Precious Metals News 30th July 2011 - Celticgold

Precious Metals News 30th July 2011 - Celticgold

Precious Metals News 30th July 2011 - Celticgold

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Precious</strong> <strong>Metals</strong> <strong>News</strong> 30 th <strong>July</strong> <strong>2011</strong><br />

Hello and welcome to the first CELTICGOLD newsletter.<br />

This free information is designed to inform you with the latest news<br />

in the precious metals markets and help to preserve your wealth.<br />

Three to four times a month you’ll be informed about recent developments<br />

and in depth knowledge of the gold and silver markets. In addition<br />

to the in depth analysis, we also provide a bit of quirky stories about<br />

money.<br />

Each newsletter we will summarize the views from some of the top<br />

traders and technicians in the gold and silver market today.<br />

We hope you enjoy reading this first newsletter and find the information<br />

Helpful and educational – thank you for your time.<br />

All the best,<br />

Stefan Krämer<br />

Director CELTICGOLD<br />

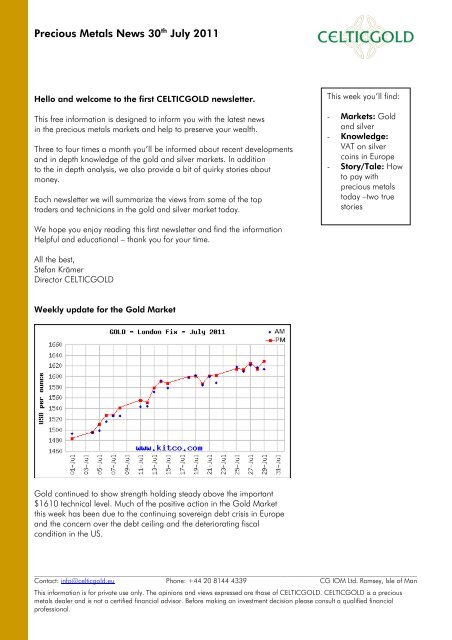

Weekly update for the Gold Market<br />

Gold continued to show strength holding steady above the important<br />

$1610 technical level. Much of the positive action in the Gold Market<br />

this week has been due to the continuing sovereign debt crisis in Europe<br />

and the concern over the debt ceiling and the deteriorating fiscal<br />

condition in the US.<br />

This week you’ll find:<br />

- Markets: Gold<br />

and silver<br />

- Knowledge:<br />

VAT on silver<br />

coins in Europe<br />

- Story/Tale: How<br />

to pay with<br />

precious metals<br />

today –two true<br />

stories<br />

________________________________________________________________________________________________________________<br />

Contact: info@celticgold.eu Phone: +44 20 8144 4339 CG IOM Ltd. Ramsey, Isle of Man<br />

This information is for private use only. The opinions and views expressed are those of CELTICGOLD. CELTICGOLD is a precious<br />

metals dealer and is not a certified financial advisor. Before making an investment decision please consult a qualified financial<br />

professional.

<strong>Precious</strong> <strong>Metals</strong> <strong>News</strong> 30 th <strong>July</strong> <strong>2011</strong><br />

The fact that Gold is exhibiting such strength during the summer season,<br />

which is typically the slow season for the yellow metal is a very bullish<br />

sign for a possible major move up in the coming weeks and months. The<br />

next technical support level on the upside for Gold is the $1665-1675<br />

level. However we may have resistance as gold approaches the $1650<br />

level. (Source for technical indicators: www.jsmineset.com)<br />

According to trader Dan Norcini who writes on Jim Sinclair’s site we<br />

could see a pull back to as low as $1525 if we have some positive news<br />

come out of both the US and Europe as far as the debt situation is<br />

concerned. Should that happen a major buying opportunity would occur<br />

in our opinion. We expect that Gold price could move up rapidly in the<br />

fall months as the debt situation worsens in the US and in Europe.<br />

Our view at Celtic Gold is that regardless of what the Gold price does in<br />

the coming weeks do not sell any of your core physical metal. Continue<br />

to add to your holdings should we get a dip in price. We believe that the<br />

Gold bull market has much further to run. We will do our best to help<br />

you navigate the market and identify the best time to add to your<br />

positions.<br />

Update on the Silver Market<br />

Silver prices tend to be more volatile than Gold and therefore harder to<br />

forecast short term price movements. However the same factors driving<br />

Gold prices higher are also driving Silver prices higher.<br />

Silver has outperformed Gold during <strong>July</strong> and has shown strong<br />

resilience holding above $40/ounce. Keep in mind that should we have<br />

________________________________________________________________________________________________________________<br />

Contact: info@celticgold.eu Phone: +44 20 8144 4339 CG IOM Ltd. Ramsey, Isle of Man<br />

This information is for private use only. The opinions and views expressed are those of CELTICGOLD. CELTICGOLD is a precious<br />

metals dealer and is not a certified financial advisor. Before making an investment decision please consult a qualified financial<br />

professional.

