ELECTRONIC SALES SUPPRESSION: A THREAT TO TAX REVENUES

ELECTRONIC SALES SUPPRESSION: A THREAT TO TAX REVENUES

ELECTRONIC SALES SUPPRESSION: A THREAT TO TAX REVENUES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

40 – ANNEX. FISCAL TILLS AND CERTIFIED POS SYSTEMS<br />

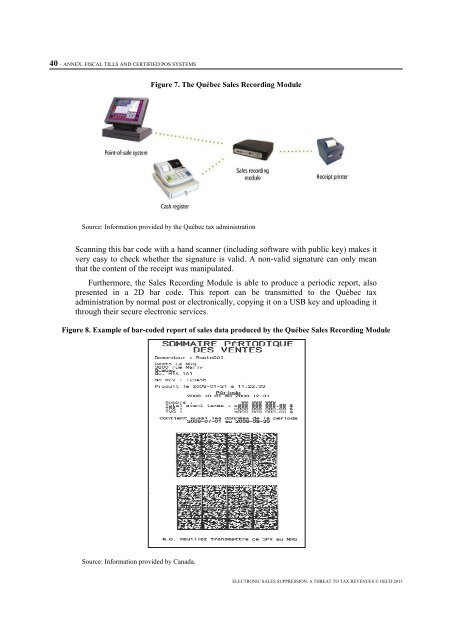

Figure 7. The Québec Sales Recording Module<br />

Source: Information provided by the Québec tax administration<br />

Scanning this bar code with a hand scanner (including software with public key) makes it<br />

very easy to check whether the signature is valid. A non-valid signature can only mean<br />

that the content of the receipt was manipulated.<br />

Furthermore, the Sales Recording Module is able to produce a periodic report, also<br />

presented in a 2D bar code. This report can be transmitted to the Québec tax<br />

administration by normal post or electronically, copying it on a USB key and uploading it<br />

through their secure electronic services.<br />

Figure 8. Example of bar-coded report of sales data produced by the Québec Sales Recording Module<br />

Source: Information provided by Canada.<br />

<strong>ELECTRONIC</strong> <strong>SALES</strong> <strong>SUPPRESSION</strong>: A <strong>THREAT</strong> <strong>TO</strong> <strong>TAX</strong> <strong>REVENUES</strong> © OECD 2013