwithstanding the ongoing austerity and our measured response to it,we shall mark the 30th anniversary of the <strong>Government</strong> <strong>Finance</strong> <strong>Profession</strong>this year. There will be a single GFP Training Event, at the Hilton Metropolein Brighton, on Wednesday 7th and Thursday 8th November. For the firsttime it will be open to all members, both Qualified and Trainee, but therewill be a bespoke programme for our Trainees on the first day. After Easter,CONTENTS04 NewsA round-up of recent newsand events that affect FPs07081012Accountancy newsNews from the UK’s majoraccountancy bodiesCIPFA’s WCPSHighlights fromthe World ClassPerformanceSymposiumEmerging strongerCIPFA launches discussiondocument on making thefinance function fitterCover storyWe spoke to Sir BobKerslake, new Head of theHome Civil Service, and SueHiggins, DG<strong>Finance</strong> at theDCLG – whereSir Bob isPermanent Secretary15 ApprenticeshipsApprenticeship schemesoffer a land of opportunity161921Send your comments to: Terry Rogers, <strong>Gasette</strong> Editor, <strong>HM</strong> <strong>Treasury</strong>, 1 Horse Guards Road,London, SW1A 2HQ. Telephone: 020 7270 5874 (GTN: 270 5874).Email: TheGFP@hmtreasury.gsi.gov.ukwe’ll start taking bookings for this event at anexcellent ‘Early Bird’ rate. There is limitedavailability so book early to guarantee yourplace. It promises to be our best ever with somevery special guests – so watch this space, as theysay.Last year, we had a record number of entriesfor our GFP Awards, which have now becomerecognised as an excellent way ofacknowledging all the hard work of yourcolleagues or team members. Please note,however, the earlier window for yournominations this year. It opens on 16th April andcloses on 6th July. All details of our 30thanniversary Training Event and the 2012 GFP Awards can be found on theGFP website – go to www.thegfp-treasury.org. You will also find newfeatures there like Richard Douglas’ blog and all the latest information onthe <strong>Finance</strong> Transformation Programme (FTP). Very soon we will alsoincorporate a feature to enable you to ‘Tweet’ the GFP.Enjoy reading this edition of <strong>Gasette</strong>. See you in the summer.Terry Rogers, EditorACCA seminarHead of the GFP RichardDouglas outlined his visionfor the futureGFP Awards 2012The Qualifieds’ TrainingEvent is back in Brightonthis year – as are the awardsCIMA surveyWe reveal the findings of asurvey of business leaders222324262830Banking technologySmartphone technology ismaking banking betterLead from the frontWhy leadership skills arevital in these austere timesFTP updateThe <strong>Finance</strong> TransformationProgramme makes progressWorking overseasHong Kong and one FP’sadventure of a lifetimeIFRS focusWhy governments are loathto embrace change<strong>Gasette</strong> quiz specialTest your brain power, plusa chance to win an iPod!ABOUT GASETTE ISSUE # 108VIEWS EXPRESSED IN GASETTE ARE NOT NECESSARILY THE OFFICIAL VIEWS OF THEGOVERNMENT FINANCE PROFESSION OR <strong>HM</strong> TREASURYEditorial services provided by PQ Magazine. Production by Armstrong MediaPrinted by Holbrooks Printers, Portsmouth © <strong>HM</strong> <strong>Treasury</strong> 2012ARMstrongMEDIAspring 2012theGASETTE 03

News<strong>Finance</strong> inthe front lineThe GFP is “in full view and on thefront line” in the battle to cut thedeficit, Economic Secretary to the<strong>Treasury</strong> Chloe Smith MP told morethan 200 senior financeprofessionals at the CIPFA WorldClass Performance Symposium.Smith told delegates that anumber of workstreams had beenset up to bring together membersof the <strong>Finance</strong> Leadership Group,Director-Generals of <strong>Finance</strong> fromthe largest-spending departments,and representatives from the<strong>Treasury</strong> and Cabinet Office. Theywill focus on:• <strong>Treasury</strong> spending controls andEmergingstrongerCIPFA has launched EmergingStronger: Shaping the financefunction to meet new and futurechallenges. The paper emphasisesthat top performing organisationsrequire top performing financefunctions, identifying four key areasin which finance must contributestrongly: leading innovation, addingvalue, managing risk and cuttingcosts. <strong>This</strong> in turn focuses thinkingon four critical roles: innovator,A risky businessAccounting is about providinginformation to help makegood decisions, and gooddecisions mean less risk,according to the ACCA’s PaulMoxey. The accountant’s dayto-dayrole is about managingdeveloping incentives for goodfinancial management.• The development of costconsciouscultures in departments.• Shared services.• Management information.• <strong>Finance</strong> skills for non-financeprofessionals.• Developing our financeprofessionals.“These are workstreams that arebeing driven by seniormanagement right acrossWhitehall, committed to instillingstronger financial management,”the minister said.• For more see pages 8-9.CIPFA CEOSteve Freerbusiness partner, steward, andprovider/commissioner. The paperargues that through these coreroles the finance function has theopportunity to showcase itsimportance in taking theorganisation forward and toemerge stronger post austerity.• For more see page 10.risk, he said, even if they don’trecognise it. Moxey stressedthat risk happens at all levelsof the business and it doesn’tsit in silos. He stressed: “Riskmanagement needs to besomething undertaken byeveryone in an organisationso it is fully integrated.”‘Golden age’for accountants<strong>Government</strong> accountants are entering a “golden age”, accordingto Head of the <strong>Profession</strong> Richard Douglas. “I want to see theaccountant at the heart of the decision-making process,” he said.“I want to move finance from the backroom to the boardroom.We have to, to deal with the scale of the challenges facingfinance.” For more see page 16.<strong>This</strong> year it could be you!Don’t get caught out – we areasking for nominations for the GFPAwards 2012 early this year! Thefull list of categories and rules ofentry will all be posted onlineat www.thegfptreasury.org,just afterthe Easter holidays. Lastyear we had winnersamong others fromDWP, MoD, <strong>HM</strong>RC andthe <strong>Treasury</strong> itself. But therewere also winners from theDepartment for Rural Affairs, DfE,the Department for Communitiesand Local <strong>Government</strong>, The CourtsService, and the EnvironmentAgency. The awards then are opento all departments, agencyand arm’s length bodies,so isn’t it time you oryour department wasrecognised for all yourhard work?All we need is 250words explaining why the‘nominee’ should win a GFPaward.THE GFP PRESENTS...The 30TH ANNIVERSARY TRAININGEVENTBACK TO THE BRIGHTON METROPOLE7th and 8th NOVEMBER 201204 theGASETTE spring 2012

Fraud & error in the public sectorKeeping one step aheadEvery year £21 billion is lost to the public sector throughfraud and error. What steps are your organisation takingto tackle the problem?What role does technical expertise play in the detection and prevention offraud & error?Forensic and analytic tools bring information to life. They reveal distinct fraud and errortypologies and their prevalence in current operations. Deloitte’s depth of technicalexpertise allows us to offer both packaged tools and custom built technical offerings.Is technical expertise enough?Absolutely not. Our client research shows that, when tackling fraud and error,organisations’ culture and willingness to share information is equally as important asthe technical capabilities. Deloitte’s wealth of experience in cultural change managementcan help ensure your workforce is appropriately equipped.Michael CullenDeloitte PartnerFraud & ErrorContactsDeloitte is helping a number of clients keep one step ahead. Find out moreby contacting:Michael Cullenmcullen@deloitte.co.ukMartin Simpsonmarsimpson@deloitte.co.ukFind out more at www.deloitte.co.uk/gps/one-step-ahead© 2012 Deloitte LLP. All rights reserved.Member of Deloitte Touche Tohmatsu Limited

HYPERIONEnterprisePerformanceManagementLeader in Business IntelligenceLeader in Business AnalyticsLeader in Planning and BudgetingLeader in Financial ConsolidationCommon Reporting and InteractionGovernance Risk and ComplianceStrategy ManagementPlanning and ForecastingFinancial CloseProfitability ManagementCommon Integration and AnalysisData Quality and Consistent Dimensionswww.oracle.com/epm

