Box Spreads of Equity Index options on Futures as a ... - CME Group

Box Spreads of Equity Index options on Futures as a ... - CME Group

Box Spreads of Equity Index options on Futures as a ... - CME Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

cmegroup.com<br />

This article discusses the potential<br />

for using Opti<strong>on</strong>s <str<strong>on</strong>g>Box</str<strong>on</strong>g> Strategies <strong>as</strong> a<br />

collateralized lending and borrowing<br />

alternative – and some advantages<br />

they may <str<strong>on</strong>g>of</str<strong>on</strong>g>fer over a term repo<br />

arrangement.<br />

With a myriad <str<strong>on</strong>g>of</str<strong>on</strong>g> expirati<strong>on</strong>s and strike listings from which to choose,<br />

market participants can <str<strong>on</strong>g>of</str<strong>on</strong>g>ten utilize index opti<strong>on</strong> products to engineer<br />

very interesting financial soluti<strong>on</strong>s. In this short article, we highlight the<br />

possibility <str<strong>on</strong>g>of</str<strong>on</strong>g> using <str<strong>on</strong>g>Index</str<strong>on</strong>g> Opti<strong>on</strong> <str<strong>on</strong>g>Box</str<strong>on</strong>g> <str<strong>on</strong>g>Spreads</str<strong>on</strong>g> to simulate collateralized<br />

lending and borrowing.<br />

opti<strong>on</strong> <str<strong>on</strong>g>Box</str<strong>on</strong>g> <str<strong>on</strong>g>Spreads</str<strong>on</strong>g><br />

An opti<strong>on</strong> box spread c<strong>on</strong>sists <str<strong>on</strong>g>of</str<strong>on</strong>g> four individual opti<strong>on</strong> positi<strong>on</strong>s, or “legs.”<br />

Using the <strong>CME</strong> <strong>Group</strong> European-style End-<str<strong>on</strong>g>of</str<strong>on</strong>g>-M<strong>on</strong>th (EOM) <str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g> <strong>on</strong> S&P<br />

500 futures <strong>as</strong> an example, we can c<strong>on</strong>sider the following combinati<strong>on</strong>, with all<br />

<str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g> expiring at the end <str<strong>on</strong>g>of</str<strong>on</strong>g> September 2008:<br />

L<strong>on</strong>g Short<br />

Call Struck at 500 Put Struck at 500<br />

Put Struck at 2,500 Call Struck at 2,500<br />

Notice that, <strong>as</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> this writing (early August 2008), the two l<strong>on</strong>g <str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g><br />

positi<strong>on</strong>s are “deep in the m<strong>on</strong>ey,” where<strong>as</strong> the two short positi<strong>on</strong>s are<br />

deep out <str<strong>on</strong>g>of</str<strong>on</strong>g> the m<strong>on</strong>ey. More interestingly, regardless <str<strong>on</strong>g>of</str<strong>on</strong>g> the price <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

underlying futures at the expirati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> these <str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g>, this combinati<strong>on</strong> will<br />

always generate a payout <str<strong>on</strong>g>of</str<strong>on</strong>g> 2,000 index points, 1 or $500,000. As such, the<br />

box spread behaves like a discount instrument, with the premium priced<br />

at the net present value <str<strong>on</strong>g>of</str<strong>on</strong>g> the 2,000-point pay<str<strong>on</strong>g>of</str<strong>on</strong>g>f. Effectively, the trade is<br />

equivalent to lending out $500,000 for the period corresp<strong>on</strong>ding to the<br />

remaining life <str<strong>on</strong>g>of</str<strong>on</strong>g> the <str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g> c<strong>on</strong>tracts.<br />

<str<strong>on</strong>g>Box</str<strong>on</strong>g> Spread <strong>as</strong> Collateralized Lending<br />

