Pharmaceutical Royalties in Licensing Deals - PharmaVentures Ltd

Pharmaceutical Royalties in Licensing Deals - PharmaVentures Ltd

Pharmaceutical Royalties in Licensing Deals - PharmaVentures Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Pharmaceutical</strong> Industry - No Place for the 25% Rule of Thumb<br />

agreed. Add to that the fact that some royalty rates exist well <strong>in</strong> excess of 25% of sales; the<br />

rule of thumb would seem to be of little use <strong>in</strong> def<strong>in</strong><strong>in</strong>g a suitable outcome.<br />

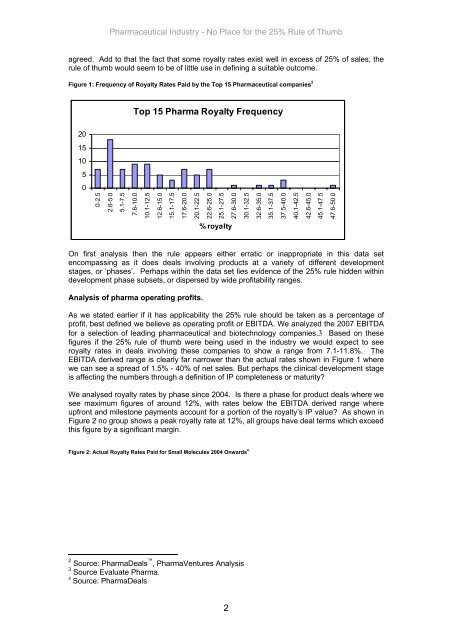

Figure 1: Frequency of Royalty Rates Paid by the Top 15 <strong>Pharmaceutical</strong> companies 2<br />

20<br />

15<br />

10<br />

5<br />

0<br />

0-2.5<br />

2.6-5.0<br />

5.1-7.5<br />

Top 15 Pharma Royalty Frequency<br />

7.6-10.0<br />

10.1-12.5<br />

12.6-15.0<br />

15.1-17.5<br />

17.6-20.0<br />

20.1-22.5<br />

22.6-25.0<br />

25.1-27.5<br />

% royalty<br />

On first analysis then the rule appears either erratic or <strong>in</strong>appropriate <strong>in</strong> this data set<br />

encompass<strong>in</strong>g as it does deals <strong>in</strong>volv<strong>in</strong>g products at a variety of different development<br />

stages, or ‘phases’. Perhaps with<strong>in</strong> the data set lies evidence of the 25% rule hidden with<strong>in</strong><br />

development phase subsets, or dispersed by wide profitability ranges.<br />

Analysis of pharma operat<strong>in</strong>g profits.<br />

As we stated earlier if it has applicability the 25% rule should be taken as a percentage of<br />

profit, best def<strong>in</strong>ed we believe as operat<strong>in</strong>g profit or EBITDA. We analyzed the 2007 EBITDA<br />

for a selection of lead<strong>in</strong>g pharmaceutical and biotechnology companies.3 Based on these<br />

figures if the 25% rule of thumb were be<strong>in</strong>g used <strong>in</strong> the <strong>in</strong>dustry we would expect to see<br />

royalty rates <strong>in</strong> deals <strong>in</strong>volv<strong>in</strong>g these companies to show a range from 7.1-11.8%. The<br />

EBITDA derived range is clearly far narrower than the actual rates shown <strong>in</strong> Figure 1 where<br />

we can see a spread of 1.5% - 40% of net sales. But perhaps the cl<strong>in</strong>ical development stage<br />

is affect<strong>in</strong>g the numbers through a def<strong>in</strong>ition of IP completeness or maturity?<br />

We analysed royalty rates by phase s<strong>in</strong>ce 2004. Is there a phase for product deals where we<br />

see maximum figures of around 12%, with rates below the EBITDA derived range where<br />

upfront and milestone payments account for a portion of the royalty’s IP value? As shown <strong>in</strong><br />

Figure 2 no group shows a peak royalty rate at 12%, all groups have deal terms which exceed<br />

this figure by a significant marg<strong>in</strong>.<br />

Figure 2: Actual Royalty Rates Paid for Small Molecules 2004 Onwards 4<br />

2 Source: Pharma<strong>Deals</strong> , <strong>PharmaVentures</strong> Analysis<br />

3 Source Evaluate Pharma.<br />

4 Source: Pharma<strong>Deals</strong><br />

2<br />

27.6-30.0<br />

30.1-32.5<br />

32.6-35.0<br />

35.1-37.5<br />

37.5-40.0<br />

40.1-42.5<br />

42.6-45.0<br />

45.1-47.5<br />

47.6-50.0