Accountancy newsAATPROFESSIONS FOR GOODThe AAT, along with theACCA and ICAEW, hassigned up to an initiative tohelp increase the number ofpeople from non-privileged backgroundsentering accountancy and tax. The SocialMobility Toolkit for the <strong>Profession</strong>s is the firstcommon frameworkto measure theprogress of socialmobility within theprofessions. The52-page toolkitexamines theeconomic, businessand moral case forsocial mobility. It alsoprovides bestpracticeadvice onhow to collect andprocess data onsocial mobility and how organisations candiversify the socio-economic profiles of theirmembers and employees.ACCASAY NO TO PAPERThe ACCA has announced that infuture its UK and Irish students willhave to go online for registration,exam results, exam entry and examdockets. From early 2012 the ACCA stoppedissuing paper for these services. The othercountries who are going down the online-onlyroute are Hong Kong, Singapore, Malaysia,Australia and New Zealand. The ACCA says that“most students are currently interacting withACCA online and this initiative reflects studentdemand for, and positive feedback on, ouronline services”.CIMABECOME A CGMAThe creation of theChartered GlobalManagement Accountantdesignation is the most significant event inCIMA’s 93-year history, says President HaroldBaird. Earlier this year CIMA officially launchedthe CGMA, which is ‘powered’ by the AICPACIPFA is working in Sri Lanka with the ICASLand CIMA as they build, inpartnership, what willhopefully become thepremier financialmanagement qualification.The CGMA is theculmination of 18 monthswork between the twobodies.RECORD STUDENTRECRUITMENTCIMA recruited a recordnumber of new students in2011, with some 26,500embarking on their journeyto become fully qualifiedchartered management accountants. Last year’sgrowth was consistent across all of CIMA’straditional key markets, including the UK, SriLanka and South Africa. In Russia studentnumbers almost tripled and CIMA had anexcellent year in India with a 38% year-on-yeargrowth. Andrew Harding, MD at CIMA said:“We are delighted to welcome our largest-everstudent annual intake. <strong>This</strong> shows ambitiousgraduates and school leavers across the worldare taking no chances with their future careers.”CIPFAFIXING THE FOUNDATIONSCIMA President Harold Baird withthe American Institute of CertifiedPublic Accountants’ Gregory J AntonFIXING FOUNDATIONSCIPFA and the Institute of CharteredAccountants of Sri Lanka (ICASL) have agreed towork together to transform the support availableto Sri Lankan public finance professionals. Amemorandum of understanding was recentlysigned in Berlin and the new partnership willnow develop a joint qualification andmembership arrangements. <strong>This</strong> newpartnership is the first outward sign of CIPFA’snew international prospectus ‘Fixing theFoundations’ in action. The institute wants tobring international public sector bodies togetherto restore confidence in countries’ managementof public finances and to improve standards.CIPFA believes the time is now right for a stepchangein financial management ingovernments. A key component in thisphilosophy is making the CIPFA qualificationmuch more readily available globally.CIoTCTA GOING INTERNATIONALThe Chartered Institute of Taxation(CIoT) has announced that it is tolicense the Irish Tax Institute (ITI) to usethe designations ‘Chartered TaxAdviser’ and ‘CTA’ as the first step indeveloping the CTA brand as an international‘Gold Standard’ in tax. The CIoT is proposing, indefined circumstances, to licensetax bodies in other countries todesignate their members as CTAs.CIoT President Anthony Thomassaid: “While the CTA brand ishighly recognised and very wellrespected in the UK, it is less wellknown elsewhere. With taxbecoming increasingly globalised,and our members travelling to andworking in more and morecountries, we believe it will benefitour members to raise the profile ofthe CTA designationinternationally.”ICAEWBOARDROOM DIVERSITYNews that the European Union is topress ahead with plans for quotas toincrease the proportion of women oncorporate boards, is likely to trigger alively discussion between Brussels and nationalgovernments, said the ICAEW’s Sharron Gunnrecently. However, she felt that the challenge isnot only how to get more women into thesesenior positions, but also how to ensure thistalent is developed and retained. Gunn stressedthat helping women who disengage following acareer break was another key move that wouldhave long-term benefits.ICASSPREAD THE TRUTH, PLEASE!The UK’s national debtis going up and is goingto rise by 61% in thisParliament, explained Allister Heath, editor ofCity AM at a packed ICAS business breakfastmeeting recently. He told the room ofaccountants that they needed to spread thetruth! People seem to believe the national debtis going down, but we could not be further fromthe truth. So, while debt stands at around£950bn by the time of the next election it couldbe nearer £1.5tn. Heath also wondered whethersix years of cuts was politically viable. “Perhapsthey should have gone for something moredrastic in the short-term,” he ventured.The ICAS business breakfast is the first in aseries of meetings planned by the institute southof the border.spring 2012theGASETTE 07

CIPFA/<strong>HM</strong>T symposiumMore than 200 senior FPsattended the CIPFA/<strong>HM</strong>TWorld Class PerformanceSymposium. Here <strong>Gasette</strong>brings you some of thehighlights from the eventCUTTING THE DEFICIT puts the<strong>Government</strong> <strong>Finance</strong> <strong>Profession</strong> “in fullview and on the front line”, EconomicSecretary to the <strong>Treasury</strong> Chloe SmithMP told the conference. “The scale ofthe challenge means that we have towork tirelessly to ensure budgetaryconstraint and good value for money,”she said. “We need to make a concertedeffort to be as efficient and asresourceful as possible, identifying andreducing waste, judging precisely wheresavings can be made.”Smith said it was vital that there is acoordinated strategy for improvingfinancial management in the publicsector, and that it was essential toincrease transparency to promoteconfidence in the <strong>Government</strong>’s financialmanagement strategy. “That’s why theCoalition <strong>Government</strong> has made a firmcommitment to strengthen financialdiscipline through our <strong>Finance</strong>Transformation Programme,” said Smith.The minister said the GFP is becomingincreasingly influential across<strong>Government</strong>, with the new head of theCivil Service, Sir Bob Kerslake, being aCIPFA-qualified accountant.The ideas set out in the ManagingTaxpayers’ Money Wisely programmeidentified priority areas for reform, saidSmith. Ensuring finance is integral toboard decision making, and ensuringthat senior management work inpartnership with finance wasfundamental. “The new CorporateGovernance Code for Central<strong>Government</strong> Departments is central tothat ambition,” said Smith. “It sets outthe role of government non-executives,bringing in senior external expertise andchallenge at departmental board level tohelp underpin stronger financialmanagement.”She continued: “We are embedding acost conscious culture across the publicsector – increasing transparency to helpdrive better financial performance across<strong>Government</strong>. Last year we published thefirst ever audited consolidated Whole of<strong>Government</strong> Accounts for the publicsector. Those accounts covered the<strong>Finance</strong>professionalson the front line• EST Chloe Smithaddresses delegates at theCIPFA/<strong>HM</strong>T symposium• The Head of the GFP,Richard Douglas, alsoaddressed thesymposium, on thesubject of how thefinance profession ischanging to confrontthe challenges ahead.It was the theme of anaddress he gave to theACCA’s Public SectorNetwork the nightbefore the CIPFAconference; you canfind out what he saidby turning to page 16whole of UK central government, localgovernment and public corporations –around 1,500 public bodies in total.And, the Main Estimates for 2011-2were prepared using the new Clear Lineof Sight framework for the first time –allowing for improved scrutiny andaccountability of governmentexpenditure.”Smith said real progress was beingmade on ‘Project Oscar’, the strategy toreplace the current COINS database by2013. “<strong>This</strong> new system will substantiallyimprove the quality and consistency offinancial data across government – thefirst phase goes live this summer,” shetold delegates.Promoting greater professionalism andfinancial awareness across <strong>Government</strong>was also fundamental, the minister said.“It is essential that all senior civil servantsdemonstrate a reasonable level offinancial competency, which is why allSCS staff now have to have theirperformance assessed against at leastone finance or efficiency objective.”She concluded: “Finally, we areembedding expert central functionsacross Whitehall. Ensuring that we domore by way of joined up thinking,within and across departments. If we areto succeed in transforming Whitehallculture, and making strong financialmanagement the norm not theexception, it is vital that we share bestpractice across all departments.”Smith said she had secured fullsupport for the <strong>Finance</strong> TransformationProgramme from a number of seniorministers. “We have established anumber of workstreams to bringtogether members of the <strong>Finance</strong>Leadership Group, Director-Generals offinance from our largest spendingDepartments, and colleagues in the<strong>Treasury</strong> and Cabinet Office to focus on08 theGASETTEspring 2012

