You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Legal eagle<br />

relationship, and professional advice will provide<br />

you with options and understanding.<br />

A living together agreement can record what<br />

you both intend to put in financially, how you<br />

live together, who is responsible for what and<br />

ultimately who takes out what in the event of<br />

separation.<br />

Advertorial<br />

Getting Married<br />

People continue to get married and to many it<br />

remains the ultimate promise to make. Couples<br />

are marrying later in life; in some cases more<br />

than once, and it can often mean that they bring<br />

"baggage" with them – the physical results of what<br />

can be years of hard work.<br />

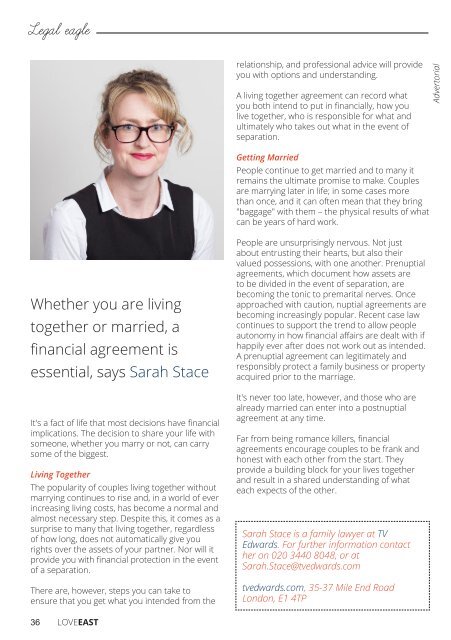

Whether you are living<br />

together or married, a<br />

financial agreement is<br />

essential, says Sarah Stace<br />

It's a fact of life that most decisions have financial<br />

implications. The decision to share your life with<br />

someone, whether you marry or not, can carry<br />

some of the biggest.<br />

Living Together<br />

The popularity of couples living together without<br />

marrying continues to rise and, in a world of ever<br />

increasing living costs, has become a normal and<br />

almost necessary step. Despite this, it comes as a<br />

surprise to many that living together, regardless<br />

of how long, does not automatically give you<br />

rights over the assets of your partner. Nor will it<br />

provide you with financial protection in the event<br />

of a separation.<br />

There are, however, steps you can take to<br />

ensure that you get what you intended from the<br />

People are unsurprisingly nervous. Not just<br />

about entrusting their hearts, but also their<br />

valued possessions, with one another. Prenuptial<br />

agreements, which document how assets are<br />

to be divided in the event of separation, are<br />

becoming the tonic to premarital nerves. Once<br />

approached with caution, nuptial agreements are<br />

becoming increasingly popular. Recent case law<br />

continues to support the trend to allow people<br />

autonomy in how financial affairs are dealt with if<br />

happily ever after does not work out as intended.<br />

A prenuptial agreement can legitimately and<br />

responsibly protect a family business or property<br />

acquired prior to the marriage.<br />

It's never too late, however, and those who are<br />

already married can enter into a postnuptial<br />

agreement at any time.<br />

Far from being romance killers, financial<br />

agreements encourage couples to be frank and<br />

honest with each other from the start. They<br />

provide a building block for your lives together<br />

and result in a shared understanding of what<br />

each expects of the other.<br />

Sarah Stace is a family lawyer at TV<br />

Edwards. For further information contact<br />

her on 020 3440 8048, or at<br />

Sarah.Stace@tvedwards.com<br />

tvedwards.com, 35-37 Mile End Road<br />

London, E1 4TP<br />

36 LOVEEAST