Login to Trade - Demo - Reliance Securities

Login to Trade - Demo - Reliance Securities

Login to Trade - Demo - Reliance Securities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

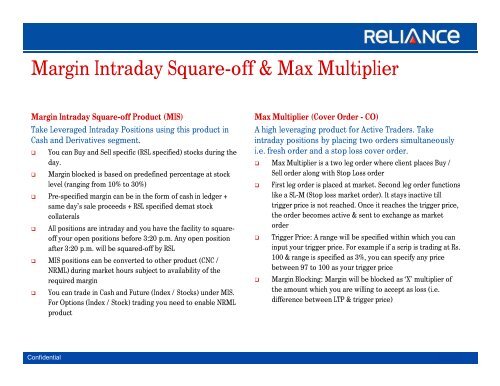

Margin Intraday Square-off & Max Multiplier<br />

Margin Intraday Square-off Product (MIS)<br />

Take Leveraged Intraday Positions using this product in<br />

Cash and Derivatives segment.<br />

You can Buy and Sell specific (RSL specified) s<strong>to</strong>cks during the<br />

day.<br />

Margin blocked is based on predefined percentage at s<strong>to</strong>ck<br />

level (ranging from 10% <strong>to</strong> 30%)<br />

Pre-specified margin can be in the form of cash in ledger +<br />

same day’s sale proceeds + RSL specified demat s<strong>to</strong>ck<br />

collaterals<br />

All positions are intraday and you have the facility <strong>to</strong> squareoff<br />

your open positions before 3:20 p.m. Any open position<br />

after 3:20 p.m. will be squared-off by RSL<br />

MIS positions can be converted <strong>to</strong> other product (CNC /<br />

NRML) during market hours subject <strong>to</strong> availability of the<br />

required margin<br />

You can trade in Cash and Future (Index / S<strong>to</strong>cks) under MIS.<br />

For Options (Index / S<strong>to</strong>ck) trading you need <strong>to</strong> enable NRML<br />

product<br />

Max Multiplier (Cover Order - CO)<br />

A high leveraging product for Active <strong>Trade</strong>rs. Take<br />

intraday positions by placing two orders simultaneously<br />

i.e. fresh order and a s<strong>to</strong>p loss cover order.<br />

Max Multiplier is a two leg order where client places Buy /<br />

Sell order along with S<strong>to</strong>p Loss order<br />

First leg order is placed at market. Second leg order functions<br />

like a SL-M (S<strong>to</strong>p loss market order). It stays inactive till<br />

trigger price is not reached. Once it reaches the trigger price,<br />

the order becomes active & sent <strong>to</strong> exchange as market<br />

order<br />

Trigger Price: A range will be specified within which you can<br />

input your trigger price. For example if a scrip is trading at Rs.<br />

100 & range is specified as 3%, you can specify any price<br />

between 97 <strong>to</strong> 100 as your trigger price<br />

Margin Blocking: Margin will be blocked as ‘X’ multiplier of<br />

the amount which you are willing <strong>to</strong> accept as loss (i.e.<br />

difference between LTP & trigger price)<br />

Confidential Slide