NEBA0007-A4 2011 Annual Report.indd - Netball WA

NEBA0007-A4 2011 Annual Report.indd - Netball WA

NEBA0007-A4 2011 Annual Report.indd - Netball WA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

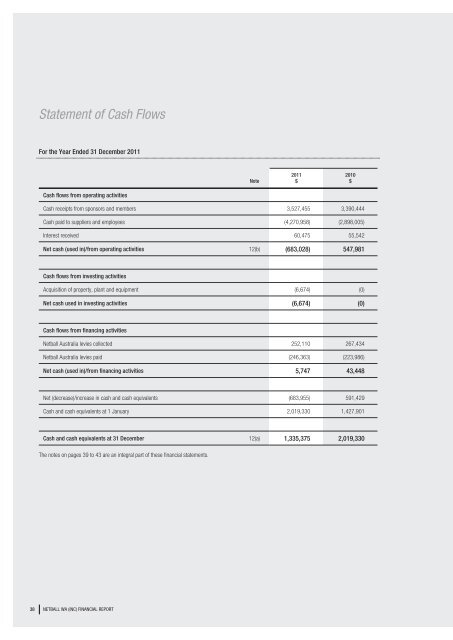

Statement of Cash Flows Notes to the Financial Statements<br />

For the Year Ended 31 December <strong>2011</strong><br />

Cash fl ows from operating activities<br />

Cash receipts from sponsors and members 3,527,455 3,390,444<br />

Cash paid to suppliers and employees (4,270,958) (2,898,005)<br />

Interest received 60,475 55,542<br />

Net cash (used in)/from operating activities 12(b) (683,028) 547,981<br />

Cash fl ows from investing activities<br />

Acquisition of property, plant and equipment (6,674) (0)<br />

Net cash used in investing activities (6,674) (0)<br />

Cash fl ows from fi nancing activities<br />

<strong>Netball</strong> Australia levies collected 252,110 267,434<br />

<strong>Netball</strong> Australia levies paid (246,363) (223,986)<br />

Net cash (used in)/from fi nancing activities 5,747 43,448<br />

Net (decrease)/increase in cash and cash equivalents (683,955) 591,429<br />

Cash and cash equivalents at 1 January 2,019,330 1,427,901<br />

Cash and cash equivalents at 31 December 12(a) 1,335,375 2,019,330<br />

The notes on pages 39 to 43 are an integral part of these fi nancial statements.<br />

38 NETBALL <strong>WA</strong> (INC) FINANCIAL REPORT<br />

Note<br />

<strong>2011</strong><br />

$<br />

2010<br />

$<br />

For the Year Ended 31 December <strong>2011</strong><br />

Note 1: Statement of Signifi cant Accounting Policies<br />

This fi nancial report is a special purpose fi nancial report prepared in order to<br />

satisfy the fi nancial reporting requirements of the Association’s Constitution.<br />

The Board has determined that the Association is not a reporting entity.<br />

The fi nancial report has been prepared in accordance with the requirements<br />

of the following Australian Accounting Standards:<br />

ASSB 1031: Materiality<br />

No other Australian Accounting Standards, other authoritative pronouncements<br />

of the Australian Accounting Standards Board have been applied.<br />

The fi nancial report has been prepared on an accruals basis and is based<br />

on historic costs and does not take into account changing money values,<br />

or except where specifi cally stated, current valuations of non-current assets.<br />

The following specifi c accounting policies, which are consistent with the<br />

previous period unless otherwise stated, have been adopted in the preparation<br />

of this fi nancial report.<br />

(a) Income Tax<br />

No provision for income tax has been raised as the Association is exempt from<br />

income tax.<br />

(b) Plant and equipment<br />

Items of plant and equipment are measured at cost less<br />

accumulated depreciation.<br />

When parts of an item of plant and equipment have different useful lives, they<br />

are accounted for as separate items.<br />

Gains and losses on disposal of an item of plant and equipment are determined<br />

by comparing the proceeds from disposal with the carrying amount of plant and<br />

equipment and are recognised net within “other income” in profi t or loss.<br />

Depreciation<br />

Depreciation is recognised in profi t or loss on a straightline and<br />

diminishing basis over the estimated useful lives of each part of an item<br />

of plant and equipment.<br />

The estimated useful lives for the current and comparative periods are<br />

as follows:<br />

<strong>2011</strong> 2010<br />

Plant and Equipment 3 years 3 years<br />

Depreciation methods, useful lives and residual values are reviewed at each<br />

reporting date.<br />

NETBALL <strong>WA</strong> (INC) FINANCIAL REPORT<br />

39