excise duty/tobacco

excise duty/tobacco

excise duty/tobacco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Taxation of <strong>tobacco</strong> products<br />

in the European Union<br />

Frank Van Driessche<br />

DG Taxation and Customs Union<br />

May 2006<br />

1

Legislation on taxation<br />

Directive 92/79/EEC (Approximation of taxes on<br />

cigarettes)<br />

Directive 92/80/EEC (Approximation of taxes on<br />

manufactured <strong>tobacco</strong> other than cigarettes)<br />

Directive 95/59/EEC (Taxes other than turnover<br />

taxes which affect the consumption of<br />

manufactured <strong>tobacco</strong>)<br />

Codification of the three Directives is in preparation<br />

2

Main objectives of legislation<br />

Improve the operation of the internal market:<br />

– Establish minimum <strong>excise</strong> duties<br />

– Approximate the structure of <strong>excise</strong> duties<br />

Prevent distortion of competition between<br />

different <strong>tobacco</strong> products<br />

Safeguard free determination of the<br />

maximum retail selling price<br />

NB No health policy objectives!<br />

3

Tobacco product categories<br />

Cigarettes (majority of market)<br />

Cigars and Cigarillos<br />

Smoking <strong>tobacco</strong><br />

– Fine-cut Fine cut <strong>tobacco</strong> for the rolling of cigarettes<br />

– other smoking <strong>tobacco</strong><br />

4

Taxation of Cigarettes<br />

5

tax<br />

Optional<br />

minimum<br />

<strong>duty</strong><br />

Structure of <strong>excise</strong> duties<br />

MPPC<br />

MPPC – Most Popular Price Category<br />

ad valorem<br />

<strong>duty</strong><br />

EU minimum <strong>duty</strong> (57% and €<br />

60/64 per 1000 of MPPC)<br />

specific<br />

<strong>duty</strong><br />

price<br />

National taxes:<br />

•Specific <strong>excise</strong> <strong>duty</strong><br />

•Ad valorem <strong>excise</strong> <strong>duty</strong><br />

•VAT<br />

6

Characteristics of EU taxation<br />

system of cigarettes<br />

Combination of ad valorem and specific <strong>duty</strong><br />

– Compromise between southern MS (producing<br />

raw <strong>tobacco</strong> and preferring ad valorem taxation)<br />

and northern MS (not producing raw <strong>tobacco</strong><br />

and preferring specific <strong>duty</strong>)<br />

– National brands of southern MS are produced<br />

with their own, cheaper, national <strong>tobacco</strong>. Ad<br />

valorem system favors these products over<br />

cigarettes of international brands, produced with<br />

more expensive <strong>tobacco</strong><br />

7

Taxation structure on<br />

cigarettes<br />

Excise <strong>duty</strong> on cigarettes must consist of a SPECIFIC and<br />

an AD VALOREM element<br />

– Specific:<br />

A fixed amount per 1000 cigarettes<br />

between 5% and 55% of total tax (<strong>excise</strong> + VAT)<br />

– Ad valorem:<br />

A percentage of Tax ax Inclusive nclusive Retail etail Selling elling Price rice<br />

(TIRSP)<br />

– The specific amount and the ad valorem % are<br />

applied to cigarettes of all price categories<br />

8

Minimum overall <strong>excise</strong> <strong>duty</strong> on<br />

cigarettes<br />

Minimum level of taxation<br />

– 57% of the TIRSP of cigarettes and<br />

– € 60 per 1000 cigarettes (€ ( 64 from 1/07/2006)<br />

– Both established by reference to MPPC<br />

(Most Popular Price Category)<br />

9

Derogations and transition periods<br />

MS with minimum <strong>excise</strong> <strong>duty</strong> of at least € 95/1000 (€ (<br />

101/1000 since 1/07/2006) for MPPC do not need to<br />

comply with 57% rule (Sweden, Denmark)<br />

Transition period for Greece and Spain: € 64 have to be<br />

reached by 1/1/2008 (though currently Greece has €<br />

78/1000 and Spain € 69/1000)<br />

Transition periods for the Czech Republic, Estonia,<br />

Hungary, Latvia, Lithuania, Poland, Slovakia and Slovenia:<br />

€ 64 have to be reached by 31/12/2007 – 31/12/2009<br />

Transition period for France: lower <strong>excise</strong> duties can be<br />

levied to cigarettes for Corsica until 31/12/2009<br />

10

Optional minimum <strong>excise</strong> <strong>duty</strong><br />

Legal basis<br />

– Article 16(5) of 95/59/EEC (cigarettes)<br />

Requirements:<br />

– Applied to cigarettes sold at price lower than<br />

MPPC<br />

– Cannot exceed the <strong>excise</strong> <strong>duty</strong> levied on MPPC<br />

