Marlene Mitten Garnishment Manager Hewitt Associates

Marlene Mitten Garnishment Manager Hewitt Associates

Marlene Mitten Garnishment Manager Hewitt Associates

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

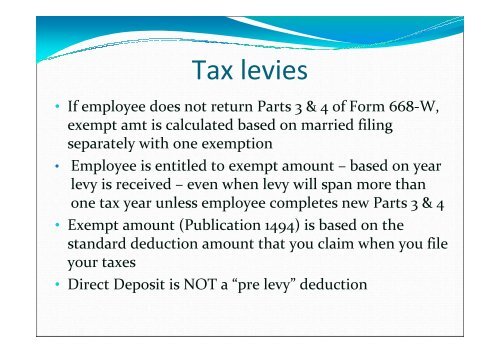

Tax levies<br />

• If employee does not return Parts 3 & 4 of Form 668-W,<br />

exempt amt is calculated based on married filing<br />

separately with one exemption<br />

• Employee is entitled to exempt amount – based on year<br />

levy is received – even when levy will span more than<br />

one tax year unless employee completes new Parts 3 & 4<br />

• Exempt amount (Publication 1494) is based on the<br />

standard deduction amount that you claim when you file<br />

your taxes<br />

• Direct Deposit is NOT a “pre levy” deduction