Cornell Alumni News - eCommons@Cornell - Cornell University

Cornell Alumni News - eCommons@Cornell - Cornell University

Cornell Alumni News - eCommons@Cornell - Cornell University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

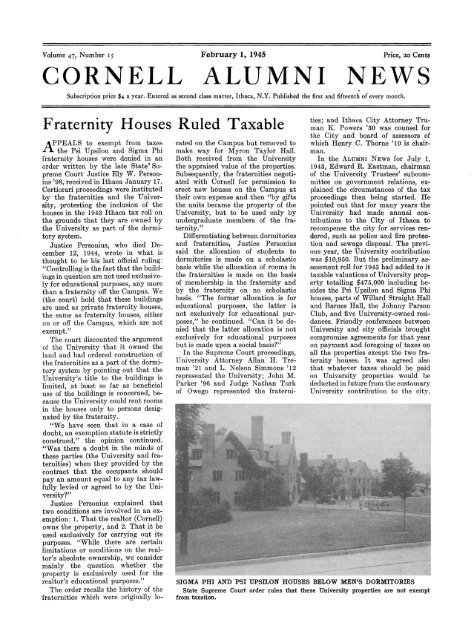

Volume 47, Number 15 February 1, 1945 Price, 20 Cents<br />

CORNELL ALUMNI NEWS<br />

Subscription price $4 a year. Entered as second class matter, Ithaca, N.Y. Published the first and fifteenth of every month.<br />

Fraternity Houses Ruled Taxable<br />

APPEALS to exempt from taxes<br />

-£*• the Psi Upsilon and Sigma Phi<br />

fraternity houses were denied in an<br />

order written by the late State' Supreme<br />

Court Justice Ely W. Personius<br />

'98, received in Ithaca January 17.<br />

Certiorari proceedings were instituted<br />

by the fraternities and the <strong>University</strong>,<br />

protesting the inclusion of the<br />

houses in the 1943 Ithaca tax roll on<br />

the grounds that they are owned by<br />

the <strong>University</strong> as part of the dormitory<br />

system.<br />

Justice Personius, who died December<br />

12, 1944, wrote in what is<br />

thought to be his last official ruling:<br />

"Controlling is the fact that the buildings<br />

in question are not used exclusively<br />

for educational purposes, any more<br />

than a fraternity off the Campus. We<br />

(the court) hold that these buildings<br />

are used as private fraternity houses,<br />

the same as fraternity houses, either<br />

on or off the Campus, which are not<br />

exempt."<br />

The court discounted the argument<br />

of the <strong>University</strong> that it owned the<br />

land and had ordered construction of<br />

the fraternities as a part of the dormitory<br />

system by pointing out that the<br />

<strong>University</strong>'s title to the buildings is<br />

limited, at least so far as beneficial<br />

use of the buildings is concerned, because<br />

the <strong>University</strong> could rent rooms<br />

in the houses only to persons designated<br />

by the fraternity.<br />

"We have seen that in a case of<br />

doubt, an exemption statute is strictly<br />

construed," the opinion continued.<br />

"Was there a doubt in the minds of<br />

these parties (the <strong>University</strong> and fraternities)<br />

when they provided by the<br />

contract that the occupants should<br />

pay an amount equal to any tax lawfully<br />

levied or agreed to by the <strong>University</strong>?"<br />

Justice Personius explained that<br />

two conditions are involved in an exemption:<br />

1. That the realtor (<strong>Cornell</strong>)<br />

owns the property, and 2. That it be<br />

used exclusively for carrying out its<br />

purposes. "While there are certain<br />

limitations or conditions on the realtor's<br />

absolute ownership, we consider<br />

mainly the question whether the<br />

property is exclusively used for the<br />

realtor's educational purposes."<br />

The order recalls the history of the<br />

fraternities which were originally lo-<br />

cated on the Campus but removed to<br />

make way for Myron Taylor Hall.<br />

Both received from the <strong>University</strong><br />

the appraised value of the properties.<br />

Subsequently, the fraternities negotiated<br />

with <strong>Cornell</strong> for permission to<br />

erect new houses on the Campus at<br />

their own expense and then "by gifts<br />

the units became the property of the<br />

<strong>University</strong>, but to be used only by<br />

undergraduate members of the fraternity."<br />

Differentiating between dormitories<br />

and fraternities. Justice Personius<br />

said the allocation of students to<br />

dormitories is made on a scholastic<br />

basis while the allocation of rooms in<br />

the fraternities is made on the basis<br />

of membership in the fraternity and<br />

by the fraternity on no scholastic<br />

basis. "The former allocation is for<br />

educational purposes, the latter is<br />

not exclusively for educational purposes,"<br />

he continued. "Can it be denied<br />

that the latter allocation is not<br />

exclusively for educational purposes<br />

but is made upon a social basis?"<br />

In the Supreme Court proceedings,<br />

<strong>University</strong> Attorney Allan H. Treman<br />

'21 and L. Nelson Simmons '12<br />

represented the <strong>University</strong>; John M.<br />

Parker '96 and Judge Nathan Turk<br />

of Owego represented the fraterni-<br />

ties; and Ithaca City Attorney Truman<br />

K. Powers '30 was counsel for<br />

the City and board of assessors of<br />

which Henry C. Thome '10 is chairman.<br />

In the ALUMNI NEWS for July 1,<br />

1943, Edward R. Eastman, chairman<br />

of the <strong>University</strong> Trustees' subcommittee<br />

on government relations, explained<br />

the circumstances of the tax<br />

proceedings then being started. He<br />

pointed out that for many years the<br />

<strong>University</strong> had made annual contributions<br />

to the City of Ithaca to<br />

recompense the city for services rendered,<br />

such as police and fire protection<br />

and sewage disposal. The previous<br />

year, the <strong>University</strong> contribution<br />

was $10,950. But the preliminary assessment<br />

roll for 1943 had added to it<br />

taxable valuations of <strong>University</strong> property<br />

totalling $475,000 including besides<br />

the Psi Upsilon and Sigma Phi<br />

houses, parts of Willard Straight Hall<br />

and Barnes Hall, the Johnny Parson<br />

Club, and five <strong>University</strong>-owned residences.<br />

Friendly conferences between<br />

<strong>University</strong> and city officials brought<br />

compromise agreements for that year<br />

on payment and foregoing of taxes on<br />

all the properties except the two fraternity<br />

houses. It was agreed also<br />

that whatever taxes should be paid<br />

on <strong>University</strong> properties would be<br />

deducted in future from the customary<br />

<strong>University</strong> contribution to the city,<br />

SIGMA PHI AND PSI UPSILON HOUSES BELOW MEN'S DORMITORIES<br />

State Supreme Court order rules that these <strong>University</strong> properties are not exempt<br />

from taxation.