building a STRONGER foundation - Cemex

building a STRONGER foundation - Cemex

building a STRONGER foundation - Cemex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CEMEX, S.A.B. DE C.V. AND SUBSIDIARIES<br />

Notes to the Consolidated Financial Statements – (Continued)<br />

As of December 31, 2010, 2009 and 2008<br />

(Millions of Mexican pesos)<br />

CEMEX’s policy is to recognize interest and penalties related to unrecognized tax benefits as part of the income tax in the consolidated<br />

statements of operations. Final balance for interest and penalties accrued under MFRS and U.S. GAAP was Ps1,055 and Ps1,981,<br />

respectively, as of December 31, 2010, and was Ps1,108 under MFRS and Ps3,064 under U.S. GAAP as of December 31, 2009.<br />

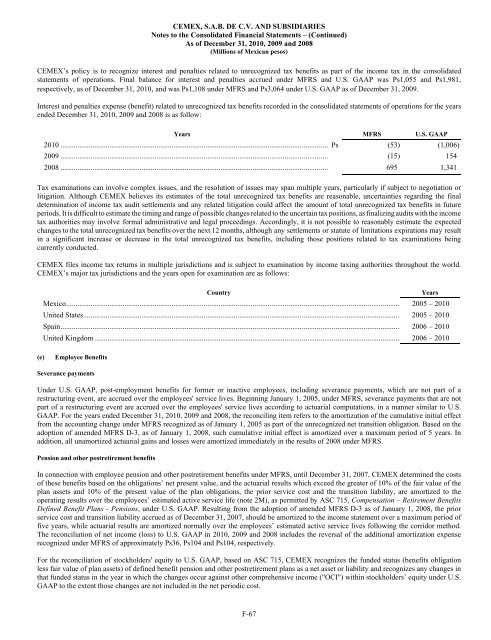

Interest and penalties expense (benefit) related to unrecognized tax benefits recorded in the consolidated statements of operations for the years<br />

ended December 31, 2010, 2009 and 2008 is as follow:<br />

Years MFRS U.S. GAAP<br />

2010 .............................................................................................................................................. Ps (53) (1,006)<br />

2009 .............................................................................................................................................. (15) 154<br />

2008 .............................................................................................................................................. 695 1,341<br />

Tax examinations can involve complex issues, and the resolution of issues may span multiple years, particularly if subject to negotiation or<br />

litigation. Although CEMEX believes its estimates of the total unrecognized tax benefits are reasonable, uncertainties regarding the final<br />

determination of income tax audit settlements and any related litigation could affect the amount of total unrecognized tax benefits in future<br />

periods. It is difficult to estimate the timing and range of possible changes related to the uncertain tax positions, as finalizing audits with the income<br />

tax authorities may involve formal administrative and legal proceedings. Accordingly, it is not possible to reasonably estimate the expected<br />

changes to the total unrecognized tax benefits over the next 12 months, although any settlements or statute of limitations expirations may result<br />

in a significant increase or decrease in the total unrecognized tax benefits, including those positions related to tax examinations being<br />

currently conducted.<br />

CEMEX files income tax returns in multiple jurisdictions and is subject to examination by income taxing authorities throughout the world.<br />

CEMEX’s major tax jurisdictions and the years open for examination are as follows:<br />

Country Years<br />

Mexico................................................................................................................................................................................. 2005 – 2010<br />

United States........................................................................................................................................................................ 2005 – 2010<br />

Spain.................................................................................................................................................................................... 2006 – 2010<br />

United Kingdom .................................................................................................................................................................. 2006 – 2010<br />

(e) Employee Benefits<br />

Severance payments<br />

Under U.S. GAAP, post-employment benefits for former or inactive employees, including severance payments, which are not part of a<br />

restructuring event, are accrued over the employees' service lives. Beginning January 1, 2005, under MFRS, severance payments that are not<br />

part of a restructuring event are accrued over the employees' service lives according to actuarial computations, in a manner similar to U.S.<br />

GAAP. For the years ended December 31, 2010, 2009 and 2008, the reconciling item refers to the amortization of the cumulative initial effect<br />

from the accounting change under MFRS recognized as of January 1, 2005 as part of the unrecognized net transition obligation. Based on the<br />

adoption of amended MFRS D-3, as of January 1, 2008, such cumulative initial effect is amortized over a maximum period of 5 years. In<br />

addition, all unamortized actuarial gains and losses were amortized immediately in the results of 2008 under MFRS.<br />

Pension and other postretirement benefits<br />

In connection with employee pension and other postretirement benefits under MFRS, until December 31, 2007, CEMEX determined the costs<br />

of these benefits based on the obligations’ net present value, and the actuarial results which exceed the greater of 10% of the fair value of the<br />

plan assets and 10% of the present value of the plan obligations, the prior service cost and the transition liability, are amortized to the<br />

operating results over the employees’ estimated active service life (note 2M), as permitted by ASC 715, Compensation – Retirement Benefits<br />

Defined Benefit Plans - Pensions, under U.S. GAAP. Resulting from the adoption of amended MFRS D-3 as of January 1, 2008, the prior<br />

service cost and transition liability accrued as of December 31, 2007, should be amortized to the income statement over a maximum period of<br />

five years, while actuarial results are amortized normally over the employees’ estimated active service lives following the corridor method.<br />

The reconciliation of net income (loss) to U.S. GAAP in 2010, 2009 and 2008 includes the reversal of the additional amortization expense<br />

recognized under MFRS of approximately Ps36, Ps104 and Ps104, respectively.<br />

For the reconciliation of stockholders' equity to U.S. GAAP, based on ASC 715, CEMEX recognizes the funded status (benefits obligation<br />

less fair value of plan assets) of defined benefit pension and other postretirement plans as a net asset or liability and recognizes any changes in<br />

that funded status in the year in which the changes occur against other comprehensive income ("OCI") within stockholders’ equity under U.S.<br />

GAAP to the extent those changes are not included in the net periodic cost.<br />

F-67