2008 Annual Report Julius Baer Holding Ltd. - Julius Bär Gruppe

2008 Annual Report Julius Baer Holding Ltd. - Julius Bär Gruppe

2008 Annual Report Julius Baer Holding Ltd. - Julius Bär Gruppe

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes<br />

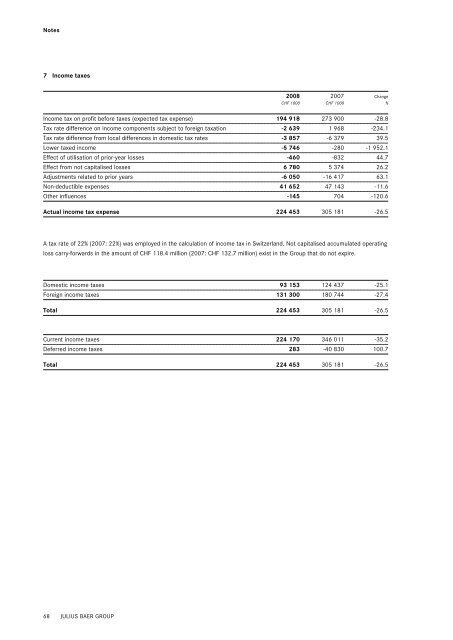

7 Income taxes<br />

68 JULIUS BAER GROUP<br />

<strong>2008</strong> 2007 Change<br />

CHF 1000 CHF 1000 %<br />

Income tax on profit before taxes (expected tax expense) 194 918 273 900 -28.8<br />

Tax rate difference on income components subject to foreign taxation -2 639 1 968 -234.1<br />

Tax rate difference from local differences in domestic tax rates -3 857 -6 379 39.5<br />

Lower taxed income -5 746 -280 -1 952.1<br />

Effect of utilisation of prior-year losses -460 -832 44.7<br />

Effect from not capitalised losses 6 780 5 374 26.2<br />

Adjustments related to prior years -6 050 -16 417 63.1<br />

Non-deductible expenses 41 652 47 143 -11.6<br />

Other influences -145 704 -120.6<br />

Actual income tax expense 224 453 305 181 -26.5<br />

A tax rate of 22% (2007: 22%) was employed in the calculation of income tax in Switzerland. Not capitalised accumulated operating<br />

loss carry-forwards in the amount of CHF 118.4 million (2007: CHF 132.7 million) exist in the Group that do not expire.<br />

Domestic income taxes 93 153 124 437 -25.1<br />

Foreign income taxes 131 300 180 744 -27.4<br />

Total 224 453 305 181 -26.5<br />

Current income taxes 224 170 346 011 -35.2<br />

Deferred income taxes 283 -40 830 100.7<br />

Total 224 453 305 181 -26.5