CIPFA/<strong>HM</strong>T symposiumcross-cutting areas,” she said. “Theseinclude <strong>Treasury</strong> spending controls anddeveloping incentives for good financialmanagement; ERG efficiency controlsand incentives to the development ofcost conscious cultures in departments;shared services; managementinformation; finance skills for non-financeprofessionals; and developing our financeprofessionals.”The EST said these workstreams arebeing driven by senior management rightacross Whitehall, committed to instillingstronger financial management. “But it’sa transformation that has to reachbeyond the upper echelons of Whitehall.If we are to embed a strong culture offinancial management, then everyone indepartments needs to feel they havesome responsibility for it.“In fact all the members of the <strong>Finance</strong>Transformation Programme Board – thePermanent Secretaries, the <strong>Finance</strong> DGsled by Richard Douglas and the Non-Executive Directors – all agree that the<strong>Finance</strong> Transformation Programme is notjust about transforming finance andfinance processes, but about real culturechange,” she said.WORLD CLASS ROUND-UPRECOVERY WARNINGBritain’s recovery is likely to be slower than firstthought and is at risk from a number of factors,Gemma Tetlow of the Institute for Fiscal Studiestold delegates. She said that while deficit reductionwas the right course of action it wasn’t a giventhat the Chancellor’s objectives could be achieved.“If macro economic forecasts are wrong there isa risk to revenues,” said Tetlow. There needs to becare in planning public policy, she said, andproblems in the Eurozone could affect plans toplug the £114bn hole in the public finances. Thereis also a risk that George Osborne would beunable to implement spending cuts, said Tetlow,programme director at the IFS. “There is noprecedent for this,” she said. Ireland in the late1980s cut 10% of public spending but Britain’scuts will be deeper, she added. Tetlow said thatwhile 80% of the deficit plan relied on spendingreductions, most of these were not yet in place.They are to be rolled out over the next five years,but there is a danger government “won’t be ableto introduce the spending cuts as planned”, shesaid. Tax rises that make up the remaining 20% ofthe deficit plan have already been introduced.A RISKY BUSINESS‘Enjoy’ might not the right word, but delegateshad to sit up and take note of John Scott’spresentation on risk. The Chief Risk Officer atZurich Global identified a number of risks thatcould affect the UK’s prosperity. Unfortunately itwas a long list; Scott highlighted that the globaleconomy had created an ‘inconnectivity of risk’,whereby seemingly distant events couldreverberate around the world.Threats to economic stability also includesclimate change; terrorism and geo-politicaltensions; war (with reference to Iran); populationgrowth and related <strong>issue</strong>s, such as the scarcity ofwater; natural disasters (the Japanese earthquake);and the illegal economy (drug crime, counterfeitgoods, etc).The ‘dark side of connectivity’ brought its own<strong>issue</strong>s – cyber crime and digital disruption beingjust two. “The seeds of dystopia are starting togerminate,” Scott said.Understanding and tackling these risks shouldbe the priority for governments in the comingyears, Scott concluded. Their progress – orotherwise – will be monitored.qu_lific_ _ionsWhat’s missing from your finance team?If you are facing the challenge of improving productivity with fewer resources,then AAT has the solution. Our cost-effective training builds practical skillsand knowledge, bringing immediate results to the workplace.AAT qualifications can fill the skills gap in your finance team today, and ourprofessional membership will keep your organisation one step ahead for the future.Funding may be available via apprenticeships0845 863 0795 aat.org.uk/skillsgapAAT is a not for profit organisation with over 120,000 members worldwide. Registered charity no.1050724The professional bodyfor accounting techniciansspring 2012theGASETTE 09

<strong>Finance</strong> fitnessEMERGINGSTRONGERTHE CHALLENGE OF making efficienciesis only just beginning to bite. Severalcommentators have said that the easycuts have been made, the fat taken out;now the real challenge starts. The financefunction has been subject to cuts, too. Soin this climate how do we make sure thatfinance is not only at the heart ofdecision making, but leads the change byoffering solutions to take organisationsforward while ensuring that the financefunction itself is fit for the future?The <strong>Finance</strong> TransformationProgramme is raising the bar acrosscentral government. It has to. The recentreport by the Public Accounts Committeehas highlighted that previous efficiencyprogrammes have often added cost, notyielded savings. The total costs forimplementing shared services has been£1.4bn yet the savings achieved (up tothe end of 2010-11) were only £159m.Given the scale of the challenge goingforward this is not an option. Costincreases in one area mean real cutselsewhere. <strong>This</strong> is not a great advert forachieving efficiencies – if we have failedto deliver savings so far, how will wemanage in the future?WHAT MUST CHANGE?CIPFA has just launched a discussiondocument, ‘Emerging Stronger: Shapingthe finance function to meet new andfuture challenges’, which argues thattop-performing organisations must havetop-performing finance functions. But inreality few organisations, either in theprivate or public sector, have been able toachieve this.The discussion document is not a ‘howto’ list. First, it asks finance leaders whatcontribution their finance function makesto delivering the organisation’s objectivesefficiently and effectively. Second, it asksthem to identify the key challenges indeveloping a finance function that isoutward looking and fit for the future,whilst invariably being smaller.The finance function has four keyroles: innovator; business partner;steward; and provider/commissioner.Manj Kalar outlines proposals in a CIPFAdiscussion document aimed at makingthe finance function fit for the future• Manj Kalar is TechnicalManager – Central<strong>Government</strong> & FinancialManagement, CIPFAInnovator: Public service reform isfundamentally assessing what servicesshould be provided and whether theseshould be chargeable either wholly or inpart. The finance community hasknowledge, expertise and a uniqueperspective that understanding thenumbers provides. As an innovator,finance can use its analytical insights todrive the development of future policy.For example, the finance professional canassess the risks and benefits of newapproaches to financing services (such aspayment by results). <strong>This</strong> will informorganisational strategy and thedevelopment of business models.Business partner: Business partnering isseen as the norm in local government –inevitably, as authorities have beenmaking cuts to services long beforeausterity became the centrepiece ofcentral government policy.The business partner supports soundfinancial decision making and promotesgood financial management, ensuringresources stretch as far as possible.Studies have shown how businesspartners offer value added activity byproviding better business intelligence.How? The business partner combinestheir specialised professional expertisewith their unique position at the heart ofthe organisation. <strong>This</strong> is becoming morein vogue in central government – financeis breaking out of corporate services andbecoming part of the business. However,mere rebranding as a business partner isnot enough. Different skills are requiredto effectively operate in this arena – softskills such as communication andinfluencing to build relationships withinternal and external stakeholders, notthe qualities associated with thestereotypical accountant’s personality.Steward: In its stewardship role, financeis the guardian of taxpayers’ money,making sure it is spent on what it shouldbe and how it should be. The steward’sfocus is ensuring that risks are managedeffectively and that effective controls arein place. But we must appreciate thateven though it is counter cultural for anaccountant, especially a centralgovernment accountant, we cannoteliminate risks. It is only by acceptingand managing risks that we can lead theattack on costs locked up in the system.Provider/commissioner: <strong>This</strong> is thebread-and-butter territory of the financefunction – financial operations such aspayments processing. These are goodareas to start the attack on costs throughprocess standardisation, automation andeven outsourcing if this is the cheapestoption. It is important for finance to leadby example in showcasing how it cansupport the organisation in makingefficiencies. Moving forward, theprovider/commissioner will:• Simplify and eliminate processes toreduce costs (lean thinking).• Reduce wasted effort throughdiversionary activity (for example, byproviding training so that work doesn’tneed to be done twice) or discretionaryactivity (for example, by questioning thevalue of some activities and challengingthe “we’ve-always-done-it-this-way”culture).• Assess the procurement strategy.• Get better at defining shared services(especially the adoption of vanillaapplications – retaining the old processesrequires customisation, preventseconomies of scale being achieved andincreases costs).CONCLUSIONThrough the four core roles, the financefunction now can showcase theimportance of finance in taking theorganisation forward. More than that, ithas a moral responsibility to do so, sothat finance emerges stronger postausterity.10 theGASETTEspring 2012

