Islamic Banker

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Islamic</strong> <strong>Banker</strong> March 2013 final _IB_JanFeb 2010.qxd 17/04/2013 16:12 Page 4<br />

Sukuk<br />

NEWS<br />

IN FOCUS<br />

bank asya issues debut Us$250m sukuk<br />

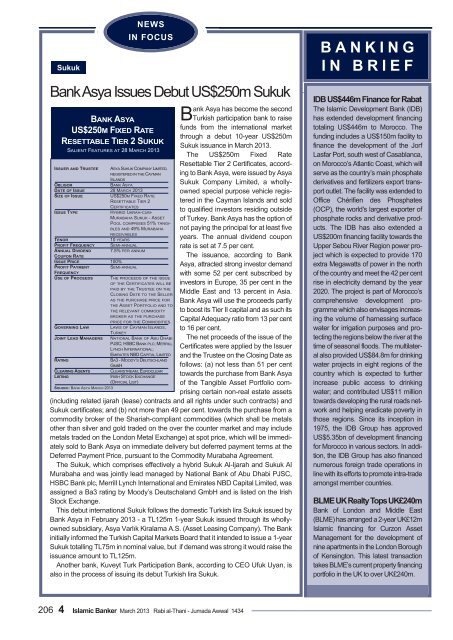

bANK ASyA<br />

US$250M FIxED RATE<br />

RESETTAbLE TIER 2 SUKUK<br />

saLient FeatURes at 28 maRch 2013<br />

ISSUER AND TRUSTEE asya sUKUK comPany Limited,<br />

RegisteRed in the cayman<br />

isLands<br />

ObLIGOR banK asya<br />

DATE OF ISSUE 28 maRch 2013<br />

SIZE OF ISSUE Us$250m FiXed Rate<br />

ResettabLe tieR 2<br />

ceRtiFicates<br />

ISSUE TyPE hybRid iJaRah-cUmmURabaha<br />

sUKUK - asset<br />

PooL comPRises 51% tangi-<br />

bLes and 49% mURabaha<br />

ReceivabLes<br />

TENOR 10 yeaRs<br />

PROFIT FREqUENCy semi-annUaL<br />

ANNUAL DIVIDEND 7.5% PeR annUm<br />

COUPON RATE<br />

ISSUE PRICE 100%<br />

PROFIT PAyMENT semi-annUaL<br />

FREqUENCy<br />

USE OF PROCEEDS the PRoceeds oF the issUe<br />

oF the ceRtiFicates WiLL be<br />

Paid by the tRUstee on the<br />

cLosing date to the seLLeR<br />

as the PURchase PRice FoR<br />

the asset PoRtFoLio and to<br />

the ReLevant commodity<br />

bRoKeR as the PURchase<br />

PRice FoR the commodities.<br />

GOVERNING LAW LaWs oF cayman isLands,<br />

tURKey<br />

jOINT LEAD MANAGERS nationaL banK oF abU dhabi<br />

PJsc; hsbc banK PLc; meRRiLL<br />

Lynch inteRnationaL;<br />

emiRates nbd caPitaL Limited<br />

RATING ba3 - moody’s deUtschLand<br />

gmbh<br />

CLEARING AGENTS cLeaRstReam, eURocLeaR<br />

LISTING iRish stocK eXchange<br />

(oFFiciaL List)<br />

SOURCE: banK asya maRch 2013<br />

bank asya has become the second<br />

turkish participation bank to raise<br />

funds from the international market<br />

through a debut 10-year Us$250m<br />

sukuk issuance in march 2013.<br />

the Us$250m Fixed Rate<br />

Resettable tier 2 certificates, according<br />

to bank asya, were issued by asya<br />

sukuk company Limited, a whollyowned<br />

special purpose vehicle registered<br />

in the cayman islands and sold<br />

to qualified investors residing outside<br />

of turkey. bank asya has the option of<br />

not paying the principal for at least five<br />

years. the annual dividend coupon<br />

rate is set at 7.5 per cent.<br />

the issuance, according to bank<br />

asya, attracted strong investor demand<br />

with some 52 per cent subscribed by<br />

investors in europe, 35 per cent in the<br />

middle east and 13 percent in asia.<br />

bank asya will use the proceeds partly<br />

to boost its tier ii capital and as such its<br />

capital adequacy ratio from 13 per cent<br />

to 16 per cent.<br />

the net proceeds of the issue of the<br />

certificates were applied by the issuer<br />

and the trustee on the closing date as<br />

follows: (a) not less than 51 per cent<br />

towards the purchase from bank asya<br />

of the tangible asset Portfolio comprising<br />

certain non-real estate assets<br />

(including related ijarah (lease) contracts and all rights under such contracts) and<br />

