DR. WILHELM BINDER IMPRESSIONS OF A ... - Kendrion

DR. WILHELM BINDER IMPRESSIONS OF A ... - Kendrion

DR. WILHELM BINDER IMPRESSIONS OF A ... - Kendrion

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

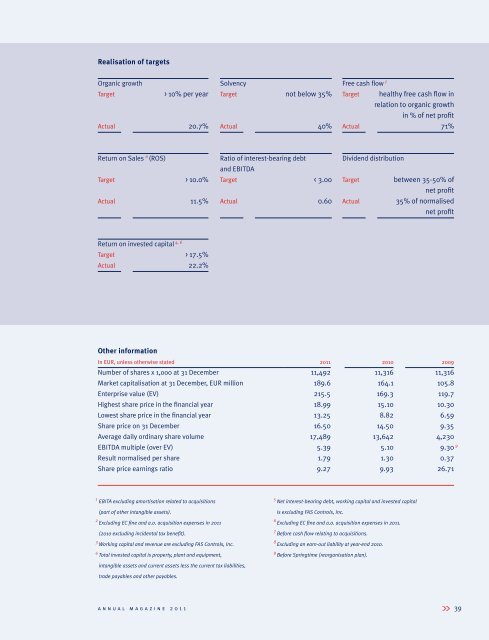

Realisation of targets<br />

Organic growth<br />

Target > 10% per year<br />

Actual 20.7%<br />

Return on Sales 6 (ROS)<br />

Target > 10.0%<br />

Actual 11.5%<br />

4, 6<br />

Return on invested capital<br />

Target > 17.5%<br />

Actual 22.2%<br />

Other information<br />

In EUR, unless otherwise stated 2011 2010 2009<br />

Number of shares x 1,000 at 31 December 11,492 11,316 11,316<br />

Market capitalisation at 31 December, EUR million 189.6 164.1 105.8<br />

Enterprise value (EV) 215.5 169.3 119.7<br />

Highest share price in the fi nancial year 18.99 15.10 10.30<br />

Lowest share price in the fi nancial year 13.25 8.82 6.59<br />

Share price on 31 December 16.50 14.50 9.35<br />

Average daily ordinary share volume 17,489 13,642 4,230<br />

EBITDA multiple (over EV) 5.39 5.10 9 9.30<br />

Result normalised per share 1.79 1.30 0.37<br />

Share price earnings ratio 9.27 9.93 26.71<br />

1<br />

EBITA excluding amortisation related to acquisitions<br />

(part of other intangible assets).<br />

2<br />

Excluding EC fi ne and a.o. acquisition expenses in 2011<br />

(2010 excluding incidental tax benefi t).<br />

Solvency<br />

3 Working capital and revenue are excluding FAS Controls, Inc.<br />

4<br />

Total invested capital is property, plant and equipment,<br />

intangible assets and current assets less the current tax liabilities,<br />

trade payables and other payables.<br />

Target not below 35%<br />

Actual 40%<br />

Ratio of interest-bearing debt<br />

and EBITDA<br />

Target < 3.00<br />

Actual 0.60<br />

Free cash fl ow 7<br />

5<br />

Net interest-bearing debt, working capital and invested capital<br />

is excluding FAS Controls, Inc.<br />

6<br />

Excluding EC fi ne and a.o. acquisition expenses in 2011.<br />

7 Before cash fl ow relating to acquisitions.<br />

8 Excluding an earn-out liability at year-end 2010.<br />

9 Before Springtime (reorganisation plan).<br />

Target healthy free cash fl ow in<br />

relation to organic growth<br />

in % of net profi t<br />

Actual 71%<br />

Dividend distribution<br />

Target between 35-50% of<br />

net profi t<br />

Actual 35% of normalised<br />

net profi t<br />

annual magazine 2011 >> 39