PUBLIC SECTOR EMPLOYMENTFELL BY MORE THAN QUARTEROF A MILLION IN 2011*DON’T BE ANOTHER STAT.REPAINT YOUR PICTURE.Gain the skills and qualifications required to stay ahead withICAEW. Our wide range of qualifications and leadershipprogrammes develop the knowledge and skills you need,to prepare you for the complex challenges ahead.For more information contact frank.garvey@icaew.com to seehow we can help you.*ONS, Public Sector Employment, 2011icaew.com/learning

Cover storyWITH THE CIVIL SERVICE going throughits “most radical changes since the war”,2011 was a tumultuous year. Itculminated in the departure of ‘GoD’,the esteemed Sir Gus O’Donnell, whohad led the Service for more than sixyears. So great was considered the taskfacing Sir Gus’ successor that PM DavidCameron decided to split the roles ofCabinet Secretary and Head of the HomeCivil Service between Sir Bob Kerslake,Permanent Secretary at the Departmentfor Communities and Local <strong>Government</strong>(DCLG), and Sir Jeremy Heywood, whobecame Cabinet Secretary.<strong>Gasette</strong> spoke to Sir Bob during earlyMarch in the Victoria offices of DCLG,where he has been Permanent Secretarysince November 2010. One of only twoPerm Secs with an accountancyqualification (the other being MarkLowcock at DfID), we asked Sir Bob whatadvantages his CIPFA qualification gavehim in his new role.“It is really valuable grounding. Theskills and disciplines you learn stand youin good stead.” It helps you, he said, toidentify “the logical structuring of <strong>issue</strong>s.In order to tackle financial <strong>issue</strong>s youhave to be very clear on what theproposition is, how it is going to work,A safe pairof hands<strong>Gasette</strong> spoke to Sir Bob Kerslake, new Head of the Home Civil Serviceand Permanent Secretary at the DCLG, about transforminggovernment and the role finance has to play in facilitating changewho is going to be involved in the decision making,so it does give you that discipline, it is tremendouslyhelpful.” Although he says: “I wouldn’t now say I’man accountant.”Indeed, his remit means Sir Bob has to take a pan-Civil Service view, while also closely managing affairsat DCLG. He works two days a week as Head of theHome Civil Service, two days with his Department,and spends Fridays getting “out and about” –something he enjoys doings and sees as vital to hisrole. “It was my birthday recently and the team gotme a mug with ‘Two Jobs Bob’ on it” he laughs.“But it is perfectly possible for me to do both jobsbecause I have such a strong team here working onmy behalf.”Sir Bob’s two roles are complementary, he says.“Sometimes there is a perception that if you are partof a corporate centre you are remote from the dayto-day<strong>issue</strong>s that can affect a major department.But I can see things as departments do. Also, beinghead of the Civil Service gives me a perspective onwhat is happening in other departments. Forinstance I’ve been doing the Capability Review inother departments so I can see what is being donewell and feed that back into DCLG.”One of Sir Bob’s tasks is to oversee the <strong>Finance</strong>SUE HIGGINS’ CAREER HAS a remarkablenumber of similarities to that of Sir BobKerslake, the Permanent Secretary of herdepartment. Both are CIPFA-qualifiedaccountants who plied their trade at thehigher levels of local government, beforetrading up for an elevated position in theCivil Service. They worked in tandem atthe London Borough of Hounslow in the1980s, before Sir Bob recruited Higginsto the DCLG in August 2011. Higginsmade the switch to the Civil Service,however, in August 2009, moving tohead up the education department’sfinance and corporate functions. It wasturbulent times as the previousadministration battled towards the May2010 General Election, and she hasalready worked for three differentSecretaries of State in her short time as acivil servant.In two years at DCSF/DfE, Higgins hadled the corporate transformationprogramme which saw the transactionalsupport functions moved out of thedepartment to the DWP shared servicecentre, reducing costs and achieving acivil service award in 2010 forprogramme and project management.She took the opportunity when it aroseto be reunited with Sir Bob. “I rememberwhen Bob joined Hounslow, in the late1980s. When he started he came roundand shook hands with every singlemember of staff in the financedepartment.“He spent as much time with peoplepaying the invoices as with the moresenior technical accountants. As a juniormember of staff I was blown away bythat; it was so counter-cultural, given thetime. He is an inspiration, and the mainreason I moved across was the chance towork with him.”While underlining the importance ofher accountancy qualification, Higginsbelieves it is just a part of being a goodleader. “A qualification is important, butwhat’s vital is the right leadership. On topof that, a qualification is a bonus,” shesays. “What is really important too,” sheadds, “is that people keepingdeveloping, and that’s developing in thebroadest sense. But an accountancyqualification gives you a very strongunderpinning, of the values and theapproach that you bring to your work.And for the Head of the Home Civil12 theGASETTEspring 2012

Cover storyPersonal fileBorn: Bath, EnglandEducation: Mathmatics degree,University of WarwickStatus: Married to Anne, twochildrenLives: SheffieldHobbies: Walking in the PeakDistrict, theatre, film, opera. Likesmusic “from classical to hip-hop”Sport: Follows both Sheffieldteams but favours United (“I haveto be careful here”, he says)Transformation Programme (FTP), ofwhich he says: “The FTP has made realadvances in terms of strengtheningfinancial capability. It’s an area I’ve beeninvolved with in a number of differentguises for quite a long time now.Previously, as the Chief Executive of alocal authority and from my time on theboard of the Office of the Deputy PrimeMinister, I’ve been able to see how muchstronger it’s got, but there is a need to gofurther. We need a combination of moreconsistent strengths across the whole ofWhitehall, and crucially we need tostrengthen the financial skills of nonfinancepeople. But I think one of thegreat strengths of the FTP is that it drawsin finance professionals, and others, fromright across Whitehall now.”But there are areas to improve on, hesaid. While Sir Bob believes the quality ofboth financial reporting and accountinghas gone up, there is a need for strongerfinancial management informationalongside better managementinformation to help improve the decisionmaking process. “We need tounderstand where the gaps are andwhere it has done well, both in andoutside of government. It’s interestingthat the non-execs have brought in somereally interesting ideas from the privatesector. We need to focus on the prioritiesfor getting the right financialinformation, then we need a sharedprogramme of change that will deliverthat,” he said. “The process of changeand improvement must be driven fromwithin – we now have the leadershipcapabilities to do that. It’s about selforganisedchange and improvement.”Sir Bob also believes departments“need to improve their commercialskills”; one headline-grabbing initiativerecently introduced was the MajorProjects Leadership Academy – which ➝Leading from the front<strong>Finance</strong> is just part of a successful mix, says Sue Higgins, D-G <strong>Finance</strong> at the DCLGService to be qualified is a real feather in the capfor the accountancy profession.”Her role is much broader than finance, beinga corporate contributor in the department asone of three DGs and across the Civil Service.Sue works closely with GFP Head RichardDouglas and the rest of the Financial LeadershipGroup (FLG). “Richard has given us allportfolios; it’s been really empowering. I haveresponsibility for financial reporting andmanagement information; I’ve really enjoyed it,and through the financial reporting I’ve reallyhad to brush up on my technical accountingskills. It’s a real help in terms of trying to get theright strategic approach.”So how has she been developing her role,and the way her department works, sincejoining last summer? “On the financial reportingside, this is the first year we have Clear Line ofSight (CLOS); in implementing CLOS it’simportant that we do it in a way that maximisesthe chances of departments and arm’s lengthbodies laying their accounts before recess andwithout qualification, which is a really big askgiven all of the changes happening. I’ve workedvery closely with the National Audit Office and<strong>Treasury</strong> trying to frame the guidance andapproach.“On the management information (MI) side,Cabinet Office and <strong>HM</strong> <strong>Treasury</strong> chair theManagement Information Strategy Group – I’mthe GFP rep on that. It has two aims; the longerterm aim is to get a management informationstrategy agreed across the whole ofgovernment; while the quicker wins we aretrying to deliver are ensuring that Cabinet Officeand <strong>Treasury</strong> join up more on their requests forinformation, minimising the number ofcommissions to departments.“We’ve already made some really goodprogress – we’ve agreed a set of data standardsfor everything except fraud and error. I’moptimistic that soon we will get to a placewhere central commission will reduce, useconsistent definition and more will be plannedin advance.”The shared services concept also featuresheavily in Higgins’ working world. “Oscar, thereplacement for COINS, is key, as is the sharedservices agenda across government goingforward.”Higgins believes the <strong>Finance</strong> LeadershipGroup is well prepared to deal with the hugenumber of changes that are taking place. “TheFLG has been incredibly stable for the past 18months,” she says. “There is a strong rapportbetween members: Richard Douglas is gettingthe best out of all of us and we are pushing toget improvements in place.”Higgins is also full of praise for her DCLGcolleagues. She says: “<strong>This</strong> department hasfantastic financial skills. And Bob has been verysupportive of the finance function’s efforts toimprove – they are top-class people here.<strong>Finance</strong> really does add value to policy.” In fact,Higgins’ team have moved up to third in ➝spring 2012theGASETTE 13