17 MS introduced a minimum <strong>excise</strong> <strong>duty</strong> on<br />

cigarettes<br />

11

Example (pack of 20)<br />

Pre tax price (excluding taxes) 0.7 EUR<br />

TIRSP EUR<br />

Excise <strong>duty</strong><br />

- Specific: 1 EUR<br />

- Ad valorem: 0.8 EUR (27% of TIRSP)<br />

- Total: 1.8 EUR (60% of TIRSP)<br />

____________<br />

Price excluding VAT 2.5 EUR<br />

VAT 20% 0.5 EUR<br />

____________<br />

TIRSP (including taxes) 3 EUR<br />

Notes: - Total tax (<strong>excise</strong> + VAT) = 2.3 EUR or 77% of TIRSP<br />

12

Tax and TIRSP differentials in MS (I)<br />

After the enlargement, the differentials have<br />

widened (EU15: 1/4, EU25: 1/7)<br />

Resulting from differences in:<br />

– Pre-tax Pre tax prices (depending on purchasing power)<br />

and retail margins<br />

– Excise <strong>duty</strong> rates<br />

– Structure of <strong>excise</strong> duties<br />

– VAT (15-25%) (15 25%) on <strong>tobacco</strong> products (multiplier effect)<br />

13

Average pre-tax pre tax prices in 2004 in<br />

100,00<br />

90,00<br />

80,00<br />

70,00<br />

60,00<br />

50,00<br />

40,00<br />

30,00<br />

20,00<br />

10,00<br />

0,00<br />

Aus tria<br />

Belgium<br />

C yp rus<br />

EUR/1000<br />

C zech Republi<br />

Denmark<br />

Estonia<br />

Finland<br />

France<br />

G ermany<br />

G reece<br />

Hungary<br />

Ireland<br />

Italy<br />

Latvia<br />

Lithuania<br />

Luxembourg<br />

Malta<br />

Netherlands<br />

Poland<br />

Portugal<br />

Slovak R epub li<br />

Slove nia<br />

Spain<br />

Sweden U K<br />

14

Relationship between PPS, pre-tax pre tax<br />

PPS<br />

250,00<br />

200,00<br />

150,00<br />

100,00<br />

50,00<br />

0,00<br />

Austria<br />

Belgium<br />

Cyp rus<br />

Czech Republic<br />

Denmark<br />

prices and TIRSP<br />

Purchase Pow er Standard Average TIRSP in EUR Average pre-tax price in EUR<br />

Estonia<br />

Finland<br />

France<br />

Germany<br />

Greece<br />

Hungary<br />

Ireland<br />

Italy<br />

Latvia<br />

Lithuania<br />

Luxembourg<br />

Malta<br />

Netherlands<br />

Poland<br />

Portugal<br />

Slova k Republic<br />

Slovenia<br />

Spain<br />

Sweden<br />

UK<br />

350,00<br />

300,00<br />

250,00<br />

200,00<br />

150,00<br />

100,00<br />

50,00<br />

0,00<br />

TIRSP and pre-tax price in EUR<br />

15

Tax and TIRSP differentials in MS (I)<br />

After the enlargement, the differentials have<br />

widened (EU15: 1/4, EU25: 1/7)<br />

Resulting from differences in:<br />

– Pre-tax Pre tax prices (depending on purchasing power) and retail margins<br />

– Excise <strong>duty</strong> rates<br />

– Structure of <strong>excise</strong> duties<br />

– VAT (15-25%) (15 25%) on <strong>tobacco</strong> products (multiplier effect)<br />

16

Excise <strong>duty</strong> rates in MS (on MPPC)<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Excise tax incidence on MPPC<br />

Jan 2005 (% of MPPC)<br />

64% 63% 62% 62% 61% 61% 59% 59% 59% 58% 58% 58% 57% 57% 57% 57%<br />

55% 54% 54%<br />

52%<br />

50%<br />

46% 46% 45% 45%<br />

F UK D P IRL M CY A I E B FIN GR L SI NL DK PL H EST S SK LT LV CZ<br />

57%<br />

2<br />

17

Average <strong>excise</strong> <strong>duty</strong> rates in MS<br />

Average %<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Average % of <strong>excise</strong> duties in TIRSP<br />

LV<br />

LT<br />

CZ<br />

SE<br />

SK<br />

EE<br />

HU<br />

PL<br />

AU<br />

DK<br />

SI<br />

NL<br />

BE<br />

LU<br />

ES<br />

CY<br />

IT<br />

FI<br />

MT<br />

EL<br />

IE<br />

DE<br />

PT<br />

FR<br />

UK<br />

EU Member States<br />

18

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

221<br />

Excise <strong>duty</strong> rates in MS (in<br />

191<br />

160<br />

127<br />

115 114 110 106 105 103<br />

EUR/1000)<br />

Excise tax yield on MPPC<br />

Jan 2005 (Euro/000)<br />

88<br />

85<br />

82<br />

78 78<br />

74<br />

61<br />

50<br />

46<br />

40<br />

33 31 30<br />

64 Euro / 000<br />

20 19 17<br />

UK IRL F D FIN DK M S NL B A CY I L GR P E SI H SK PL CZ EST LT BLG RO LV<br />

13<br />

3<br />

19

Tax and TIRSP differentials in MS (I)<br />

After the enlargement, the differentials have<br />

widened (EU15: 1/4, EU25: 1/7)<br />

Resulting from differences in:<br />

– Pre-tax Pre tax prices (depending on purchasing power) and retail margins<br />

