An Overview of An Agreement of Purchase and Sale ... - McMillan

An Overview of An Agreement of Purchase and Sale ... - McMillan

An Overview of An Agreement of Purchase and Sale ... - McMillan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

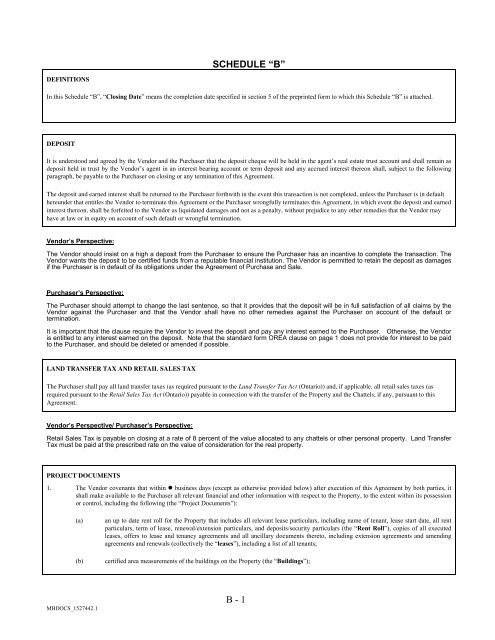

DEFINITIONS<br />

MBDOCS_1527442.1<br />

SCHEDULE “B”<br />

In this Schedule “B”, “Closing Date” means the completion date specified in section 5 <strong>of</strong> the preprinted form to which this Schedule “B” is attached.<br />

DEPOSIT<br />

It is understood <strong>and</strong> agreed by the Vendor <strong>and</strong> the <strong>Purchase</strong>r that the deposit cheque will be held in the agent’s real estate trust account <strong>and</strong> shall remain as<br />

deposit held in trust by the Vendor’s agent in an interest bearing account or term deposit <strong>and</strong> any accrued interest thereon shall, subject to the following<br />

paragraph, be payable to the <strong>Purchase</strong>r on closing or any termination <strong>of</strong> this <strong>Agreement</strong>.<br />

The deposit <strong>and</strong> earned interest shall be returned to the <strong>Purchase</strong>r forthwith in the event this transaction is not completed, unless the <strong>Purchase</strong>r is in default<br />

hereunder that entitles the Vendor to terminate this <strong>Agreement</strong> or the <strong>Purchase</strong>r wrongfully terminates this <strong>Agreement</strong>, in which event the deposit <strong>and</strong> earned<br />

interest thereon, shall be forfeited to the Vendor as liquidated damages <strong>and</strong> not as a penalty, without prejudice to any other remedies that the Vendor may<br />

have at law or in equity on account <strong>of</strong> such default or wrongful termination.<br />

Vendor’s Perspective:<br />

The Vendor should insist on a high a deposit from the <strong>Purchase</strong>r to ensure the <strong>Purchase</strong>r has an incentive to complete the transaction. The<br />

Vendor wants the deposit to be certified funds from a reputable financial institution. The Vendor is permitted to retain the deposit as damages<br />

if the <strong>Purchase</strong>r is in default <strong>of</strong> its obligations under the <strong>Agreement</strong> <strong>of</strong> <strong>Purchase</strong> <strong>and</strong> <strong>Sale</strong>.<br />

<strong>Purchase</strong>r’s Perspective:<br />

The <strong>Purchase</strong>r should attempt to change the last sentence, so that it provides that the deposit will be in full satisfaction <strong>of</strong> all claims by the<br />

Vendor against the <strong>Purchase</strong>r <strong>and</strong> that the Vendor shall have no other remedies against the <strong>Purchase</strong>r on account <strong>of</strong> the default or<br />

termination.<br />

It is important that the clause require the Vendor to invest the deposit <strong>and</strong> pay any interest earned to the <strong>Purchase</strong>r. Otherwise, the Vendor<br />

is entitled to any interest earned on the deposit. Note that the st<strong>and</strong>ard form OREA clause on page 1 does not provide for interest to be paid<br />

to the <strong>Purchase</strong>r, <strong>and</strong> should be deleted or amended if possible.<br />

LAND TRANSFER TAX AND RETAIL SALES TAX<br />

The <strong>Purchase</strong>r shall pay all l<strong>and</strong> transfer taxes (as required pursuant to the L<strong>and</strong> Transfer Tax Act (Ontario)) <strong>and</strong>, if applicable, all retail sales taxes (as<br />

required pursuant to the Retail <strong>Sale</strong>s Tax Act (Ontario)) payable in connection with the transfer <strong>of</strong> the Property <strong>and</strong> the Chattels, if any, pursuant to this<br />

<strong>Agreement</strong>.<br />

Vendor’s Perspective/ <strong>Purchase</strong>r’s Perspective:<br />

Retail <strong>Sale</strong>s Tax is payable on closing at a rate <strong>of</strong> 8 percent <strong>of</strong> the value allocated to any chattels or other personal property. L<strong>and</strong> Transfer<br />

Tax must be paid at the prescribed rate on the value <strong>of</strong> consideration for the real property.<br />

PROJECT DOCUMENTS<br />

1. The Vendor covenants that within business days (except as otherwise provided below) after execution <strong>of</strong> this <strong>Agreement</strong> by both parties, it<br />

shall make available to the <strong>Purchase</strong>r all relevant financial <strong>and</strong> other information with respect to the Property, to the extent within its possession<br />

or control, including the following (the “Project Documents”):<br />

(a) an up to date rent roll for the Property that includes all relevant lease particulars, including name <strong>of</strong> tenant, lease start date, all rent<br />

particulars, term <strong>of</strong> lease, renewal/extension particulars, <strong>and</strong> deposits/security particulars (the “Rent Roll”), copies <strong>of</strong> all executed<br />

leases, <strong>of</strong>fers to lease <strong>and</strong> tenancy agreements <strong>and</strong> all ancillary documents thereto, including extension agreements <strong>and</strong> amending<br />

agreements <strong>and</strong> renewals (collectively the “leases”), including a list <strong>of</strong> all tenants;<br />

(b) certified area measurements <strong>of</strong> the buildings on the Property (the “Buildings”);<br />

B - 1