ApprenticeshipsFEBRUARY 6TH–10TH was NationalApprenticeship Week 2012. The week’s800 events were supported by DavidCameron and Nick Clegg, and celebratedthe positive impact of apprentices acrossthe country. You may also have noticed anew national advertising campaign at atime of year when many young peopleare considering their career options.But do you really know what anapprenticeship is, and how they can helpthe <strong>Government</strong> <strong>Finance</strong> <strong>Profession</strong>?Many big employers have large-scaleapprenticeship schemes either to helpattract new talent into their businesses orto train and upskill their existing staff.Over 100,000 employers in 160,000workplaces offer frameworks across awide range of industry sectors.An apprenticeship is a work-basedtraining programme. Or, put anotherway, it is a real job. Much of the learningcomes from the experience of applyingnew knowledge and skills in theworkplace. However, formal learning anda qualification is a key element - infinance teams, for example, this willoften be the AAT (Association ofAccounting Technician) exams orequivalents from the other accountingYou’rehired!Apprenticeship schemes can helpgovernment attract staff at a time whenrecruitment budgets are frozen for manydepartments across the public serviceinstitutes. Depending on the age of theapprentice, the cost of this training maybe paid for by the government: in full ifunder 18, or 50% for 19-24 years old.For older apprentices, the contribution isa little less.A recent study by the University ofWarwick Institute for EmploymentResearch showed that apprentices are avery worthwhile investment foremployers. Some of the benefits includeimproved retention of employees and theprogression of apprentices to become themanagers and supervisors of the future.Many organisations in the publicsector have imposed recruitment freezesas they seek to manage staff numbersdown to the levels that they can afford.<strong>This</strong> has inevitably limited opportunitiesfor new apprentices, even though incentral government these werespecifically excluded from recruitmentrestrictions. But as wider recruitmentagain picks up, finance professionals canhave a key role in advocatingapprenticeships as a means to bring newpeople and ideas into the organisation,training on the job rather thanexpensively recruiting those with skillsalready formed. Many public sectororganisations already have wellestablishedapprenticeship schemes,including local authorities, the armedforces and the National Health Service.But more can certainly be done, with theuse of apprenticeships across the publicsector falling behind that of industry.A RANGE OF OPTIONSOf specific relevance to the GFP, theapprenticeship frameworks on offerinclude accounting, payroll andbookkeeping, with training availablefrom intermediate to advanced level, andbeyond. Not all finance jobs require fullyqualified professionals, but many wouldbenefit from some formal training.Apprenticeships offer a range ofoptions for those starting out on financecareers, as well as providing a routethrough to completing full accounting orother qualifications thereafter.The opportunities for higher level studyare indeed set to grow. For example,PwC has recently been awarded £1.5mto develop a new higher apprenticeshipprogramme in professional services,focusing on tax, audit and consultancymanagement, working with the ICAEWand the Association of Tax Technicians.An apprenticeship programme mayalso help raise spirits in teams bydemonstrating a commitment to invest inlearning for people already in post, or byintroducing motivated new joiners to theteam.If you want to find out more, theNational Apprenticeship Service (NAS) willprovide a representative to talk to youabout your needs, identify a trainingprovider and offer the free facility torecruit for apprentices online. As a firststep, however, take a look at the NASwebsite - www.apprenticeships.org.uk.spring 2012theGASETTE 15

ACCA seminarTalking shop: Richard Douglaswith ACCA Chief ExecutiveHelen Brand, centre, andHelen Ripley, BusinessDevelopment Manager– Public SectorWelcome to the‘golden age’<strong>Gasette</strong> caught up with the GFP’s boss Richard Douglas when hedelivered a presentation to accountants at ACCA’s Lincoln’s Inn HQPUBLIC SECTOR ACCOUNTANTS areentering “a golden age”, according toHead of the GFP Richard Douglas.Speaking to the ACCA Public SectorNetwork, Douglas outlined his vision forthe role of finance in central government– one that puts the accountant at theheart of the decision-making process. “Iwant to move finance from thebackroom to the boardroom,” he said,adding: “We have to, to deal with thescale of the challenges facing finance.”Of these, Douglas said the toughestfacing finance professionals (FPs) was thecurrent restraint that was likely to go onbeyond the current Spending Review andinto 2016. <strong>This</strong> meant FPs had to getmore out of fewer resources in order tomaintain service levels and meet withusers’ expectations. “There is a realreduction in discretionary spend and I forone didn’t come into public service tomake cuts,” he said.So how can FPs better use resources?“We need to understand what drivescosts,” said Douglas. “And we need toset out the priorities for investment.” Butwhile it was good to have a vision, it was,Douglas conceded, sometimes difficult tomake this a reality.He described four ‘pillars’ that financecan use as a platform to get to the heartof government. “Excellent leadership isvital,” said Douglas. “People at all levelsneed to be financially literate. We needto develop a cost-conscious culture –again, at all levels, right through thesystem. At the moment this is not therein Whitehall. We also need excellent,efficient, professional finance functions. Itis critically important FPs lead from thefront. As individuals FPs must develop therequired skills.”Douglas described the fourth ‘pillar’ asthe need for expert central functions.“What happens in the Cabinet Officeand in the <strong>Treasury</strong> has a fundamentalimpact on us,” he said.So how will these four objectives bereached? “The <strong>Finance</strong> TransformationProgramme will do this,” stressedDouglas. Priority areas include spendingframework rules that do not incentivisegood financial management. “We needto challenge these rules,” said Douglas.Another area of focus is the ‘talentmanagement’ of finance professionals,said Douglas. “We are not creating ourown pool of talent. A percentage of FPsmust be ‘home-grown’,” he said. “We’vegot to get the best out of our FPs.”Douglas also identified animprovement of the finance skills of nonfinance professionals as a target area.“It’s important everyone has the rightskills – we need finance to be at theheart of what everyone does.”Each department should draw up theirown list of priorities, said Douglas, andthrough this shared services best practicecould be developed. “At the moment,we just don’t do this,” said Douglas.Douglas, who combines his role asHead of the GFP with his ‘day job’ asDirector-General Policy, Strategy and<strong>Finance</strong> at the Department of Health,also outlined the skills FPs need todevelop. “There needs to be afundamental shift in technical andprofessional skills,” he said. “Influencingskills are vital to put finance at the toptable,” he ventured. “Communicationskills are too – we are not good at this. Interms of knowledge it is important thatyou understand your own business. <strong>This</strong>means getting out and about within yourorganisation. Extending this further, youneed knowledge of the way otherpeople’s businesses work – both withinand outside government.” In terms ofpersonal qualities, FPs need to be resilientand credible, consistent and reliable. “FPsmust be innovative too,” said Douglas.“We can’t just carry on doing the samestuff we’ve always done.“But this is a fantastic time to be an FPin government,” he said. “It is a fantastictime to be an accountant. We areentering a golden age.”HELEN BRAND:ACCOUNTANTS ADD VALUEHelen Brand, CEO at the ACCA, commented: “Richard communicated very clear messages,and ones that ACCA would agree with: that it is vital to put finance at the heart of thedecision making process in government, as in any business . My lasting impression fromthe event was the implicit message that accountants can add the most value by rising tothe current challenge by leading from the front. Again, this is a message consistent withACCA's own belief that the finance function is no longer just about numbers but alsoabout strategic leadership. The scale of the challenges are unprecedented, but present thegreatest opportunities to our members. I welcome Richard's offer to return to ACCA toreview how they were tackled and to update us all on progress.”16 theGASETTEspring 2012

Opportunity seized?In a time of austerity and constant change, Ernst & Younghelps make reform and improvement self-sustaining. Webring a fresh approach to transforming public services.Solving problems and shaping solutions. Building capabilityand achieving potential. Above all, making a difference.What’s next?ey.com/uk© Ernst & Young LLP 2011.All Rights Reserved.The UK firm Ernst & Young LLP is a limited liability partnership registered in England and Wales with registered number OC300001 and is a member firm of Ernst & Young Global Limited.