<strong>Precious</strong> <strong>Metals</strong> <strong>News</strong> 30 th <strong>July</strong> <strong>2011</strong><br />

some weakness in the Gold price in the month of August, Silver will likely<br />

decline more than Gold in percentage terms.<br />

Silver investors should not panic if this occurs as the long term<br />

fundamentals are just as strong if not stronger than the Gold market.<br />

Just as with Gold, should we have a bit of a pull back in Silver during<br />

August this would be a buying opportunity in our opinion.<br />

We will likely see much action in the Gold and Silver markets next week<br />

as the debt ceiling issue in the US comes to a head.<br />

Knowledge: VAT on silver coins<br />

In the old days, silver and gold was equally used as legal tender. But<br />

that got changed in 1800’s by the British government.<br />

If you wish to buy silver, you can choose between bars and coins. Mostly<br />

in Europe governments charge a value added tax (VAT) on coins and<br />

bars.<br />

There has been an ongoing discussion between silver dealers in Ireland<br />

and the Irish Revenue. The question was: Are silver coins with a face<br />

value officially legal tender subject to VAT?<br />

Irish Revenue stated: Legal tender coins in use are not subject to VAT.<br />

Legal tender coins ‘in use’ means the Euro coins that we use in daily life.<br />

All traded pure silver coins are therefore not legal tender. This includes<br />

all of the most popular silver coins sold in Europe, such as the Vienna<br />

Philharmoniker, the Canadian Maple Leaf, the American Eagle and the<br />

Australian Kookaburra. (See table to the right)<br />

We have thoroughly researched the VAT situation in Ireland when<br />

customers started to buy silver coins. On March 29 th <strong>2011</strong> the Irish<br />

Revenue clarified the vat on silver coins.<br />

For more information click on link below:<br />

Source: http://www.revenue.ie/en/tax/vat/rates/decision-detail-<br />

01692.jsp<br />

VAT rates on silver<br />

coins and bars in<br />

Europe:<br />

Austria 20%<br />

Belgium 21%<br />

Denmark 25%<br />

France 19.6%<br />

Germany 7%<br />

Italy 20%<br />

Ireland 21%<br />

Luxembourg 15%<br />

Netherlands 19%<br />

Spain 18%<br />

United<br />

Kingdom 20%<br />

1oz Maple Leaf silver<br />

coin – traded at 33.00<br />

EUR incl. 7% VAT.<br />

________________________________________________________________________________________________________________<br />

Contact: info@celticgold.eu Phone: +44 20 8144 4339 CG IOM Ltd. Ramsey, Isle of Man<br />

This information is for private use only. The opinions and views expressed are those of CELTICGOLD. CELTICGOLD is a precious<br />

metals dealer and is not a certified financial advisor. Before making an investment decision please consult a qualified financial<br />

professional.

<strong>Precious</strong> <strong>Metals</strong> <strong>News</strong> 30 th <strong>July</strong> <strong>2011</strong><br />

What can you do if you would like to buy silver coins but your<br />

country has a high VAT rate?<br />

1. You buy through a country that does not charge VAT on coins<br />

such as United States of America, Canada and Switzerland<br />

If you buy in one of the above countries and keep it stored there,<br />

you will not be charged VAT on coins. However if you ship your<br />

coins out of one of these countries you’ll need to pay a VAT to<br />

the country you ship to. Another option is to fly into one of these<br />

countries, buy the coins below 10,000 EUR (or US$, or CHF)<br />

and bring them back personally without declaring.<br />

Please check the Carry-on allowances with your airline when<br />

carrying silver for 10K.<br />

2. You buy through a European country that has the lowest VAT<br />

rate on silver coins – in this case Germany.<br />

For everyone who would like to own silver coins, <strong>Celticgold</strong><br />

partners with ‘pro/cent Inc.’ a German company. pro/cent is<br />

also run and owned by myself.<br />

There are two ways that we help you to own silver at the lowest<br />

VAT rate in Europe:<br />

- We process your order through pro/cent and your coins are<br />

stored in a fully insured high security vault in Germany.<br />

- pro/cent processes your order and you either take delivery in<br />

Germany and personally transport the coins to your home<br />

country or you hire a reputable curier service which we can help<br />

you identify who then transports the coins directly to you.<br />

You’ll find current silver prices on our celticgold website<br />

including 7% VAT. However prices do not include shipping fees.<br />

Please call us for more details.<br />

2010 15 EUR Silver<br />

coin ‚Horse’<br />

The price of this<br />

Centralbank coin costs<br />

36 EUR and weighs<br />

28.28 gram with a<br />

purity of 925/1,000<br />

Current silver prices @<br />

www.kitco.com<br />

The 1oz (31.1 gram)<br />

Vienna Philharmoniker<br />

What subject or<br />

theme are you interested?<br />

Please let us know and<br />

we are happy to answer<br />

in one of the next<br />

newsletters.<br />

________________________________________________________________________________________________________________<br />

Contact: info@celticgold.eu Phone: +44 20 8144 4339 CG IOM Ltd. Ramsey, Isle of Man<br />

This information is for private use only. The opinions and views expressed are those of CELTICGOLD. CELTICGOLD is a precious<br />

metals dealer and is not a certified financial advisor. Before making an investment decision please consult a qualified financial<br />

professional.

