Untitled - Colombo Stock Exchange

Untitled - Colombo Stock Exchange

Untitled - Colombo Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

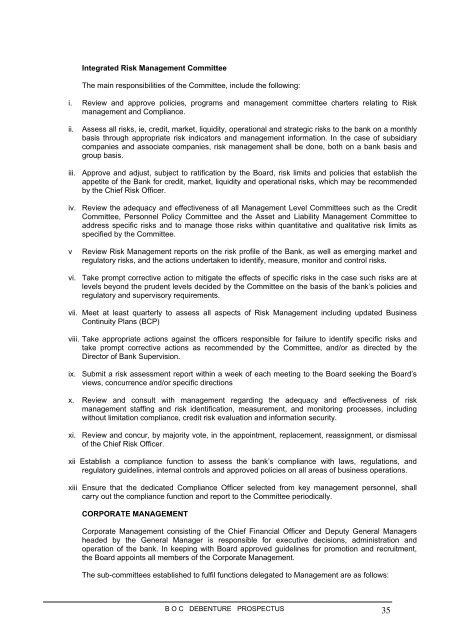

Integrated Risk Management Committee<br />

The main responsibilities of the Committee, include the following:<br />

i. Review and approve policies, programs and management committee charters relating to Risk<br />

management and Compliance.<br />

ii. Assess all risks, ie, credit, market, liquidity, operational and strategic risks to the bank on a monthly<br />

basis through appropriate risk indicators and management information. In the case of subsidiary<br />

companies and associate companies, risk management shall be done, both on a bank basis and<br />

group basis.<br />

iii. Approve and adjust, subject to ratification by the Board, risk limits and policies that establish the<br />

appetite of the Bank for credit, market, liquidity and operational risks, which may be recommended<br />

by the Chief Risk Officer.<br />

iv. Review the adequacy and effectiveness of all Management Level Committees such as the Credit<br />

Committee, Personnel Policy Committee and the Asset and Liability Management Committee to<br />

address specific risks and to manage those risks within quantitative and qualitative risk limits as<br />

specified by the Committee.<br />

v Review Risk Management reports on the risk profile of the Bank, as well as emerging market and<br />

regulatory risks, and the actions undertaken to identify, measure, monitor and control risks.<br />

vi. Take prompt corrective action to mitigate the effects of specific risks in the case such risks are at<br />

levels beyond the prudent levels decided by the Committee on the basis of the bank’s policies and<br />

regulatory and supervisory requirements.<br />

vii. Meet at least quarterly to assess all aspects of Risk Management including updated Business<br />

Continuity Plans (BCP)<br />

viii. Take appropriate actions against the officers responsible for failure to identify specific risks and<br />

take prompt corrective actions as recommended by the Committee, and/or as directed by the<br />

Director of Bank Supervision.<br />

ix. Submit a risk assessment report within a week of each meeting to the Board seeking the Board’s<br />

views, concurrence and/or specific directions<br />

x. Review and consult with management regarding the adequacy and effectiveness of risk<br />

management staffing and risk identification, measurement, and monitoring processes, including<br />

without limitation compliance, credit risk evaluation and information security.<br />

xi. Review and concur, by majority vote, in the appointment, replacement, reassignment, or dismissal<br />

of the Chief Risk Officer.<br />

xii Establish a compliance function to assess the bank’s compliance with laws, regulations, and<br />

regulatory guidelines, internal controls and approved policies on all areas of business operations.<br />

xiii Ensure that the dedicated Compliance Officer selected from key management personnel, shall<br />

carry out the compliance function and report to the Committee periodically.<br />

CORPORATE MANAGEMENT<br />

Corporate Management consisting of the Chief Financial Officer and Deputy General Managers<br />

headed by the General Manager is responsible for executive decisions, administration and<br />

operation of the bank. In keeping with Board approved guidelines for promotion and recruitment,<br />

the Board appoints all members of the Corporate Management.<br />

The sub-committees established to fulfil functions delegated to Management are as follows:<br />

B O C DEBENTURE PROSPECTUS 35