GFP AwardsWinners all: the 2011parade of championsTIME TO SHINEThe Birmingham Metropole was abuzz following the annualGFP Awards night. So who walked off with the prizes?THE GFP AWARDS are a unique chance tohighlight all the good work the financeprofession is doing throughout centralgovernment. Along with the great and good,the unsung heroes – for one night at least –are all recognised for their hard work anddedication. The 2011 roll of honour againcaptures what a diverse bunch the GFP are!The awards were wonderfully hosted byNicholas Owen. First up, and winner of theOutstanding Contribution to the <strong>Profession</strong>was the Whole of <strong>Government</strong> AccountsTeam, <strong>HM</strong> <strong>Treasury</strong>. The judges said this teamwas “incredibly motivated and have activelysupported each other through the ups anddowns”.The hotly contested <strong>Finance</strong> Team of theYear category had two winners – TheMidlands Regional <strong>Finance</strong> Team, HerThe Whole of <strong>Government</strong> Accounts teamwon the Outstanding Contribution tothe <strong>Profession</strong> categoryMajesty’s Courts and Tribunal Service; and theStrategic Weapons <strong>Finance</strong> Team, Ministry ofDefence. The judges just could separate thesetwo great teams.Ken Beeton was honoured with theLifetime Achievement Award. He retired inDecember as Director Financial ManagementReporting at the <strong>Treasury</strong>. Presenting him withthe trophy, the Head of the GFP, RichardDouglas, thanked Ken “for all his hard workin taking forward our profession to where it istoday”. The judges felt during his time at the<strong>Treasury</strong> he was responsible for strengtheninggovernance, financial management andassurance across government.The GFP Awards 2012 will be launchingsoon, so make sure you go online to discoverthe closing date. Visit the GFP’s website(www.thegfp-treasury.org) today!Ken Beeton with his LifetimeAchievement AwardTHE ROLL OF HONOUROutstanding Contribution to the <strong>Profession</strong>Whole of <strong>Government</strong> Accounts Team, <strong>HM</strong> <strong>Treasury</strong>Personality of the YearIan Haldenby, Department for Education<strong>Government</strong>’s Accounting Technician of the YearLynn Williams, Department for Work and Pensions(DWP)Part Qualified Accountant of the YearWendy Richmond, <strong>HM</strong>RCNewly Qualified of the YearFaisal Mir, Department for Communities and Local<strong>Government</strong>Project Team of the YearThe External Funding Financial Governance Team,Environment AgencyUnsung hero of the YearDennis Duignan, DWPSustainability AwardThe <strong>Finance</strong> and Commercial Teams, DWPMentor of the YearCaptain Paul Carcone, British ArmyBoss of the YearMichael Richardson, DWP<strong>Finance</strong> Team(s) of the Year• Midlands Regional <strong>Finance</strong> Team, Her Majesty’sCourts and Tribunals Service• Strategic Weapons <strong>Finance</strong> Team, Ministry ofDefence<strong>Finance</strong> Director of the YearPaul Coombes, Director of <strong>Finance</strong>, Estates andPerformance, Vehicle and Operator Services AgencyInnovation in <strong>Government</strong>The <strong>Finance</strong>, Planning and Control Team, <strong>HM</strong>RCHead of the GFP’s Award for LifetimeAchievementKen Beeton, Director Financial ManagementReporting, <strong>HM</strong> <strong>Treasury</strong>spring 2012theGASETTE 19

INDISPENSABLEFREE STUDYRESOURCE

CIMA surveyCIMA’s Charles Tilleyoutlines the findingsfrom an institutesurvey of worldbusiness leadersFacing the challengesHEAD ONDOUGLAS FLINT, chairman of HSBC andone of CIMA’s most prominent members,recently summed up the current businessenvironment with the comment: “I don’tthink we’ve ever been in a period of ourlifetimes where things have been moreuncertain.” With this focus in mind,CIMA and the American Institute ofCertified Public Accountants (AICPA)decided to ask business leaders aroundthe world how they view the globalchallenges and what their priorities willbe over the next few years. The resultwas our new report, Rebooting business:valuing the human difference.Almost 300 business leaders from over20 countries were surveyed. <strong>This</strong> wasfollowed up by 17 in-depth interviewswith CEOs, chairpeople and otherbusiness leaders who, between them, areresponsible for over 2m jobs and marketcapitalisation of $1trillion.So what did we find? There is nodoubt that reducing costs is still a priority.But at the same time there has been aclear shift in focus. Central to ourfindings was the fact that the humandimension of the business (such ascustomer and supplier relationships,talent development, intellectual capital) isa core value. Some 68% acknowledgedthat most of their organisationalvalue is non-financial. They seepeople’s ideas, skills, knowledge andrelationships as more importantthan traditional, financial sources ofvalue. Our conclusion was that theneed to measure and manage thehuman dimension has never beenmore critical – and we need theright people with the right skills todo this.So why are firms still placing somuch emphasis on financial value?The majority of our business leaders(69%) felt that the financial marketsare holding businesses to ransom asmany investors show little or no interestin the longer term. There are otherproblems, too. Many respondents (76%)said the current reporting systempromotes excessive focus on financialsand 28% felt there are also challengesfrom existing and new regulations.So, what is the solution? Firstly,integrated reporting has an essential roleto play. Integrated reporting shows thelinks between an organisation’s strategy,governance and financial performanceand the social, environmental andeconomic context within which itoperates. <strong>This</strong> is an initiative that is being• Rebooting business:valuing the humandifference can be foundon the home page of thenew CGMA sitehttp://www.cgma.org• Public sectorperformance: a globalperspective can be foundat: www.cimaglobal.com/publicperformanceled by the International IntegratedReporting Council, an organisation thatthe AICPA and CIMA work closely with.By reinforcing the diverse connections,integrated reporting can help businessesto make better decisions and enableinvestors and other stakeholders tounderstand how an organisation is reallyperforming. It can also help to overcomethe current over-focus on financialreporting and put in place better ways ofmeasuring the non-financial value of acompany.In conclusion, the CEOs in our surveywere adamant that they need help in‘connecting the dots’ to give a clearpicture of how the organisation isrunning and where the opportunities are.<strong>This</strong> points to the core strengths ofmanagement accountants.In a global business environment, it isessential that organisations employfinance professionals who can operateon a global scale. At the end of January,CIMA and the AICPA jointly launched anew designation: the Chartered GlobalManagement Accountant (CGMA). <strong>This</strong>new designation is designed to ensurethat management accountants are fullyequipped to meet the challenges aheadboth in terms of developing businesssustainability and extracting value fromthe human dynamic on bothnational and internationalplatforms.While the AICPA/CIMA report isfocused on the private sector, it isessential to address the <strong>issue</strong>sfacing the public sector as well.Although the public sector is basedon a very different framework. Ittoo must take on a new paradigmif it is to remain fit for purpose.A second CIMA report, Publicsector performance: a globalperspective, looks at the commonchallenges faced by most publicsector organisations and outlinessolutions to some of the biggestchallenges ahead – including the <strong>issue</strong> ofaligning policy to outcomes.Combined, these two reports providea powerful impetus for organisations ofall types to re-evaluate their operationalfocus. At the heart of this paradigm shiftis the management accountant. In anenvironment where change is the onlyconstant, management accountants havethe agility and adaptability to guide andsupport critical decision making and todrive forward strong, sustainableperformance.• Charles Tilley is CEO of CIMAspring 2012theGASETTE 21