– Excise <strong>duty</strong> rates<br />

– Structure of <strong>excise</strong> duties<br />

– VAT (15-25%) (15 25%) on <strong>tobacco</strong> products (multiplier effect)<br />

20

Tax and TIRSP differentials in MS (I)<br />

After the enlargement, the differentials have<br />

widened (EU15: 1/4, EU25: 1/7)<br />

Resulting from differences in:<br />

– Pre-tax Pre tax prices (depending on purchasing power) and retail margins<br />

– Excise <strong>duty</strong> rates<br />

– Structure of <strong>excise</strong> duties<br />

– VAT (15-25%) (15 25%) on <strong>tobacco</strong> products (multiplier<br />

effect)<br />

22

Total tax yield (including VAT)<br />

280<br />

260<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

273<br />

Total tax yield (<strong>excise</strong> and VAT) on MPPC<br />

Jan 2005 (EUR/000)<br />

245<br />

201<br />

156 155<br />

151 148<br />

137<br />

134 133<br />

113<br />

105 103<br />

98 96 93<br />

VAT<br />

Excise tax yield<br />

UK IRL F DK D FIN S M NL B A I CY GR L P E SI H SK PL CZ EST LT LV<br />

75<br />

65 62<br />

54<br />

44 42<br />

38<br />

27<br />

18<br />

4<br />

23

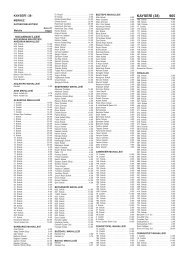

TIRSP differentials in MS<br />

€6.25<br />

€6.98<br />

Retail selling price MPPC<br />

€5.00<br />

Jan 2005 (EUR/20)<br />

€3.68<br />

€3.56<br />

€2.72<br />

€3.82<br />

€8.08<br />

€4.17<br />

€4.11<br />

€2.40<br />

€2.10<br />

€2.80<br />

€1.39<br />

€3.00<br />

€1.75<br />

€1.84<br />

€4.26<br />

€0.51<br />

€3. 61<br />

€1.21<br />

€1.75<br />

€ 0.43<br />

€1.69<br />

€0.38<br />

€0.79 €0.47<br />

€2.70<br />

€4.00<br />

€0.90<br />

€1.15<br />

€0.60<br />

€0.51<br />

€0.37<br />

€0.67<br />

€0.43<br />

€2.87<br />

24<br />

6

Tax and RSP differentials in MS (II)<br />

Consequences:<br />

– Increased cross border shopping<br />

– Contraband<br />

Countries affected:<br />

– France, UK, Germany (inflow from low taxing<br />

MS)<br />

– Low taxing MS (inflow from Romania, Russia,<br />

Belarus, Ukraine)<br />

25

Taxation of other <strong>tobacco</strong><br />

products<br />

26

Tobacco product categories<br />

Cigarettes (majority of market)<br />

Cigars and Cigarillos<br />

Smoking <strong>tobacco</strong><br />

– Fine-cut Fine cut <strong>tobacco</strong> for the rolling of cigarettes<br />

– other smoking <strong>tobacco</strong><br />

27

Cigars and<br />

cigarillos<br />

Fine-cut<br />

<strong>tobacco</strong><br />

Other<br />

smoking<br />

<strong>tobacco</strong><br />

Minimum level of taxation<br />

Ad valorem<br />

<strong>duty</strong> (% of max<br />

TIRSP)<br />

OR<br />

Specific <strong>duty</strong><br />

(per kg or per<br />

number of<br />

items)<br />

OR<br />

A mixture of<br />

both<br />

5% of TIRSP or € 11 per 1000<br />

items or per kg<br />

36% of TIRSP or € 32 per kg<br />

20% of the TIRSP or € 20 per kg<br />

28

Derogation<br />

Transition period for France: lower <strong>excise</strong><br />

duties can be levied to <strong>tobacco</strong> products for<br />

Corsica until 31/12/2009<br />

29

Optional minimum <strong>excise</strong> <strong>duty</strong><br />

Legal basis<br />

– Article 3 of Directive 92/80 (other <strong>tobacco</strong><br />

goods)<br />

Requirements:<br />

– Applied only in cases where the structure of<br />

<strong>excise</strong> duties is either ad valorem or mixed<br />

30

Recent changes and future<br />

plans<br />

31

Thank you for your attention!<br />

32