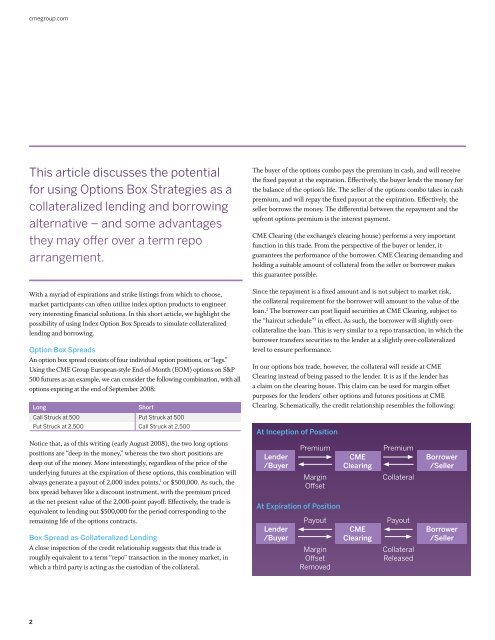

A close inspecti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the credit relati<strong>on</strong>ship suggests that this trade is<br />

roughly equivalent to a term “repo” transacti<strong>on</strong> in the m<strong>on</strong>ey market, in<br />

which a third party is acting <strong>as</strong> the custodian <str<strong>on</strong>g>of</str<strong>on</strong>g> the collateral.<br />

2<br />

The buyer <str<strong>on</strong>g>of</str<strong>on</strong>g> the <str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g> combo pays the premium in c<strong>as</strong>h, and will receive<br />

the fixed payout at the expirati<strong>on</strong>. Effectively, the buyer lends the m<strong>on</strong>ey for<br />

the balance <str<strong>on</strong>g>of</str<strong>on</strong>g> the opti<strong>on</strong>’s life. The seller <str<strong>on</strong>g>of</str<strong>on</strong>g> the <str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g> combo takes in c<strong>as</strong>h<br />

premium, and will repay the fixed payout at the expirati<strong>on</strong>. Effectively, the<br />

seller borrows the m<strong>on</strong>ey. The differential between the repayment and the<br />

upfr<strong>on</strong>t <str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g> premium is the interest payment.<br />

<strong>CME</strong> Clearing (the exchange’s clearing house) performs a very important<br />

functi<strong>on</strong> in this trade. From the perspective <str<strong>on</strong>g>of</str<strong>on</strong>g> the buyer or lender, it<br />

guarantees the performance <str<strong>on</strong>g>of</str<strong>on</strong>g> the borrower. <strong>CME</strong> Clearing demanding and<br />

holding a suitable amount <str<strong>on</strong>g>of</str<strong>on</strong>g> collateral from the seller or borrower makes<br />

this guarantee possible.<br />

Since the repayment is a fixed amount and is not subject to market risk,<br />

the collateral requirement for the borrower will amount to the value <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

loan. 2 The borrower can post liquid securities at <strong>CME</strong> Clearing, subject to<br />

the “haircut schedule” 3 in effect. As such, the borrower will slightly overcollateralize<br />

the loan. This is very similar to a repo transacti<strong>on</strong>, in which the<br />

borrower transfers securities to the lender at a slightly over-collateralized<br />

level to ensure performance.<br />

In our <str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g> box trade, however, the collateral will reside at <strong>CME</strong><br />

Clearing instead <str<strong>on</strong>g>of</str<strong>on</strong>g> being p<strong>as</strong>sed to the lender. It is <strong>as</strong> if the lender h<strong>as</strong><br />

a claim <strong>on</strong> the clearing house. This claim can be used for margin <str<strong>on</strong>g>of</str<strong>on</strong>g>fset<br />

purposes for the lenders’ other <str<strong>on</strong>g>opti<strong>on</strong>s</str<strong>on</strong>g> and futures positi<strong>on</strong>s at <strong>CME</strong><br />

Clearing. Schematically, the credit relati<strong>on</strong>ship resembles the following:<br />

At Incepti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> positi<strong>on</strong><br />

Lender<br />

/Buyer<br />

Premium<br />

Margin<br />

Offset<br />

At Expirati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> positi<strong>on</strong><br />

Lender<br />

/Buyer<br />

Payout<br />

Margin<br />

Offset<br />

Removed<br />

<strong>CME</strong><br />

Clearing<br />

<strong>CME</strong><br />

Clearing<br />

Premium<br />

Collateral<br />

Payout<br />

Collateral<br />

Rele<strong>as</strong>ed<br />

Borrower<br />

/Seller<br />

Borrower<br />

/Seller