BankingEvolutions inpaymentsChris Hearn and Mike Walters explain how smartphone technologiesare helping to make the banking and business worlds to work fasterTHE PAYMENTS LANDSCAPE is evolving rapidly andchange is being driven by a number of differenttypes of non-bank service providers – includinglarge-scale collecting businesses, such as utility firms,and on-line organisations that are seeking new waysto meet consumers’ payment needs.The payments processing market is also movingrapidly, with access to Faster Payments in the UKdriving an expectation of immediacy of settlement.In parallel there has been widespread growth inconsumer ownership of smartphones, with rapidlyincreasing use of online ‘stores’ for purchases.Research recently published by OfCom identifiedthat ownership of smartphones has reached 46% inthe UK and take-up was higher in the UK thanamong the other European countries.Large-scale collecting or receipting businesses,such as utility companies and local authorities, havelong been established users of Direct Debitpayments, because of the control it gives them overtheir customer relationships.Increasingly, such companies and other large,frequent billers have turned to online billing for theircustomers, to improve efficiency, lower operationalcosts and deliver value for money. Many have alsobegun to introduce new technology, includingmobile phone applications that give their customersgreater visibility of their usage and bills and enhanceease of use.Banks however, continue to play a central role infacilitating payments and emerging paymentmethods are no exception. Over two-thirds of thepayments which Barclays processes on behalf of itscorporate clients relate to corporate receipts from, orpayments to, their consumer and SME customers. Inthe case of large-scale collecting or receiptingbusinesses, banks provide the tools and mechanismsthat make it straightforward for utility companiesand local authorities, for example, to interact withtheir customers.Although mobile wallets have been launched bysome providers, surveys by polling company YouGovhas shown that consumers want to be able to usefunds in underlying bank accounts rather than storefunds on a device. Consumers are increasingly keento manage the stores of value they have withinmultiple wallets and vouchers. One way to do this isto ensure direct access to their main bank account,within any online payments environment.Barclays has recognised the importance of usingfunds from a bank account and has launched amobile application called Barclays Pingit, that allowsusers to make clean, simple and safe payments.Barclays Pingit is Europe’s first person-to-personservice for sending and receiving money usingmobile phone numbers. It allows users to receiveand send money, for free, to anyone with a UKcurrent account and UK mobile phone number,simply by using that mobile number.There is no need to share bank details becausethe user’s mobile number is linked to their currentaccount. To send money, customers can downloadand use the free Barclays Pingit app, available oniOS, Android and Blackberry, or they can registeronline to receive payments.Money is then sent using the Faster PaymentsService – meaning payments are effectively in realtime – and text messages are sent to both thesender and the payee to confirm thetransfer. Transfers are as safe as any otherbanking transaction and the app isprotected by a five-digit passcode, set bythe user.Barclays Pingit has been initiallylaunched to the consumer market andwe are currently developing theapplication to allow corporate clients toreceive payments from their owncustomers.<strong>This</strong> would enable consumers to paytheir utility and other bills via theirsmartphones. We are also investigatinghow Barclays Pingit could be developedto allow corporate clients to sendpayments, such as refunds, to theircustomers.For corporates, receiving payments viaBarclays Pingit should be significantly lesstime-consuming to manage, particularlycompared to existing paper-basedcollections including cheque and cash. Inaddition, Barclays Pingit could help toimprove the corporate’s reconciliationprocesses, as all payments receivedwould have unique reference detailsincluded with the payment receipt.Overall, the service is being designedto help reduce corporate costs associatedwith manual and paper based processes– including cheque handling – improvecustomer service and speed up <strong>issue</strong>resolution, as payment confirmation isinstant via SMS. The service would alsoprovide the corporates’ own customerswith an easy, alternative and convenientpayment method to pay their bills.• Chris Hearn and Mike Walters, Barclays22 theGASETTEspring 2012

LeadershipLeadership at the helm ofdepartmental spendingTo manage public money wisely at a time of great austerity you needto have the right leadership skills in place, says Sumita ShahWE ARE CURRENTLY dealing with thebiggest economic crisis in living memory,which is having not just a financial but asocial and political impact. Over the pastfew years, governments around theworld have become increasingly exposedto financial reporting fraud, leaving themexposed to financial fragility and thusneeding publically funded bail-outs andincreased debt servicing costs.UK government departments arecurrently engaged in providing verychallenging and very diverseprogrammes of change. Integrity in thebusiness is all-important. The need toidentify and manage risk, achieve valuefrom information systems and manageassets and liabilities is a key ‘must’.Accountability, transparency, governanceand ethics are an important aspect ofthe key business processes within eachdepartment.Good financial management andreporting have always been central tothe effective and efficient delivery ofpublic services – at a time of reducedpublic confidence in public spending –the accountancy profession has animportant part to play in theimprovement of financial discipline andto restoring credibility to governmentfinances and taxpayers’ money. Indeed,the need for accurate, transparent andtimely financial reporting to aid decisionmaking has never been greater, at a timewhen government needs to plan for areduction in the resources available tosupport expenditure plans.Challenges facing governmentdepartments include how to implementand improve financial managementwhile managing a cost-cutting exerciseacross the board. And all this dependson the leadership skills of thosemanaging the UK’s finances.It is, perhaps, a little obvious then tosuggest that you need people withsound business and financial mind-setsand great leadership skills to identify andmanage risks, and control and shape theUK’s finances. However, given the keyrole that accountants have to play in therunning of the country’s finances, it isonly recently that the UK has hadqualified accountants leading each of itskey finance functions.With all the challenges they arefacing, are these accountants makingthe right choices? Cutting staff levels isoften seen as the easiest option, but is itthe right decision and are decisionmakersperhaps being a little hasty intheir budget cuts?The National Audit Office (NAO)reported recently that althoughdepartments have made cuts andachieved savings they were not wellplaced to make further changes as theirplanning was “not based on a strategicview”. In her report on the Whole of<strong>Government</strong> Accounts (WGA), MargaretHodge, chair of the Public AccountsCommittee, stressed that the <strong>Treasury</strong>needed to get a grip on trends in somekey areas of risk and have plans forbetter managing them. We would goone step further and say that this is trueof all government departments; after all,• Sumita Shah, TechnicalManager, Public Sector,ICAEWthey provide the figures that areconsolidated into the WGA so surely it isa responsibility of all those qualifiedfinance leaders within government.In this current environment, financialmanagement, leadership skills andcompetencies are more important thanever.LEADERSHIP AND CULTUREDoes the UK have the right leadership,culture, skills and capabilities in place totake it through these times of austerity?According to Institute of <strong>Government</strong>’sresearch on turnover of staff in the civilservice, it doesn’t.It is imperative that governmentdevelop its managers to lead. Leadershipand culture are derived from a clear tonefrom the top, starting in the boardroom.Board members should be taking a keeninterest in improving financialknowledge in current times.<strong>Finance</strong> directors need to be able tocommunicate, engage and build effectiverelationships with board members, tohelp build confidence in the ability of thefinance function to contribute to boardleveldecision-making. A strong financedirector should be able to demonstratestrong leadership and commitment toimproving financial understanding atboard level as well as within and acrossdepartments.There needs to be strong financialmanagement, integrated withperformance reporting, if government isto succeed in its policy-making, planningand delivering policy objectives. Strongfinancial management needs leadershipfrom the top. Developing staff andenhancing their skills and qualificationswill be vital to enable them to stay intune with the current mood and learn todo more with less.Find out more about leadership and skills atICAEW’s public sector conferences, in partnershipwith the NAO and in association with the<strong>Government</strong> <strong>Finance</strong> <strong>Profession</strong>www.icaew.com/psconflondon2012 andwww.icaew.com/psconfleeds2012spring 2012theGASETTE 23

