2008 Annual Report - MiTAC International

2008 Annual Report - MiTAC International

2008 Annual Report - MiTAC International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

the price is subject to adjustment based on the net asset value of that division on the<br />

acquisition date. As of April 6, 2009, the Company, SSDL and SSDL’s subsidiary had<br />

paid US$35,352 in advance for this purchase. Regarding the net asset value, discussions<br />

are still ongoing.<br />

2) The Company decided to participate in the private placement of Loyalty Founder<br />

Enterprise Co., Ltd. and subscribe for 60,000,000 shares issued through the private<br />

placement in the amount of $150,000, with a subscription price of NT$2.5 (in dollars) per<br />

share. Therefore, the Company will hold 25.24% equity interest in Loyalty Founder<br />

Enterprise Co., Ltd. after this subscription. As of April 6, 2009, the Company had paid<br />

$80,000 for the share subscription.<br />

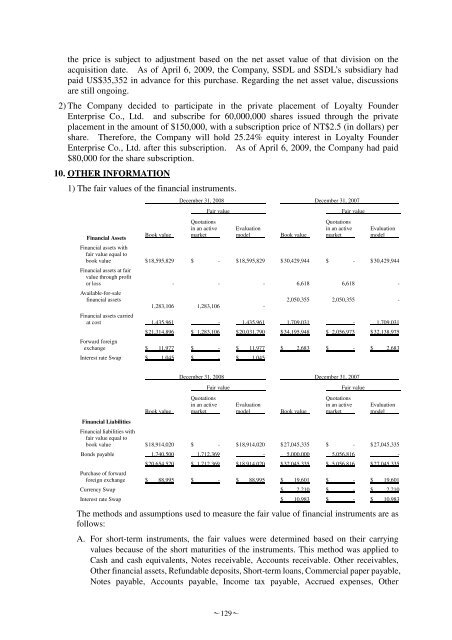

10. OTHER INFORMATION<br />

1) The fair values of the financial instruments.<br />

Financial Assets<br />

Financial assets with<br />

fair value equal to<br />

book value<br />

Financial assets at fair<br />

value through profit<br />

or loss<br />

Available-for-sale<br />

financial assets<br />

Financial assets carried<br />

at cost<br />

Forward foreign<br />

exchange<br />

Book value<br />

$ 18,595,829<br />

-<br />

1,283,106<br />

1,435,961<br />

December 31, <strong>2008</strong> December 31, 2007<br />

Quotations<br />

in an active<br />

market<br />

$ -<br />

Fair value Fair value<br />

-<br />

1,283,106<br />

-<br />

129<br />

Evaluation<br />

model<br />

$ 18,595,829<br />

-<br />

-<br />

1,435,961<br />

Book value<br />

$ 30,429,944<br />

6,618<br />

2,050,355<br />

1,709,031<br />

Quotations<br />

in an active<br />

market<br />

$ -<br />

6,618<br />

2,050,355<br />

-<br />

Evaluation<br />

model<br />

$ 30,429,944<br />

-<br />

-<br />

1,709,031<br />

$ 21,314,896 $ 1,283,106 $ 20,031,790 $ 34,195,948 $ 2,056,973 $ 32,138,975<br />

$ 11,977<br />

$ -<br />

$ 11,977<br />

Interest rate Swap $ 1,045 $ - $ 1,045<br />

Financial Liabilities<br />

Financial liabilities with<br />

fair value equal to<br />

book value<br />

Book value<br />

$ 18,914,020<br />

$ 2,683<br />

$ -<br />

December 31, <strong>2008</strong> December 31, 2007<br />

Quotations<br />

in an active<br />

market<br />

$ -<br />

Fair value Fair value<br />

Evaluation<br />

model<br />

$ 18,914,020<br />

Book value<br />

$ 27,045,335<br />

Quotations<br />

in an active<br />

market<br />

$ -<br />

$ 2,683<br />

Evaluation<br />

model<br />

$ 27,045,335<br />

Bonds payable 1,740,500 1,712,369 - 5,000,000 5,056,816 -<br />

Purchase of forward<br />

foreign exchange<br />

$ 20,654,520 $ 1,712,369 $ 18,914,020 $ 32,045,335 $ 5,056,816 $ 27,045,335<br />

$ 88,995<br />

$ -<br />

$ 88,995<br />

$ 19,601<br />

$ -<br />

$ 19,601<br />

Currency Swap $ 2,210 $ - $ 2,210<br />

Interest rate Swap $ 10,983 $ - $ 10,983<br />

The methods and assumptions used to measure the fair value of financial instruments are as<br />

follows:<br />

A. For short-term instruments, the fair values were determined based on their carrying<br />

values because of the short maturities of the instruments. This method was applied to<br />

Cash and cash equivalents, Notes receivable, Accounts receivable. Other receivables,<br />

Other financial assets, Refundable deposits, Short-term loans, Commercial paper payable,<br />

Notes payable, Accounts payable, Income tax payable, Accrued expenses, Other