sukuk certificates; and (b) not more than 49 per cent. towards the purchase from a<br />

commodity broker of the shariah-compliant commodities (which shall be metals<br />

other than silver and gold traded on the over the counter market and may include<br />

metals traded on the London metal exchange) at spot price, which will be immediately<br />

sold to bank asya on immediate delivery but deferred payment terms at the<br />

deferred Payment Price, pursuant to the commodity murabaha agreement.<br />

the sukuk, which comprises effectively a hybrid sukuk al-ijarah and sukuk al<br />

murabaha and was jointly lead managed by national bank of abu dhabi PJsc,<br />

hsbc bank plc, merrill Lynch international and emirates nbd capital Limited, was<br />

assigned a ba3 rating by moody’s deutschaland gmbh and is listed on the irish<br />

stock exchange.<br />

this debut international sukuk follows the domestic turkish lira sukuk issued by<br />

bank asya in February 2013 - a tL125m 1-year sukuk issued through its whollyowned<br />

subsidiary, asya varlık Kiralama a.s. (asset Leasing company). the bank<br />

initially informed the turkish capital markets board that it intended to issue a 1-year<br />

sukuk totalling tL75m in nominal value, but if demand was strong it would raise the<br />

issuance amount to tL125m.<br />

another bank, Kuveyt turk Participation bank, according to ceo Ufuk Uyan, is<br />

also in the process of issuing its debut turkish lira sukuk.<br />

206 4 <strong>Islamic</strong> banker march 2013 Rabi al-thani - Jumada awwal 1434<br />

b A N K I N G<br />

I N b R I E F<br />

IDb US$446m Finance for Rabat<br />

the islamic development bank (idb)<br />

has extended development financing<br />

totaling Us$446m to morocco. the<br />

funding includes a Us$150m facility to<br />

finance the development of the Jorf<br />

Lasfar Port, south west of casablanca,<br />

on morocco’s atlantic coast, which will<br />

serve as the country’s main phosphate<br />

derivatives and fertilizers export transport<br />

outlet. the facility was extended to<br />

office chérifien des Phosphates<br />

(ocP), the world's largest exporter of<br />

phosphate rocks and derivative products.<br />

the idb has also extended a<br />

Us$200m financing facility towards the<br />

Upper sebou River Region power project<br />

which is expected to provide 170<br />

extra megawatts of power in the north<br />

of the country and meet the 42 per cent<br />

rise in electricity demand by the year<br />

2020. the project is part of morocco’s<br />

comprehensive development programme<br />

which also envisages increasing<br />

the volume of harnessing surface<br />

water for irrigation purposes and protecting<br />

the regions below the river at the<br />

time of seasonal floods. the multilateral<br />

also provided Us$84.8m for drinking<br />

water projects in eight regions of the<br />

country which is expected to further<br />

increase public access to drinking<br />

water; and contributed Us$11 million<br />

towards developing the rural roads network<br />

and helping eradicate poverty in<br />

those regions. since its inception in<br />

1975, the idb group has approved<br />

Us$5.35bn of development financing<br />

for morocco in various sectors. in addition,<br />

the idb group has also financed<br />

numerous foreign trade operations in<br />

line with its efforts to promote intra-trade<br />

amongst member countries.<br />

bLME UK Realty Tops UK£240m<br />

bank of London and middle east<br />

(bLme) has arranged a 2-year UK£12m<br />

islamic financing for curzon asset<br />

management for the development of<br />

nine apartments in the London borough<br />

of Kensington. this latest transaction<br />

takes bLme’s current property financing<br />

portfolio in the UK to over UK£240m.