Annual Report 99/00 - InvestorInfo

Annual Report 99/00 - InvestorInfo

Annual Report 99/00 - InvestorInfo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

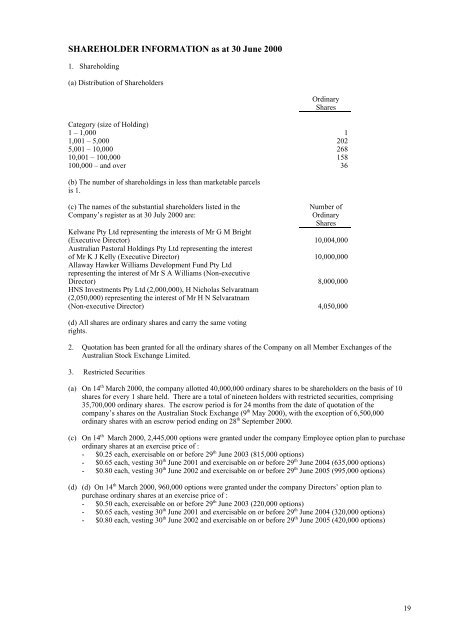

SHAREHOLDER INFORMATION as at 30 June 2<strong>00</strong>0<br />

1. Shareholding<br />

(a) Distribution of Shareholders<br />

Ordinary<br />

Shares<br />

Category (size of Holding)<br />

1 – 1,<strong>00</strong>0 1<br />

1,<strong>00</strong>1 – 5,<strong>00</strong>0 202<br />

5,<strong>00</strong>1 – 10,<strong>00</strong>0 268<br />

10,<strong>00</strong>1 – 1<strong>00</strong>,<strong>00</strong>0 158<br />

1<strong>00</strong>,<strong>00</strong>0 – and over 36<br />

(b) The number of shareholdings in less than marketable parcels<br />

is 1.<br />

(c) The names of the substantial shareholders listed in the<br />

Company’s register as at 30 July 2<strong>00</strong>0 are:<br />

Number of<br />

Ordinary<br />

Shares<br />

Kelwane Pty Ltd representing the interests of Mr G M Bright<br />

(Executive Director) 10,<strong>00</strong>4,<strong>00</strong>0<br />

Australian Pastoral Holdings Pty Ltd representing the interest<br />

of Mr K J Kelly (Executive Director) 10,<strong>00</strong>0,<strong>00</strong>0<br />

Allaway Hawker Williams Development Fund Pty Ltd<br />

representing the interest of Mr S A Williams (Non-executive<br />

Director) 8,<strong>00</strong>0,<strong>00</strong>0<br />

HNS Investments Pty Ltd (2,<strong>00</strong>0,<strong>00</strong>0), H Nicholas Selvaratnam<br />

(2,050,<strong>00</strong>0) representing the interest of Mr H N Selvaratnam<br />

(Non-executive Director) 4,050,<strong>00</strong>0<br />

(d) All shares are ordinary shares and carry the same voting<br />

rights.<br />

2. Quotation has been granted for all the ordinary shares of the Company on all Member Exchanges of the<br />

Australian Stock Exchange Limited.<br />

3. Restricted Securities<br />

(a) On 14 th March 2<strong>00</strong>0, the company allotted 40,<strong>00</strong>0,<strong>00</strong>0 ordinary shares to be shareholders on the basis of 10<br />

shares for every 1 share held. There are a total of nineteen holders with restricted securities, comprising<br />

35,7<strong>00</strong>,<strong>00</strong>0 ordinary shares. The escrow period is for 24 months from the date of quotation of the<br />

company’s shares on the Australian Stock Exchange (9 th May 2<strong>00</strong>0), with the exception of 6,5<strong>00</strong>,<strong>00</strong>0<br />

ordinary shares with an escrow period ending on 28 th September 2<strong>00</strong>0.<br />

(c) On 14 th March 2<strong>00</strong>0, 2,445,<strong>00</strong>0 options were granted under the company Employee option plan to purchase<br />

ordinary shares at an exercise price of :<br />

- $0.25 each, exercisable on or before 29 th June 2<strong>00</strong>3 (815,<strong>00</strong>0 options)<br />

- $0.65 each, vesting 30 th June 2<strong>00</strong>1 and exercisable on or before 29 th June 2<strong>00</strong>4 (635,<strong>00</strong>0 options)<br />

- $0.80 each, vesting 30 th June 2<strong>00</strong>2 and exercisable on or before 29 th June 2<strong>00</strong>5 (<strong>99</strong>5,<strong>00</strong>0 options)<br />

(d) (d) On 14 th March 2<strong>00</strong>0, 960,<strong>00</strong>0 options were granted under the company Directors’ option plan to<br />

purchase ordinary shares at an exercise price of :<br />

- $0.50 each, exercisable on or before 29 th June 2<strong>00</strong>3 (220,<strong>00</strong>0 options)<br />

- $0.65 each, vesting 30 th June 2<strong>00</strong>1 and exercisable on or before 29 th June 2<strong>00</strong>4 (320,<strong>00</strong>0 options)<br />

- $0.80 each, vesting 30 th June 2<strong>00</strong>2 and exercisable on or before 29 th June 2<strong>00</strong>5 (420,<strong>00</strong>0 options)<br />

19