<strong>Precious</strong> <strong>Metals</strong> <strong>News</strong> 30 th <strong>July</strong> <strong>2011</strong><br />

Why is the EURO silver coin sold without VAT and is it a good<br />

value?<br />

As investors we’re interested in buying coins that are very close to the<br />

current silver price. Historically coins issued from central banks are over<br />

priced for the amount of pure silver you’re receiving per coin.<br />

Although these coins are classified as ‘collectors coins’ and are therefore<br />

not legal tender, central banks do not charge a VAT on these coins.<br />

The market price for these coins are traded at a 30% premium over the<br />

spot price of silver. In comparison, the 1oz Philharmoniker silver coin<br />

(see in box right) will typically trade for only 8 to 10% over spot. If you<br />

include VAT you’re still receiving a much better value on your<br />

investment.<br />

On the funny side of things: How to pay with<br />

precious metals – today!<br />

Many clients that invest in precious metals ask: How can I use my silver-<br />

or gold as money?<br />

Here are two fun stories:<br />

I have been travelling in and out of Ireland for over two years and have<br />

fell in love with Kinsale. While in Kinsale I needed to get a haircut.<br />

Usually I avoid going to the hairdresser for weeks and weeks and then I<br />

look a bit unkempt and hairs growing everywhere. One night at the<br />

Spaniard, I met Fintan the local ‘maitre de hair’ and booked an<br />

appointment.<br />

A bit short in cash I asked him if it would be possible to pay in silver and<br />

he was very interested. So I showed up with an 1oz Vienna<br />

Philharmoniker silver coin that was trading at that time for 28 EUR and<br />

we shook hands - two haircuts for one ounce of silver.<br />

Well, that was in December last year and I still have one free haircut –<br />

Kinsale I’m coming ☺.<br />

A female friend of mine also needed a haircut and we all know girls are<br />

a bit more expensive than us boys, so she rocked up with 1 gram of<br />

pure 24K gold.<br />

Always worth a visit:<br />

Fintan Lynch in Kinsale<br />

+353 (0)21 477-3900<br />

Write us your quirky<br />

story about money to:<br />

info@celticgold.eu<br />

If we publish your story<br />

you receive one of our<br />

cute and cuddly<br />

celticgold keyring<br />

teddys<br />

________________________________________________________________________________________________________________<br />

Contact: info@celticgold.eu Phone: +44 20 8144 4339 CG IOM Ltd. Ramsey, Isle of Man<br />

This information is for private use only. The opinions and views expressed are those of CELTICGOLD. CELTICGOLD is a precious<br />

metals dealer and is not a certified financial advisor. Before making an investment decision please consult a qualified financial<br />

professional.

<strong>Precious</strong> <strong>Metals</strong> <strong>News</strong> 30 th <strong>July</strong> <strong>2011</strong><br />

Now that sounds really precious and it is, but one gram of gold is tiny,<br />

about the size of a 1 cent Euro coin. At the time of the appointment she<br />

easily could pay with the 1 gram gold bar and our friend Fintan was<br />

happy with his new assets.<br />

Since December prices have gone up about 20+%, so that gives him a<br />

lovely tip.<br />

If you would like to have a bit of fun and try this out for yourself, we<br />

have 1 gram gold bars available for sale.<br />

* We strongly advise you hold your core gold and silver positions for the<br />

long term.<br />

<strong>Celticgold</strong>: Our take on the financial markets<br />

We at celticgold believe that a stratospheric rise of gold and silver<br />

happens in the next few years. Government bailouts, billions and trillions<br />

of dollars and euros of budget deficits at the expense of the taxpayer<br />

and massive money printing by central banks will result in a collapse of<br />

the major currencies.<br />

We at celticgold believe that one of the few ways to protect your wealth<br />

from the coming economic chaos is through physical ownership of the<br />

precious metals.<br />

Preview for next<br />

week:<br />

Knowledge: Storage<br />

Options – Pros and<br />

Cons of the different<br />

options<br />

Story/Tale:<br />

Euros4Gold – What’s<br />

behind it?<br />

________________________________________________________________________________________________________________<br />

Contact: info@celticgold.eu Phone: +44 20 8144 4339 CG IOM Ltd. Ramsey, Isle of Man<br />

This information is for private use only. The opinions and views expressed are those of CELTICGOLD. CELTICGOLD is a precious<br />

metals dealer and is not a certified financial advisor. Before making an investment decision please consult a qualified financial<br />

professional.