samir saul2 sz.pub - Faculty of Social Sciences - McMaster University

samir saul2 sz.pub - Faculty of Social Sciences - McMaster University

samir saul2 sz.pub - Faculty of Social Sciences - McMaster University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Page 12 Globalization Working Papers 06/2<br />

Zealand (1984); the Netherlands (1986); Denmark (1988); France (1989); Austria, Finland, Norway,<br />

and Sweden (1989-1990); Belgium, Ireland, and Luxembourg (1990); Portugal and Spain (1993);<br />

Greece (1994); and Iceland (1995) (Eichengreen and Mussa 1998, 35-6; IMF 1992, 6-7). At the end<br />

<strong>of</strong> 1986, the United Kingdom permitted foreign financial firms to enter the domestic securities market;<br />

other countries did likewise. Regulatory burdens were lightened; fees and charges reduced. Financial<br />

markets were increasingly liberalized, deregulated, and integrated in a worldwide network. Financial<br />

institutions were allowed an expanded range <strong>of</strong> activities. Simultaneously, distinctions between banks<br />

and non-banks faded. Moreover, the multiplication <strong>of</strong> financial instruments provided new means <strong>of</strong><br />

conducting transactions and moving capital. Substantial pooled savings and other financial resources<br />

in the hands <strong>of</strong> institutional investors found new outlets.<br />

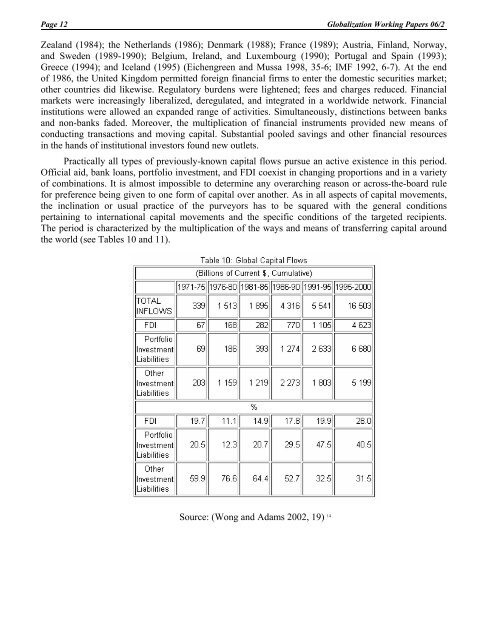

Practically all types <strong>of</strong> previously-known capital flows pursue an active existence in this period.<br />

Official aid, bank loans, portfolio investment, and FDI coexist in changing proportions and in a variety<br />

<strong>of</strong> combinations. It is almost impossible to determine any overarching reason or across-the-board rule<br />

for preference being given to one form <strong>of</strong> capital over another. As in all aspects <strong>of</strong> capital movements,<br />

the inclination or usual practice <strong>of</strong> the purveyors has to be squared with the general conditions<br />

pertaining to international capital movements and the specific conditions <strong>of</strong> the targeted recipients.<br />

The period is characterized by the multiplication <strong>of</strong> the ways and means <strong>of</strong> transferring capital around<br />

the world (see Tables 10 and 11).<br />

Source: (Wong and Adams 2002, 19) 14