FTP updateOnwards& upwardsLindsey Fussell outlines the <strong>Finance</strong> Transformation Programme’sprogress and achievements and previews the next stepTHE FINANCE TRANSFORMATIONPROGRAMME (FTP) was launched inJanuary 2011 with the publication of its‘foundation’ document ManagingTaxpayers’ Money Wisely. The aim of theFTP is to strengthen financial disciplineand deliver a real change in the way thattaxpayers’ money is managed by publicservants. <strong>This</strong> includes upgrading someof our infrastructure, but also – and evenmore importantly – undertaking acultural transformation, putting financeat the centre of decision making ingovernment.The FTP includes both crossgovernmentprojects and a focus onfinancial management (FM)improvement within departments.Initially, the programme waschampioned by Justine Greening, thenthe Economic Secretary to the <strong>Treasury</strong>,and a qualified accountant. WithJustine’s move to Transport, Chloe Smithhas taken on the role of EST and hasshown commitment to taking the FTPforward, chairing the first ProgrammeBoard meeting in her first week of office.We are fortunate in having Sir BobKerslake (DCLG), Mark Lowcock (DFID)and Ian Watmore (ERG) as FTP Boardmembers. In his new role as Head of theCivil Service, Sir Bob is taking forwardcivil service reform (see feature, page12). As part of this reform programme,Mark and Ian lead on improvingmanagement systems and processes, sowe are well positioned to ensure the FTPremains a high priority.A number of significant FTPmilestones were achieved during 2011.The new corporate governance codesets out the role of <strong>Government</strong> Non-Executives, bringing senior externalexpertise and challenge at departmentalboard level. And, recognising that goodFM is not just for finance, all SCS arenow required to have their performanceassessed against at least one finance orefficiency objective. Visible changes likethis play an important part in drivingforward a culture in which FM matters.Transparency, and accountability toParliament and the public, helps drivebetter financial performance bygovernment. After years of planning, theMain Estimates for 2011-12, presentedIan WatmoreJustine GreeningChloe Smithto Parliament in April, were prepared forthe first time using the new ‘Clear Lineof Sight’ (CLOS) framework. By aligningseveral previous spending frameworks,CLOS means a simpler system fordepartments to operate and allows forimproved scrutiny and accountability ofgovernment expenditure. Last year alsosaw publication of the Whole of<strong>Government</strong> Accounts – a massiveachievement – the UK’s first auditedconsolidated set of public sector financialstatements, covering the whole of UKcentral government, local governmentand public corporations, around 1,500public bodies.We are making real progress on‘Project Oscar’, which aims to replacethe current COINS database by 2013,with the first phase going live thissummer. We are working with IBM todeliver a robust, user-friendly system thatsupports us in freeing up time to focuson value adding activities, rather thandata quality <strong>issue</strong>s, complex reportingand extensive manual reconciliations.The <strong>Treasury</strong> and Cabinet Office are alsoworking together to improvemanagement information more broadlyacross government.These achievements come as a resultof the hard work and cooperation ofpeople across many departments.Members of the <strong>Finance</strong> LeadershipGroup (FLG) – DGs <strong>Finance</strong> from thelargest departments – are working with<strong>Treasury</strong> and Cabinet Office colleaguesto drive forward these vital systems andprocess improvements.We are also focusing on howdepartments are working to improvetheir own FM. The FTP Board and FLGthought long and hard about what FTPsuccess would look like and articulatedthis in the FTP ‘Vision Grid’ (see the GFPwebsite). Each of the 17 main centralgovernment departments was asked,earlier this year, to tell us how their FMimprovement initiatives would help todeliver the <strong>Finance</strong> TransformationProgramme. We now have a wealth ofdata to help us determine where we canfine-tune our efforts to work acrossgovernment to support better FM, andalso identify where there are outstandingexamples of best practice that can beshared more widely. I will update you onour progress in the next edition of<strong>Gasette</strong>.• Lindsey Fussell is Director of Financial Managementand Reporting, <strong>HM</strong>T, and <strong>Finance</strong> TransformationProgramme Director24 theGASETTEspring 2012

• • • •

Working overseasAhmed Bashir tells <strong>Gasette</strong> of his experiences of working in Hong KongThe lureWHEN I FIRST decided to pursue acareer in accountancy – many years ago– I was told the CIMA qualificationwould open many doors for me. <strong>This</strong>was certainly true, but my firstinternational door opened recentlywhen I was offered the opportunity towork in Hong Kong for four months asthe Marketing Director for Asia Pacific &South Africa.My initial thoughts were, “What do Iknow about marketing?” But onedoesn’t need to know marketing insideout; rahter, you need a fair idea of whatit’s about and an understanding of whatpeople around you are saying. Thebottom line is always the financialimplications of whatever it is that youmust do. I was surprised that my linemanager understood this too andthought I was the best person for therole.Equipped with my CIMA qualificationand with previous experience in Policy,and having worked as the Head ofOperations for the Marketing Group, Ifelt equipped to take on the role. So Iaccepted, seeing it as a challenge. I usedthe opportunity to develop a newfinancial management process andfurther polished my communication andmanagement skills. I even learned tospeak some Cantonese!Adding international experience toyour CV is extremely valuable anddistinguishes you from otheraccountants in this very internationalof theorientworld. Apart from becoming an expertin chopstick use and expanding mynetworks I experienced Hong Kong’sculture and learned how business isdone there. For example, one of theearliest things I discovered was thewhole business card presentationceremony. A business card has to bepresented with both hands and Chineseside up, which meant I had to get myname translated into Chinese. So nowin some circles I’m known as ‘Pak ChiYin’.I must say I was shocked at how wellrecognised CIMA was out there. CIMAas a global qualification really does giveyou the edge overseas, as it is highlyrespected. CIMA joining forces withAICPA has added more value, too.Working in UKTI I tend to travel aroundthe globe regularly and find that being aCGMA really does indicate yourexpertise and professionalism.I’m a keen believer that the CIMAqualification is a tool that helps topropel you towards very senior positions– many CEOs have a CIMA background.To date, practical elements of the CIMAqualification, specifically TOPCIMA, haveheld me in good stead. These practicalelements are essential in turning anumber-cruncher into a managementperson where the numbers become themeans to informing decision making.Overall, the opportunity to workoverseas was one of the most rewardingexperiences in my career – it turned intothe adventure of a lifetime. I used myspare time to enjoy the beautiful islands,learn Wing Chun from the son of BruceLee’s teacher and also focus on gettingmy first book – Delicate Whispers –completed and published.• Ahmed Bashir is Head of Operations, Marketing andCommunications Group, UK Trade & Investment. He is aformer PQ magazine PQ of the Year winner26 theGASETTEspring 2012

Leaders In CentraL<strong>Government</strong> FInanCereCruItInG exPertIseWe’re one of the UK’s largest suppliers of staff to the public sector, and leadersin central government finance.With strong relationships across government departments, agencies and nondepartmental bodies and a team of 300 specialist public sector consultants weare experts at matching the right person with the right job.Our deep understanding of government finance means people trust us withtheir careers and departments trust us to find the right talent.For more information in how we can help you,contact Charlotte Pond on 020 7259 8712 oremail charlotte.pond@hays.comhays.co.uk

International standardsLET’S FACE IT, reform of governmentaccounting standards is hardly the sort ofsubject likely to garner intense interestfrom the mass media or voters. Today’s24:7 media cycle, as well as the intenseand immediate economic challengesfacing many countries around the world,could combine to push such an <strong>issue</strong> welldown the priority list of an electedofficial. But this would be a significantmistake.After all, you don’t need a degree inadvanced accountancy to understandthat governments should be able toaccount for what they own and owe.And as the shadow of recession onceagain threatens many countries in theWestern world, it is obvious that policymakersneed to be able to call onaccurate data giving a more completepicture of government as they seek toplot a course for recovery.Unfortunately, it is increasinglyaccepted that such complex financialchallenges have been made moredifficult to resolve because of manygovernments’ continued reliance onantiquated, cash-basis accountingsystems – the method in which income isrecorded when cash is received, andexpenses are recorded when cash is paidout. Such a system leaves questions,among others, over how much assets areworth and how much it costs to runpublic services.MINIMAL DISCLOSURESAgainst this background, theInternational Federation of Accountants(IFAC) recently recommended that thegovernments and public sectorinstitutions of the G20 nations shouldadopt accrual accounting, arguing that itis more capable of monitoringgovernment debt and liabilities in a waythat exposes their true economicimplications. Furthermore, the IFACnoted that many sovereign countriesprovide minimal disclosures relative towhat the public, banks, investors, andcredit providers expect of the privatesector.Ernst & Young recently conducted asurvey of 33 countries around the worldto gain an understanding of the currentstate of public sector accounting from aglobal perspective. <strong>This</strong> new research setsout what governments are doing well,and where there is scope forimprovement on the road ofharmonization.Toward transparency: A comparativestudy on the challenges of reporting forMakinggovernmentsaccountableDespite the obvious benefits, many governments remain gripped bya reluctance to adopt International Public Sector AccountingStandards, says Thomas Müller-Marqués Berger28 theGASETTEspring 2012